COUNCIL AGENDA

ADDENDUM

Ordinary Council Meeting

10 December 2024

Liverpool Civic tower

Council Chambers , Level 1, 50 Scott Street, Liverpool NSW 2170

Community & Lifestyle

Reports

COM 04 Policy

Review - Code of Meeting Practice................................................. 2369...........

Corporate Support Reports

CORP 03 Investment

Report November 2024........................................................... 2424...........

Ordinary Meeting

10 December 2024

Community & Lifestyle Report

|

COM 04

|

Policy Review - Code of Meeting

Practice

|

|

Strategic

Objective

|

Visionary,

Leading, Responsible

Demonstrate

a high standard of transparency and accountability through a comprehensive

governance framework

|

|

File Ref

|

401985.2024

|

|

Report By

|

M'Leigh

Brunetta - Civic & Executive Services Manager

|

|

Approved

By

|

Tina Bono -

Director Community & Lifestyle

|

This report was deferred from Ordinary Council Meeting – 26

November 2024.

Amendments to this report include

1. Timeline for delivery (table)

2. Risks (updated)

The Model Code of Meeting Practice (the Model Code)

provides a uniform set of meeting rules for Councils throughout NSW to help

ensure more accessible, orderly, effective and efficient meetings. The

Model Code is defined by the Office of Local Government and applies to all

meetings of Councils, including committees of Council (where all committee

members are Councillors).

The

Model Code defines that Council must adopt a code of meeting practice within 12

months of the local government elections and further specifies that before

adopting a new code, it must first place the draft of the code on public

exhibition for at least 28 days and provide members of the community at least

42 days to provide feedback.

At

the 16 October 2024 Council Meeting, Council instigated to complete a review of

the Code of Meeting Practice Policy and report back to Council as a priority.

An internal and external review of the Code of Meeting Practice has

subsequently been conducted.

Recommended

amendments to the draft Code of Meeting Practice have also been tabled at the

Governance Meeting 13 November 2024.

In

addition, the report Policy Review - Code of Meeting Practice was tabled

at the 26 November 2024 Council meeting (COM07) and deferred to the 10 December

2024 Council meeting. Consultation continued with Council throughout this

period.

This

report also seeks to amend the planned date for the Governance meeting

currently scheduled for 21 May 2025. As per the Council resolution 16

October 2024, Council recommends that the Governance Meeting confirmed to take

place on 13 May 2025 be brought forward one (1) week to align to the 21 May

2025 Council Meeting date. This will ensure adequate briefing and

administrative time and align all Council Meeting dates resolved for 2025.

That Council:

1. Notes, as per Council resolution 16 October 2024, an internal

and external review of the Code of Meeting Practice has been conducted and

tabled at the Governance Meeting 13 November 2024;

2. Notes, this report was deferred

from 26 November 2024 Council meeting, and Council consultation continued

throughout this period;

3. Notes, the forecast timeline to

achieve endorsement tabled in this report;

4. Notes, the Draft Code of

Meeting Practice detailed in attachment one (1) and supports its commencement of public exhibition for at least 28 days and provide members of

the community at least 42 days to provide feedback;

5. Notes, there is an opportunity

for Councillors to provide further feedback on the draft Code of Meeting

Practice throughout the public exhibition period;

6. Reports back to Council in

February 2025, the draft Code of Meeting Practice for consideration and

adoption; and

7. Supports moving the Governance

Meeting confirmed for the 20 May to the 13 May 2025 to align to the 21 May

Council Meeting date.

Liverpool City Council is required to

adopt a Code of Meeting Practice that incorporates, at minimum, the mandatory

provisions of the Model Meeting Code of Meeting Practice (The Model Code)

specified by the NSW Office of Local Government (OLG).

The Model Code for Local Councils in NSW

is made under section 360 of the Local Government Act 1993 (the Act) and

the Local Government (General) Regulation 2005 (the

Regulation).

The Model Code applies to all meetings of

councils and committees of councils of which all the members are councillors

(committees of council). Council committees whose members include persons other

than councillors may adopt their own rules for meetings unless the council

determines otherwise.

To meet the obligations contained in the

Model Code, at its 16

October 2024 Council Meeting, Council resolved the following:

That Council:

1. Confirms

the Council meeting time to commence at 6:00pm rather than 2:00pm for each

monthly meeting for 2025.

2. Confirms

the Council meeting dates for the 2025 calendar year as follows:

· 5 February 2025;

· 26 February 2025;

· 26 March 2025;

· 23 April 2025;

· *21 May 2025;

· 25 June 2025;

· 23 July 2025;

· 27 August 2025;

· 24 September 2025;

· 22 October 2025;

· 19 November 2025; and

· 10 December 2025.

3. Confirms

the Governance Committee meeting time as 10am and the Briefing Sessions to be

held directly following the Governance Committee meetings, and meeting dates

for the 2025 calendar year as follows:

· 28 January 2025;

· 18 February 2025;

· 18 March 2025;

· 15 April 2025;

· *20 May 2025;

· 17 June 2025;

· 15 July 2025;

· 19 August

2025;

· 16 September

2025;

· 14 October

2025;

· 11 November

2025; and

· 2 December 2025.

4. Note

that the Code of Meeting Practice adopted 26 October 2022 requires

clarification with regards to clauses 3.1 and 18.1.

5. Direct

the Acting CEO that the Code of Meeting Practice is externally reviewed, and a

report comes back to Council as a priority;

6. Fund

the external review from General Funds;

7. Advertises

the Council meeting dates and commencing times of Council meetings for the 2025

calendar year; and

8. Promotes

and makes the community aware of the changes in the new year via social media

channels.

On being put to the meeting the

Foreshadowed Motion (moved by Clr Karnib) became the motion and was declared

CARRIED.

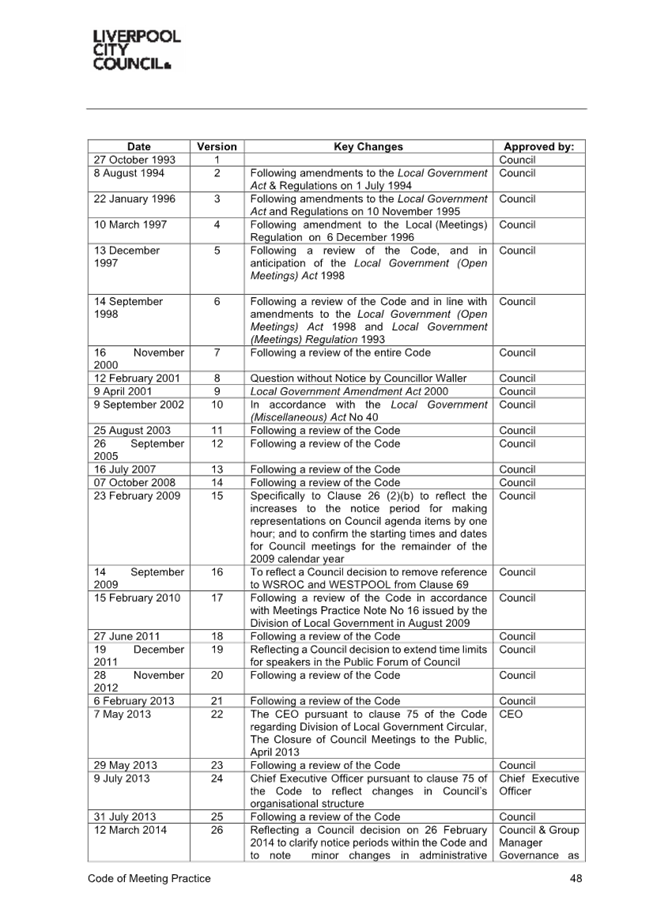

Review of Code of Meeting Practice

As per the Council resolution at its 16

October 2024 Council Meeting, Council has undertaken a review of its Code of

Meeting Practice to ensure that it fulfills the mandatory obligations contained

in the Model Code. This review was undertaken both by Council Officers

(internal review) and by an independent legal consultant (external

review).

A copy of the recommended amendments is

attached to this report.

Change in Governance meeting date

At the 16 October 2024 Council Meeting, Council moved

the proposed May Council meeting from 28th to 21st May

however, the monthly Governance Meeting was not amended to align to this date.

Currently the assigned date for the Governance

Committee Meeting is 20 May 2024.

It is proposed in this report that the Governance

Meeting on the 20 May 2025 be moved to the 13 May to ensure adequate briefing

notice and calendar alignment.

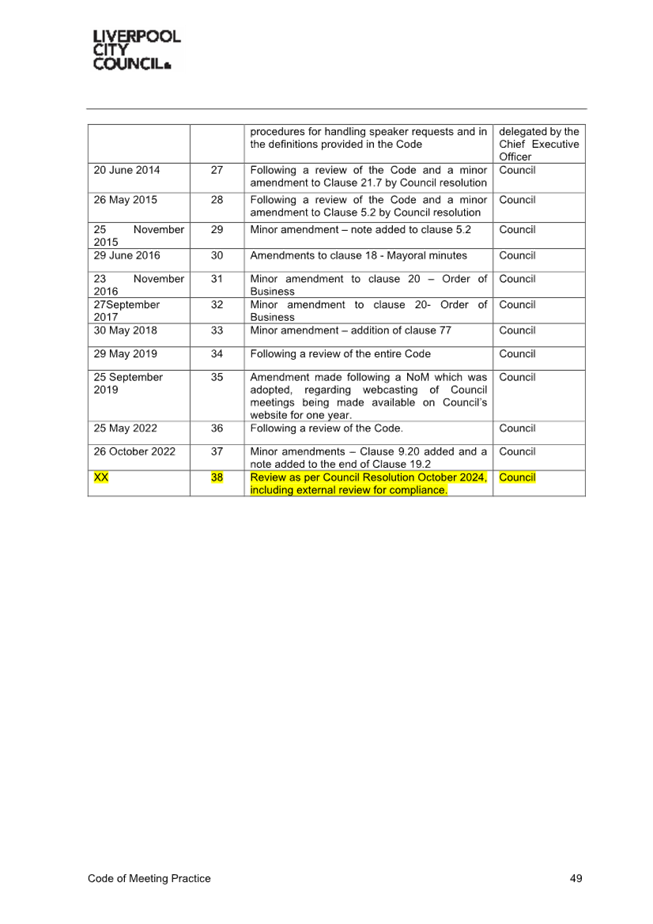

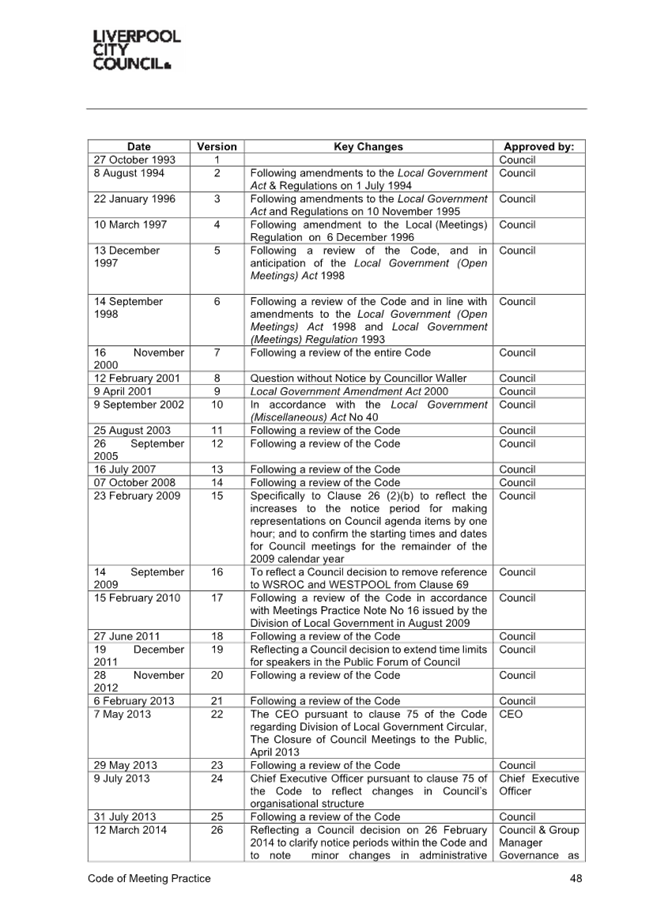

Timeline for delivery

|

ITEM

|

DATE

|

|

Council Resolution – (conduct Policy review)

|

14 October 2024

|

|

Internal and External Review – Draft Code of Meeting

Practice

|

Oct – Nov 2024

|

|

Governance Meeting – consultation of Draft Code of Meeting

Practice

|

13 November 2023

|

|

Council Meeting: Report tabled COM07 – Adjourned meeting

|

20 November 2024

|

|

Council Meeting: Report tabled COM07 – Deferred Report

|

26 November 2024

|

|

Council Meeting: Report tabled seeking endorsement for Public

Exhibition

|

10 December 2024

|

|

Proposed Public Exhibition Period

|

16 Dec – 31 Jan 2025

|

|

Community feedback considered

|

3 – 7 February 2025

|

|

Council Meeting: Report seeking draft Policy endorsement

|

26 February 2025

|

Council

resolved an external review be administered and funded from General Funds to

ensure alignment to the Model Code of Meeting Practice for Local Councils in

NSW.

|

Economic

|

There are no economic and financial considerations.

|

|

Environment

|

There are no environmental and sustainability

considerations.

|

Social

|

Raise awareness in the community about the available services and

facilities.

Promote community harmony and address discrimination.

Support access and services for people with a disability.

Deliver high quality services for children and their families.

|

Civic Leadership

|

Undertake communication practices with the community and stakeholders

across a range of media.

Foster neighbourhood pride and a sense of responsibility.

Facilitate the development of community leaders.

Encourage the community to engage in Council initiatives and actions.

Provide information about Council’s services, roles and decision

making processes.

Deliver services that are customer focused.

Operate a well-developed governance system that demonstrates

accountability, transparency and ethical conduct.

|

|

Legislative

|

Local Government Act 1993.

Local Government Regulation 2005.

|

|

Risk

|

The risk is deemed to be low.

The 2025 Council Meeting schedule has

been resolved by Council to commence at 6pm (from 2pm). Councils’

intent was to complete community consultation before commencement; however,

this cannot be achieved due to deferral.

|

1. DRAFT

Policy - Code of Meeting Practice _ 2024

|

1

|

|

COM

04

|

Policy

Review - Code of Meeting Practice

|

|

Attachment

1

|

DRAFT

Policy - Code of Meeting Practice _ 2024

|

Ordinary Meeting

10 December 2024

|

CORP 03

|

Investment Report November 2024

|

|

Strategic

Objective

|

Visionary,

Leading, Responsible

Ensure

Council is accountable and financially sustainable through the strategic

management of assets and resources

|

|

File Ref

|

406453.2024

|

|

Report By

|

Vishwa Nadan

- Chief Financial Officer

|

|

Approved

By

|

David Galpin

- Acting Director Corporate Support

|

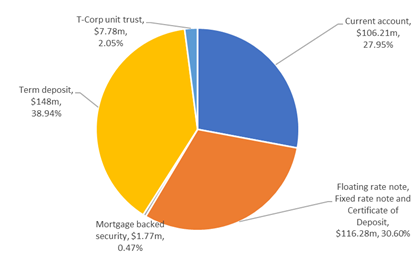

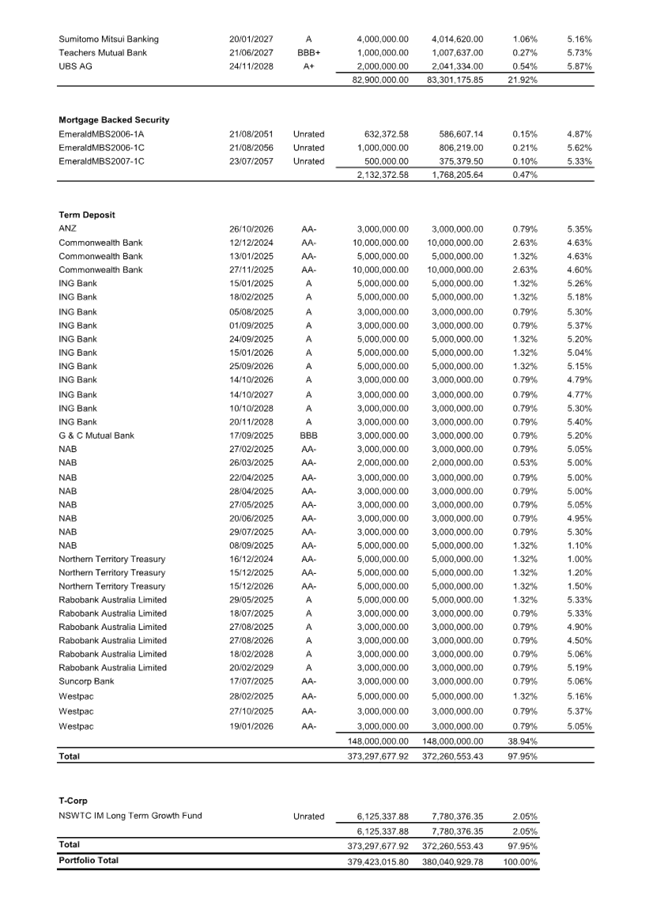

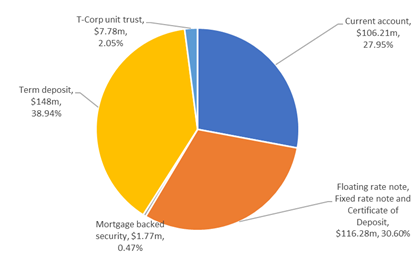

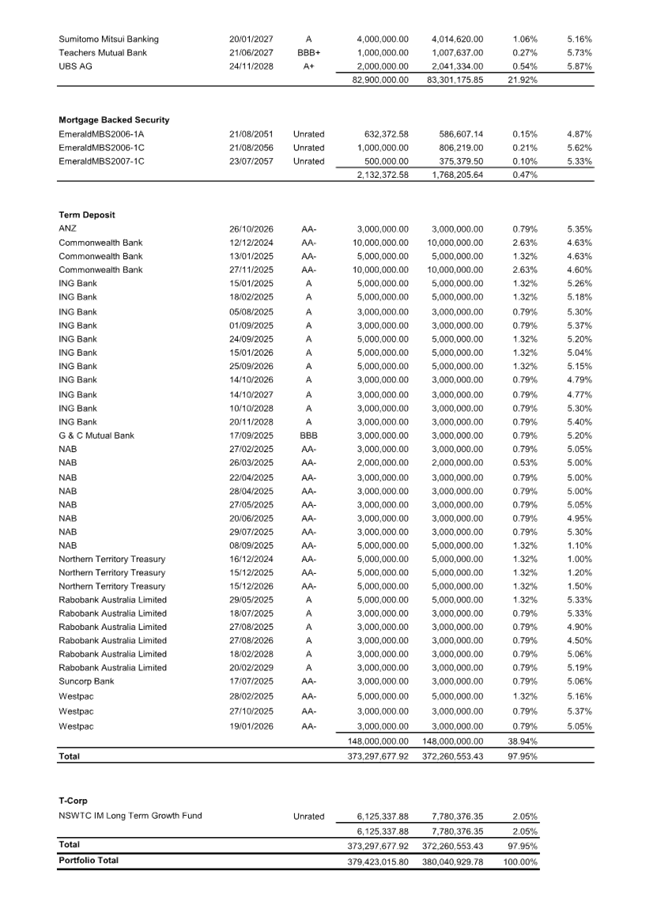

This report details Council’s investment portfolio and its

performance at 30 November 2024. Key highlights include:

· Council held investments with a market

value of $380 million.

· The Reserve Bank of Australia (RBA)’s

official cash rate remains at 4.35 per cent.

· The portfolio yield (for the year to

November 2024) was 2 basis points above the benchmark (AusBond Bank Bill Index).

|

|

AusBond Bank Bill Index

(ABBI)

|

|

Benchmark

|

4.45%

|

|

Portfolio yield

|

4.47%

|

|

Performance above benchmark

|

0.02%

|

· Council’s investment portfolio is

performing slightly better than ABBI benchmark. Council still has $19.35m in low-yielding

(returning less than 2%) investments and not maturing till 2026. These

investments will continue to impact on Council’s portfolio performance.

· Year-to-date, Council’s investment

income was $2.04 million higher than the original budget. This is due to a

combination of increase in market interest rates and unrealised gain in fair

value of Floating Rate Notes (FRNs).

· Year-to-date, Council’s investment in

mortgage-backed securities (MBSs) is valued at $364 thousand below face value.

Council’s investment advisor continues to review Council’s

investment in MBSs and recommends Council continue to hold its investments in

the Class A and Class C securities. There is significant uncertainty associated

with these investments, however presently Council’s investment advisor

believes there is, on balance, more upside opportunity than downside risk. This

is subject to ongoing regular review. MBSs are no longer rated.

· Council’s investments and reporting

obligations fully complied with the requirements of section 625 of the Local

Government Act 1993 and section 212 of the Local Government (General)

Regulation 2021.

· Council’s portfolio also fully

complied with limits set out in its current Investment Policy, noting the

exception applicable to MBSs (as investment in them pre-dates the current

Investment Policy).

· Council is committed to NSW TCorp’s

balanced investment framework and held 11.68 per cent of its portfolio in ADIs

rated BBB and below.

That the Council receives and notes this report.

Section 212 of the Local

Government (General) Regulation 2021 requires that the Responsible

Accounting Officer must provide Council with a written report setting out

details of all money that Council has invested under section 625 of the Local

Government Act 1993.

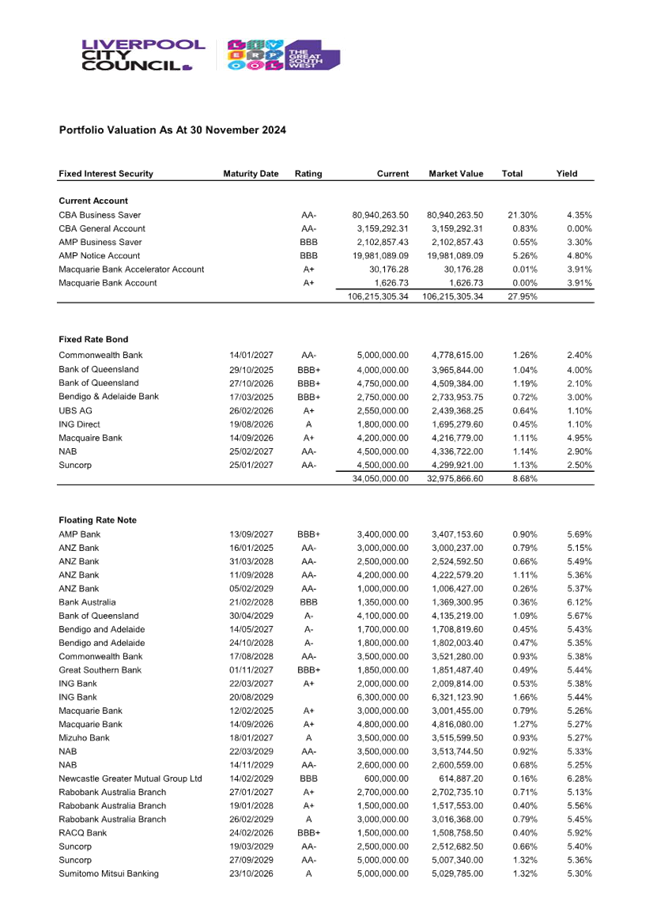

Council’s portfolio

At 30 November 2024, Council

held investments with a market value of $380 million. Council’s

investment register detailing all its investments is provided as an attachment

to this report. In summary, Council’s portfolio consisted of investments

in:

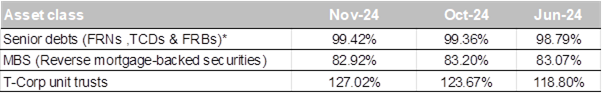

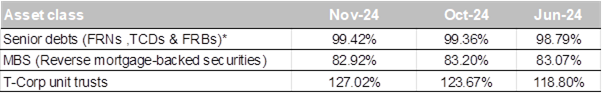

The ratio of market value compared to face value of

various debt securities is shown in the table below.

*Definition of terms

· FRN - Floating Rate Note - returns an

aggregate of a fixed margin and a variable benchmark (usually the Bank Bill

Swap Rate).

· FRB - Fixed Rate Bond – returns a

fixed coupon (interest) rate and is tradeable before maturity.

· TCD - Transferrable Certificate of Deposit -

security issued with the same characteristics as a term deposit, however it can

be sold back (transferred) into the market prior to maturity. A floating TCD

pays a coupon linked to a variable benchmark (90-day Bank Bill Swap Rate).

Council continues to closely

monitor the investments in its portfolio to ensure continued compliance and

minimal exposure to risk.

Council is committed to NSW TCorp’s

balanced investment framework and held 11.68 per cent of its portfolio in ADIs

rated BBB and below.

Mortgaged-backed securities

Council’s investment advisor

regularly reviews investments in grandfathered mortgage-backed securities

(MBSs) and continues to recommend “hold” position on investments in

Class A and both Class C securities.

There is significant uncertainty associated

with these investments, however presently the investment advisors believe there

is, on balance, more upside opportunity than downside risk. Notwithstanding

this recommendation, Council’s investment advisor has assessed that both

Class C securities are likely to eventually default. However, Council will

continue to receive interest up until default which is likely to be many years

in the future. Fitch Rating Agency has decided to withdraw its rating on MBSs

and as a result, Council’s investments in these securities are now

classed as non-rated. Year-to-date, Council’s investment in MBSs is

valued at $364 thousand below face value.

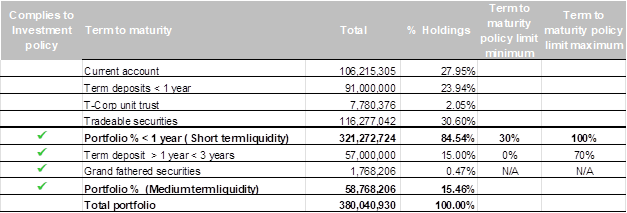

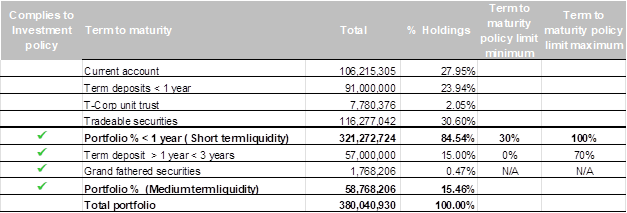

Portfolio maturity profile

The table below shows the

percentage of funds invested at different durations to maturity.

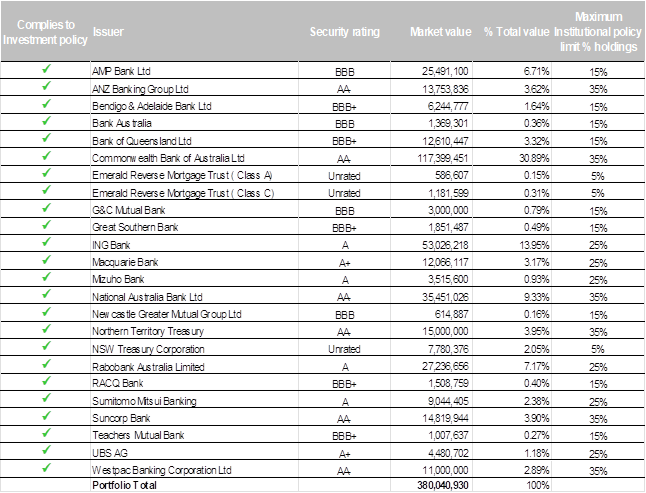

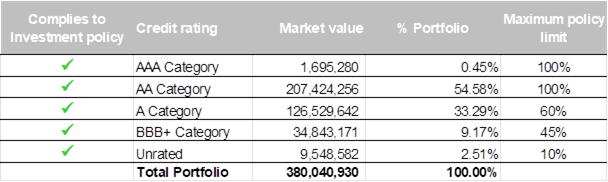

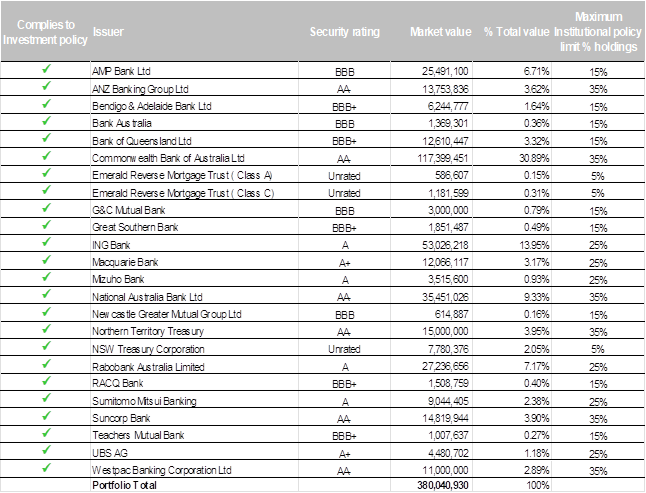

Counterparty policy limit compliance

Credit rating policy limit

compliance

Compliance

with Investment policy – In summary

|

Legislative requirements

|

ü

|

Fully compliant, noting exception applicable to grandfathered

mortgaged-backed investments.

|

|

Portfolio credit rating limit

|

ü

|

Fully compliant

|

|

Institutional exposure limits

|

ü

|

Fully compliant

|

|

Overall portfolio credit limits

|

ü

|

Fully compliant

|

|

Term to maturity limits

|

ü

|

Fully compliant

|

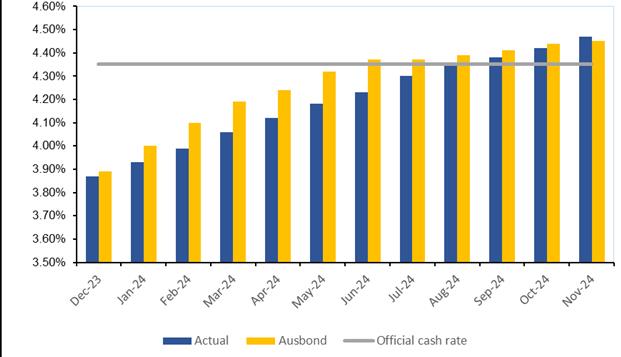

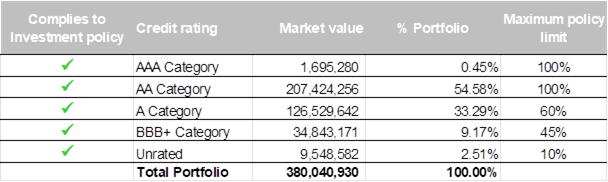

Portfolio performance against relevant

market benchmark

Council’s Investment Policy

prescribes the AusBond Bank Bill Index (ABBI) as a benchmark to measure return

on cash and fixed interest securities. The ABBI represents the average daily

yield of a parcel of bank bills. Historically there has been a positive

correlation between changes in the cash rate and the resulting impact on the

ABBI benchmark.

Council’s investment portfolio is

performing slightly better than ABBI benchmark. Council still has $19.35m in

low-yielding (returning less than 2%) investments and not maturing till

2026. These investments will continue to impact on Council’s

portfolio performance.

The portfolio yield for the year to

November 2024 was above the ABBI index by 2 basis points

(portfolio yield: 4.47%; ABBI: 4.45%).

Comparative

yields for the previous months are charted below:

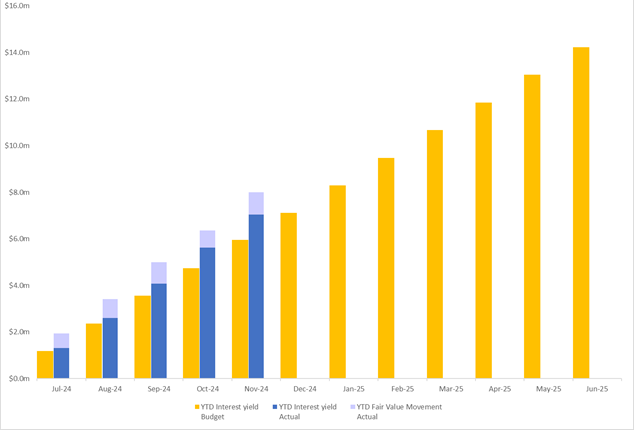

Performance of portfolio returns against

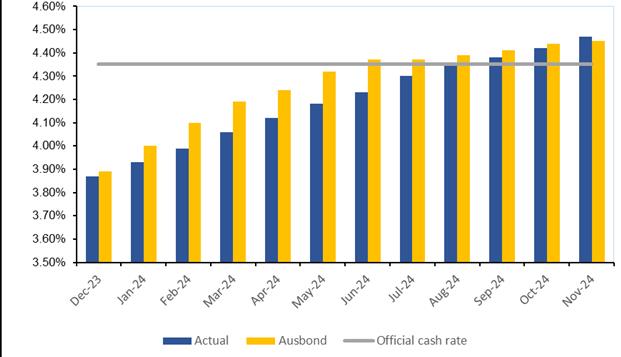

budget

Year-to-date, Council’s

investment income was $2.04m higher than the original budget. This is due to a

combination of increase in market interest rate and unrealised gain in fair

value of Floating Rate Notes (FRNs).

|

|

YTD

Budget

|

YTD

Actuals

|

Budget

Variance

|

|

Interest yield on cash holdings

|

$5.96m

|

$7.04m

|

$1.08m

|

|

Fair value market movement

|

$0.00m

|

$0.96m

|

$0.96m

|

|

Total

|

$5.96m

|

$8.00m

|

$2.04m

|

Economic outlook –

Reserve Bank of Australia

The Reserve Bank of Australia kept the

official cash rate at 4.35 per cent in its meeting on 5 November 2024.

Certificate of Responsible Accounting Officer

The Chief Financial Officer, as

Responsible Accounting Officer, certifies that the investments listed in the

attached report have been made in accordance with section 625 of the Local

Government Act 1993, section 212 of the Local Government (General)

Regulation 2021 and Council’s Investment Policy at the time of their

placement. The previous investments are covered by the grandfathering clauses

of the current investment guidelines issued by the Minister for Local

Government.

|

Economic

|

Council’s investment income was

$2.04 million higher than the original budget at 30 November 2024.

|

|

Environment

|

There are no environmental and

sustainability considerations.

|

Social

|

There are no social and cultural

considerations.

|

Civic Leadership

|

There are no civic leadership and

governance considerations.

|

|

Legislative

|

Local Government Act 1993, section 625

Local Government (General) Regulation

2021, section 212

Council is empowered by section 625 of

the Local Government Act 1993 to invest money that is not, for the time

being, required by Council for any other purpose. Council may invest money in

a form of investment notified by order of the Minister.

The Minister has published the Local

Government Act 1993 – Investment Order which specifies the forms of

investment that a council may make. It makes clear that Council must have an

investment policy and invest in accordance with that policy. Council is

required to invest prudently and must consider:

· the risk of capital or income loss or

depreciation,

· the likely income return and the timing

of income return,

· the length of the term of the proposed

investment,

· the liquidity and marketability of the

proposed investment,

· the likelihood of inflation affecting the

value of the proposed investment, and

· the costs of making the proposed

investment.

The responsible accounting officer must

provide Council with a written report setting out details of money invested

at its ordinary meetings (but only at one meeting in a month): section 212 of

the Local Government (General) Regulation 2021. The report must include a certificate as to whether

the investment has been made in accordance with the Act, the regulations and

Council’s investment policies.

|

|

Risk

|

The capital value and

return-on-investment is subject to market risks. Investment limits prescribed

in Council’s policy framework is aimed to mitigate these risks.

|

1. Investment

Portfolio November 2024

|

1

|

|

CORP

03

|

Investment

Report November 2024

|

|

Attachment

1

|

Investment

Portfolio November 2024

|

![]()