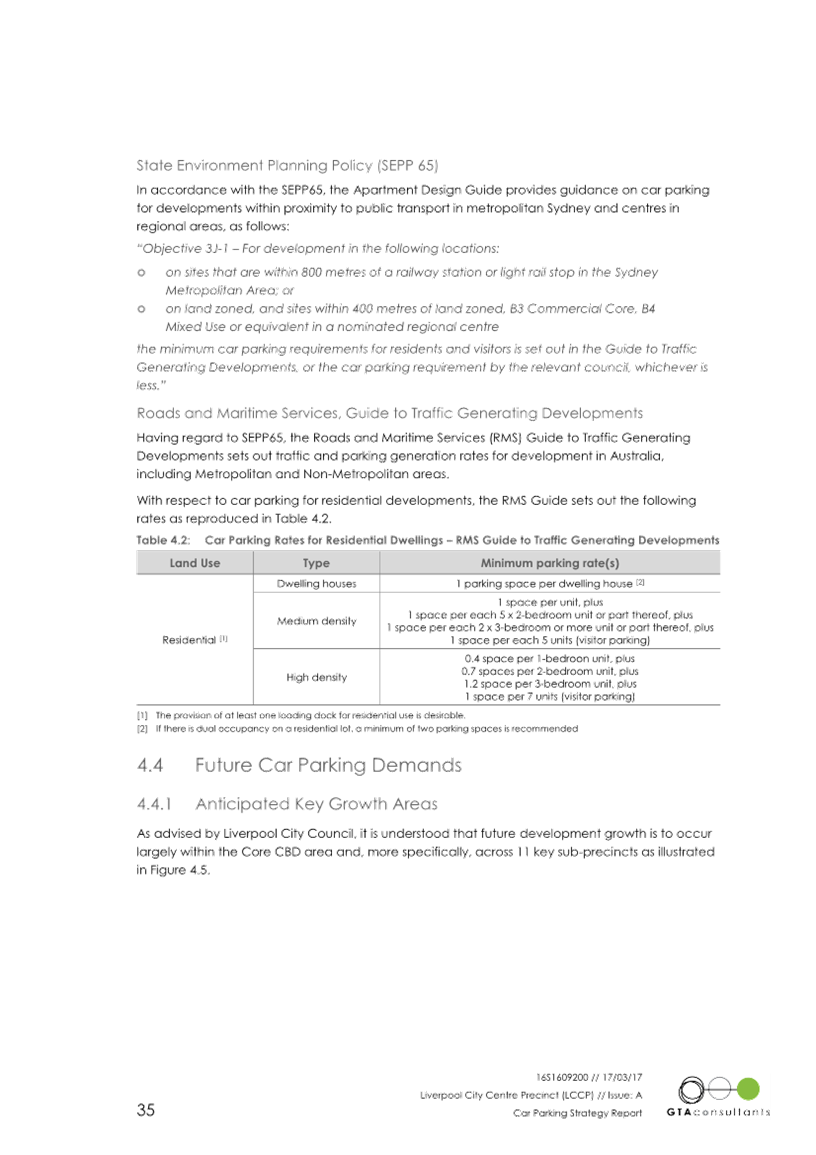

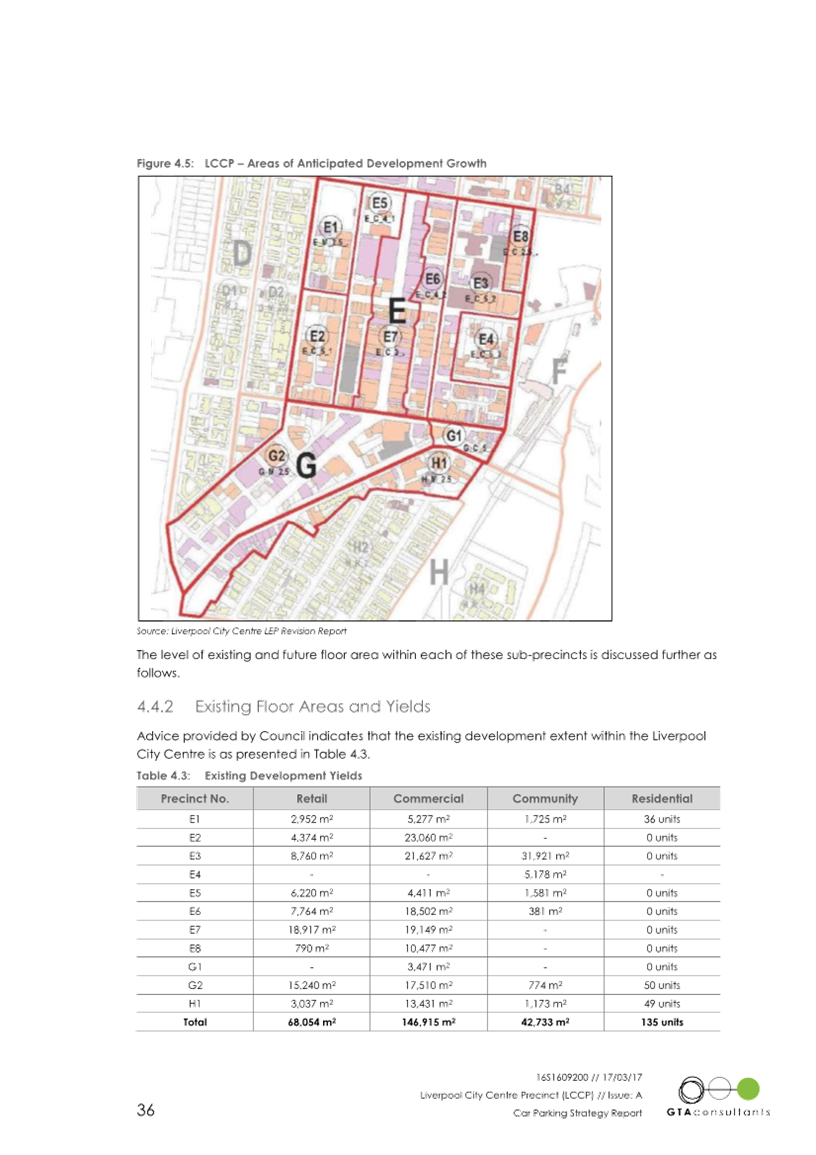

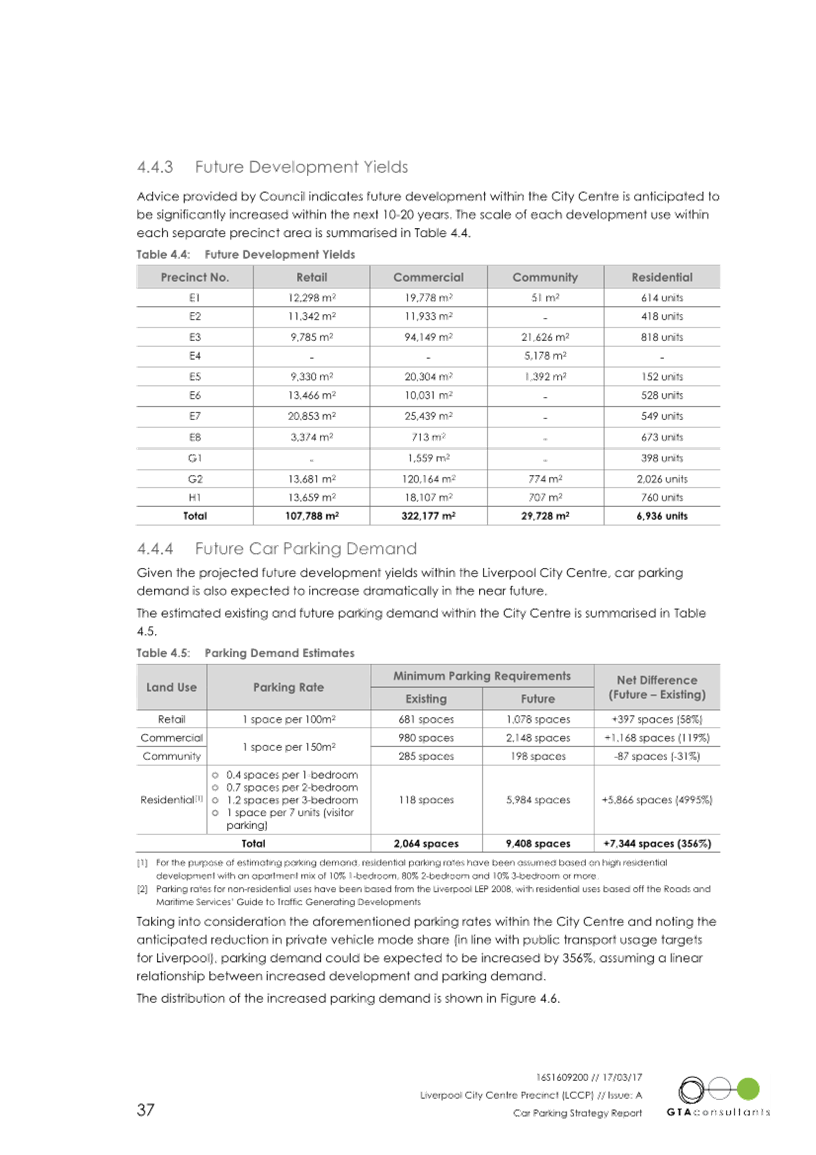

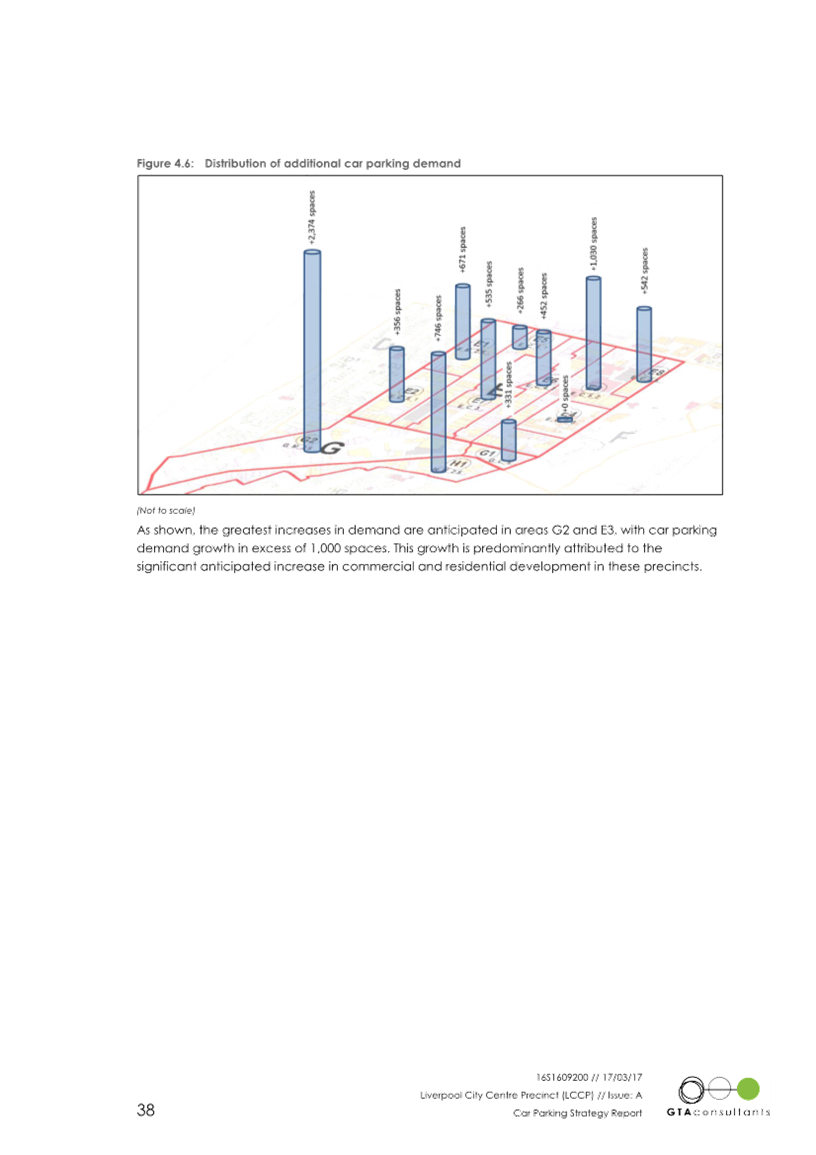

Governance

Committee Meeting

28 January 2025

Infrastructure and Planning Committee Report

|

ITEM 01

|

Potential Sites for Temporary Car Parking

within Liverpool City Centre

|

|

Strategic

Objective

|

Evolving,

Prosperous, Innovative

Continue to

invest in improving and maintaining Liverpool’s road networks and

infrastructure

|

|

File Ref

|

416295.2024

|

|

Report By

|

Daniel Riley

- Manager Development Engineering

|

|

Approved

By

|

Noelle

Warwar - Manager Community Standards

|

At

the Council Meeting held on 16th October 2024, a notice of motion was raised to

provide a report on potential

temporary sites for parking through the CBD including sites under private

ownership.

Council’s Traffic and Transport Management Team,

Property Team and Facilities Team, have reviewed previous parking studies as

well as provided an updated description of the prevailing parking conditions

within the Liverpool CBD.

This report details the outcome of the investigation.

That Council

receives the report on

potential temporary sites for parking through the CBD including sites under

private ownership.

Background

At the Council Meeting held on 16

October 2024 meeting,

Council resolved to seek a report on potential temporary sites for parking

within the CBD including sites under private ownership.

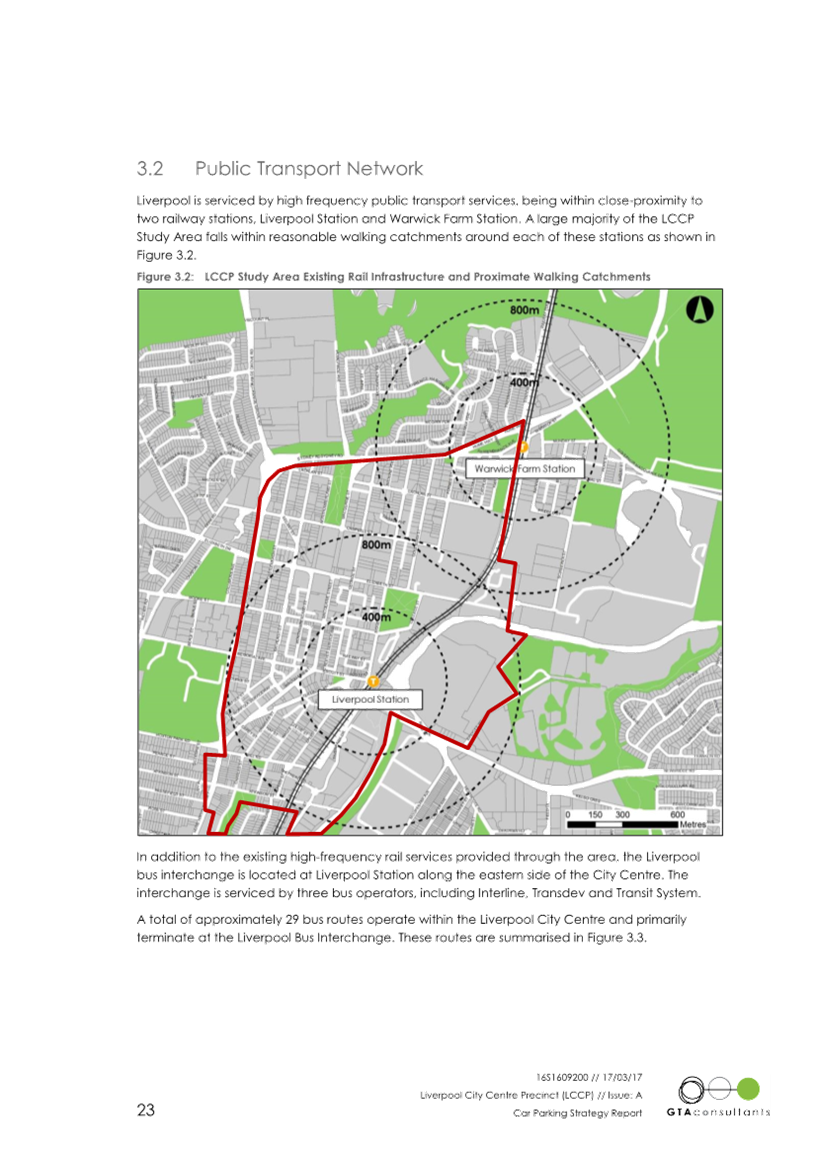

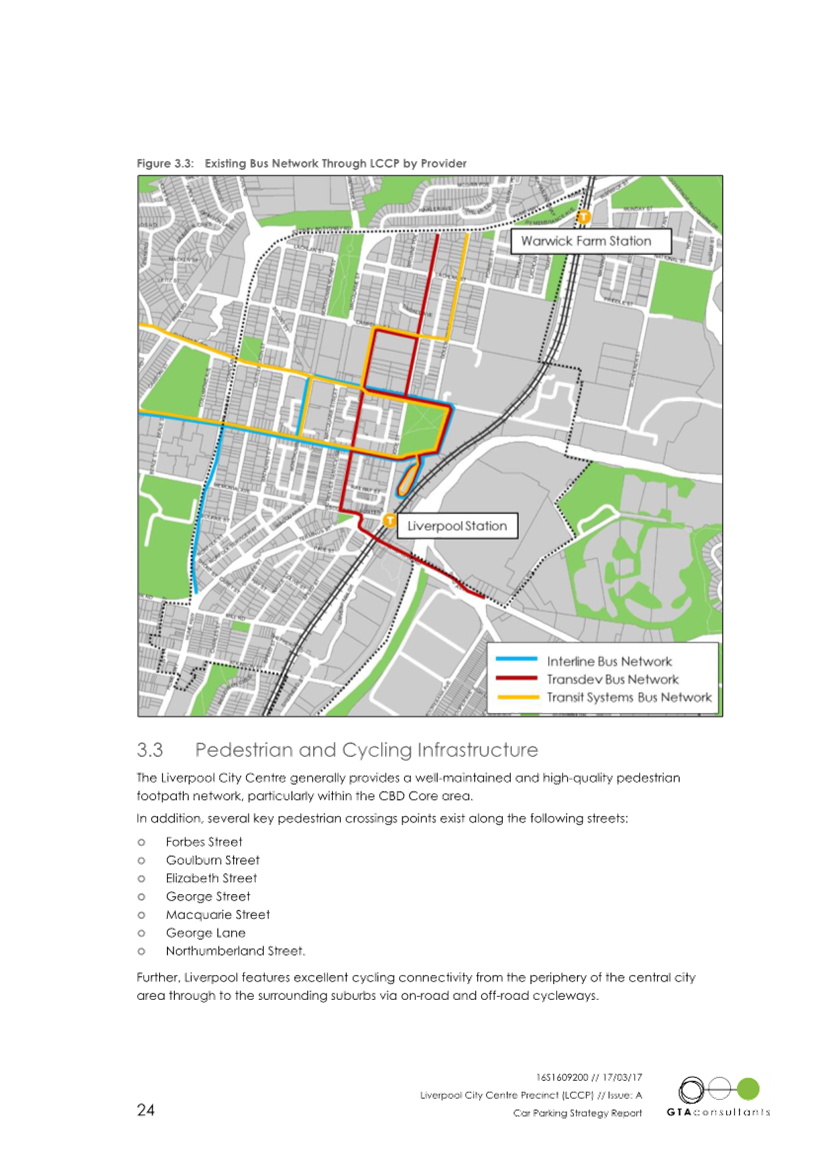

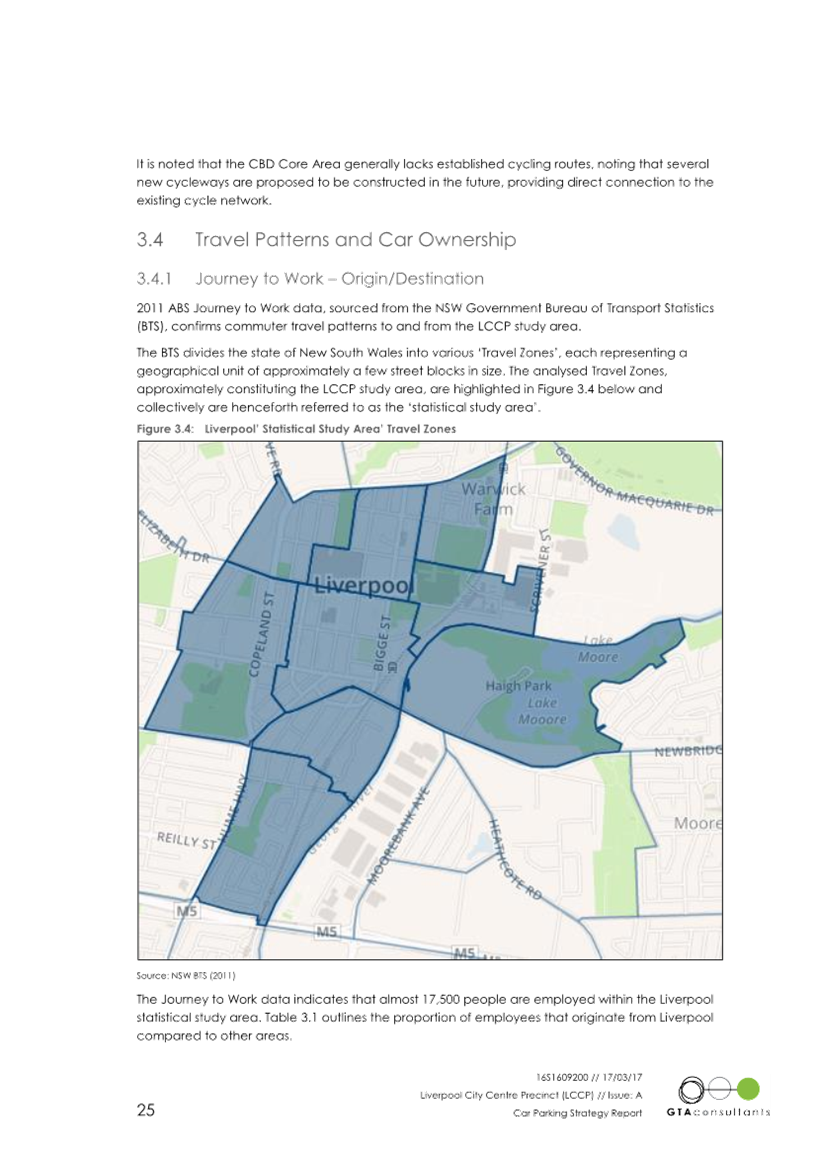

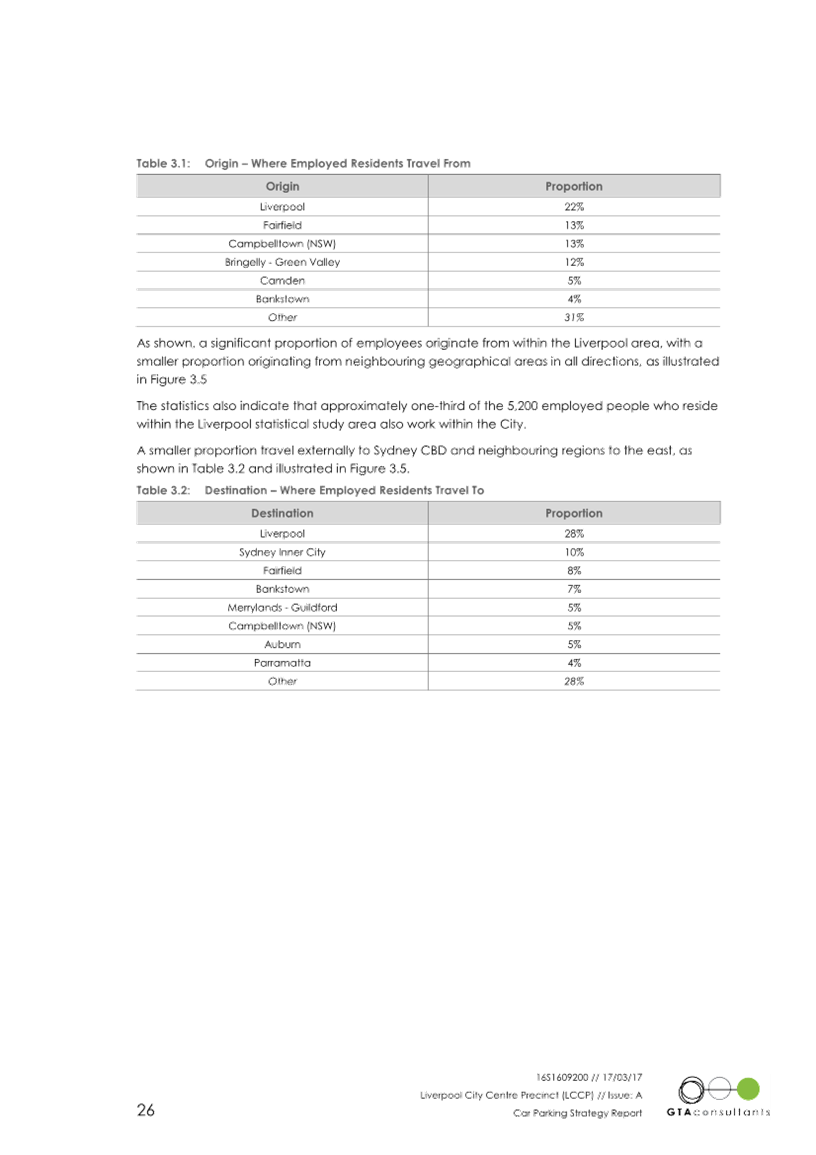

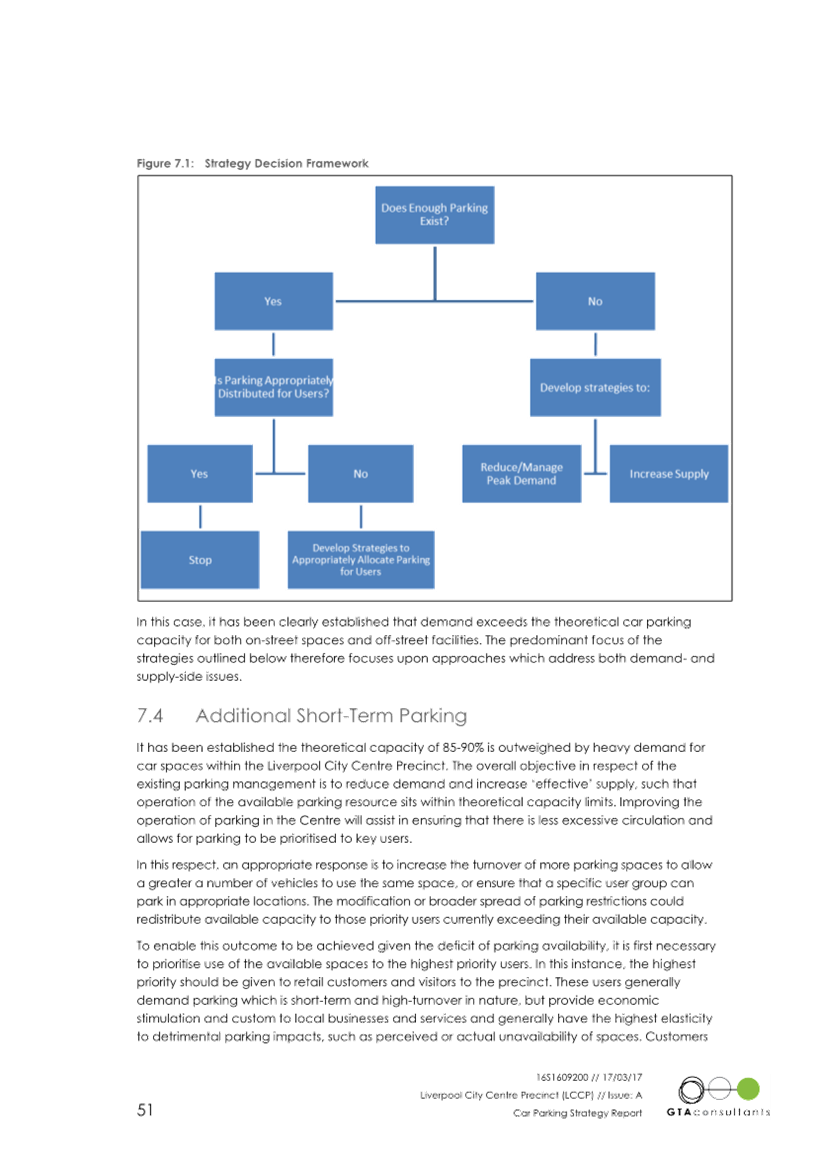

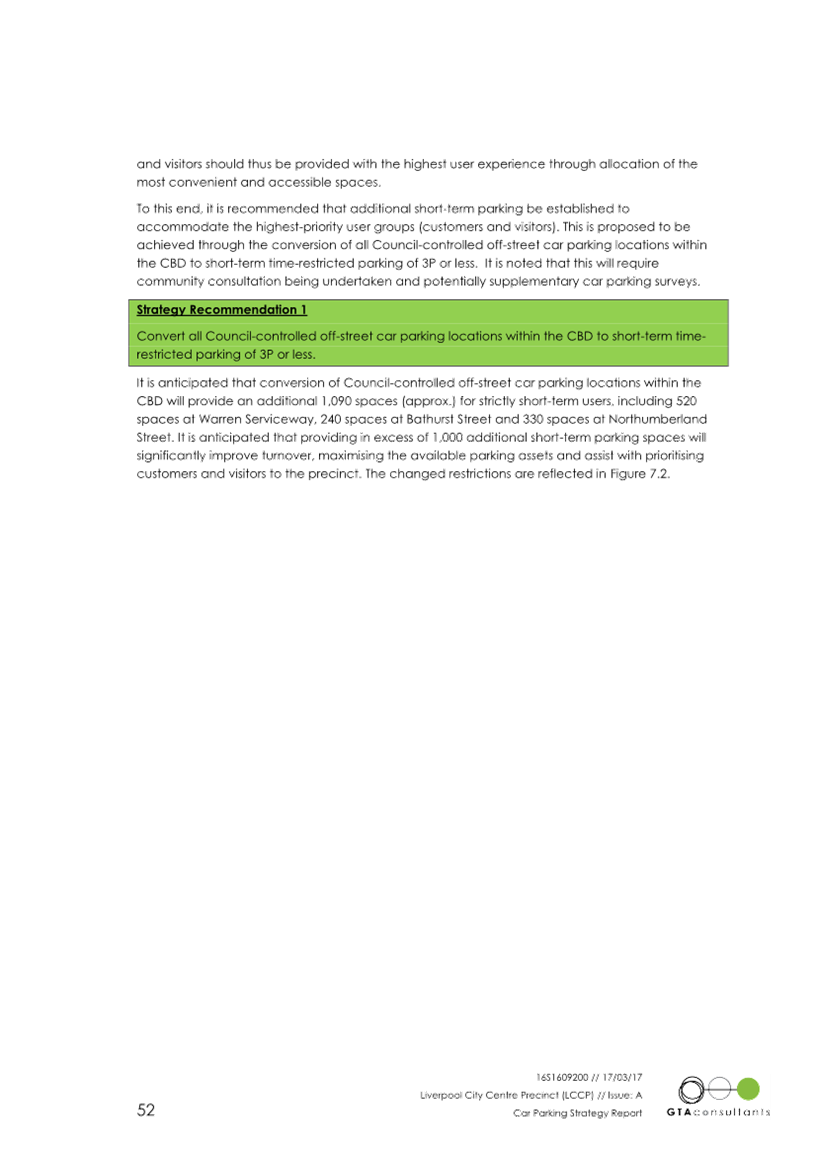

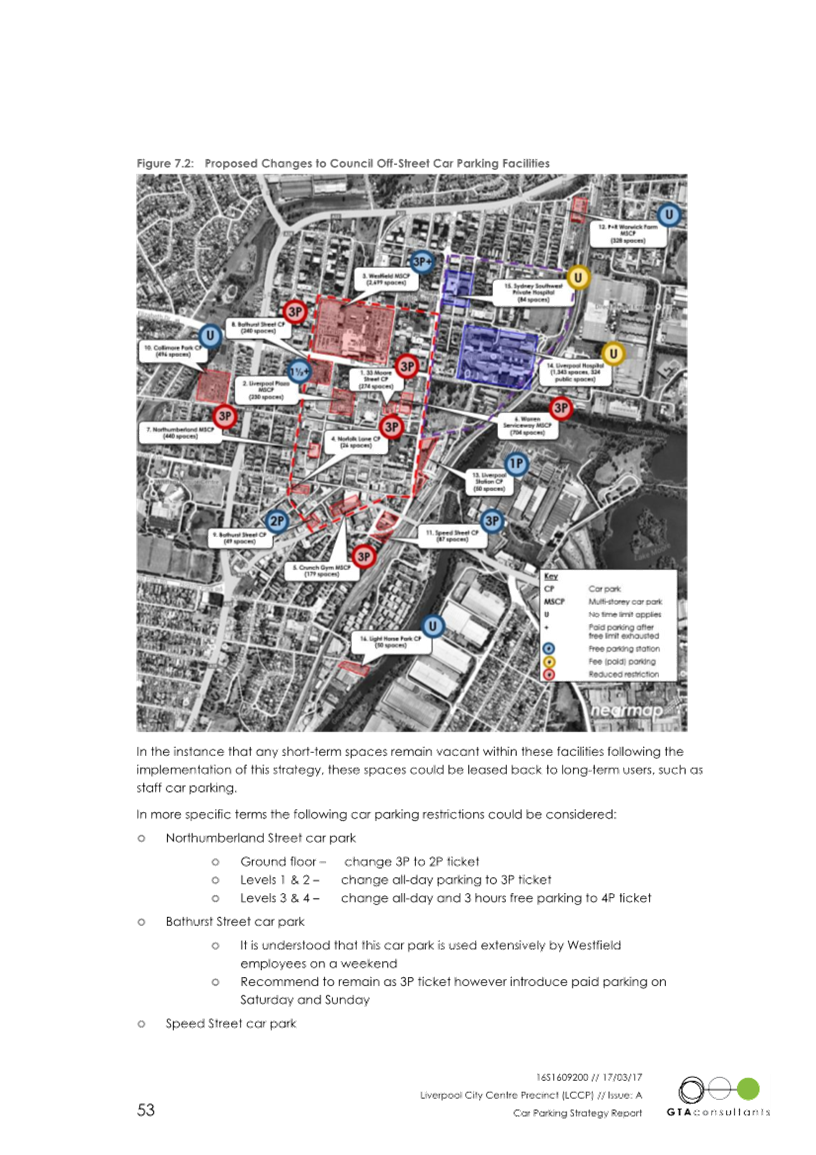

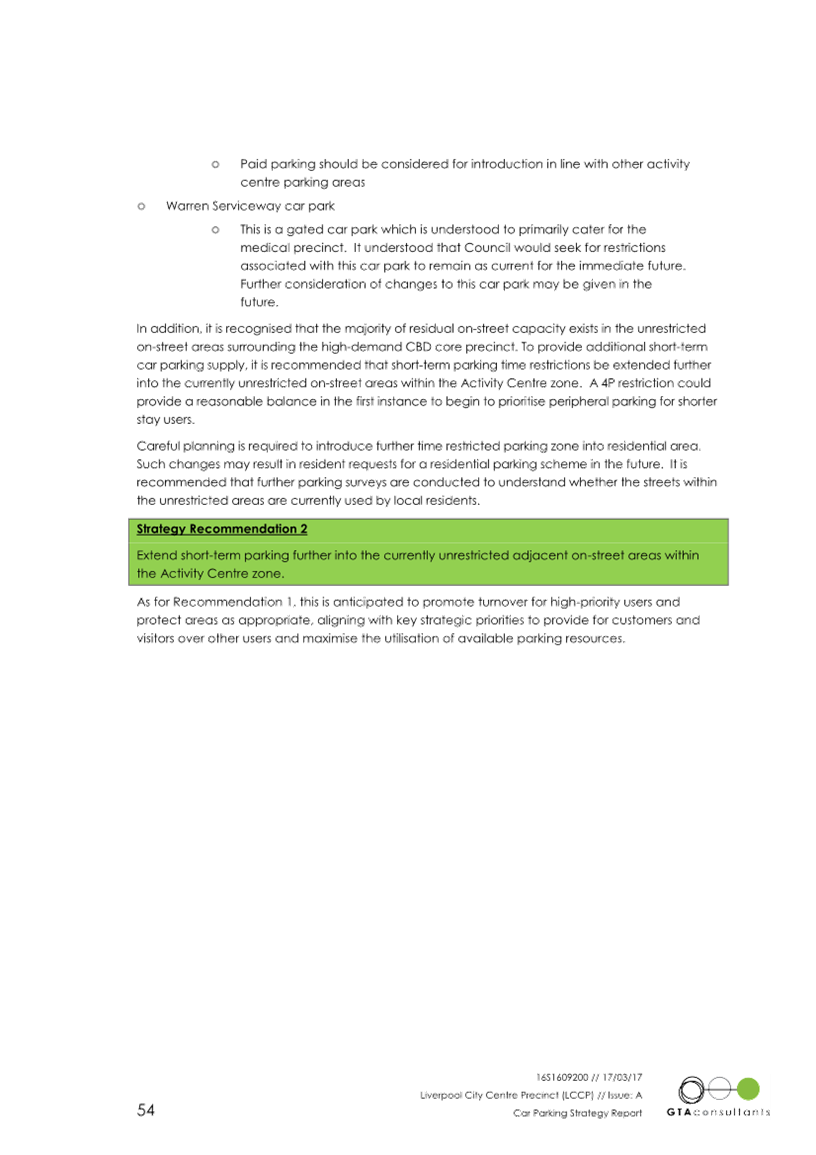

Previously Council engaged a traffic consultant, GTA,

in 2017 to prepare its City Parking Strategy Report, which included a study on

the existing supply and demand conditions of all on-street and off-street

parking spaces.

The study also provided recommendations for best

practice parking management strategies to improve accessibility and amenity for

its visitors.

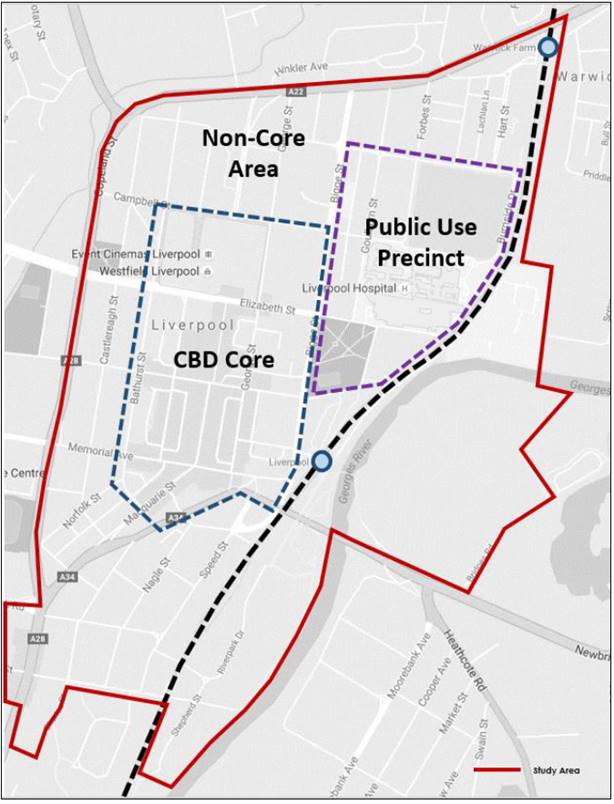

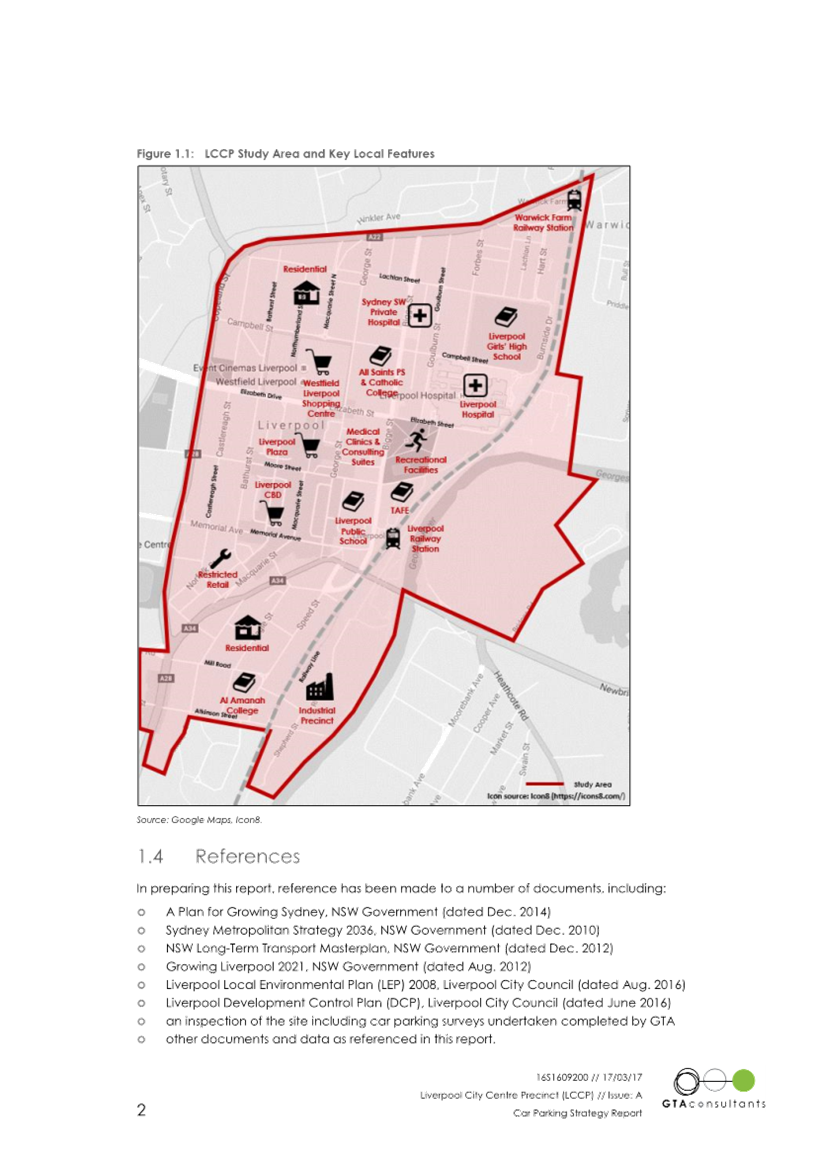

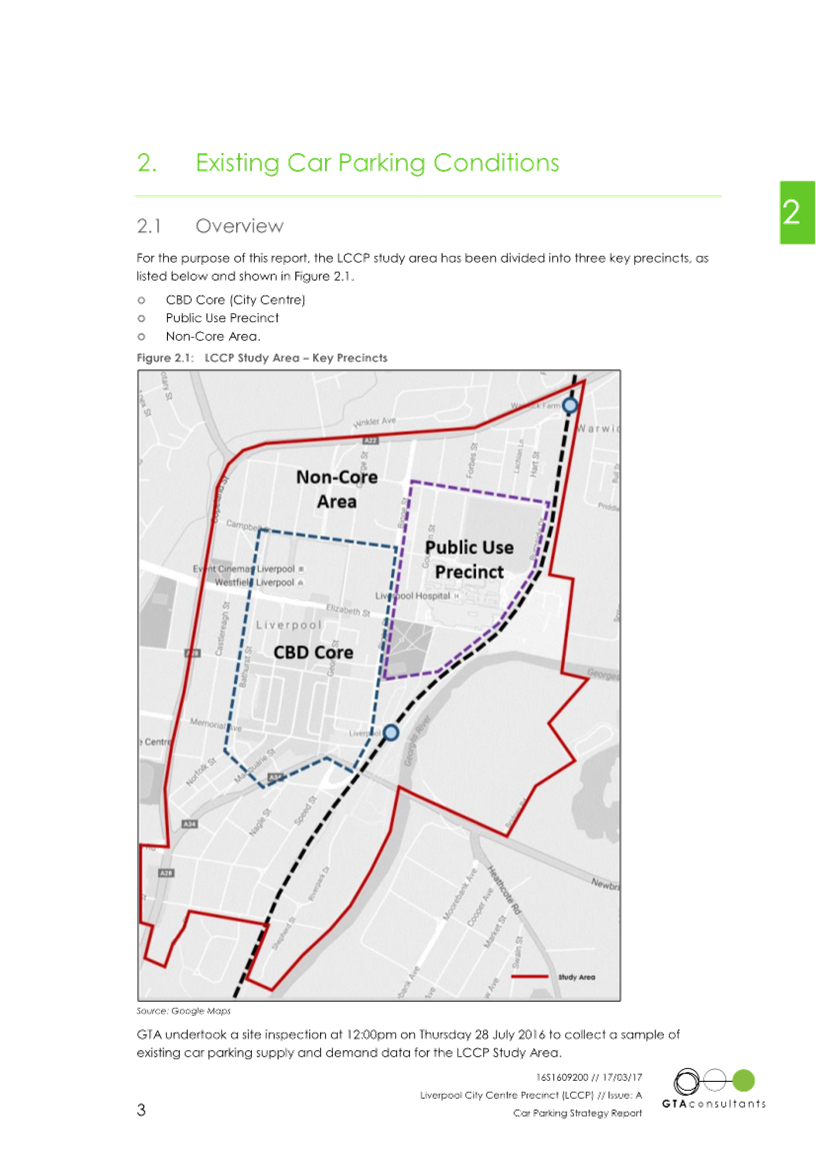

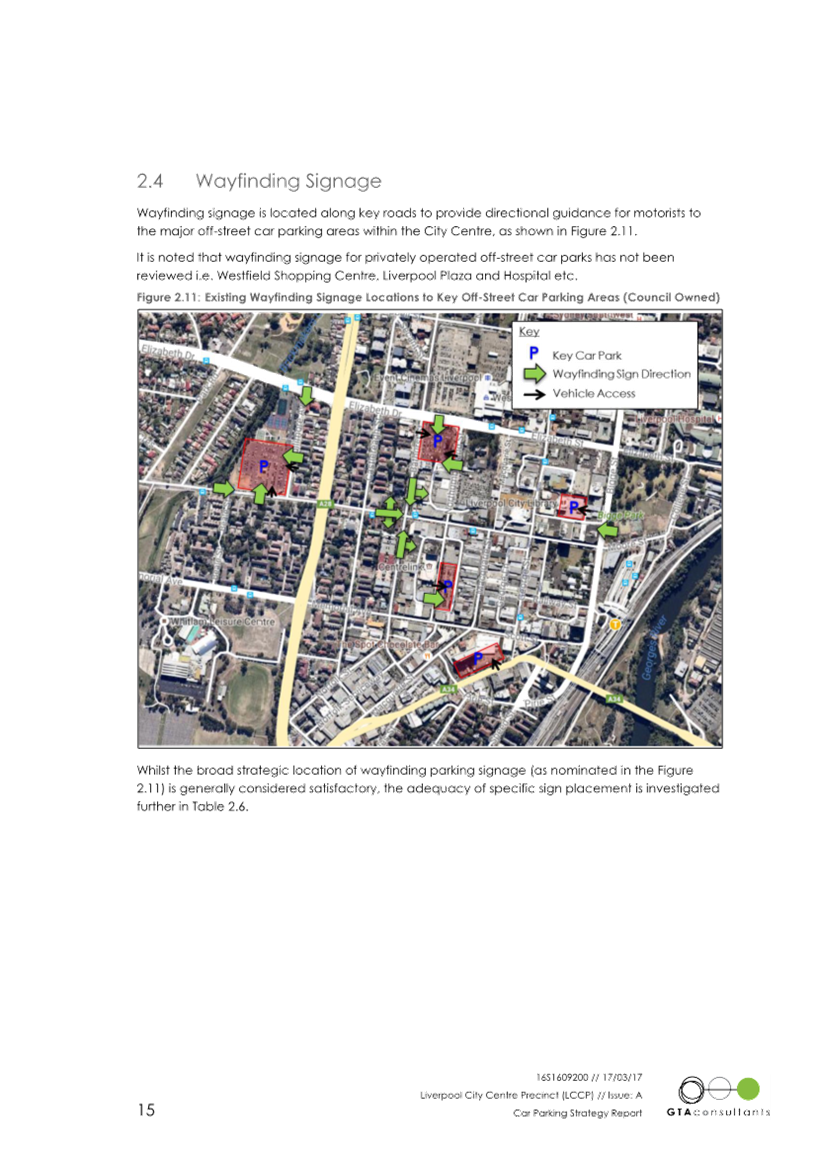

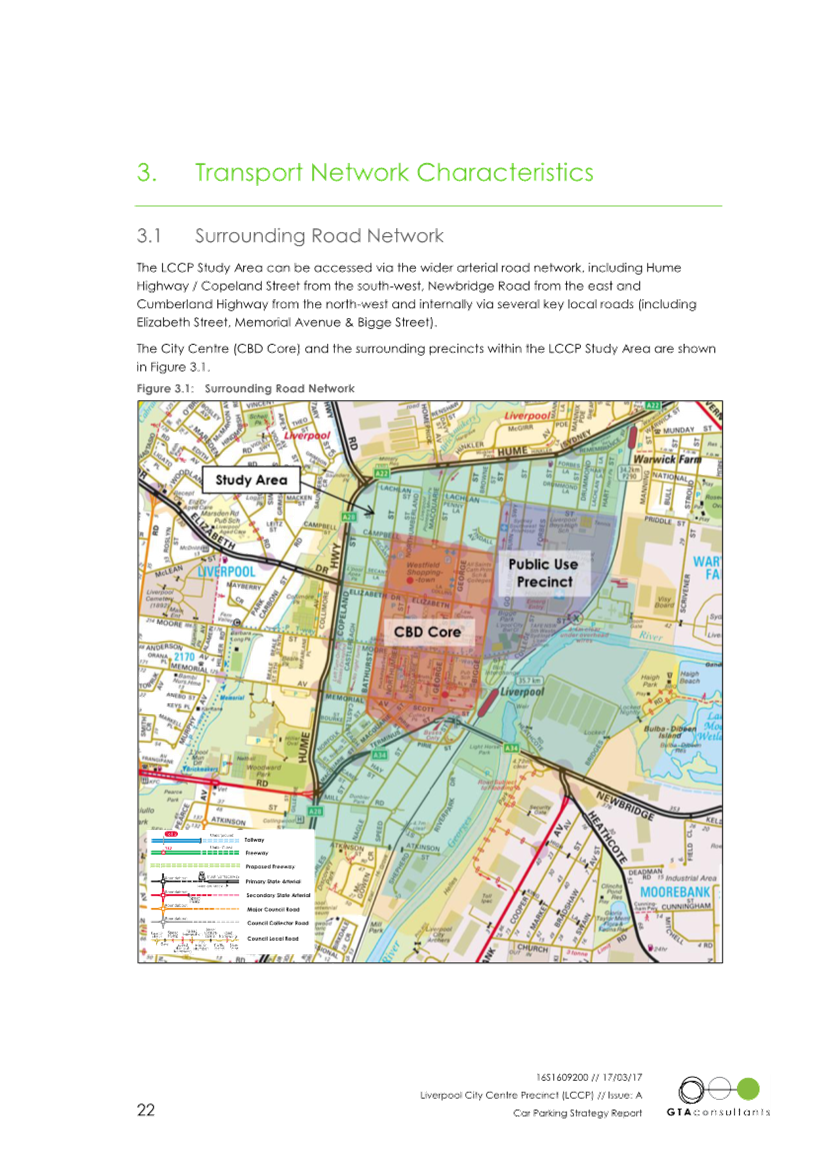

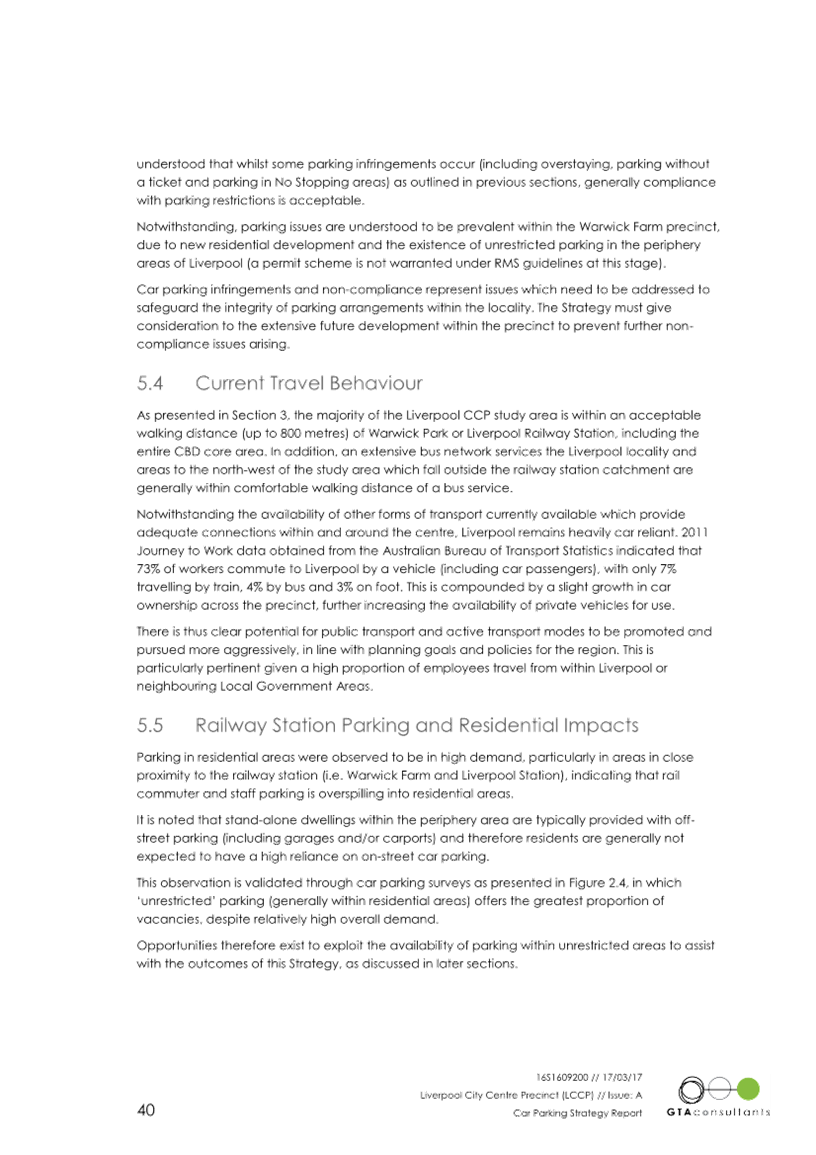

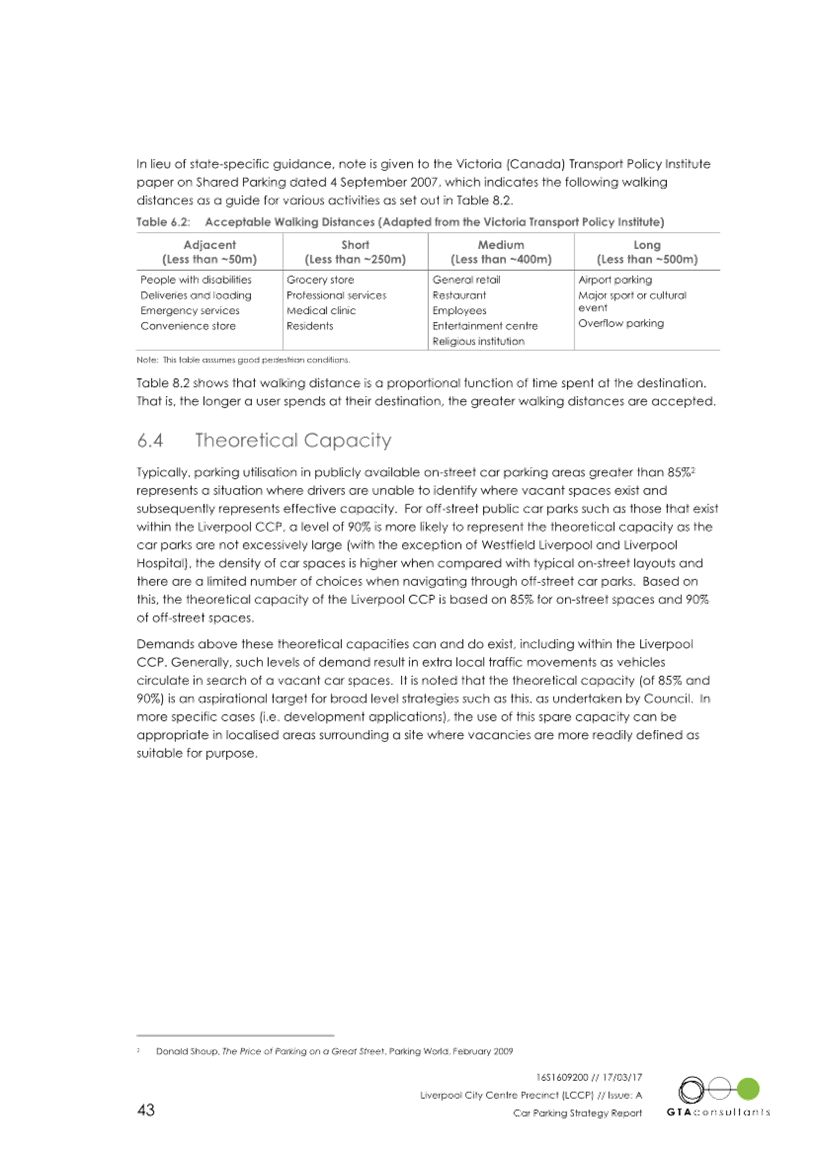

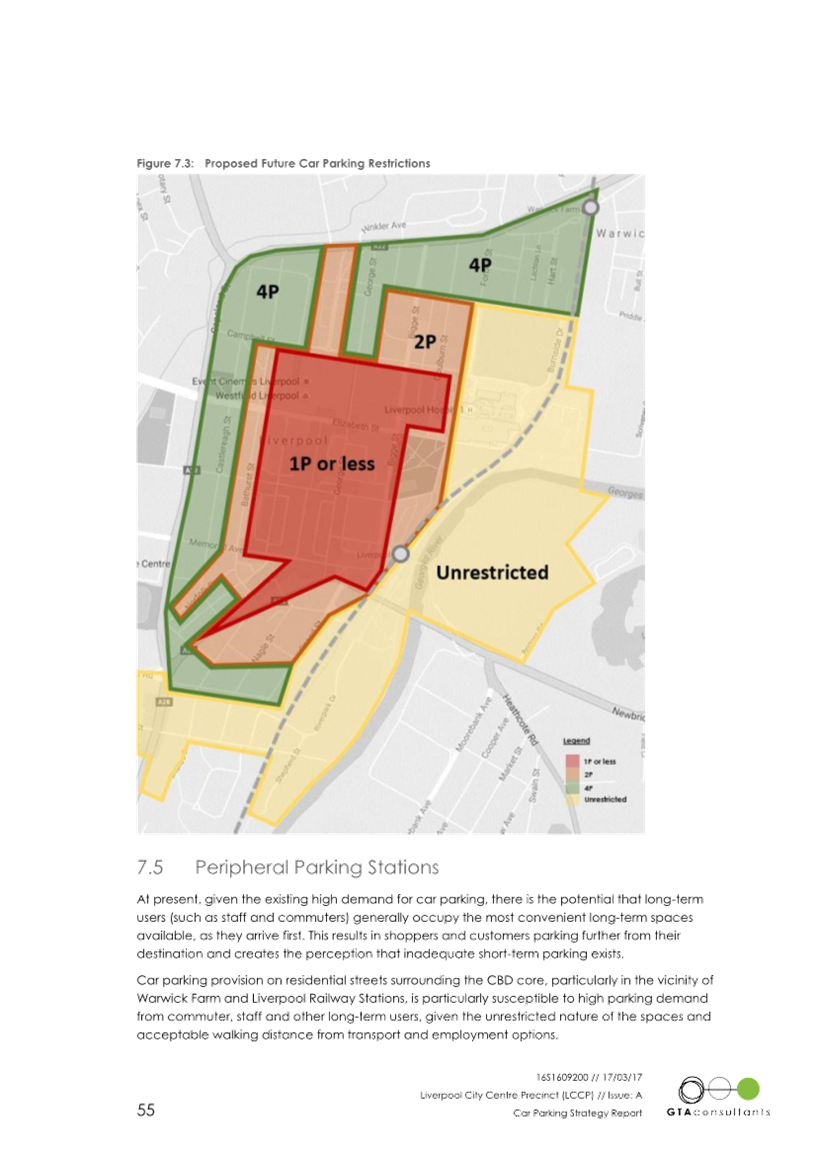

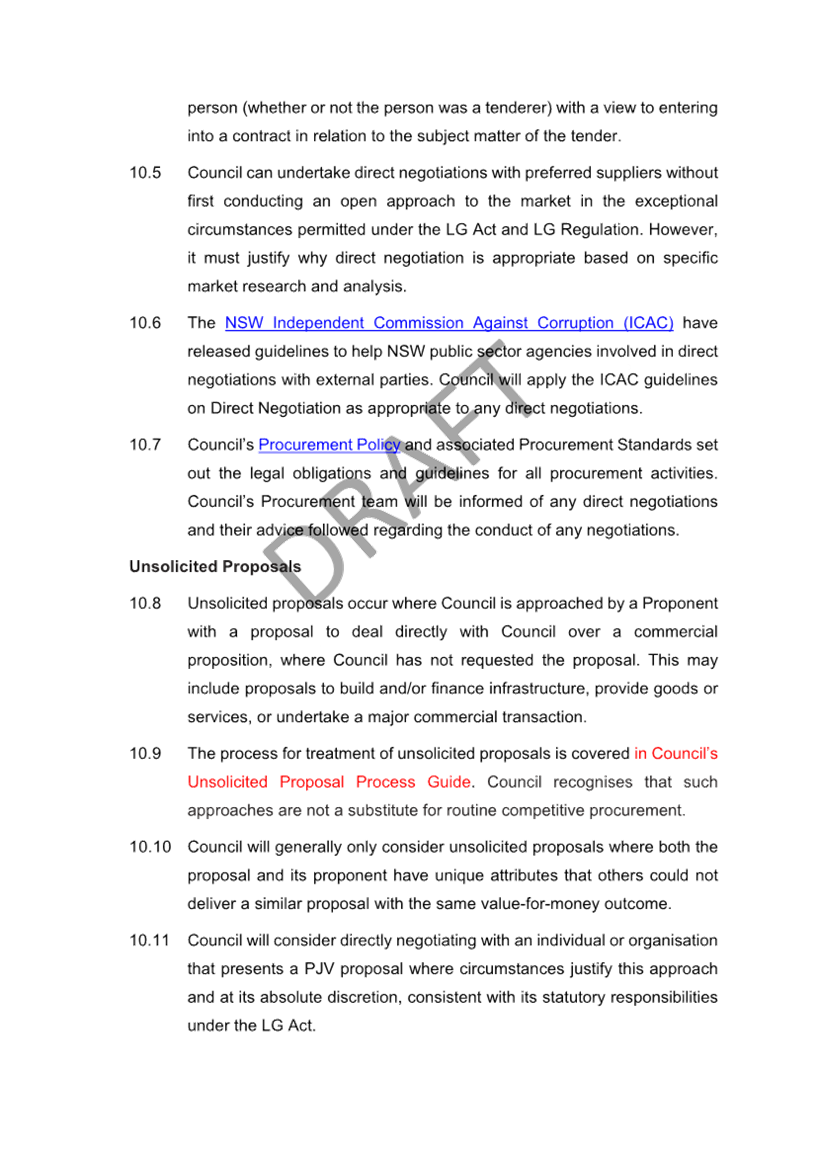

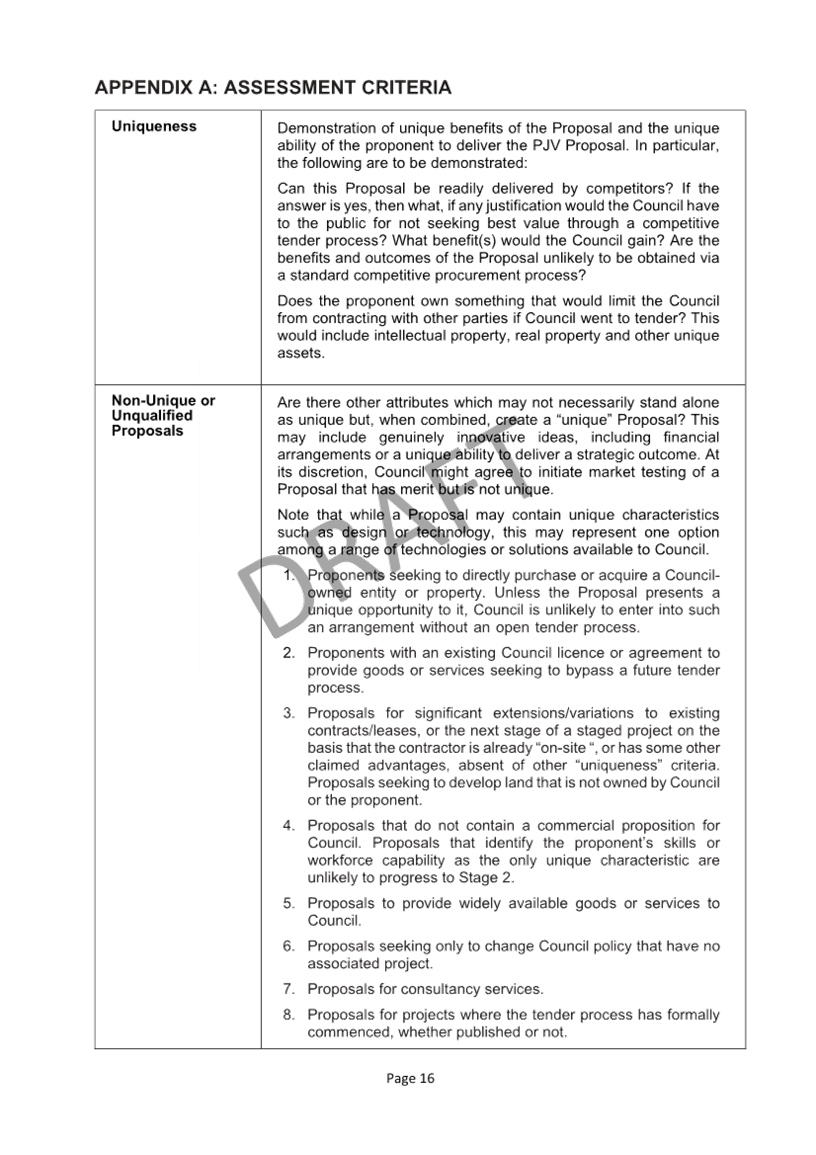

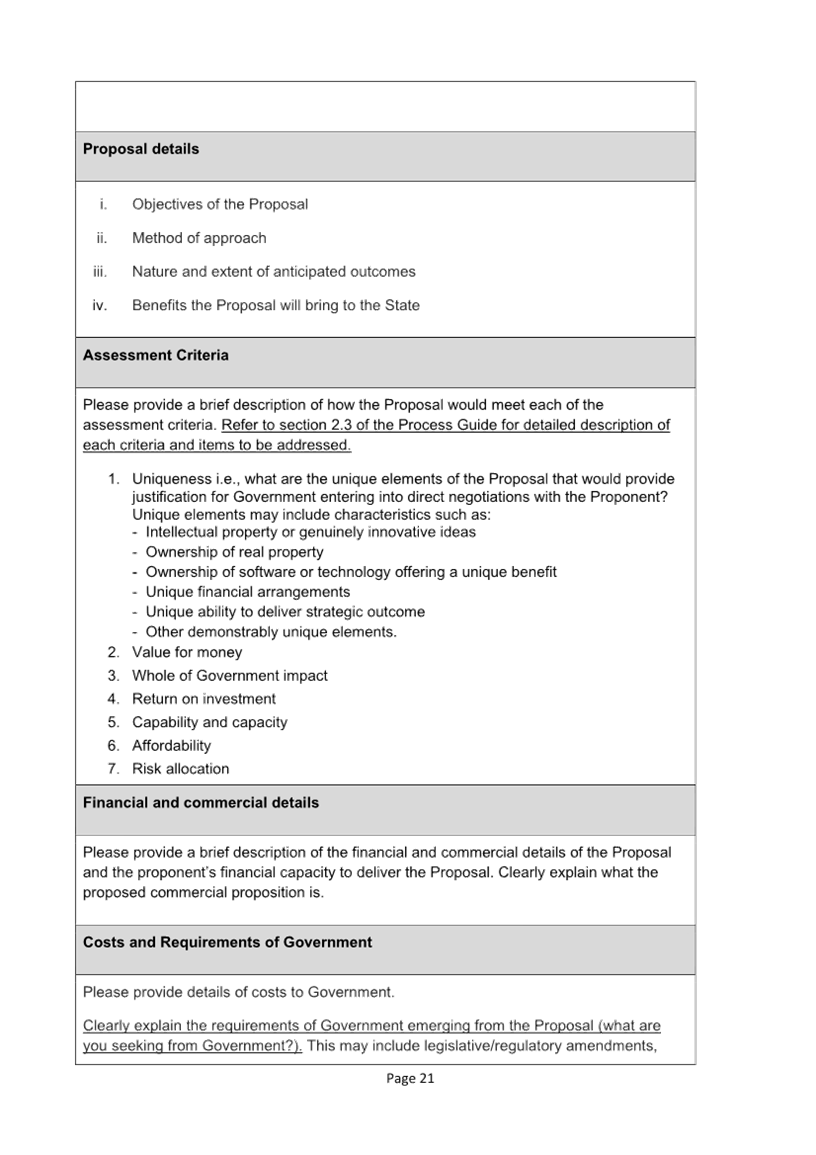

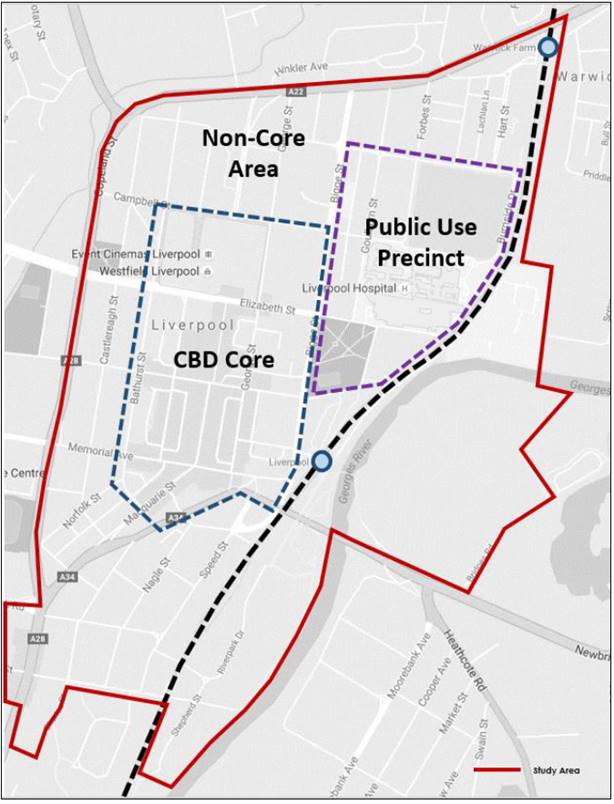

Figure

1: LCCP Study Area and Key Precincts

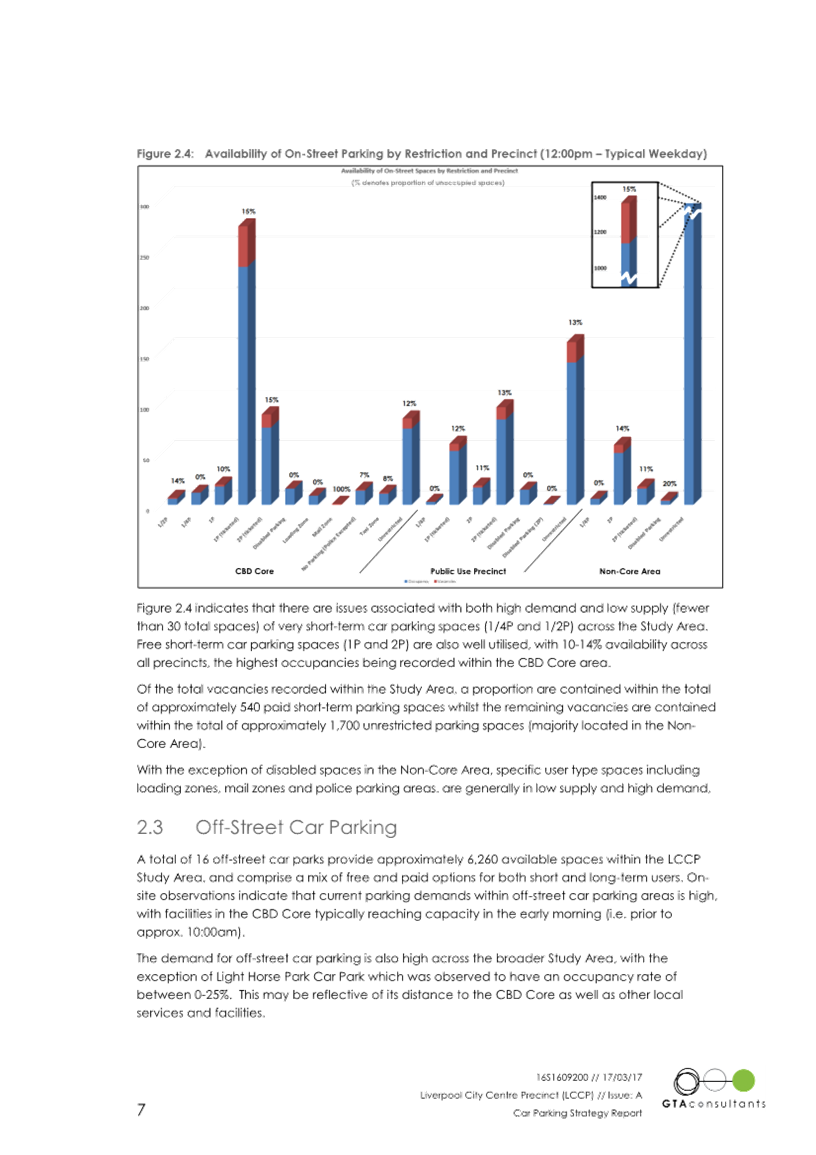

On-Street Car Parking Provision

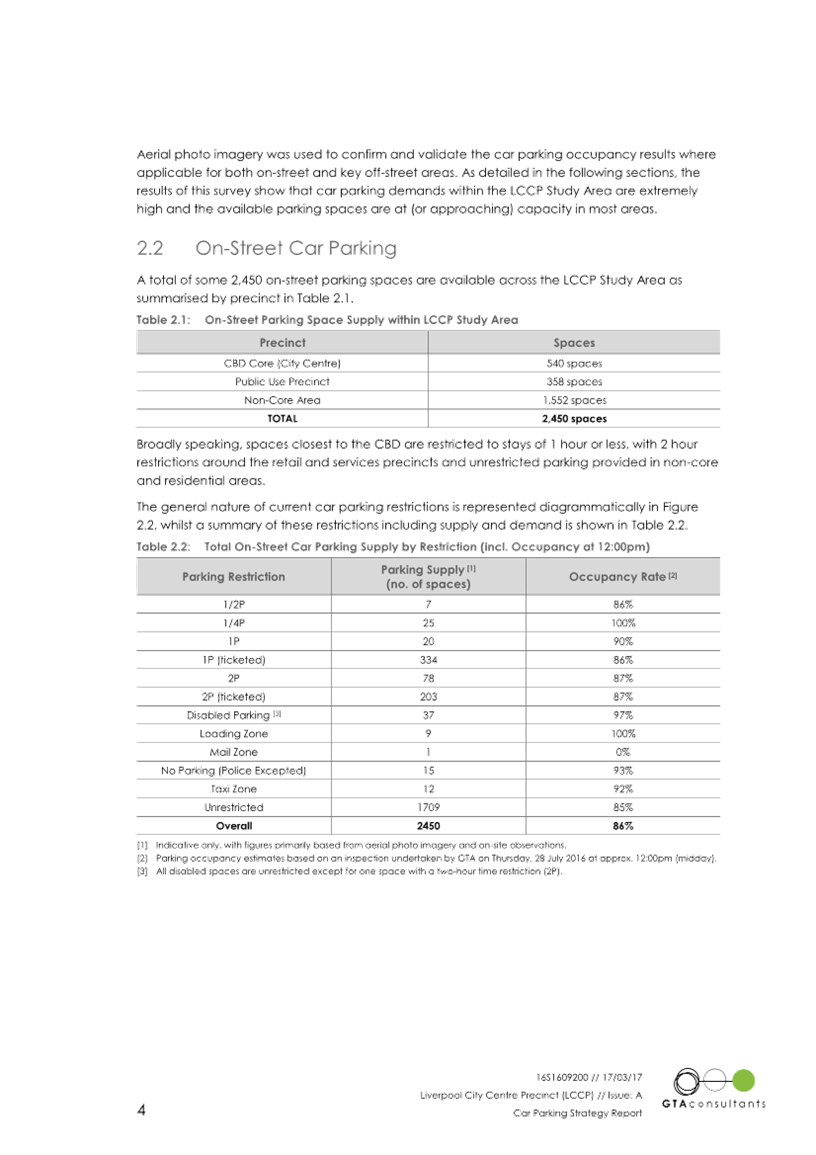

Referencing the GTA report, the Town Centre has

approximately 2,450 on-street parking

spaces, of which 540 of these are within the CBD Core.

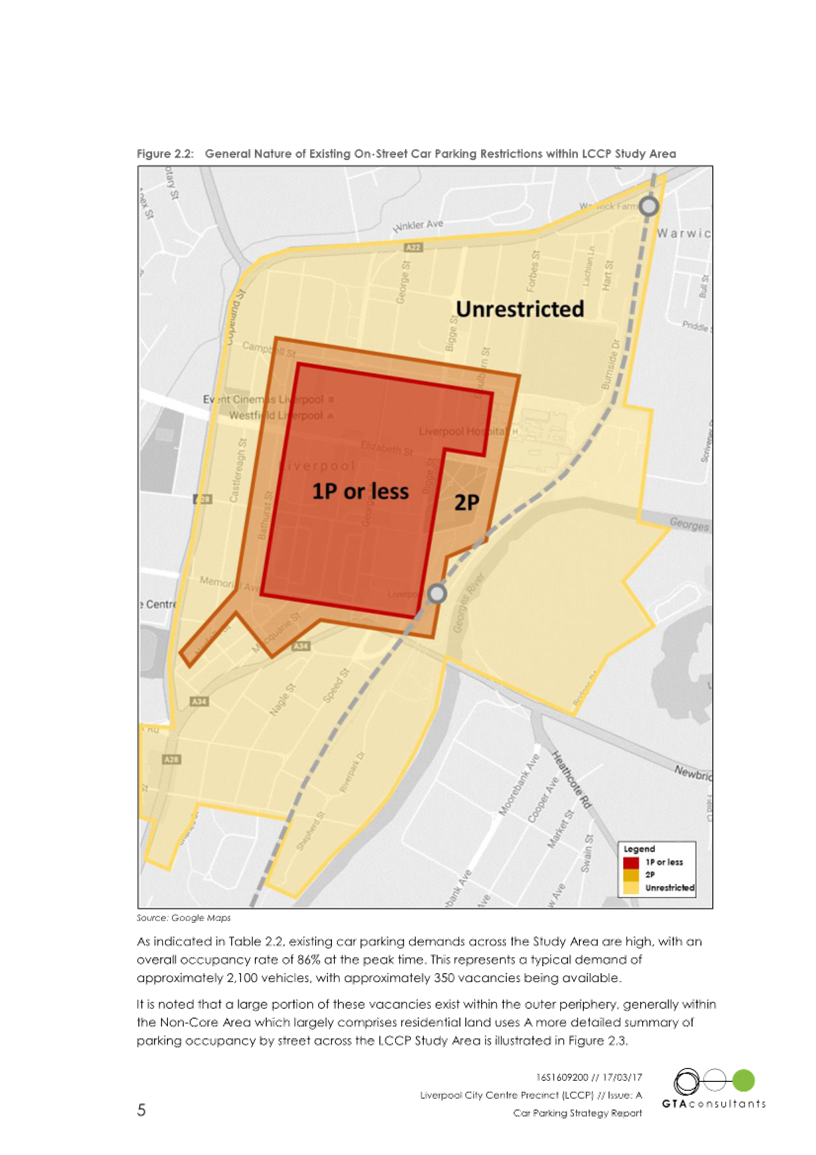

Broadly speaking, spaces closest to the CBD are

restricted to stays of 1 hour or less, with 2-hour restrictions around the

retail and services precincts and unrestricted parking provided in non-core and

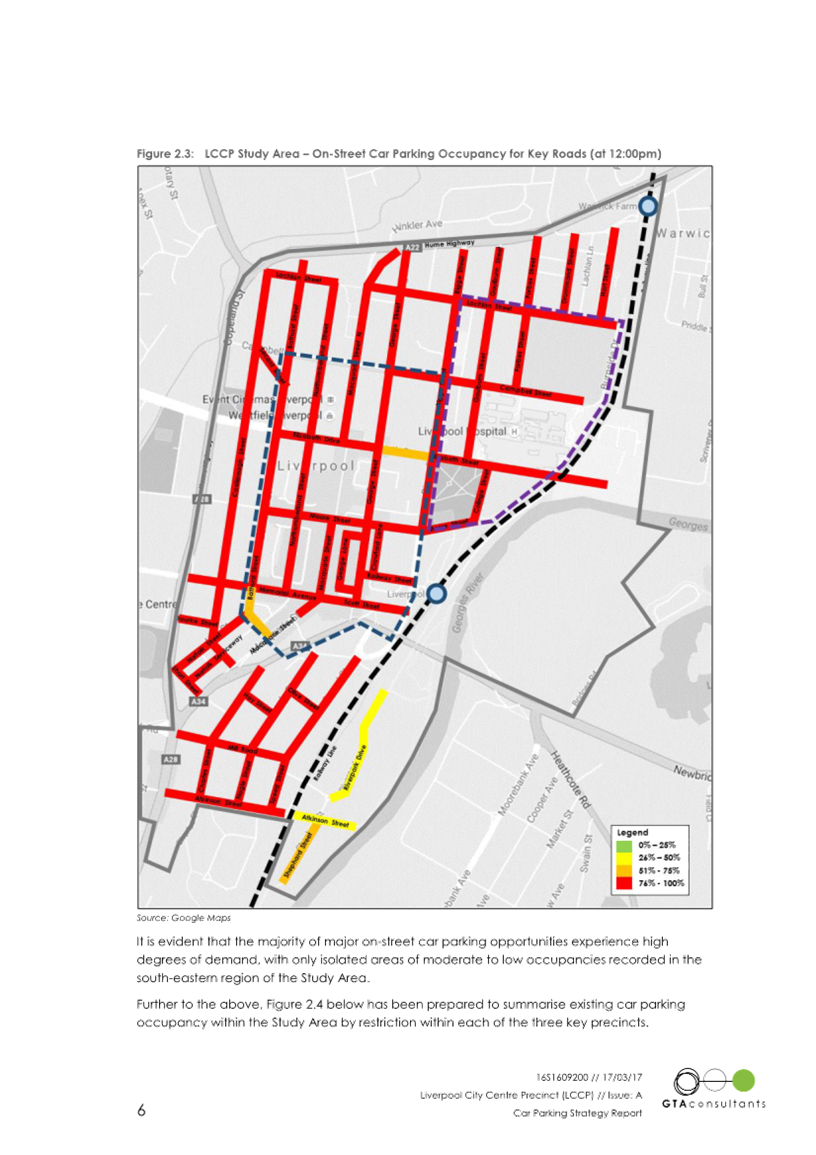

residential areas. Aerial photo imagery was used to confirm and validate the

car parking occupancy results where applicable. It was noted that most

on-street spaces are fully occupied throughout the day.

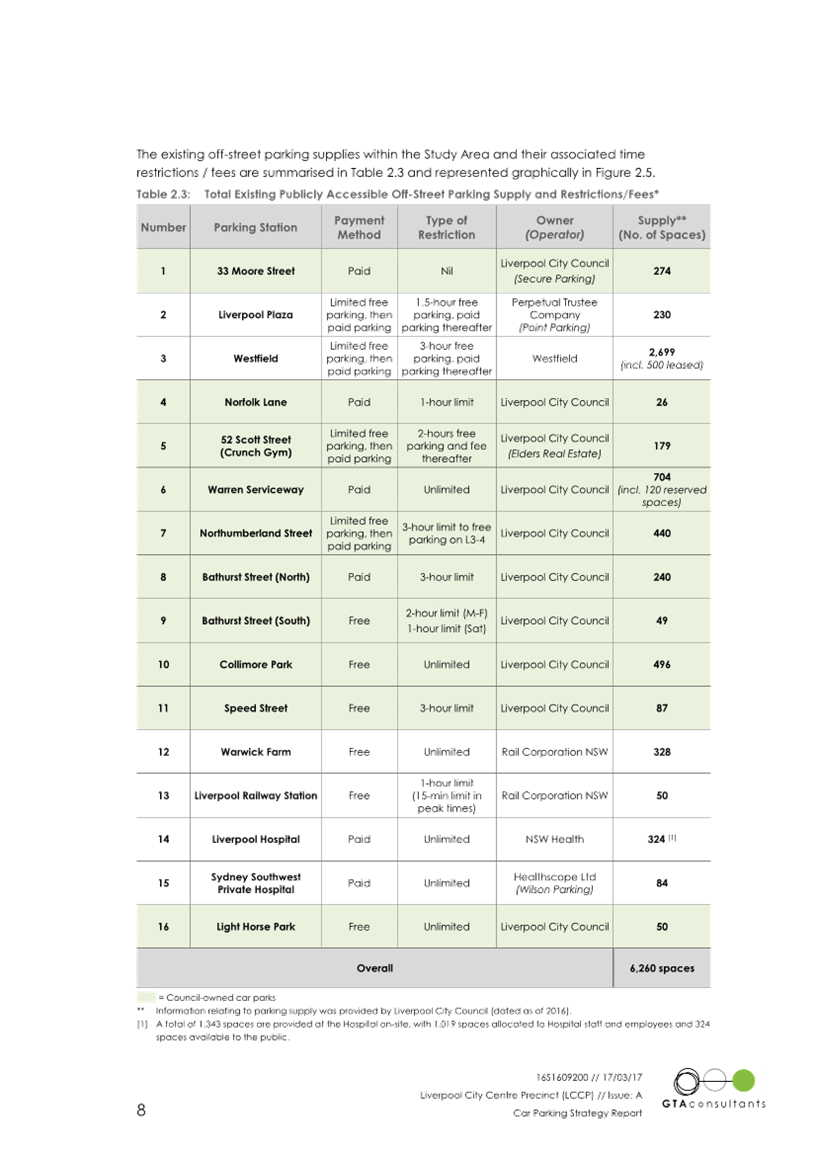

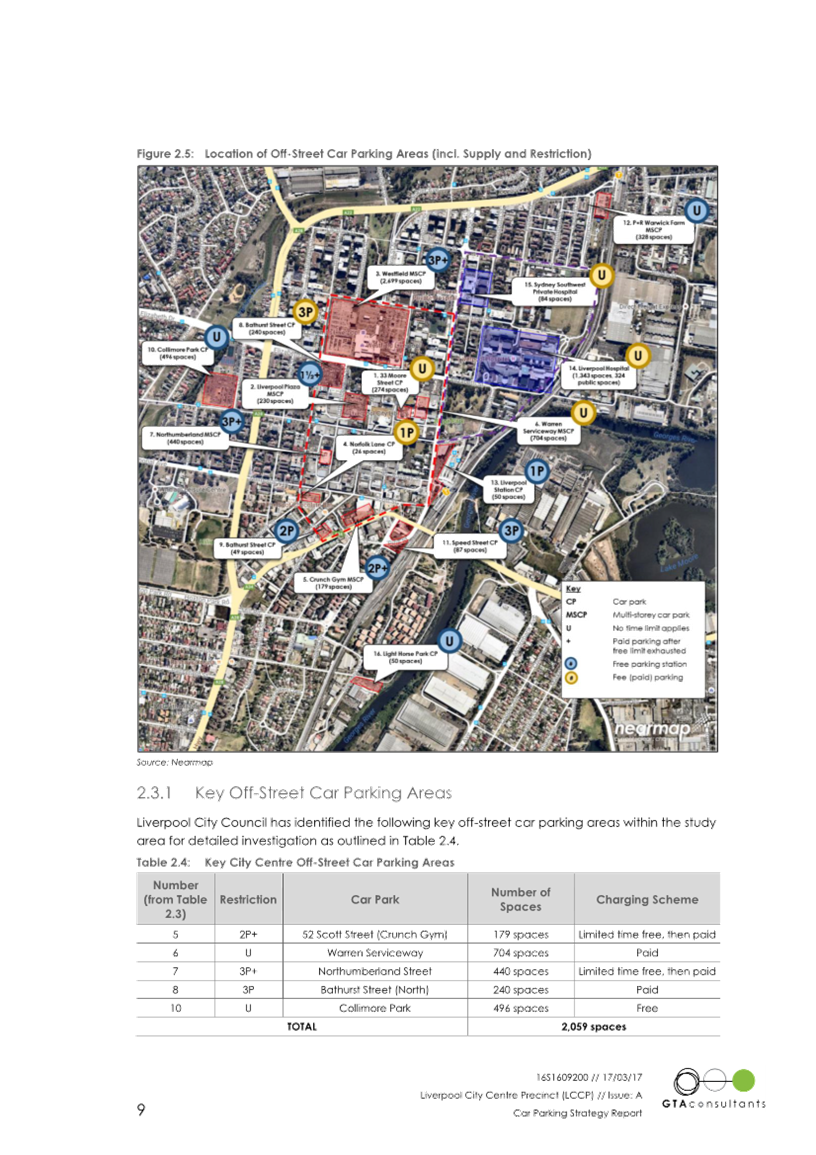

Off-Street Car Parking Provision

As

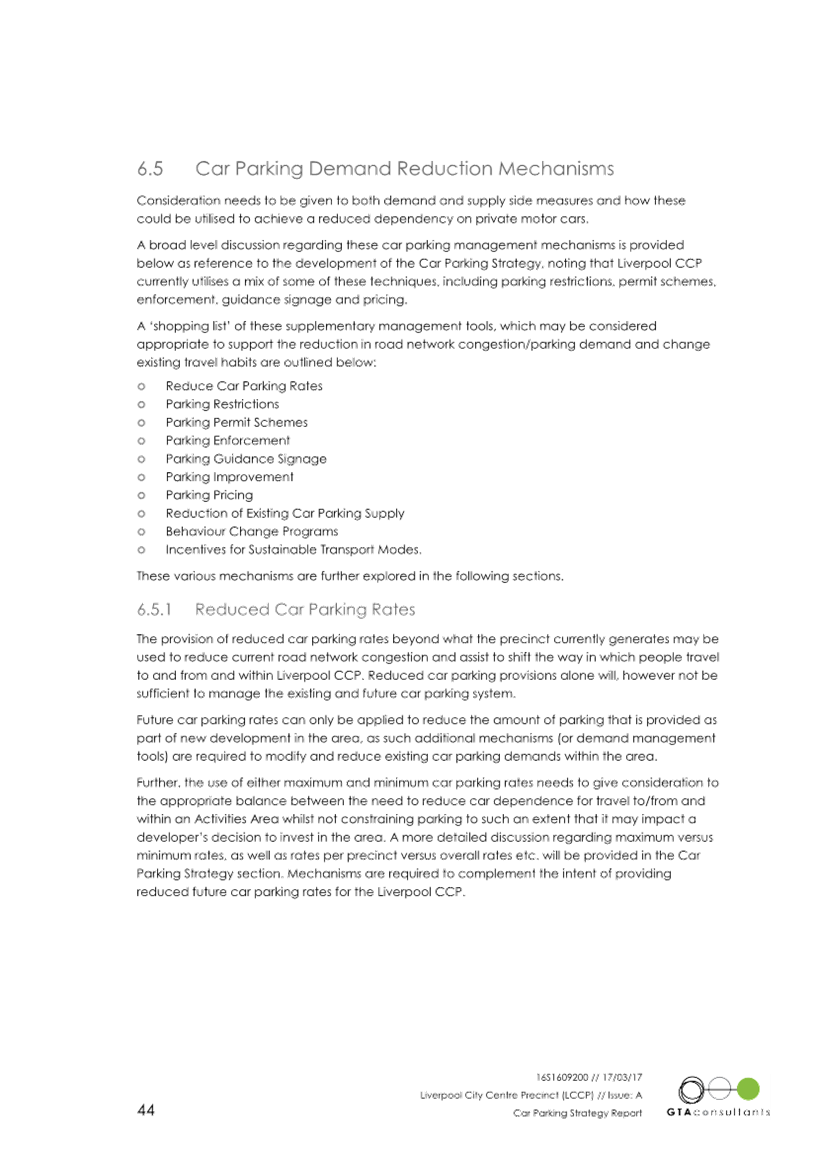

shown in Table 1, there are an estimated 9,259 off-street parking spaces within

and around the Liverpool City Centre.

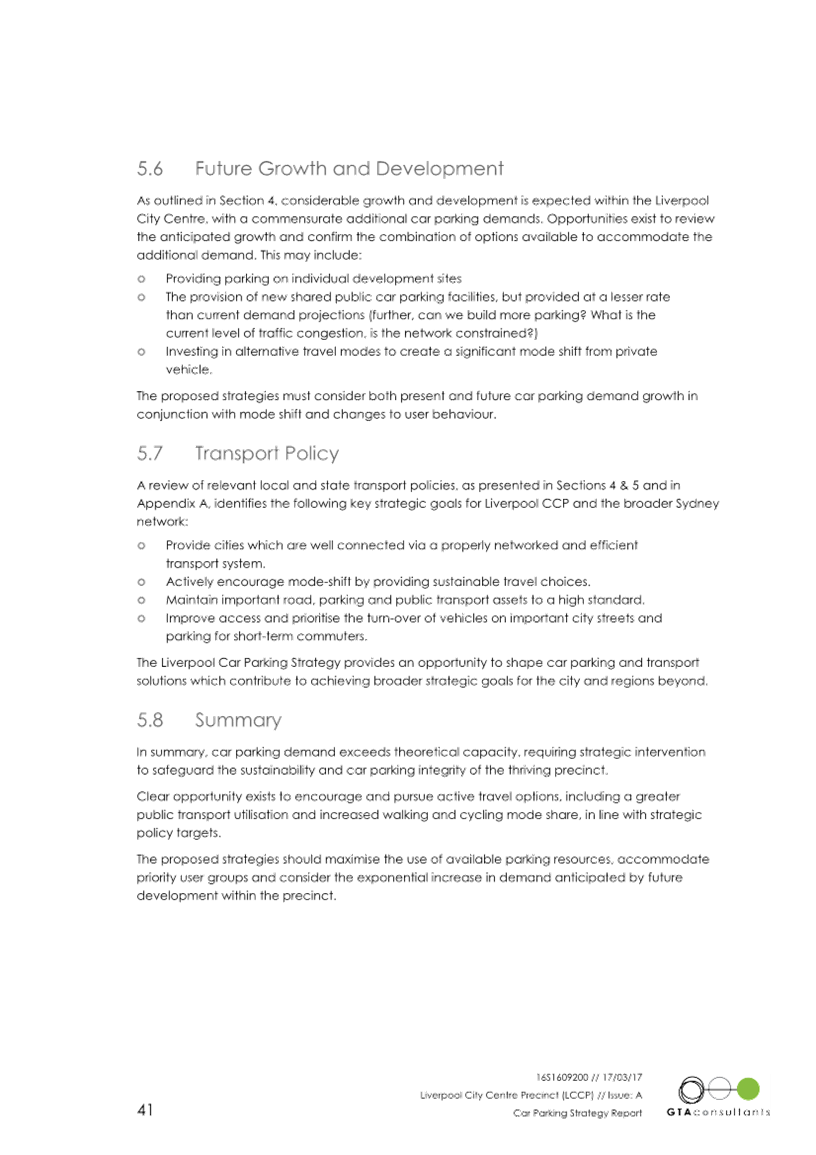

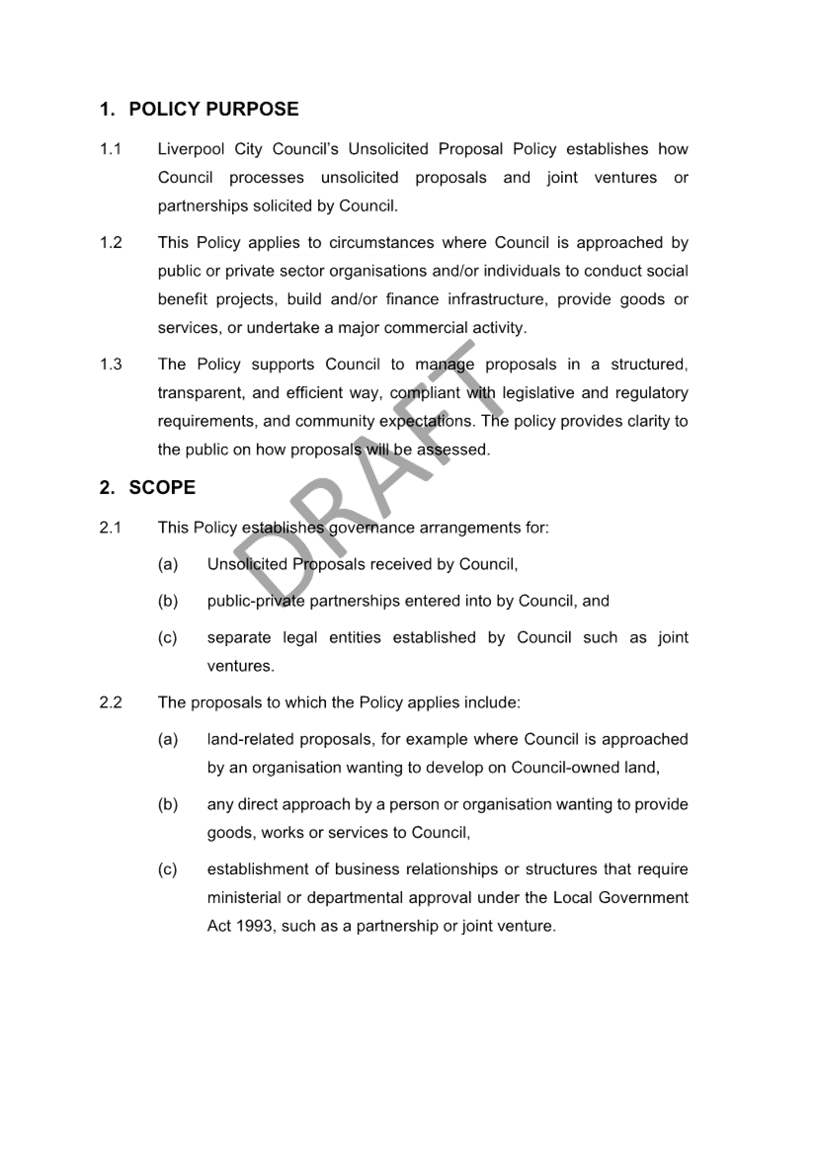

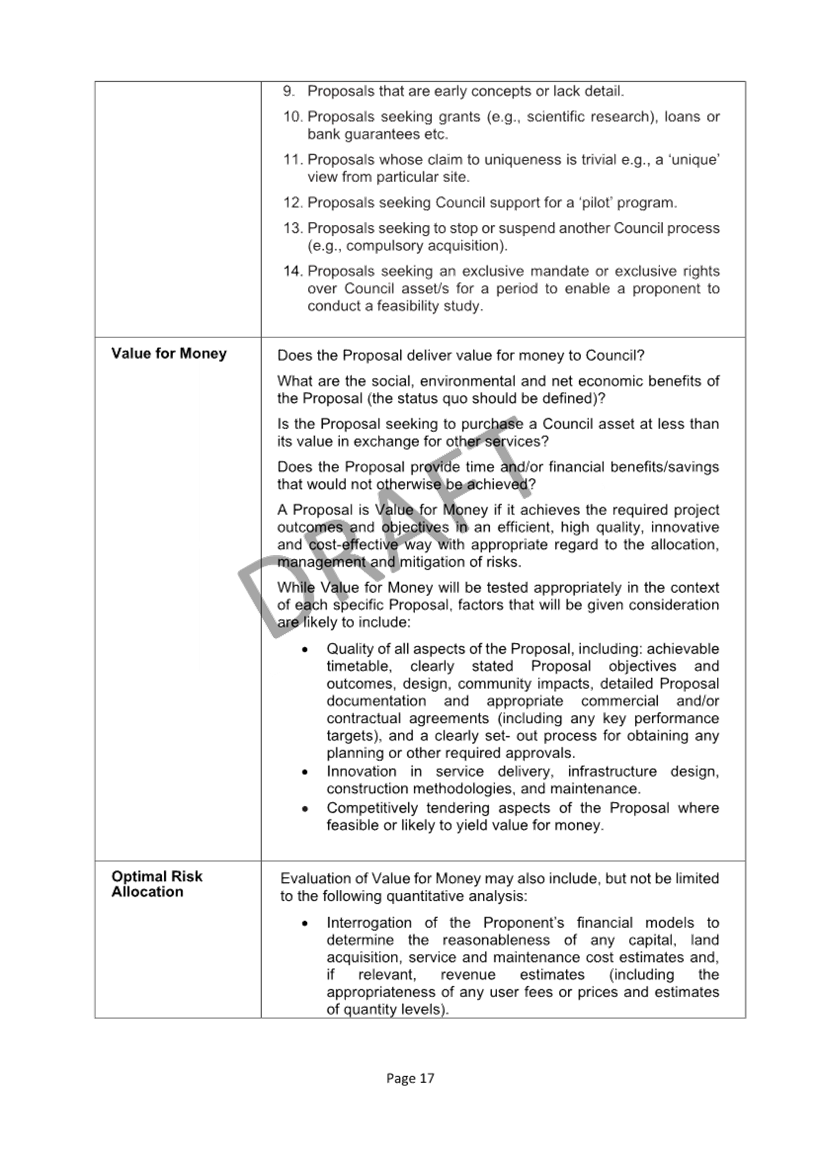

Table

1 – Existing Off-Street Car Parking Provisions

|

Parking

Station

|

Parking

Controls

|

Parking

Restrictions

|

Owner

|

Supply

(No. of Spaces)

|

Parking

Availability - Peak Times

|

|

33

Moore Street

|

Gated

|

Permanent

parkers only

|

Council

|

51

|

Not

applicable

|

|

Bathurst

Street (North)

|

Metered

+ VMS sign

|

3-hour

- metered

|

Council

|

240

|

20%

available

|

|

Bathurst

Street (South)

|

Free

|

2-hour

limit (M-F), 1-hour (Sat)

|

Council

|

49

|

20%

available

|

|

Civic

Place

|

Gated

|

3-hours

free, paid thereafter

|

Council

|

200

|

Close

to capacity

|

|

Collimore

Park

|

Free

|

Unlimited

|

Council

|

496

|

20%

available

|

|

Lighthorse

Park

|

Free

|

2 hours

free

|

Council

|

50

|

Close

to capacity

|

|

Norfolk

Service way

|

Metered

|

1-hour

limit metered

|

Council

|

26

|

|

|

Northumberland

Street

|

Metered

+ Free parking + VMS sign

|

2-hr

metered ground floor

3P free and 7P metered parking on upper levels

|

Council

|

440

|

less

than 10% available

|

|

Speed

Street

|

Free

|

3-hour

limit

|

Council

|

87

|

At

capacity

|

|

Warren

Service way

|

Gated

+ VMS sign

|

Unlimited

- Paid

|

Council

|

282

|

20%

available

|

|

Warren

Service way

|

Gated

|

Nested/permanent

|

Council

|

248

|

Not

applicable

|

|

Warren

Service way

|

Gated

|

Reserved/Contractor/DDA

bays

|

Council

|

140

|

Not

applicable

|

|

Whitlam

Leisure Centre/Woodward Park

|

Free

|

Unlimited

|

Council

|

1,051

|

Available

spaces

|

|

Liverpool

Hospital

|

Gated

+ VMS sign

|

Unlimited

- Paid

|

NSW

Health

|

1288

|

Available

spaces

|

|

Liverpool

Plaza

|

Gated

|

1 hour

free, paid thereafter

|

Private

|

230

|

30%

vacancy on rooftop

|

|

Sydney

Southwest Private Hospital

|

Gated

|

Unlimited

- Paid

|

Private

|

87

|

Available

spaces

|

|

Westfield

|

Gated

+ VMS sign

|

3-hour

free, paid thereafter

|

Private

|

3,438

|

Less

than 20% available

|

|

Liverpool

Railway Station

|

Free

|

1-hour

limit, 15-min peak times

|

Rail

Corp

|

124

|

At

capacity

|

|

Warwick

Farm Commuter Carpark

|

Gated

+ VMS sign

|

Free

for commuters - otherwise paid

|

Rail

Corp

|

732

|

Available

spaces for commuters

|

|

TOTAL

SPACES

|

|

|

|

9,259

|

|

|

|

|

|

|

|

|

Source: Council Data.

Referencing

Table 1 the last column indicates there is spare capacity within the CBD. In

particular, the car parks with the highest occupancy include privately managed

gated car parks with high long-stay fees (over 4 hours). These include

Westfields, Liverpool Plaza, Hospitals and the Warwick Farm commuter car park.

Parking Transaction Data

Northumberland Street Car Park

Council has reviewed recent parking

transaction data for this car park and notes the following:

· Ground floor car park is fully occupied yet only

generates a low number of paid parking transactions. On-site observations note

that a majority of vehicles parked on the ground floor are displaying a

mobility permit thereby voiding the need to pay for parking or comply with the

two-hour (2P) time restrictions;

· The upper levels of the car park generate a high

degree of paid transactions indicating encouraging levels of compliance and

parking demand; and

· The roof-top has minimal parking availability.

Bathurst Street Car Park (North)

This is a large at-grade car park offering three-hour

(3P) metered parking. Recent parking transaction data indicates the car park is

being well utilised, however is only generating minimal paid transactions. Once

again this is a result of the proliferation of mobility permits which allows

people to park all day for free.

Warren Serviceway Car Park

Council has reviewed recent parking

transaction data for casual users of this car park (excluding permanent

parking) and notes the following:

· There is some spare capacity throughout the day

(average of about 50 spaces or less);

· There is a good distribution of car park users based

on duration of stay including the following:

o Short Stay – Less than 2 hours (75%)

o Medium Stay – 2 hours to 6 hours (13%)

o Long Stay – over 6 hours (12%)

· Reasonable

parking fees (max daily rate of $18 to $20).

Recent increases to CBD Car Parking

Provision

Since the GTA Strategy was completed in

2017, the following new parking spaces have became available to the public

within the Liverpool City Centre:

· An additional 400 parking spaces at Warwick Farm Train

Station;

· An upgraded multi-storey car park at Liverpool

Hospital with a capacity of approximately 1,250 car parking spaces

(additional 500 car parking spaces). Only a portion of these spaces are

available to the public;

· An additional 70 car parking spaces, north of Casula

Powerhouse Museum and associated Woodbrook Road underpass; and

· Approximately 200 new car parking spaces in the

Liverpool Civic Place development.

Parking Turnover

High levels of parking turnover are considered a

desirable outcome as it ensures high utilisation of spaces while also providing

greater amenity to shoppers and visitors. Within the Liverpool CBD, turnover

can be lower than expected based on what parking controls are in place.

· Off-street car parks that are metered have low parking

turnover due to the prevalence of mobility permit holders that are consuming

limited parking spaces throughout the day;

· Public and private off-street car parks that are

access restricted (e.g. boom-gated, number plate recognition, etc.) are

expected to have higher turnover and shorter durations of stay; and

· Privately-owned

off-street car parks include higher all-day fees of around $40 which discourage

extended all-day parking. They are expected to experience higher levels of

turnover.

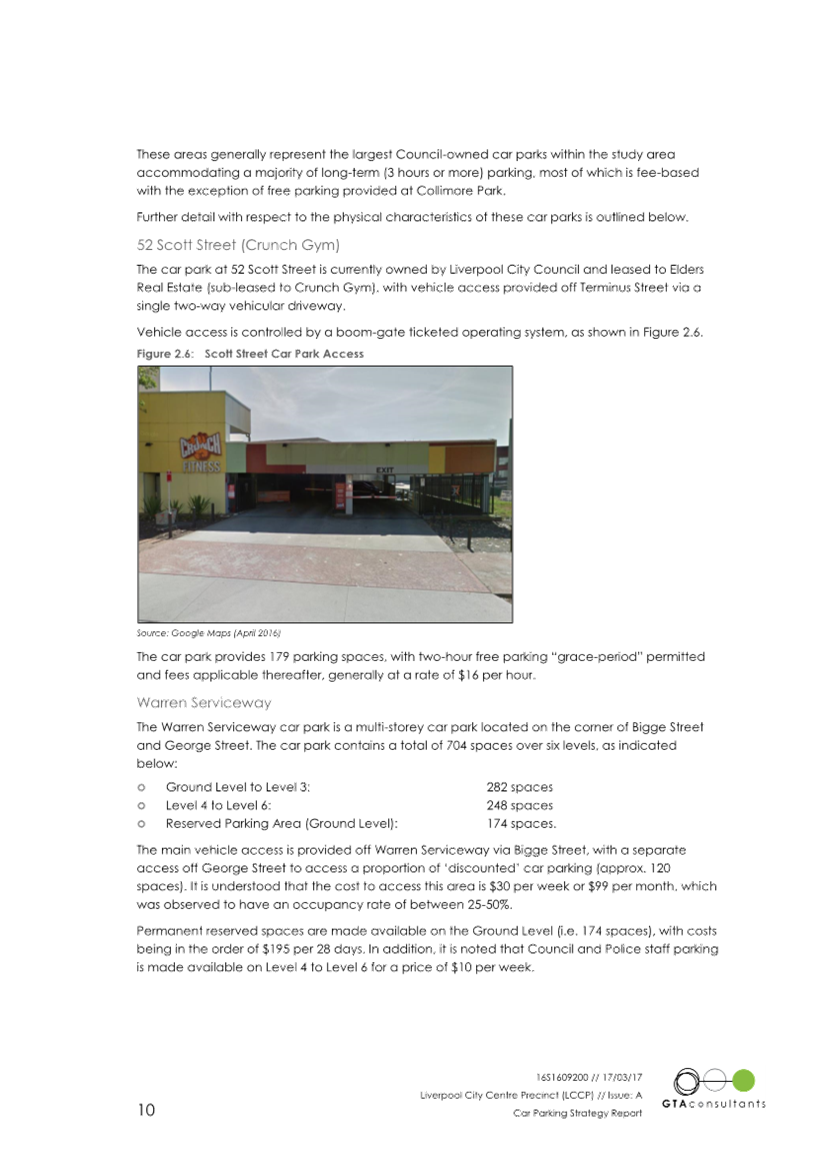

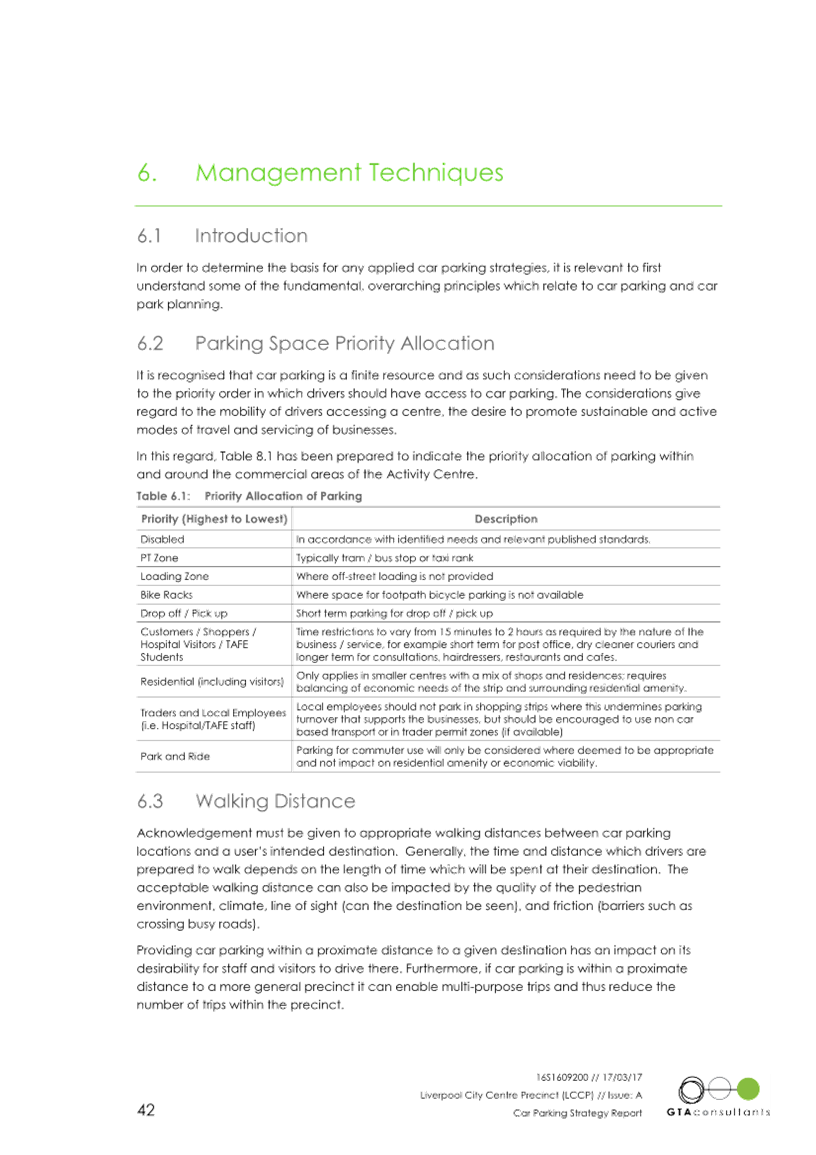

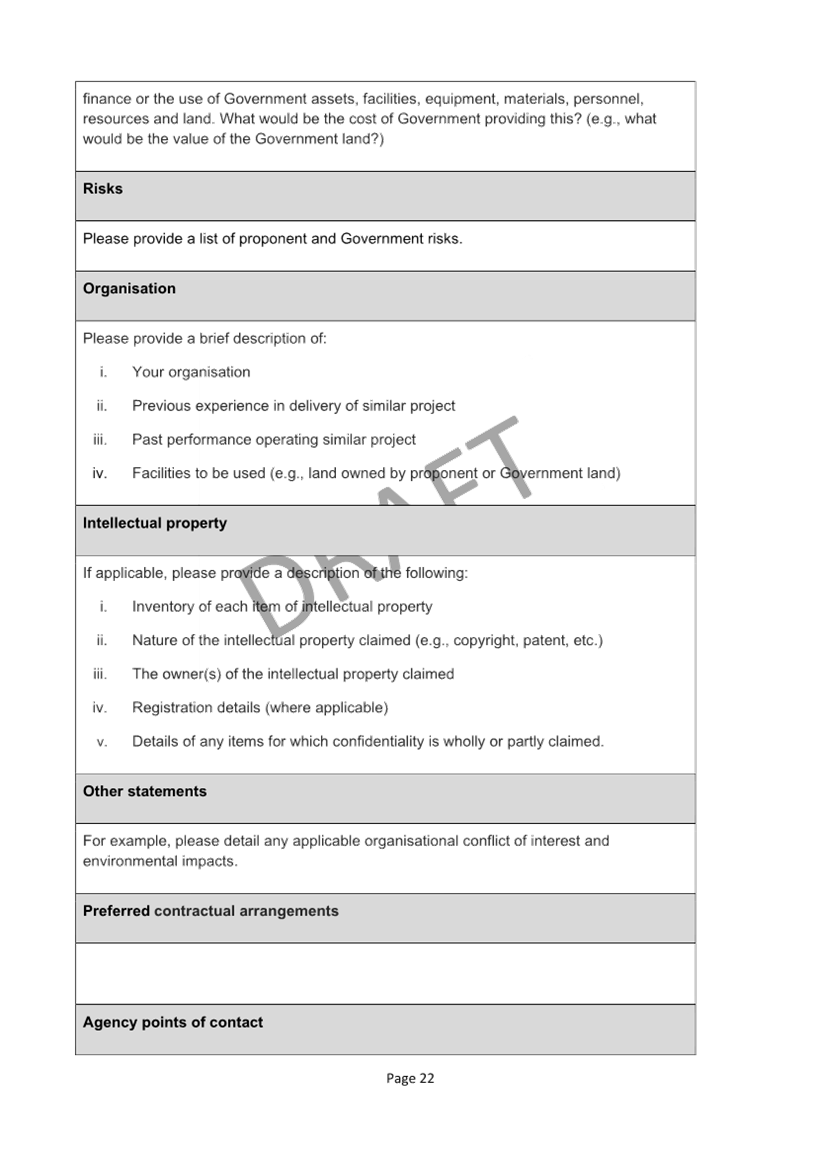

Potential Temporary Car Parking Sites

As

a result of this investigation, Council staff have identified six (6) potential

sites (see Table 2 and Figure 2 below) within the Liverpool City Centre that

could be repurposed as off-street car parking. Each location is further

assessed in the following sections.

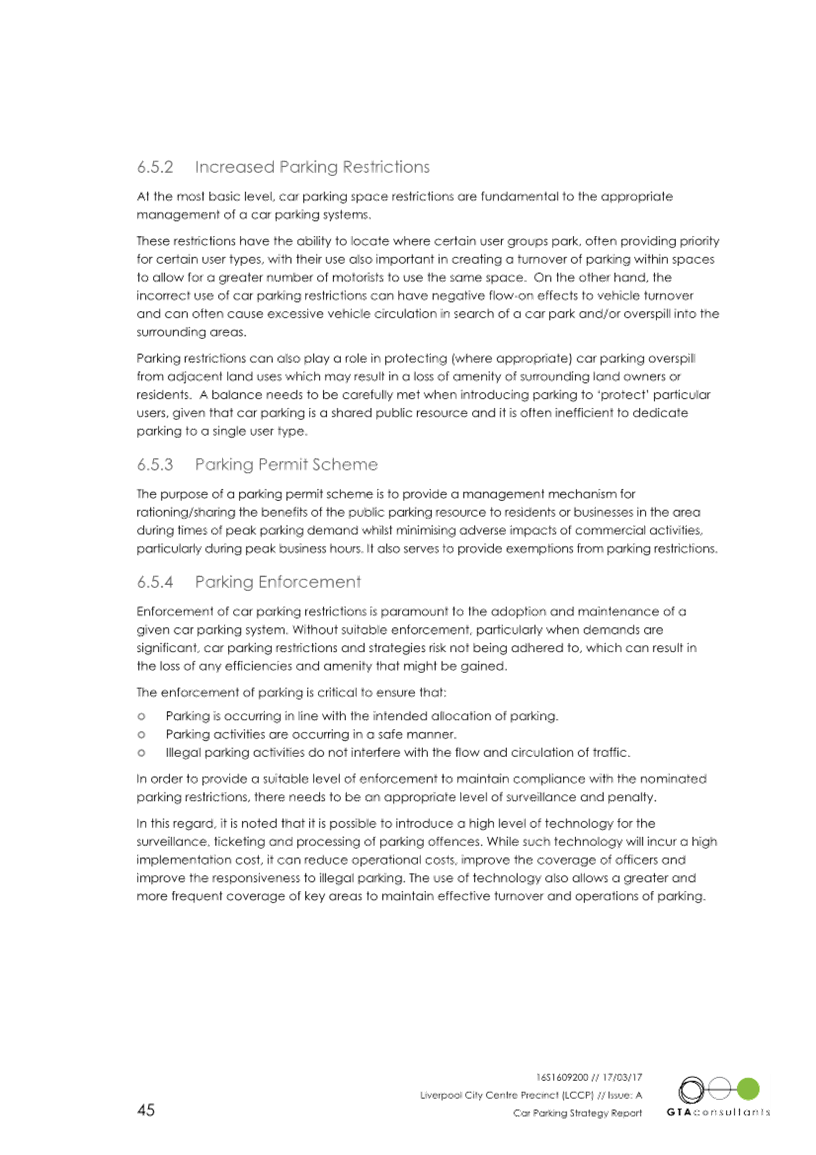

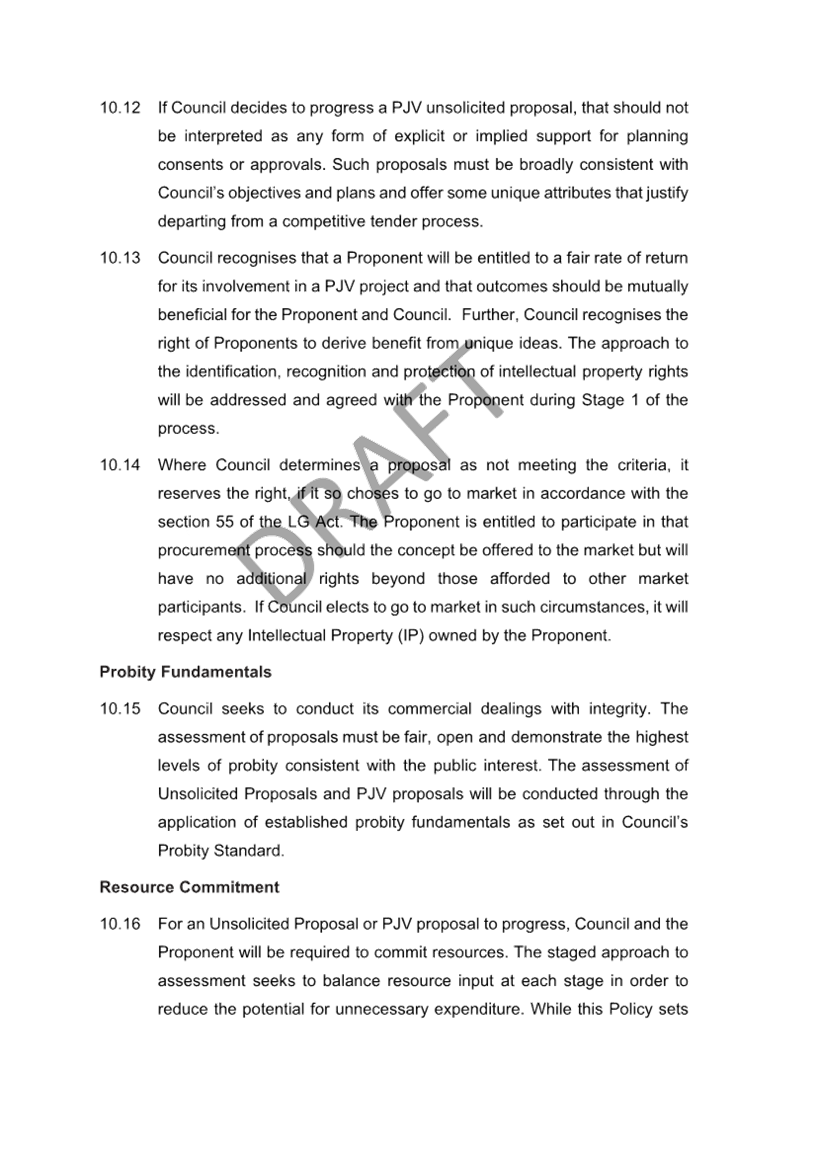

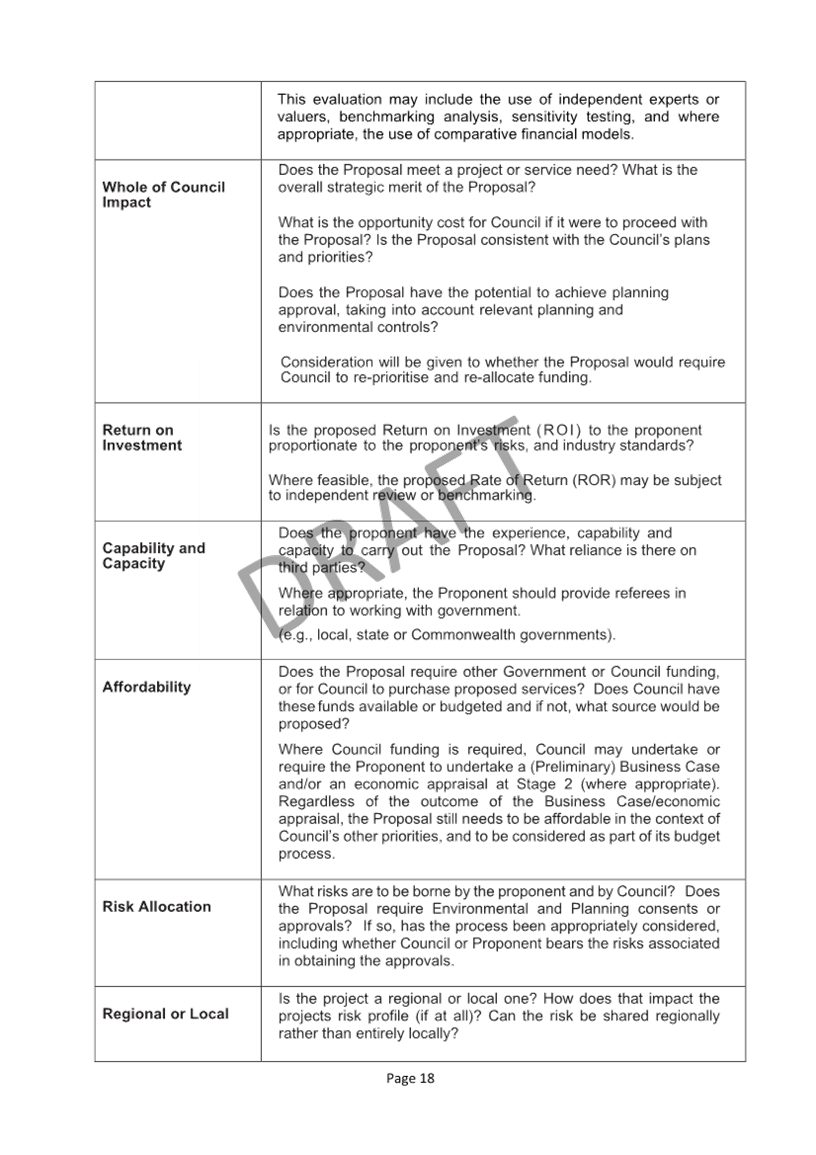

Table

2: Details of Potential Sites

|

Site No.

|

Address

|

Description

|

No. of Spaces (Approx)

|

|

1

|

11-23 Scott Street and 277 Bigge Street (Privately Owned)

|

The site of 10 lots (approx. 2400 sqm)

have access via Scott Street and Railway Serviceway.

The lots, owned by a single landowner, comprises of a mix of vacant lots and

two-storey buildings and has a current development application approved for

the demolition of the existing commercial buildings. The

site has the potential to accommodate approximately 40 spaces.

|

40

|

|

2

|

68-70 Bathurst Street (Privately Owned)

|

This is an at-grade car park comprising

approximately 45 reserved spaces for nearby workers. The site can be accessed

via is currently two street access to the site via Bathurst Street and

Huckstepp Serviceway.

|

45

|

|

3

|

40 Scott Street (Council Owned)

|

The vacant lot is a Council owned site adjacent to

the Civic Building with an existing driveway access via Scott Street. The

site has an existing two-storey building with concrete paved area which can

be developed to an at grade car park. The site has the potential to

accommodate approximately 23 spaces.

A cost

estimate prepared by consultant, T Cubed consulting, for the construction of

an at grade carpark at 40 Scott Street indicated a cost of approximately

$335,000 for 23 car parking spaces. The did not include contamination

assessment and landscaping provision. Consultant fees and contingency have

been factored at a 20% and 30% rate respectively. Based on the pro rata rate

for construction per space, Council staff have estimated the construction

costs associated with each proposed temporary carpark. The breakdown is

provided in the financial section of this report.

|

23

|

|

4

|

133 Bigge Street

(Privately Owned)

|

The is a large vacant lot (approx. 3500 sqm) along Elizabeth

Street Opposite the Catholic School. There are 3 vacant lots abutting each

other between Bigge Street and George Street; however, 2 of them are approved

for development.

The lot can be accessed via Bigge Street and Elizabeth Street and

was previously operating as a car hire yard and is owned by the Uniting

Church. It has the potential to accommodate over 100 cars and would only

require civil works including demolition of an existing small commercial

building. It is important to note that this

building contains asbestos.

|

100

|

|

5

|

26 Elizabeth Street

(Privately Owned)

|

The vacant lots at 26 Elizabeth Street (approx. 3500 sqm) are

along Elizabeth Street Opposite the Catholic School. There are 3 vacant lots

abutting each other between Bigge Street and George Street. The site is DA

approved however Council staff have undertaken initial discussions with the

site owners for its potential temporary use as a car park.

|

50

|

|

6

|

28 Elizabeth Street

(Privately Owned)

|

The vacant lot is 28 Elizabeth Street (approx. 3000 sqm) and is

along Elizabeth Street Opposite the Catholic School. There are 3 vacant lots

abutting each other between Bigge Street and George Street. The site is DA

approved however Council staff have undertaken initial discussions with the

site owners for its potential temporary use as a car park.

|

50

|

Figure 2 – Location of possible

temporary car parks

Feasibility Analysis of Temporary Sites

As

discussed previously, there is an overuse of mobility permits within the CBD.

The only operational measure to reduce the misuse of mobility permits is to

include access controls at any potential new car parks.

This

would require a car park layout that can accommodate an entry and exit lane

with a boom gate, plus some form of vehicle detection and a pass reader.

Typically

access controlled car parks should include allowance for queuing, or at least

storage for one vehicle waiting at the boom gate. Provision of this access

control would consume at least a few potential parking spaces, thereby ruling

out the likely viability of Site 1 (11-23 Scott Street and 277 Bigge Street)

and Site 2 (68-70 Bathurst Street) as new publicly accessible temporary car

parks.

However,

either of these sites could be used for reserved or pre-booked parking,

allowing authorised users to access these small car parks via a

remote-controlled sliding gate (i.e. a boom gate solution would not be

required). Council could redirect some of its reserved parkers, including

staff, into these car parks thereby freeing up scarce spaces for public access.

The

most viable option would be the three vacant lots on Elizabeth Street i.e.

Sites 4, 5 and 6. These sites have the capacity to include an entry and exit

lane with median aisles, boom gates, intercom and vehicle detection.

Noting

that the proposed car parks would be temporary in nature, the landowner could

potentially undertake development at an opportunity that suits them. Thereby

reducing the cost benefit ratio and preventing Council from recuperating the

construction costs. This would have to be factored in as part of any leasing

agreement.

Construction Costs

A

cost estimate prepared by T Cubed Consulting for the construction of an

at-grade car park at 40 Scott Street (Site 4) indicated a cost of approximately

$335,000 for the provision of 23 parking spaces. The analysis did not account

for a contamination assessment

and landscaping provision.

Consultant fees and contingency have been factored at

a 20% and 30% rate respectively. Based on the pro-rata rate for construction

per space, Council staff have estimated the construction costs associated with

each proposed temporary car park. The breakdown is provided in the financial

section of this report.

It is important to note that in addition to the above

construction costs associated with implementing car parking infrastructure,

significant operating and leasing costs would also be incurred to manage the

sites over the duration of their use. Further financial assessment would need

to be investigated if negotiations with landowners are supported to determine

cost-benefit feasibility.

Technology Considerations

Council has recently invested in modern parking technology

within its off-street car parks including:

· Pay by Plate meters

· Phone parking at the meter

· Variable message signs (live occupancy

counts) at the Bathurst Street and Northumberland Street car parks

· Licence plate recognition cameras at the

Civic Place Car park

· Mobile parking app being used at the 33

Moore street car park.

Council

also provides a webpage showing the current supply of off-street parking spaces

within the Liverpool City Centre.

Additional

initiatives for consideration include the following:

1. Install Variable Message Signs (VMS) at the Collimore

Car Park with real time car counting and occupancy.

2. Install Variable Message Sign (VMS) cantilevered on

the façade of the Civic Place Car Park.

3. Improve the Council parking webpage by including real

time occupancy information online. An App could be available to consume data

from the following sources:

a. Park Agility (VMS provider for Council)

b. TMA (equipment provider for Warren Service way)

c. Parcsafe (equipment provider for Civic Place car park)

d. Other private operators including Westfield,

Hospitals, TfNSW, etc.

4. Prepare updated car park plans to incorporate Licence

Plate Recognition and Access Control into the Bathurst Street and

Northumberland Street Car Parks (as discussed above). This would be

instrumental in removing the widescale misuse of mobility parking permits and

could free up over 50 to 100 spaces within each car park. It will also have the

benefit of dramatically improving access for short stay parkers and reducing

the need for enforcement from Council’s Parking Officers.

5. Council to allow for special permits based on approved

license plate numbers that would allow legitimate mobility permit holders the

right to continue using the car park once gated access control has been

introduced.

6. Consider expanding the use of mobile parking apps such

as UbiPark (or Ezipark, Kerb, etc.) to provide public information of available

parking spaces. These apps could also be used as an access control solution if

Council acquires small off-street car parks such as 68-70 Bathurst Street.

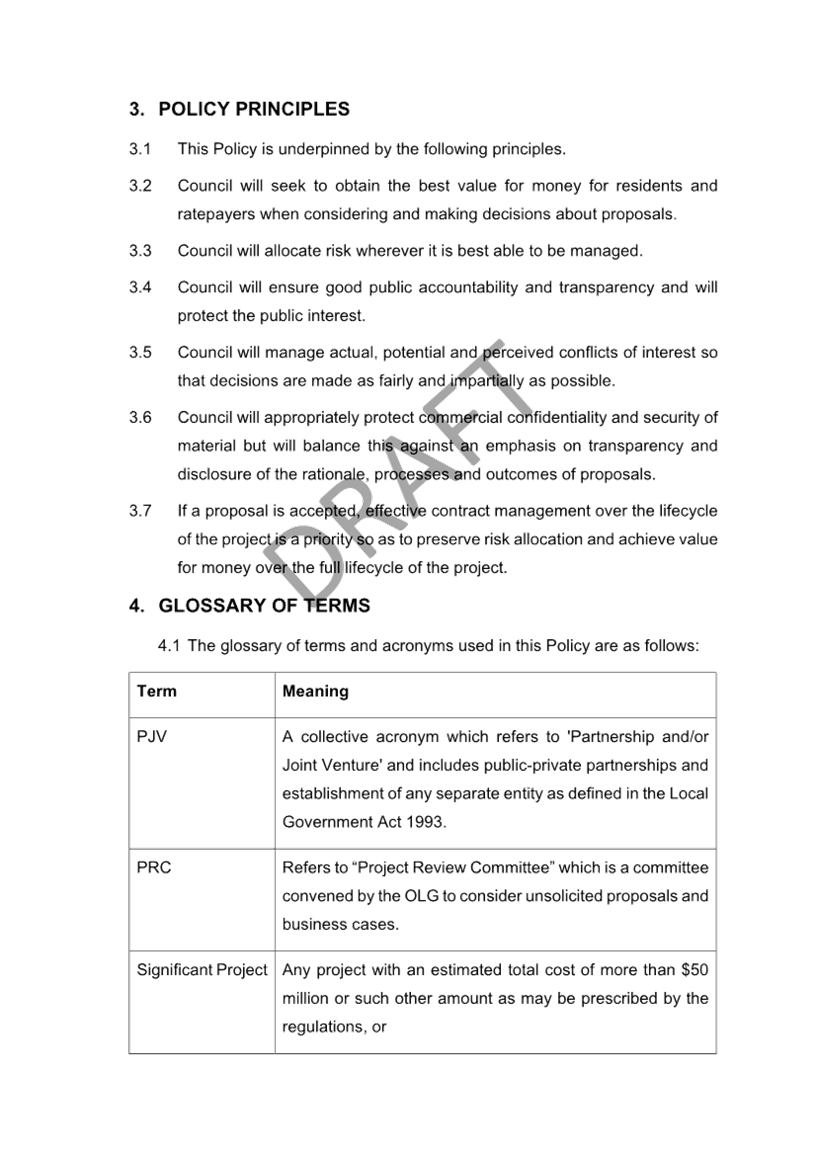

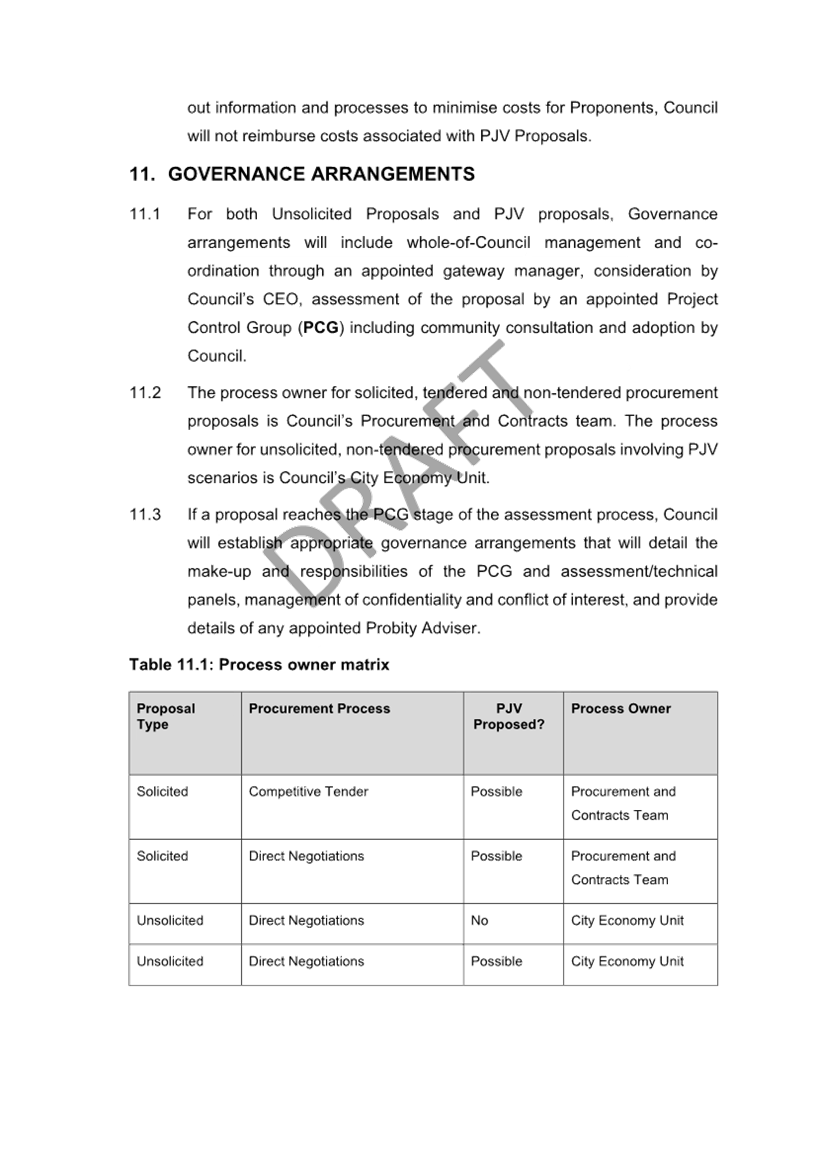

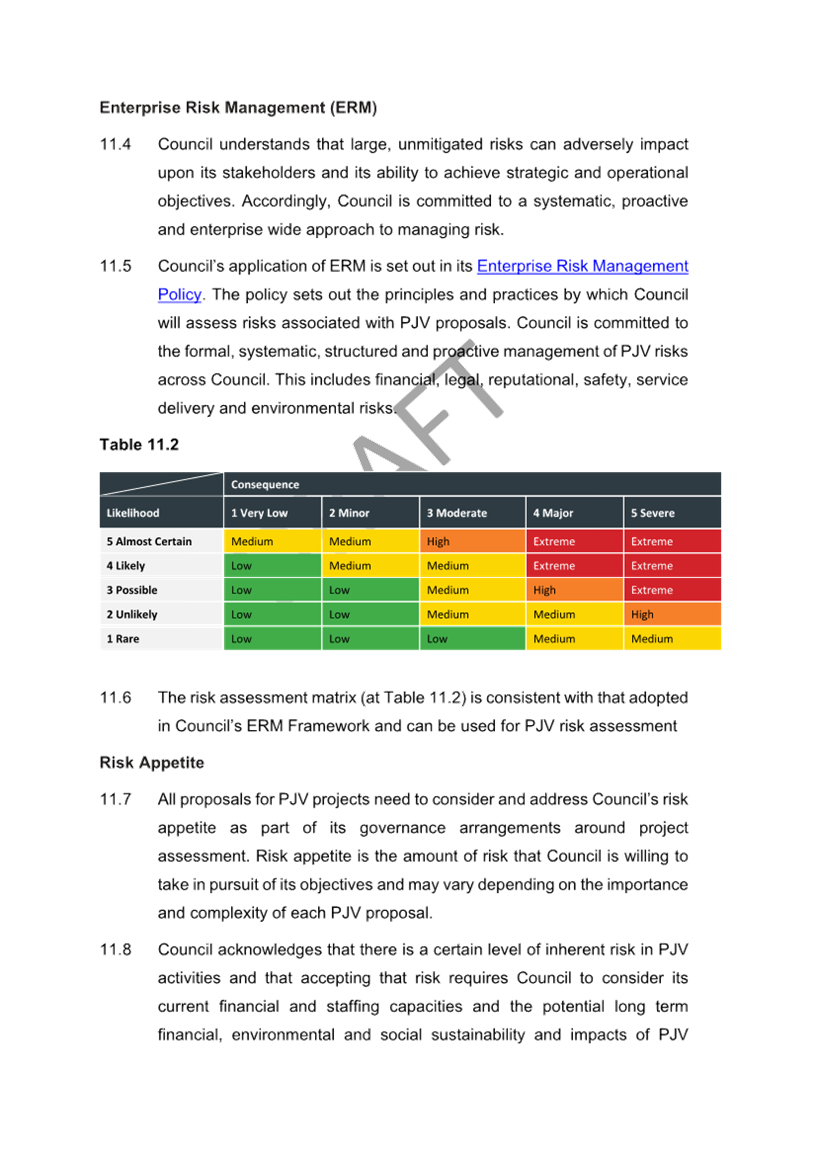

Pricing Considerations

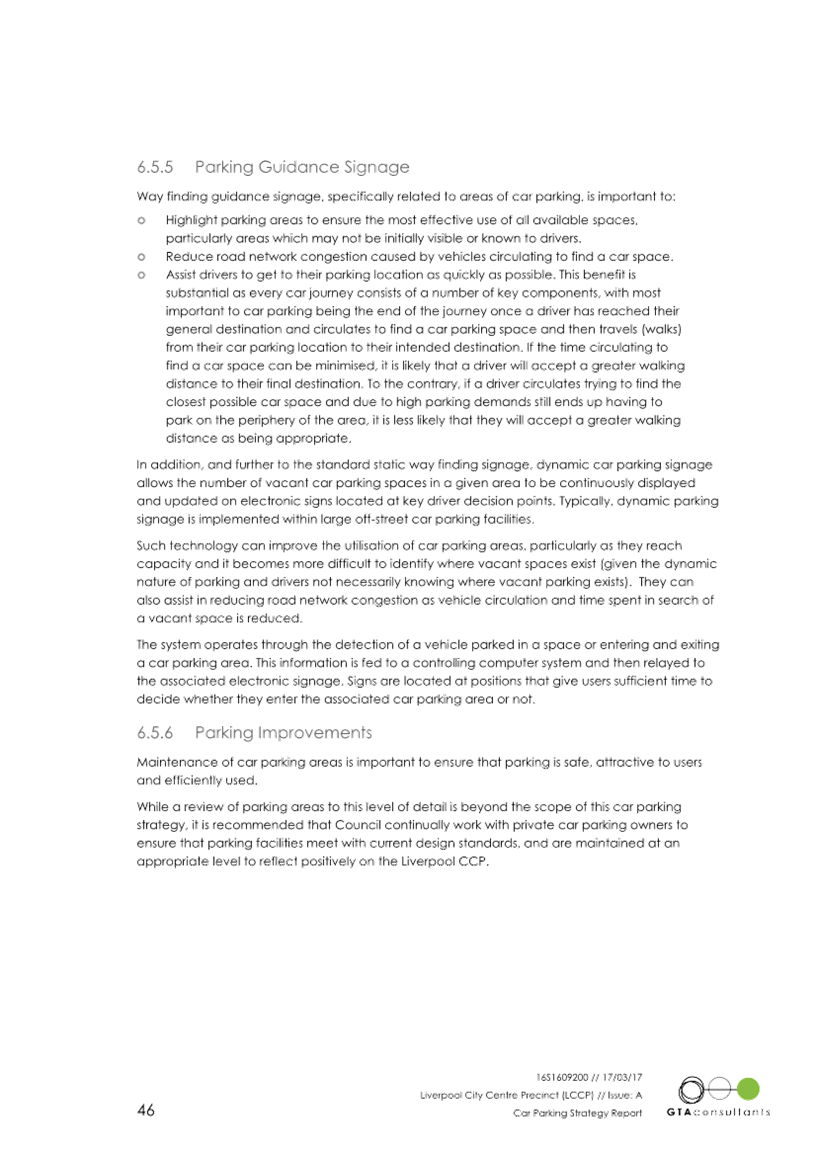

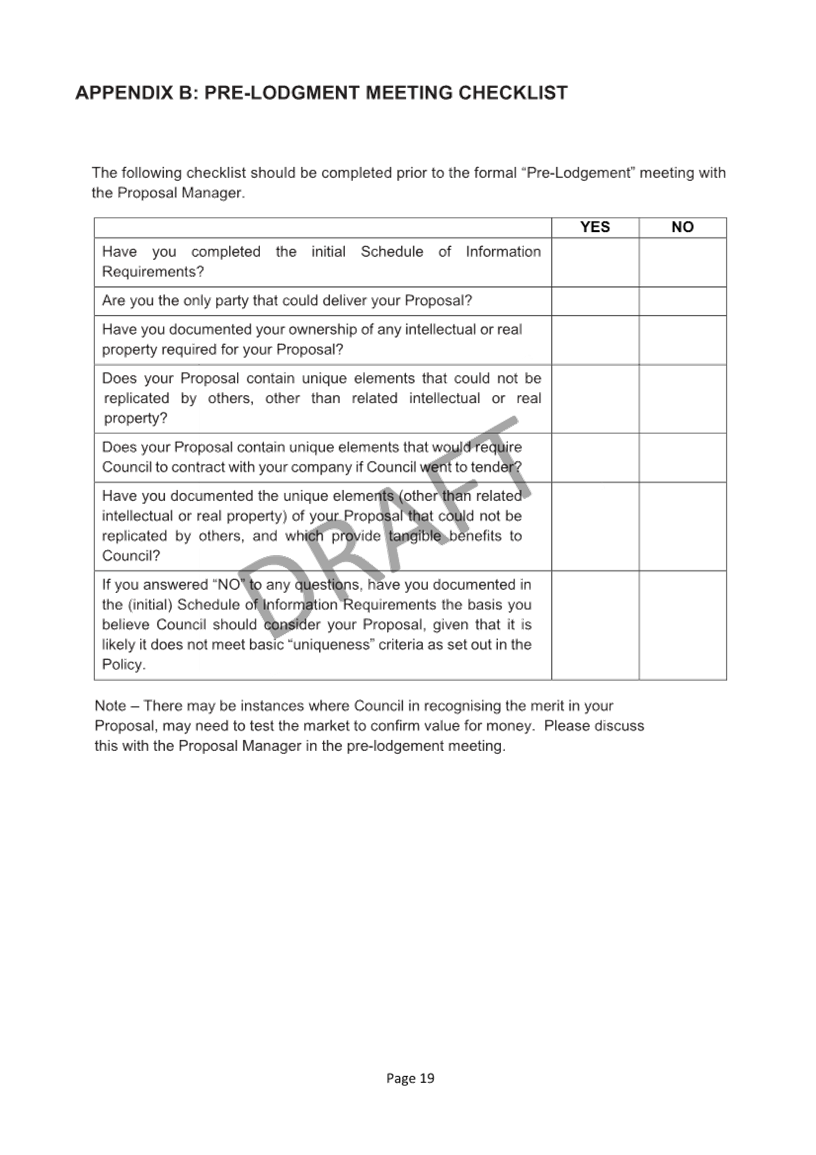

The following

table shows a comparison of parking rates for some of the key car parks.

|

Duration of stay

|

Warren Swy

|

Westfield

|

Liverpool Plaza

|

Liverpool Hospital

|

Civic Place Car Park

|

33 Moore Street Car Park

|

Bathurst Street

|

Northumberland(Ground)

|

Northumberland (Level 1 & 2)

|

Northumberland (Level 3 & 4)

|

|

0–0.5 hrs

|

$3

|

Free

|

$4

|

$4

|

Free

|

33 Moore Street car park only has monthly

parking @ $282.70, there is no casual parking

|

$2.80

|

$2.80

|

$2.80

|

Free

|

|

0.5–1.0 hrs

|

$8

|

|

1.0–1.5 hrs

|

$6

|

$12

|

$5.60

|

$5.60

|

$5.60

|

|

1.5–2.0 hrs

|

$6

|

$16

|

|

2.0–2.5 hrs

|

$9

|

$8

|

$20

|

$8.40

|

|

$8.40

|

|

2.5–3.0 hrs

|

$10

|

$24

|

|

3.0–3.5 hrs

|

$12

|

$6

|

$12

|

$6

|

|

$11.20

|

$2.80

|

|

3.5–4.0 hrs

|

$9

|

$15

|

$12

|

|

4.0–4.5 hrs

|

$15

|

$12

|

$18

|

$15

|

$14.00

|

$5.60

|

|

4.5–5.0 hrs

|

$15

|

$40

|

$20

|

|

5.0–5.5 hrs

|

$18

|

$20

|

$30

|

$16.80

|

$8.40

|

|

5.5–6.0 hrs

|

$30

|

|

6.0–6.5 hrs

|

$40

|

$19.60

|

$11.20

|

|

6.5–7.0 hrs

|

$50

|

|

7.0–7.5 hrs

|

|

$14.00

|

|

7.5–8.0 hrs

|

|

|

8.0–8.5 hrs

|

|

$16.80

|

|

8.5–9.0 hrs

|

|

|

9.0–9.5 hrs

|

|

$19.60

|

|

9.5–10.0 hrs

|

|

|

10.0–10.5 hrs

|

|

|

|

10.5–11.0 hrs

|

|

|

|

11.0–11.5 hrs

|

|

|

|

11.5–12.0 hrs

|

|

|

|

12-24 hrs

|

$20

|

|

|

|

|

Overnight

|

|

|

|

|

$50

|

|

|

|

As

can be shown in the table above, Council parking rates are far lower than the

average. The reason is that private operators want to encourage turnover and

improve accessibility for its short stay visitors.

The

main concern is the low cost of 7P parking at the Northumberland street car

park. Ideally this should be increased to coincide with parking fees at the

Warren Service way car park.

Summary

In summary within

the CBD core, there are an estimated 540 on-street spaces (2400 spaces for the

Town Centre as a whole) comprising mainly of 1P and 2P restrictions. All

on-street spaces are fully occupied throughout the day, an on-street parking

audit conducted in 2017 indicated approximately 25% of vehicles displaying a

mobility permit park all day, occupying a significant amount of spaces and

reducing parking turnover.

There are

approximately 9,259 off-street parking spaces within 17 car parks (including

nearby Whitlam Centre Car Park and the Warwick Farm Commuter Car Park). A

majority of these spaces are situated within or adjacent to the CBD Core.

Council staff have

observed low parking turnover within some of its off-street car parks,

particularly those that are managed via metered parking controls. This is due

to the prevalence of mobility permit holders who are not required to pay for

parking and are permitted to park all day in most locations with a 1P or longer

restriction. In some parking modules, mobility permit holders are occupying a

majority of available spaces. Due to the observed number of these permits,

Council considers them to be preventing improved turnover by the public.

Mobility permit holders are consuming between 100 – 200 spaces or more

per day that could otherwise be used for valid daytime visitors. worst affected

car parks include Northumberland Street and Bathurst Street Car Parks.

All other

off-street car parks with boom-gate control do not experience issues with

mobility permit holders. They are well utilized with most customers staying for

under 3 hours. The Warren Service way car park is a good example as it is well

managed and has appropriate pricing.

The Northumberland

street car park provides all day (7P) parking at a rate of $13.60, which is

well below market average. The car park is always full, and its ground level is

almost exclusively consumed by mobility permit holders. This car park is managed

by metered parking and requires regular patrols by Council Rangers.

The

council’s Facilities Team has adopted modern technology to provide a

better parking experience for its visitors. This includes Variable Message

Signs displaying real-time parking occupancy. Council has also adopted license

plate based technology to improve parking compliance and reduce operational

issues related to paper parking tickets.

With respect to

identifying new parking spaces, Council staff have identified six potential

sites that could be repurposed into new Council-managed car parks. Council

staff have commenced initial discussions enquiries with the owners of sites 26

Elizabeth Street, 28 Elizabeth Street ,133 Bigge Street and 11-23 Scott Street

and 277 Bigge Street for potential negotiation opportunities for leasing their

land. The site located at 68-70 Bigge Street is operated by commercial owners

and responses are being followed up for their interests.

The most viable

options would be the three vacant lots on Elizabeth Street i.e. 26 Elizabeth

Street, 28 Elizabeth Street and 133 Bigge Street unused lot. It has the

capacity to include an entry and exit lane with median aisles, boom gates,

intercom and vehicle detection.

Council could

increase parking supply by over 305 spaces in the short term. Any new car parks

must be controlled by a gated system (non-metered) to avoid misuse by mobility

permit holders. The potential increase in parking supply would not necessarily

compensate for the reduction in spaces caused by mobility permits holders

parking long term (all day).

Therefore, the

first step to increase the provision of parking within the Liverpool CBD is to

determine an appropriate measure to provide equity for both mobility permit

holders and the general visitors within the Bathurst Street and Northumberland

Street carparks. In this case Council should consider adopting new processes

that allow permit holders to apply for ongoing access to Council car parks

based on their nominated vehicle license plate or similar.

These sites are

not suitable for ‘drive-up’ public parking, however, are suitable

options for pre-booked or reserved parking. Council could redirect a portion of

its reserved parking customers (including some staff), thereby freeing up more

public parking spaces within its existing off-street car parks.

Further

Investigations

1. Investigate options to improve parking

turnover within its existing off-street car parks – namely the

Northumberland Street and Bathurst Street Car Parks. This will include

assessing the feasibility of removing metered timed parking and replacing it

with gated parking controls. This option would be considerably cheaper and

faster to implement – compared to acquiring and modifying new off-street

parking facilities. This would also free up parking spaces for short stay

parkers.

2. Council to administer a new parking permit

that would allow mobility permit holders limited access to one of its

off-street car parks. This would require the permit holder to apply for free

parking access. They would need to nominate their vehicle registration number,

which would in turn be registered with a new access control system

incorporating licence plate technology.

3. Review parking charges for all day (7P)

parking at the Northumberland street car park. They should be increased to

align closely with the Warren Service way Car Park.

4. Improve real time information of parking

availability through the following initiatives:

a) Introduce Variable Message Signs and car counting at

the Collimore Car Park

b) Introduce Variable Message Signs at the entrance to

the Civic Place car park with car counting data sourced from the car park

management system

c) Improve Variable message signs for Warren Service way

allowing better visibility to passing motorists.

d) Provide online live parking occupancy data on a

webpage and/or app

Costs

associated with this recommendation are outside of Council’s current

budget and long-term financial plan. The impact on the budget and long-term

financial plan are outlined in the table below.

|

Location

|

Cost

to implement Infrastructure

|

|

133

Bigge Street (approx.100 spaces)

|

$1,500,000

|

|

68-70

Bathurst Street (approx.45 spaces)

|

$150,000

(current at-grade car park)

|

|

19-21

Scott Street (approx.10 spaces)

|

$150,000

|

|

40

Scott Street (approx. 20 spaces)

|

$300,000

|

|

26

Elizabeth Street (approx. 50 spaces)

|

$750,000

|

|

28

Elizabeth Street (approx. 50 spaces)

|

$750,000

|

Note: All cost estimates are subject to contamination assessment and do not

include landscaping provision. Consultant fees and contingency have been

factored at a 20% and 30% rate respectively.

It is important to note that in addition to the above

construction costs, associated with implementing car parking infrastructure,

significant operating and leasing costs would also be incurred to manage the

sites over the duration of their use. Further financial assessment would need

to be investigated if negotiations with land owners are supported to determine

cost-benefit feasibility of each of the car parking sites.

|

Economic

|

Provide efficient parking for the City Centre.

|

|

Environment

|

Support the delivery of a range of transport options.

|

Social

|

Support access and services for people with a disability.

|

Civic

Leadership

|

There are no civic leadership and governance

considerations.

|

|

Legislative

|

There are no legislative considerations relating to

this report.

|

|

Risk

|

The risk is deemed to be Medium.

Due to the temporary nature of the car

parks, significant Council funding and resources would be allocated to

private landowners who may develop their land at any suitable opportunity,

thereby taking advantage of Councils remediation works and hence reducing

their own scope of works.

Depending on the timeframes of

development, this may result in minimal benefit to the community.

The risk is considered outside

Council’s risk appetite.

|

1. 2017

Liverpool City Centre Precinct Car Parking Strategy Report (GTA)

Governance

Committee Meeting

28 January 2025

|

ITEM 02

|

Finance Report - December 2024

|

|

Strategic

Objective

|

Visionary,

Leading, Responsible

Ensure

Council is accountable and financially sustainable through the strategic

management of assets and resources

|

|

File Ref

|

003787.2025

|

|

Report By

|

Vishwa Nadan

- Chief Financial Officer

|

|

Approved

By

|

Farooq

Portelli - Director Corporate Support

|

The

report provides an update on Council’s budget performance to December

2024.

The

December Q2 Budget Review process is currently underway.

Management

conducted a comprehensive review of the budget to identify potential savings

and efficiencies and is continuing to review vacancies to identify further

savings.

The Governance Committee members are invited to note:

that the 2024/25 year end net cost of

services position is now projected at a deficit $5.8m.

that Management has identified $1.2m

savings in salaries expenditure and is continuing to investigate further

savings

that Management has identified $10.5m in

operational savings and efficiencies

the key variations impacting on the

projected budget result.

the risks identified to-date impacting on

the projected operating result.

Council did not have any unrestricted cash

as of 31 December 2024.

Rates in arrears and debtors outstanding.

All

budget changes will be included in the December Q2 budget report and presented

to Governance Committee at its next meeting.

That the

Governance Committee receives

and notes the report.

Budget Performance

In

June 2024 the Council adopted its 2024-25 operating budget with estimated

revenue of $417.4 million and expenditure of $281.2 million. In terms of

the net operating result before grants and contributions provided for capital purposes,

Council budgeted for a conditional operating surplus of $2.6 million.

The

September Q1 Budget Review resulted in revision of 30 June 2025 Net Cost of

Service (NCOS) position to an operating deficit of $4.229m.

Subsequent

to Q1 Budget Review, Council reversed its previous resolution to sell the 3

Hoxton Park Road Property which was going to generate $14m in cash and $8.4m in

profit from sale. Other resolutions were also made to improve Councils

financial position in order to comply with financial covenants undertakings

with NSW Treasury Corporation and commercial banks.

The

December Q2 Budget Review process is currently underway.

This

report provides the Governance Committee an update on current issues (see table

below) impacting on 2024/25 budget, progress in achieving savings targets as

resolved by the Council.

|

|

Budget Impact

|

Comments

|

|

Carparking

fees

|

-$145k

|

Income

from Warren Service Way is below budget. Patrons are using LCP carpark. Delay

in installation of plate recognition software.

|

|

DA

Fees

|

-$430k

|

Lower

than expected DA’s lodged.

At

31st December, DA’s not yet determined was valued at $1.4m.

|

|

Kerb & Gutter

Inspection Fees

|

-$300k

|

Corelated

to DA assessments

|

|

Operating

Grant – PFAS

|

-$2.25m

|

NSW

Rural Fire Services has now agreed to do PFAS remediation works. A previously

committed grant will no longer be received.

|

|

Other

Income – Canterbury/ Bankstown Voyager Bridge contributions

|

-$2.4m

|

Negotiations

are on-going and will likely generate more revenue than budgeted. However,

timing is likely of that revenue will not be settled by 30 June 2025

|

|

Mattress

Recycling Income

|

-$1.0m

|

Delays

in other councils utilising CEC. Staff are actively engaging with

neighbouring Councils, however, unlikely the budgeted income will be realised

by 30 June 2025. This is offset by $450k budgeted operating expenditure. This

is an emerging risk which needs to be monitored.

|

|

Truck

Wash Bay Income

|

-$835k

|

Equipment

(costing $400k) is being procured and its unlikely budgeted income from the

initiative will be realised by 30 June 2025. This is offset by $400k budgeted

operating expenditure. This is an emerging risk which needs to be monitored.

|

|

Sale

of Recycled Materials

|

-$550k

|

Co-related

to Mattress Recycling initiative and sale of co-mingled waste.

|

|

Operating

Grant – Others

|

-$350k

|

This

target income was carried forward from previous year. Budget provision for

additional FTE’s to actively seek operating grants has been utilised to

fund other positions.

|

|

Investment

Income

|

+$2.75m

|

Includes:

· Investments at higher market rates and

capital gains on FRN’s and TCorp are likely to be achieved.

· Higher than expected interest on overdue

rates

|

|

LCP Outgoings –

Contracted Building Managers (Colliers)

|

-$400k

|

This

expenditure was not included in the original budget. Would otherwise be

recoverable from tenants.

|

|

LCP Outgoings –

Recharge to SGCH

|

+$190k

|

St

George Community Housing will be charged their share of outgoings.

|

At

its meeting on 10th December 2024, Council resolved to make $5m

operational savings by delaying recruitment of currently vacant positions and

operational expenditure (in lieu of selling assets like the CT Lewis building).

Management

conducted a comprehensive review of the budget to identify potential savings

and efficiencies. Savings identified against the targets to-date are:

|

|

Target

|

Found

|

|

Savings on staff costs

|

$2.5m

|

$1.2m

|

|

Savings on operational

expenditure

|

$2.5m

|

$10.5m

|

Management

is continuing to review vacancies and further identify savings to achieve

target.

Based

on budget adjustments identified to date, the NCOS at 30 June 2025 is projected

at a deficit $5.8m.

All

budget savings will be factored in as Q2 budget adjustments and presented back

to Governance Committee at its next meeting.

Should

the Council approve the sale of properties like the CT Lewis Building, the

projected deficit will reduce (depending on the sale price), but more

importantly improve Council’s unrestricted cash position.

Risks

The following have been identified as

further risks with the potential to change the projected budget result for the

2024/25 financial year.

|

Risk

|

Budget Impact

|

Confidence

|

|

1. Capital gain on FRN’s and TCorp

investment is subject to market conditions. The projected marked to market

gain at 30 June 2025 could be lower than projected.

|

-$500k

|

Low

|

|

2. FAG Operating Grant – The NSW

Grants Commission paid 85% of estimated financial assistance grant for FY

2024/25 in advance. Grants Commission could change its policy position to

advance payment for FY2025/26.

|

-+ $1.5m

|

Low/ Moderate

|

|

3. Council is in arbitration with the USU on

the lost flex time matter. The cost of untaken leave at the end of June could

be higher as a result.

|

-$3.0m

|

High

|

|

4. Net Loss from Disposal of Assets –

As part of the road renewal process, a portion of the road surface is

scrapped off and then replaced. The replacement cost is capitalised, however,

there is a written down value attached to the portion removed. The cost of

write-off depends on the condition of the road at time of renewal and depth

of surface removed. Budget includes a provision of $2.5 million, however, the

actual cost to June 2025 is not known.

|

-$500k - $1m

|

Medium/ High

|

Cash Reserves

At 31 December 2024, Council had $395 million in cash and

investments classified as follows:

|

|

31 December 2024

|

30 June 2024

|

|

Externally Restricted Reserves

|

$383.5m

|

$353.3m

|

|

Internally Restricted Reserves

|

$12.8m

|

$6.9m

|

|

Investments in Civic Risk Mutual

|

$6.5m

|

$6.5m

|

|

Unrestricted cash

|

($7.7m)

|

-

|

|

Total

|

$395.2m

|

$366.6m

|

Outstanding

Rates & Major Debtors

· Rates owed from previous years is $8.9m. A

debt collection run is scheduled for end of January 2025. Routine debt

collection cycle will recommence in April and October as per normal cycle.

· KARI (old library tenant) - $890k. They

have not paid their rent since August 2024

· Canterbury/ Bankstown Council (Voyager

Bridge Matter) - $2.8m

Nil

Governance

Committee Meeting

28 January 2025

Strategic Performance Committee Report

|

ITEM 03

|

Draft Unsolicited Proposal Policy and

Process Guide

|

|

Strategic

Objective

|

Visionary,

Leading, Responsible

Demonstrate

a high standard of transparency and accountability through a comprehensive

governance framework

|

|

File Ref

|

000359.2025

|

|

Report By

|

David Day -

Head of Governance

|

|

Approved

By

|

Farooq

Portelli - Director Corporate Support

|

Council currently manages the risks

associated with directly negotiating contracts under its Procurement Policy and

associated Procurement Standards.

A draft Unsolicited Proposal Policy and Unsolicited Proposal Process

Guide have been prepared to establish additional guidance and governance

arrangements for unsolicited proposals. The documents identify when Council

will consider direct negotiations in response to an unsolicited proposal and

how they will be assessed in a way that minimizes corruption risks.

That the

Governance Committee recommends to Council:

1. that

the Draft Unsolicited Proposal Policy and Draft

Unsolicited Proposal Process Guide be placed on public exhibition for a period

of not less than 28 days, and

2. that the CEO or delegate

is authorised to approve the policy and guide if no submissions are received in

the public exhibition period, and

3. that

any submissions received in the public exhibition period are reported to

Council.

Council may engage in direct negotiations to procure

goods, works, or services, or to progress projects, in limited circumstances

permitted under the Local Government Act 1993 and the Local Government

(General) Regulation 2021. There is a heightened risk of corrupt conduct and

failure to obtain best value for money for residents and ratepayers where

Council engages in direct negotiations and enters into single sourced, or

non-competed, arrangements.

Council may seek to engage in direct

negotiations in response to an unsolicited proposal where:

· the proposal falls within one

of the exemptions to tendering under the Local Government Act 1993,

· the proposal provides unique

benefits and there are no viable alternatives that do not involve direct

negotiation,

· the proposal is positively

assessed by reference to assessment criteria specified in the Guide, and

· business structures such as

partnerships and joint ventures are established in compliance with the Local

Government Act 1993 and OLG guidelines.

The draft Unsolicited Proposal Policy is underpinned by the

following principles:

· Council will seek to obtain the best value

for money for residents and ratepayers when considering and making decisions

about proposals.

· Council will allocate risk wherever it is

best able to be managed.

· Council will ensure good public

accountability and transparency and will protect the public interest.

· Council will manage actual, potential and

perceived conflicts of interest so that decisions are made as fairly and

impartially as possible.

· Council will appropriately protect

commercial confidentiality and security of material but will balance this

against an emphasis on transparency and disclosure of the rationale, processes

and outcomes of proposals.

· If a proposal is accepted, effective

contract management over the lifecycle of the project is a priority to preserve

risk allocation and achieve value for money.

The Unsolicited Proposal Policy and

Unsolicited Proposal Process Guide will help Council to manage the risks

associated with Unsolicited Proposals and associated direct negotiations in the

following ways:

· explaining key terms and raising awareness of risks associated

with direct negotiation,

· outlining legal requirements and guidelines, including the ICAC

guidelines on direct negotiations,

· drawing attention to the different governance arrangements that

apply to solicited proposals and the merits of competition,

· identifying roles and responsibilities, with appropriate oversight

by Council’s CEO and governing body, and involvement of probity advisors,

· establishing a transparent, staged process for unsolicited

proposals and partnership and joint venture proposals, with clearly defined

decision-making gateways,

· specifying assessment criteria for proposals which focus attention

on relevant considerations such as the unique benefits of the proposal, its

value, and the whole-of-Council impact,

· requiring records to be kept and information reported about

proposals.

The resulting framework should significantly improve

Council’s approach to unsolicited proposals and direct negotiations. The

circumstances it is intended to capture include unsolicited proposals related

to property transactions.

There

are no financial implications relating to the development and implementation of

the Draft Policy and Guide and will be undertaken by the Legal and Governance

team within existing budgets.

|

Economic

|

There are no economic and financial considerations.

|

|

Environment

|

There are no environmental and sustainability

considerations.

|

Social

|

There are no social and cultural considerations.

|

Civic

Leadership

|

Encourage the community to engage in Council initiatives and actions.

Provide information about Council’s services, roles and decision

making processes.

Deliver services that are customer focused.

Operate a well-developed governance system that demonstrates

accountability, transparency and ethical conduct.

|

|

Legislative

|

Local Government Act 1993

Local Government (General) Regulation 2021

NSW ICAC Publication Direct negotiations: Guidelines for managing

risks 2018

Relevant provisions are set out in the draft

Unsolicited Proposal Policy and Unsolicited Proposal Process Guide.

|

|

Risk

|

Direct negotiations and the resulting directly

sourced, or non-competed, arrangements are at heightened risk of corrupt

conduct and failure to obtain best value for money for residents and

ratepayers.

Council proposes to build on its management of these risks by creating a

policy an guide that deal specifically with unsolicited proposals.

|

1. Draft

Unsolicited Proposal Policy

2. Draft

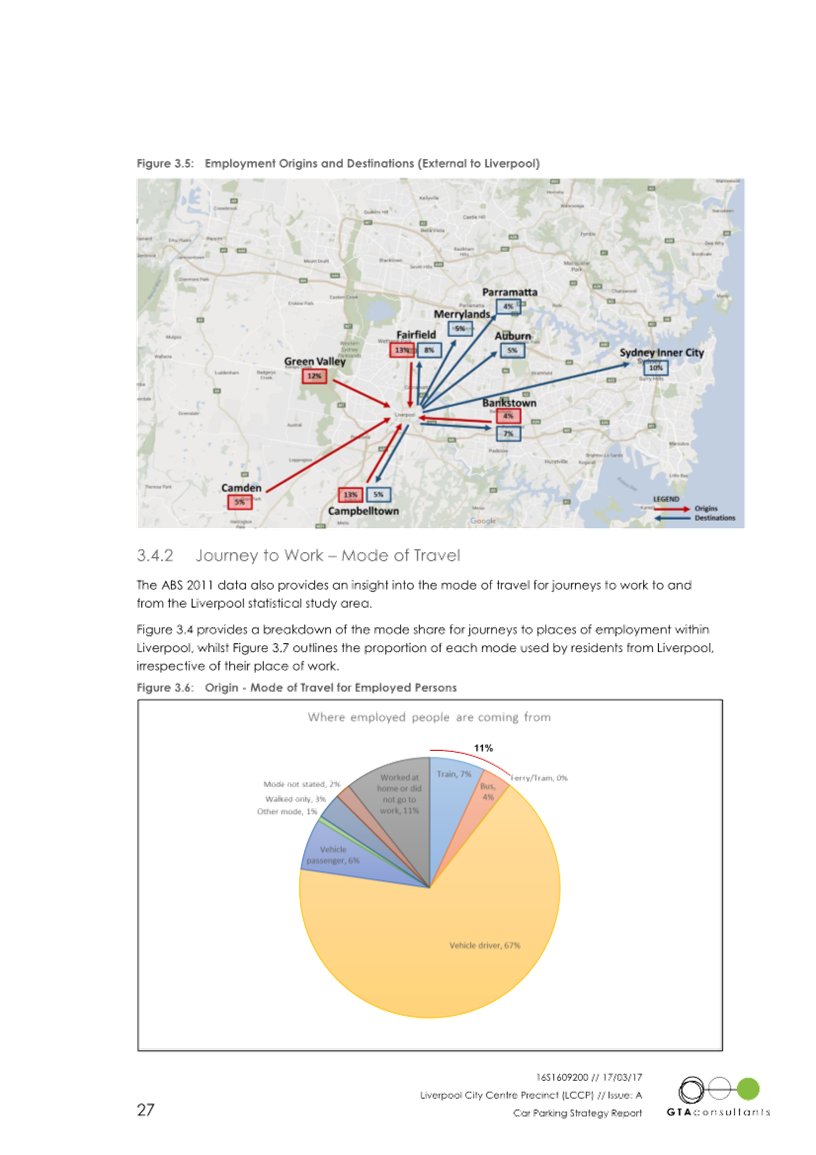

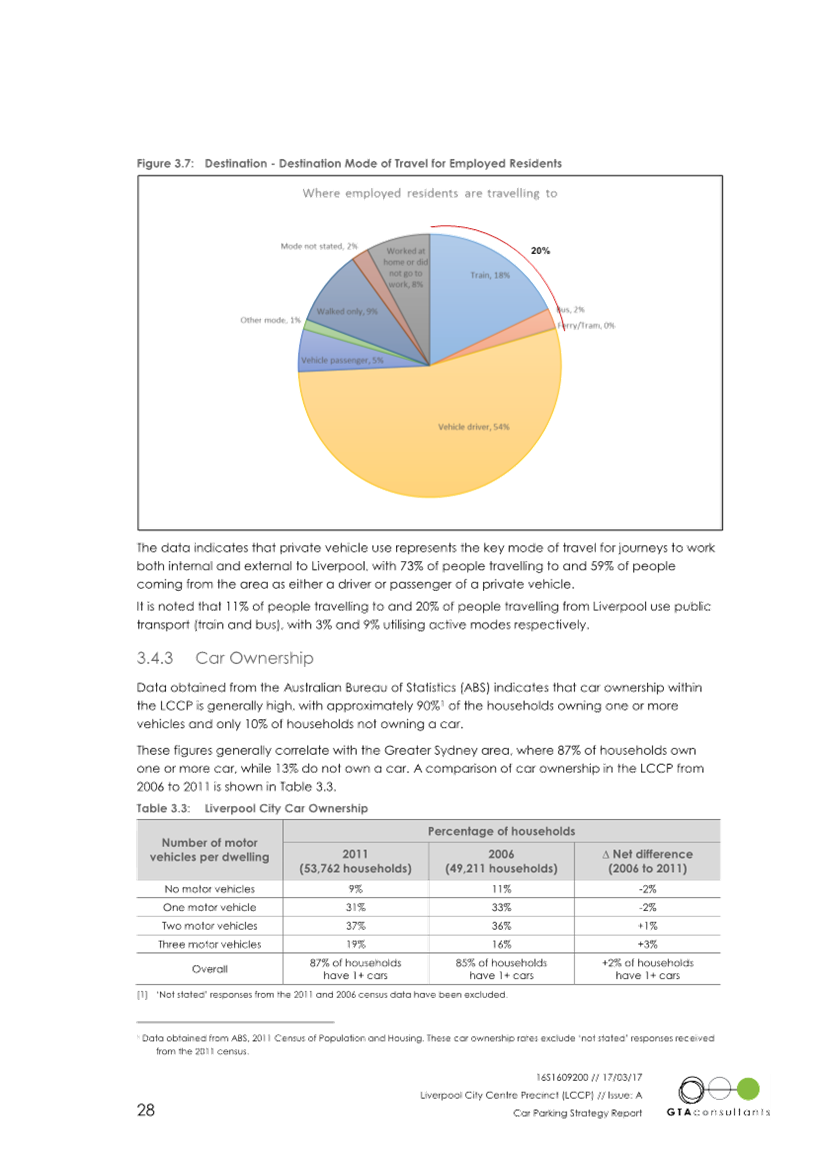

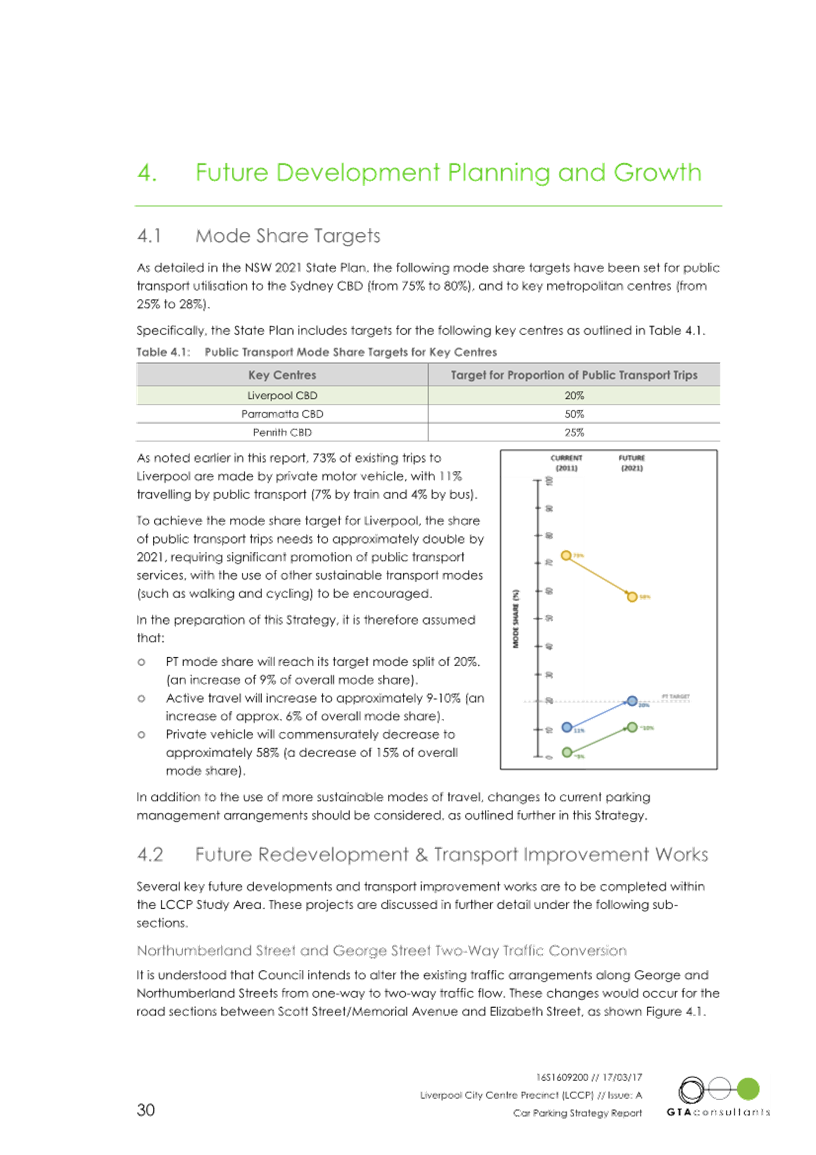

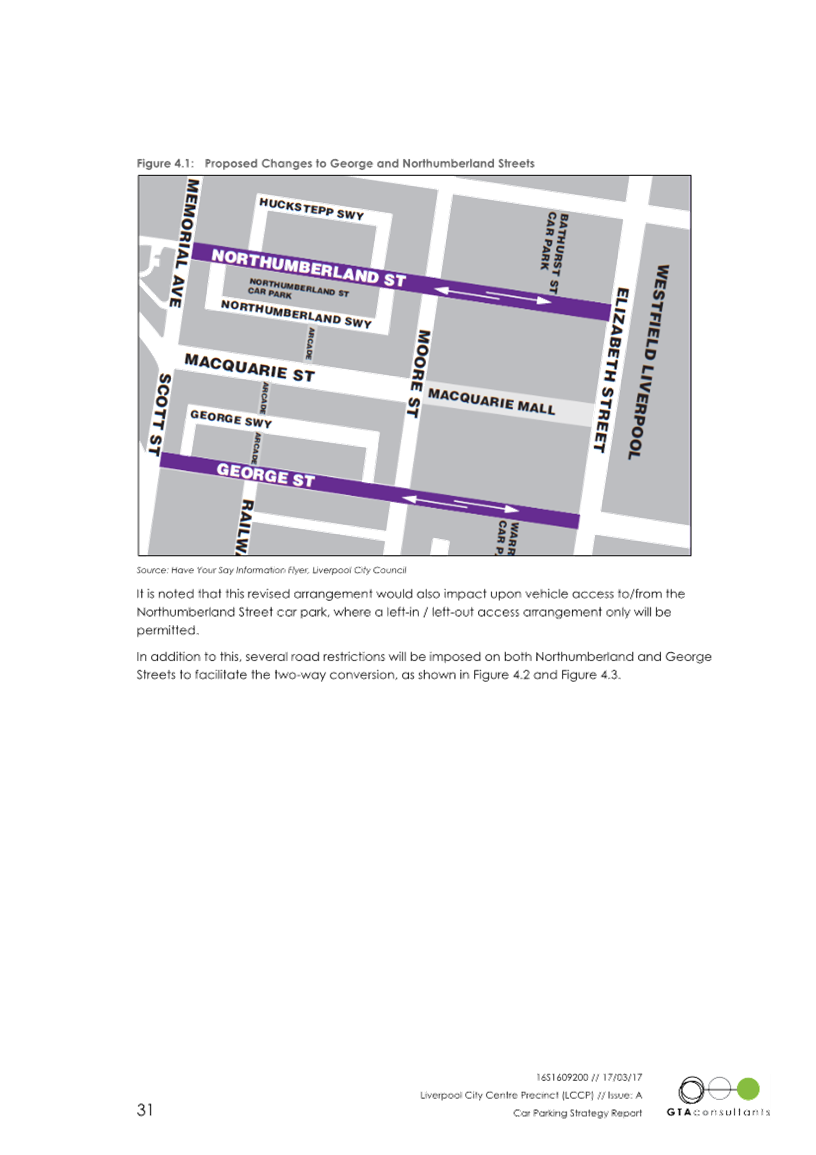

Unsolicited Proposal Process Guide