Liverpool City Council

Liverpool City Council

Addendum

Council Agenda

Ordinary Council Meeting

26 May 2015

Francis Greenway Centre

170 George Street

Liverpool

Liverpool City Council

Liverpool City Council

Addendum

Council Agenda

Ordinary Council Meeting

26 May 2015

Francis Greenway Centre

170 George Street

Liverpool

![]()

Items

PAGE TAB

Chief Financial Officer

CFO 06 Amendment to Council's Investment Policy..................................................... 3......... 1

CFO 07 Endorsement of the Delivery Program 2013-17 and Operational Plan 2015-16 including Revenue Policy............................................................................................... 25......... 2

3

Ordinary Meeting 26 May 2015

Chief Financial Officer

|

CFO 06 |

Amendment to Council's Investment Policy |

|

Strategic Direction |

Leading Proactive Council Provide business excellence and financial sustainability to deliver services that meet community expectations |

|

Key Policy |

Long-Term Financial Plan |

|

File Ref |

117374.2015 |

|

Report By |

Christian Hope - Senior Financial Accountant |

|

Approved By |

Gary Grantham - Chief Financial Officer |

Executive Summary

Council’s Investment policy is the main instrument guiding Council’s investment decisions. In practice it is reviewed at least annually to reflect changes to investment strategy, Minister’s Order on Investments or impact of changes in the investment market. Non-compliance to the Investment policy is reported to the Council in the monthly investment report and appropriate actions taken to rectify where necessary.

This report seeks amendment to the current Term to Maturity Limits in the Investment policy.

The main objective to have a Term to Maturity Limit is to ensure adequate level of liquidity in the investment portfolio. Current limits do not differentiate the investments for liquidity and is restricting council’s ability to optimise its returns on investments.

|

That Council receives and approves the recommendation to amend the Investment Policy to Exclude liquid assets from the Term to Maturity limits.

|

REPORT

Council’s Investment policy is the main instrument guiding Council’s investment decisions. In practice it is reviewed at least annually to reflect changes to investment strategy, Minister’s Order on Investments or impact of changes in the investment market. Non-compliance to the Investment policy is reported to the Council in the monthly investment report and appropriate actions taken to rectify where necessary.

This report seeks amendment to the current Term to Maturity Limits in the Investment policy. The main objective to have a Term to Maturity Limit is to ensure adequate level of liquidity in the investment portfolio. Current limits do not differentiate the investments for liquidity and is restricting council’s ability to optimise its returns on investments.

Since January 2015, returns on short term investment have been negatively impacted by two main factors:

(1) Two RBA cuts to the Cash Rate by 25 basis points each;

(2) Implementation APRA banking prudential regulation Basel lII

The average market returns on term deposits are:

- Short term deposits (< 1 year to maturity) is presently between 2.25% for 30 days to

2.9% for one year

- Medium term deposits (2 to 3 years to maturity) between 2.9% to 3.1%

Council’s investment advisors, CPG Research advised that given interest rates are at a historic low and the outlook is for prolonged low interest rate environment, the prudent course of action is to invest surplus funds that are in excess to liquidity requirements into medium - longer term assets. Liquid senior FRN’s may play a more dominant role going forward, particularly for medium-longer term assets.

Reason for recommendation to amend the Investment Policy

Address Policy restrictions to optimise Council returns by excluding liquid assets from Term to maturity limits.

For the month of April, 28% of Council’s investment portfolio had a term to maturity greater than three years [$43.8m/$155.8m]. The effect of excluding $12.8m liquid assets would result in a percentage holding of 19.9% ($31m/$155.8m) hence complying with the policy limit of 25% and scope for investing in medium to long term liquid higher yield liquid assets. This minor change in the calculations would address our current non-compliance in the April 2015 Investment Report.

The minor change to the investment policy recommended below will not contravene local government regulations and will ensure that council is able to invest in high yield liquid medium to long term senior Bonds/FRN’s.

The header for point 3.3.5 in the investment policy to read:

3.3.5 Term to Maturity Framework for non-liquid assets (exclude tradeable securities such as FRN’s,TCD’s ,Bonds etc)

CONSIDERATIONS

|

Economic and Financial |

The changes recommended will allow Council to invest in higher yield medium to long term liquid investments hence protecting against erosion of future investment income. |

|

Environmental and Sustainability |

There are no environmental and sustainability considerations. |

Social and Cultural |

There are no social and cultural considerations. |

Civic Leadership and Governance |

There are no civic leadership and governance considerations. |

ATTACHMENTS

Ordinary Meeting 26 May 2015

Chief Financial Officer

|

CFO 07 |

Endorsement of the Delivery Program 2013-17 and Operational Plan 2015-16 including Revenue Policy |

|

Strategic Direction |

Leading Proactive Council Position Council as an industry leader, delivering best practice and innovation |

|

Key Policy |

Long-Term Financial Plan |

|

File Ref |

100184.2015 |

|

Report By |

Miles Carter - Project Officer - Strategy and Performance |

|

Approved By |

Gary Grantham - Chief Financial Officer |

Executive Summary

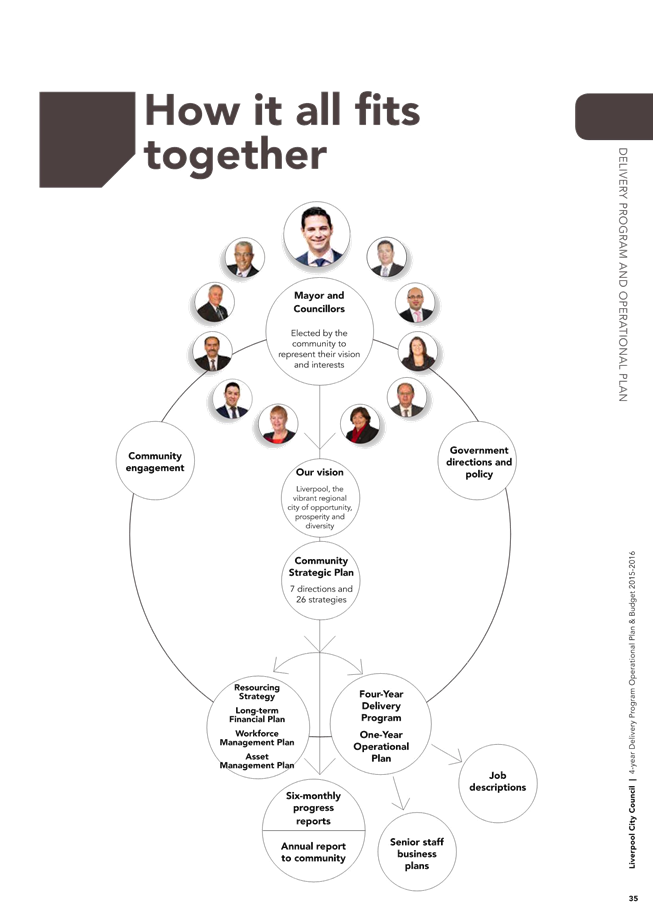

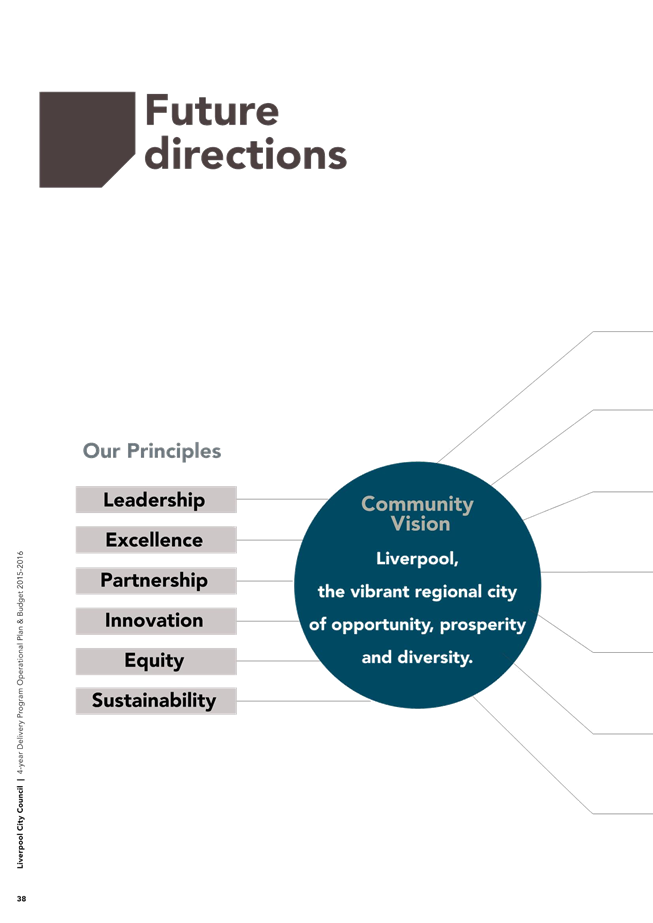

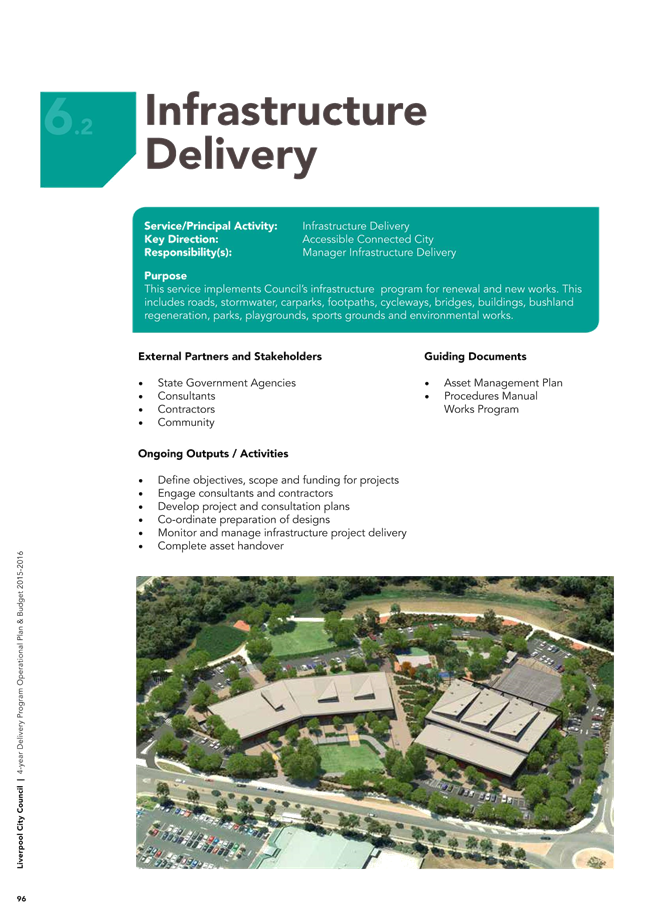

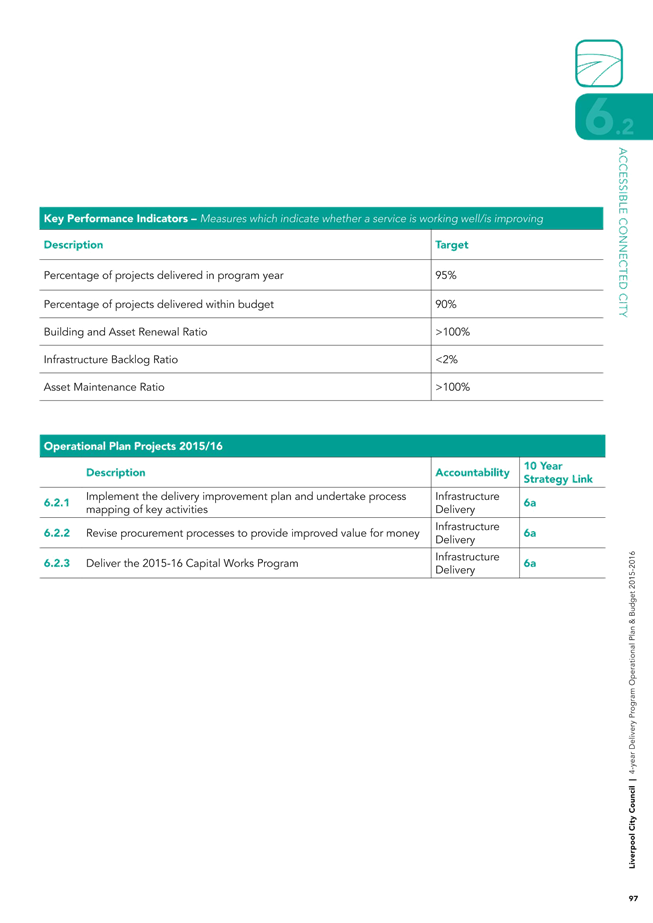

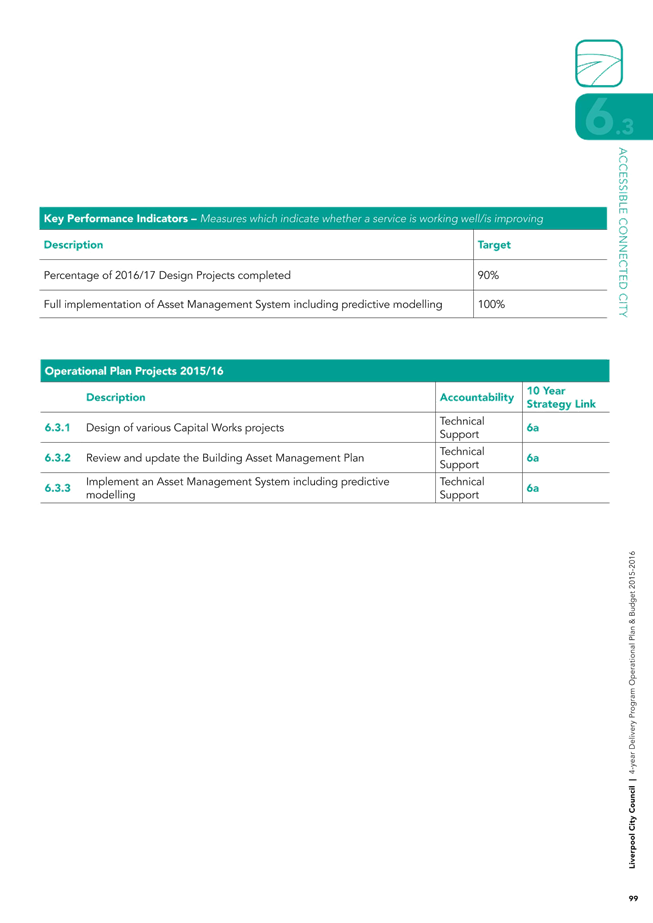

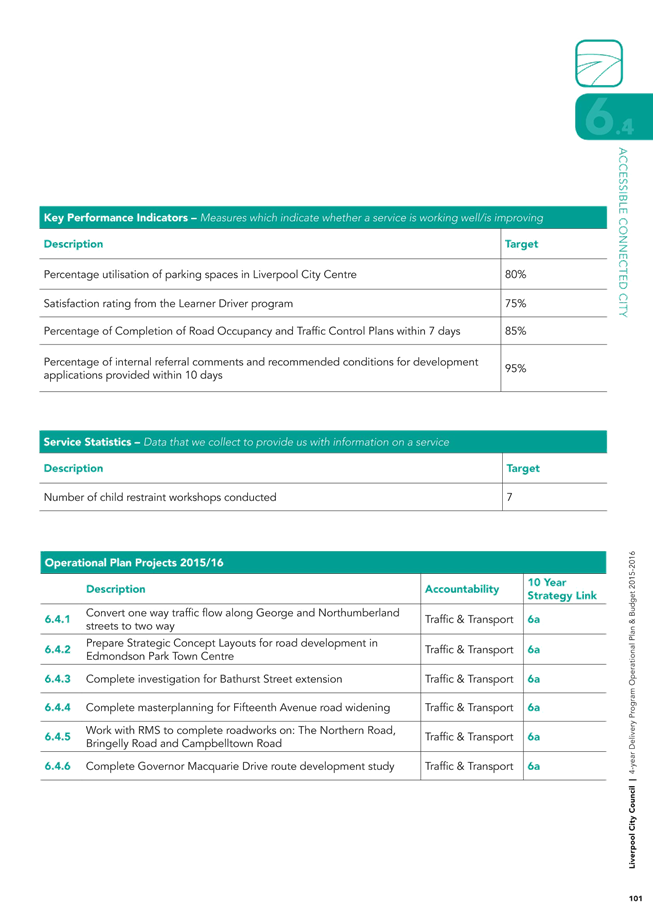

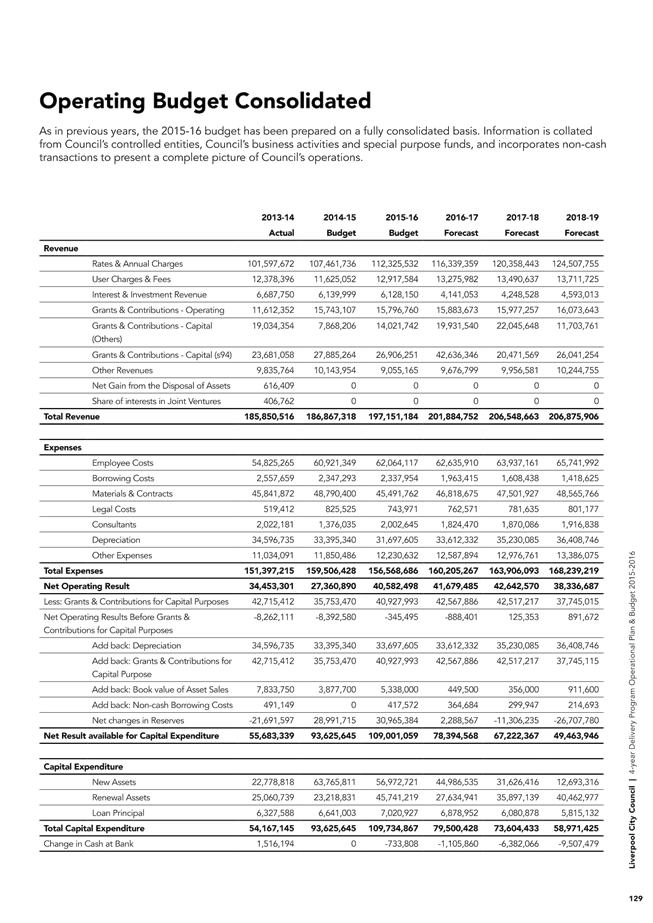

This report proposes to adopt Council’s 4-year Delivery Program and 2015-16 Operational Plan and Budget in accordance with Section 404 and 405 of the Local Government Act 1993 which requires Council to review its Delivery Program and adopt its annual Operational Plan by 30 June each year.

At its meeting on 24 March 2015, Council resolved to place the draft Delivery Program and Operational Plan and Budget on public exhibition to allow for public comments and submissions and to receive a further report after a review of public submissions.

This report outlines submissions received during the exhibition period and outlines any changes which have been made to the document as a result of submissions received.

|

That Council:

1. Adopts the 4-year Delivery Program and 2015-16 Operational Plan and Budget with the changes outlined in this report.

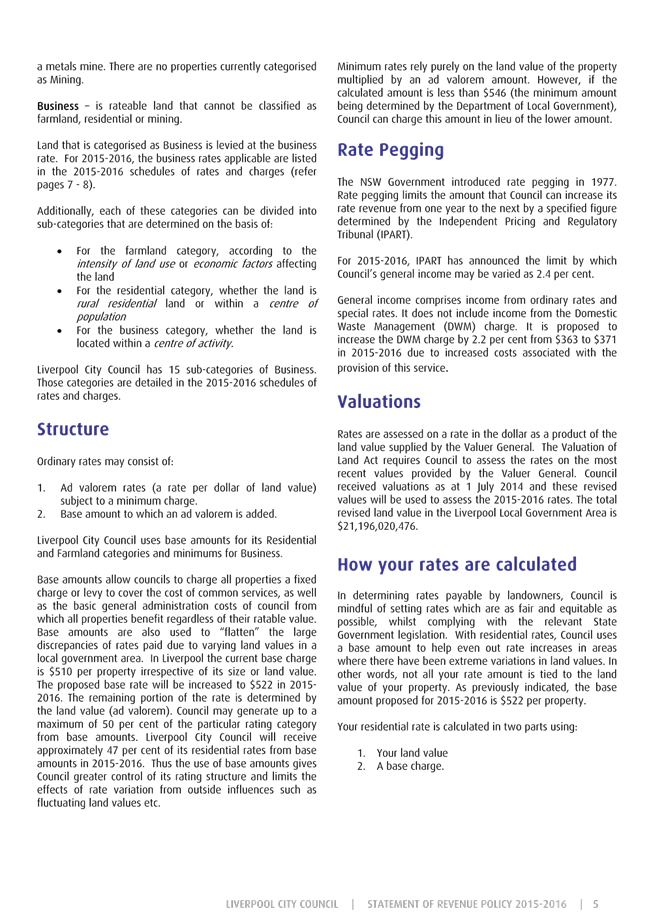

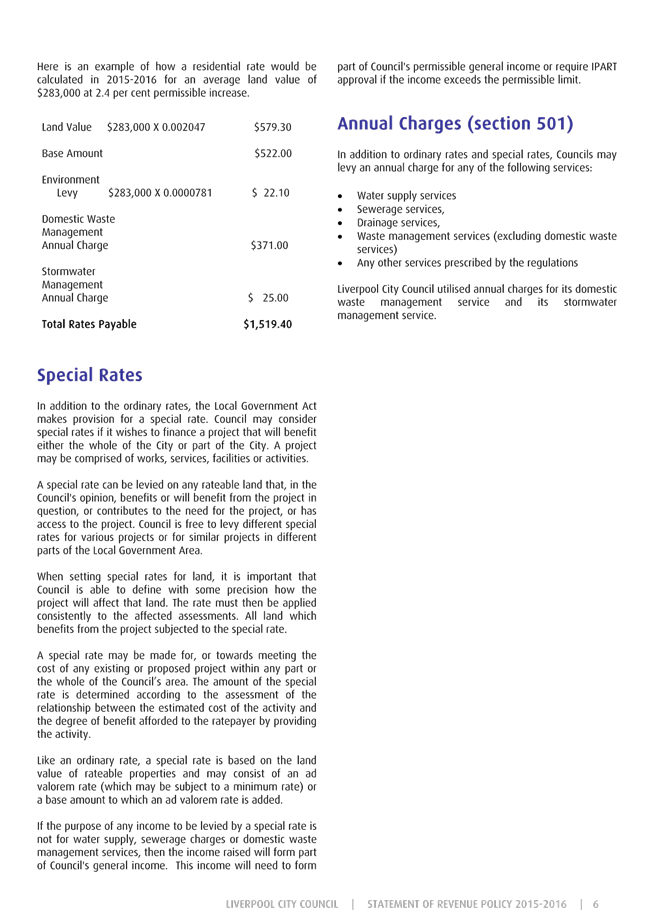

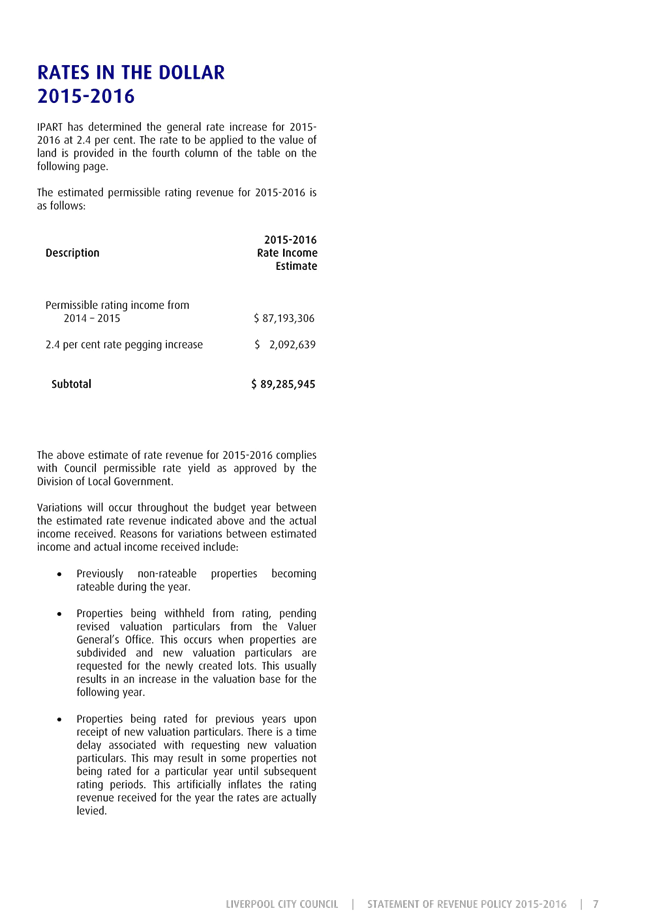

2. Makes the rates and charges for the financial year commencing 1 July 2015 as outlined in the Revenue Pricing Policy and exhibited in the draft Delivery Program and Operational Plan.

3. Writes to the individuals and groups who provided a submission, thanking them for their submission and provides a response to their feedback and, or comments.

|

REPORT

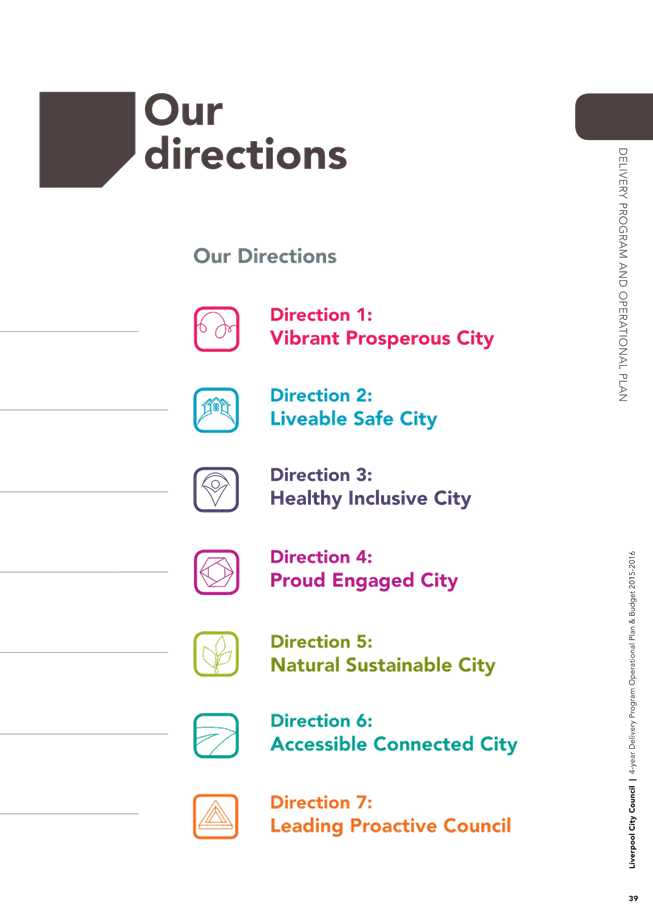

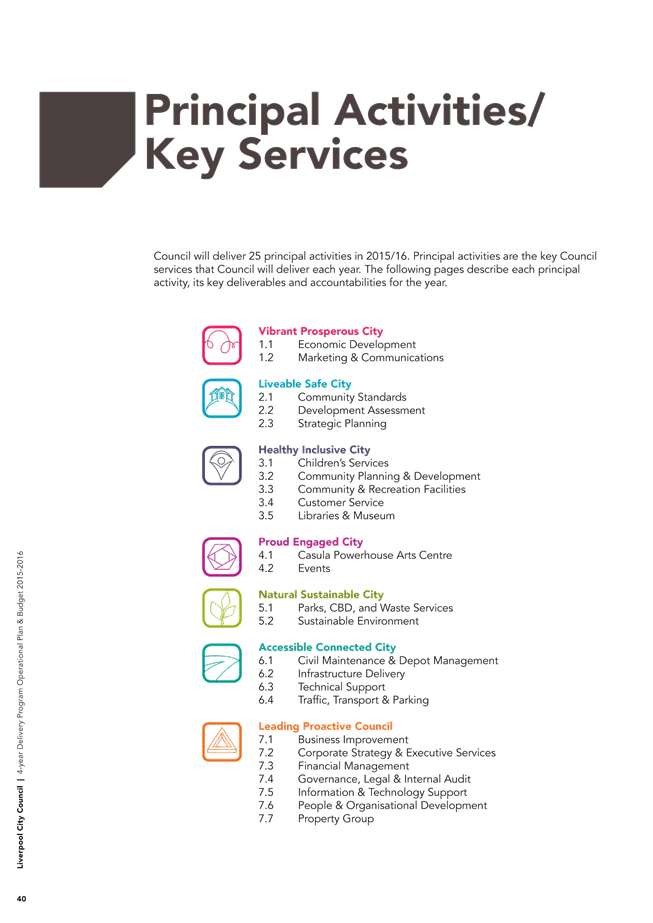

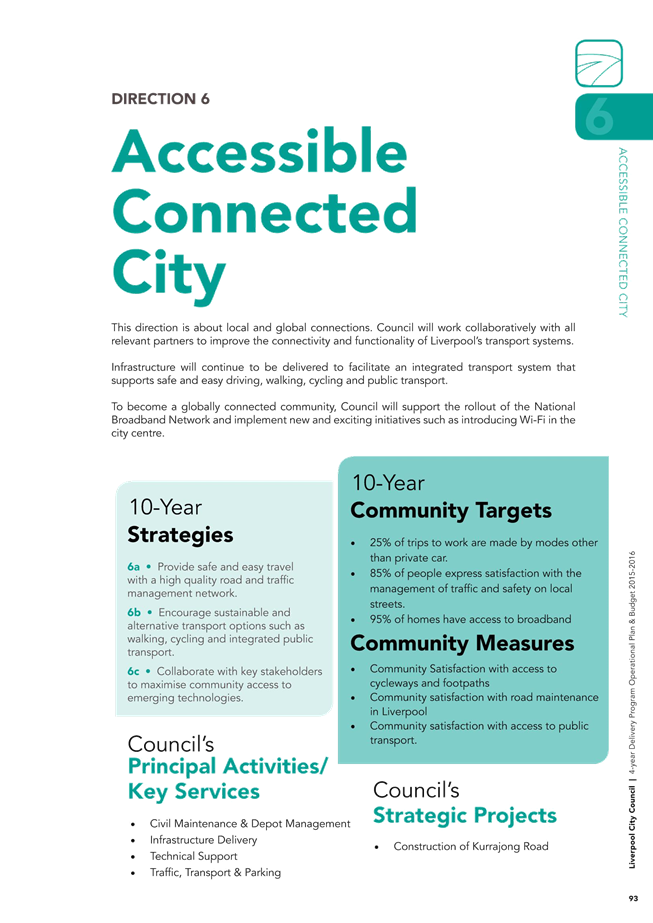

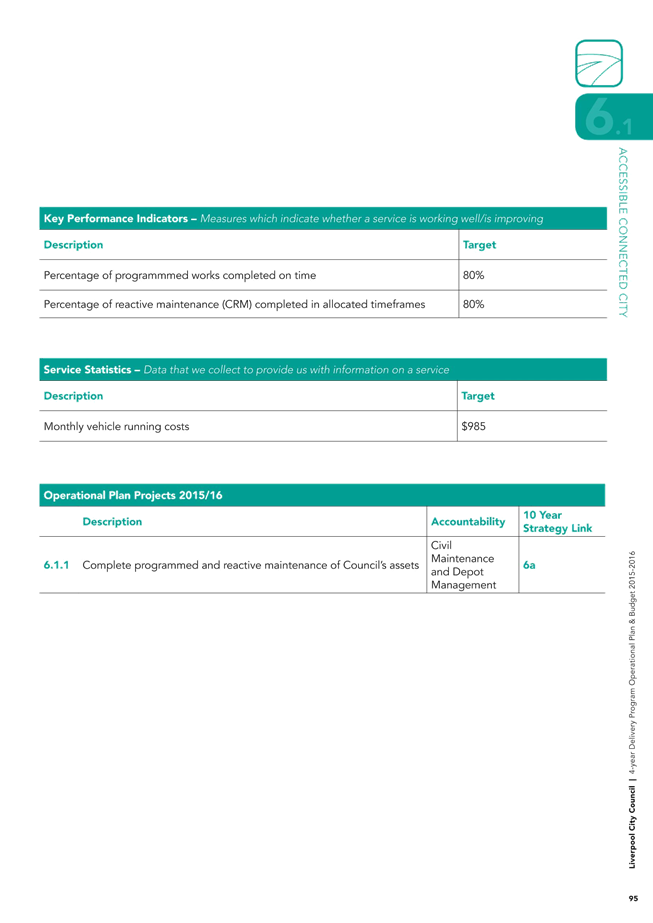

4-year Delivery Program and 2015-16 Operational Plan and Budget

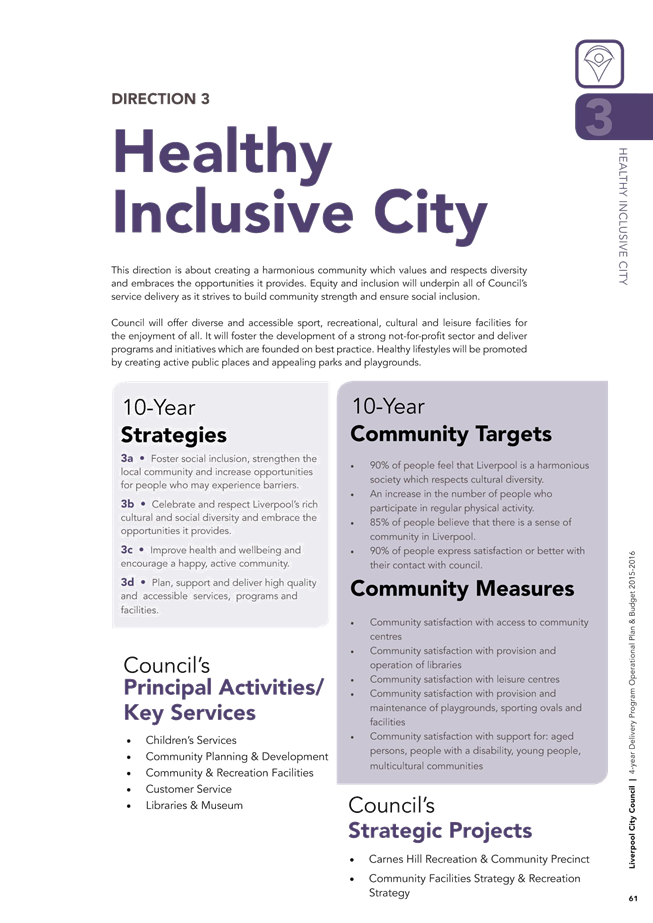

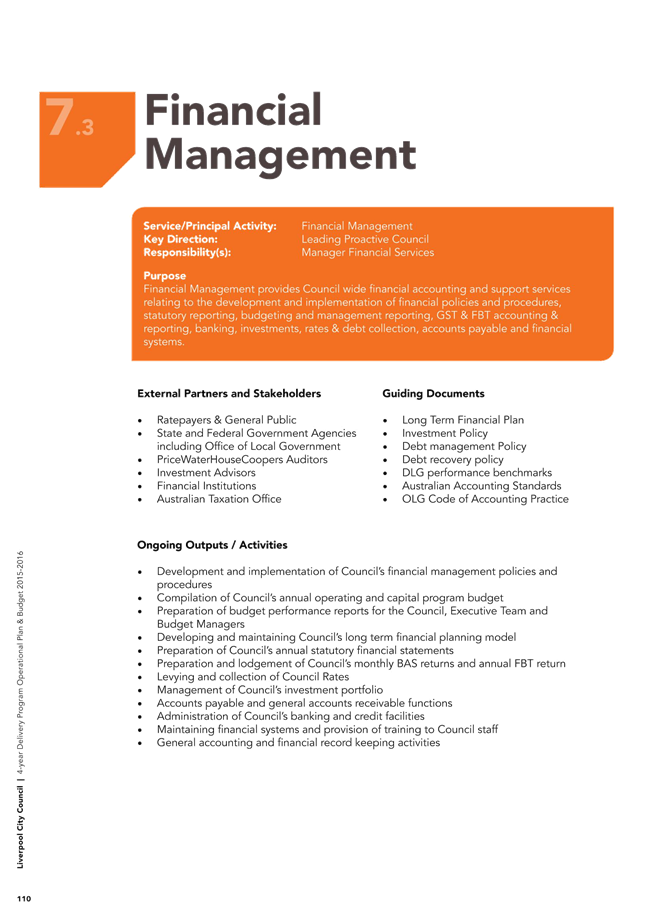

The Delivery Program documents all of the principal activities which Council will be delivering during its term of office. It is Council’s commitment to the community and outlines how it will contribute to achieving the strategies listed in the Community Strategic Plan. The Delivery Program addresses all of Council’s operations and allocates high level responsibilities for each activity.

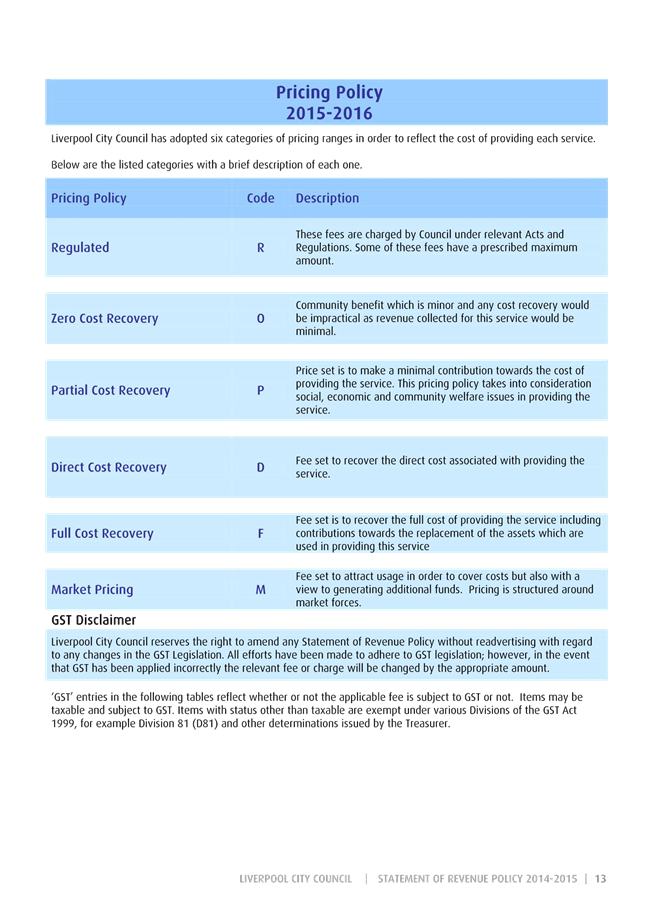

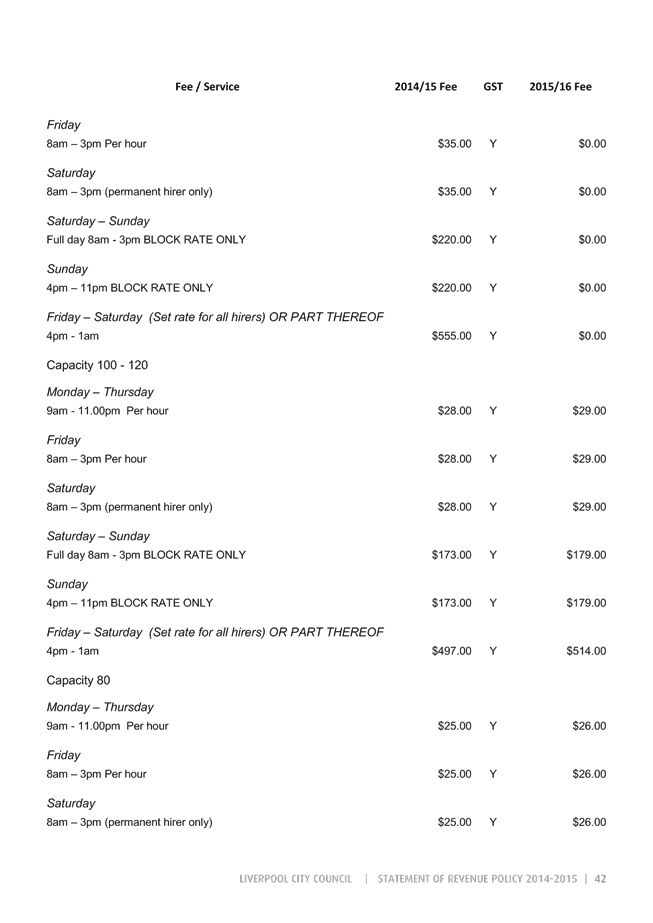

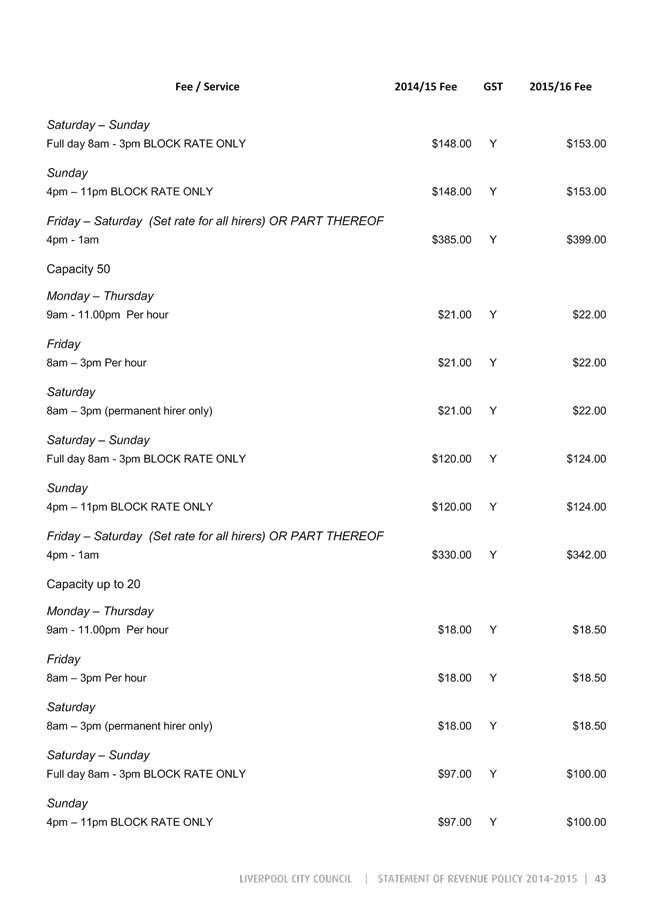

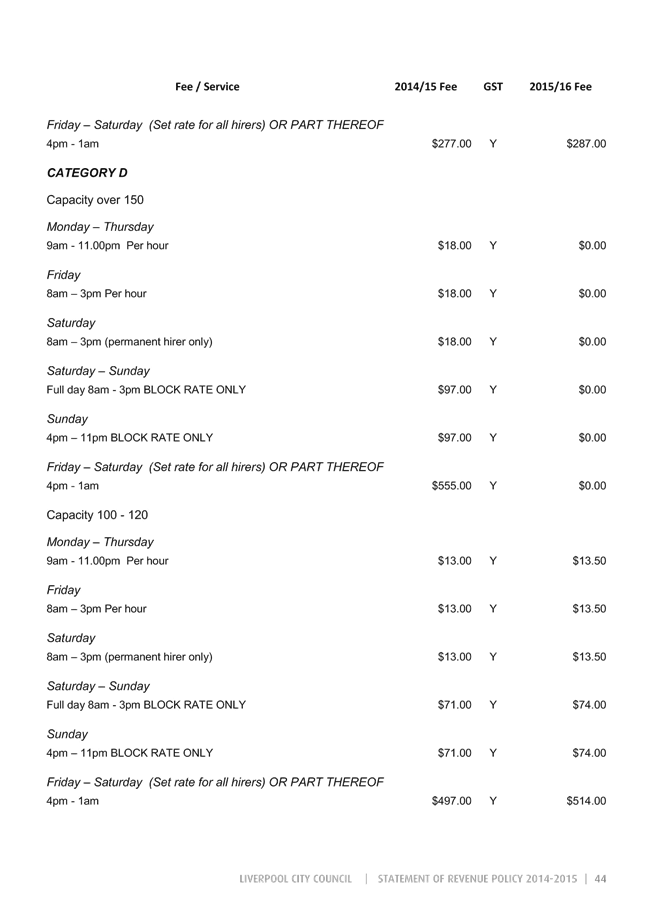

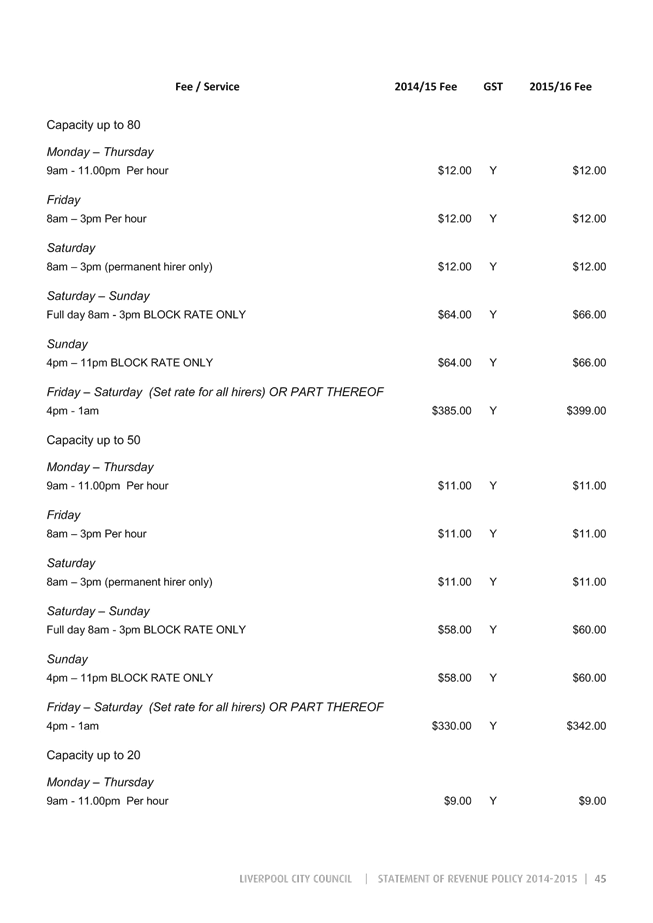

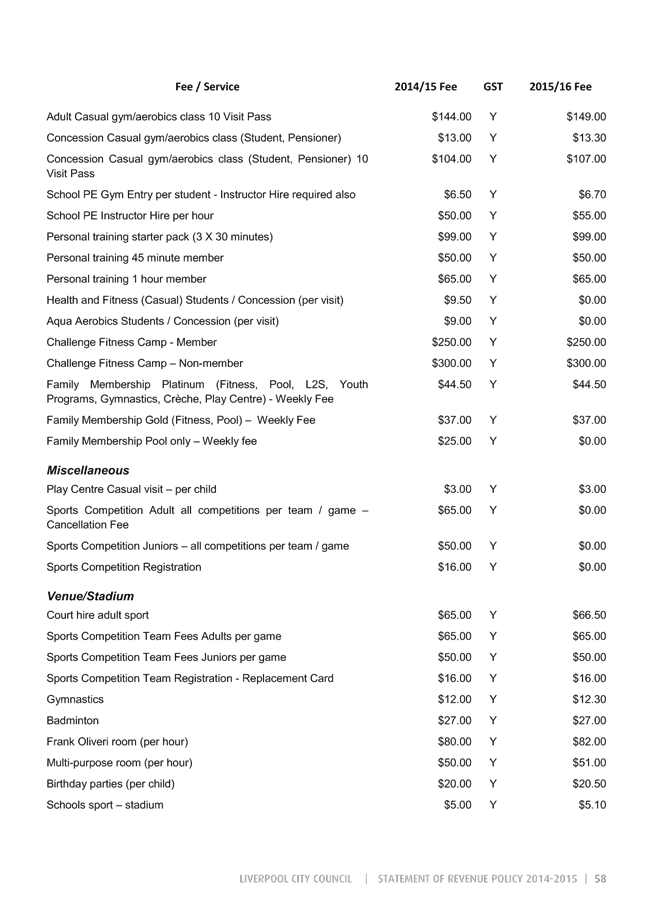

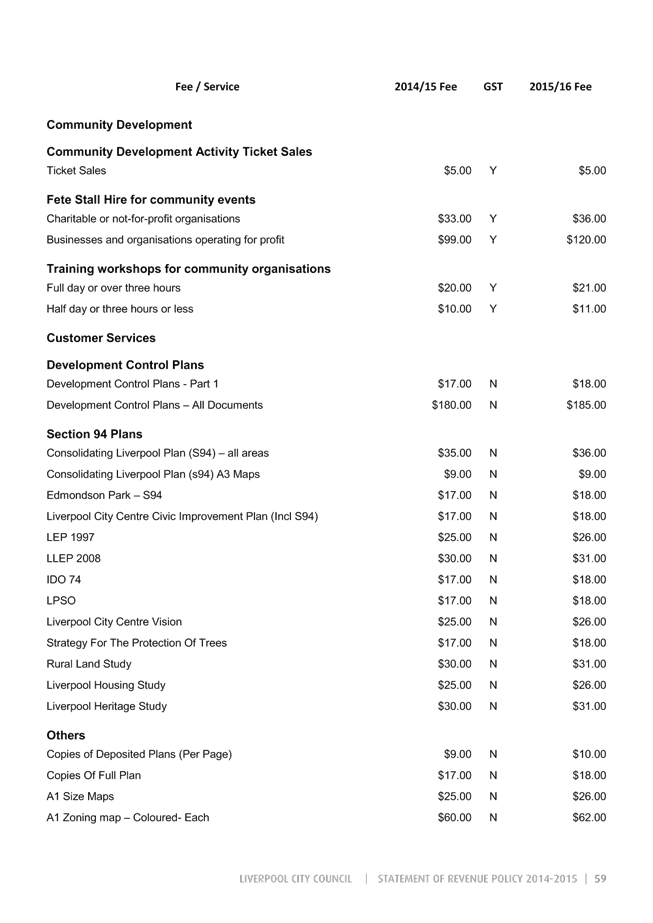

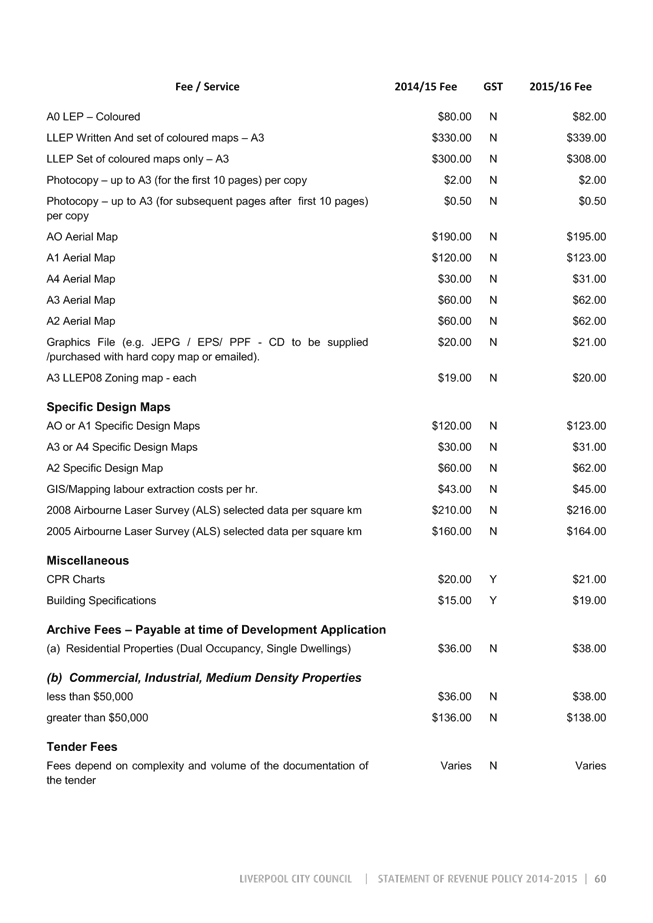

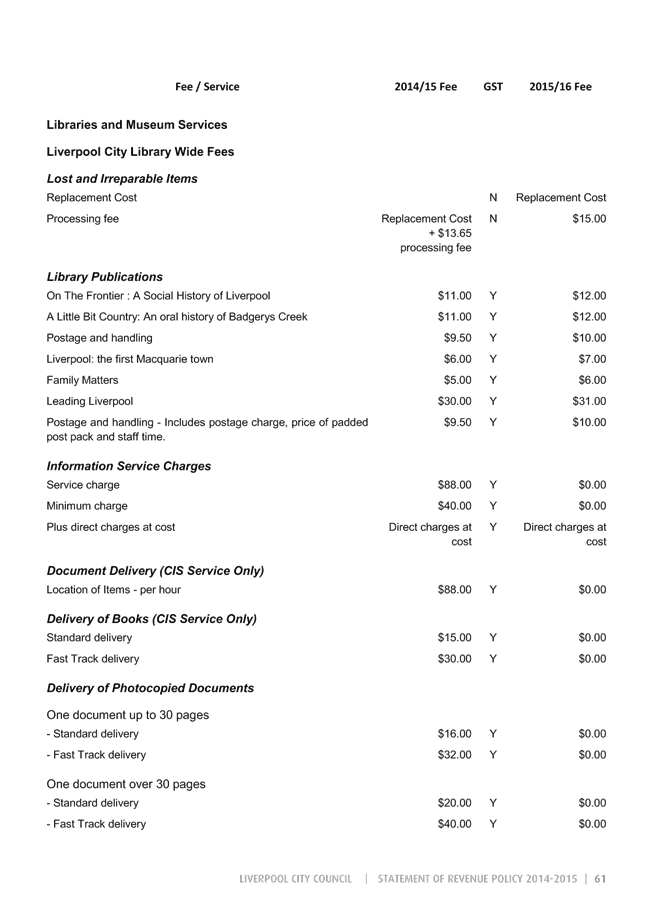

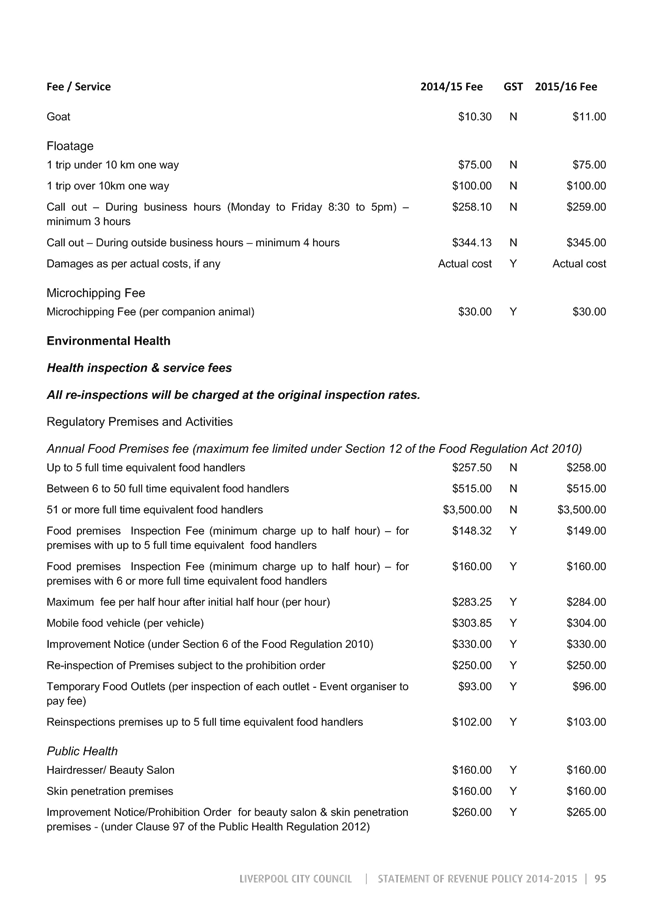

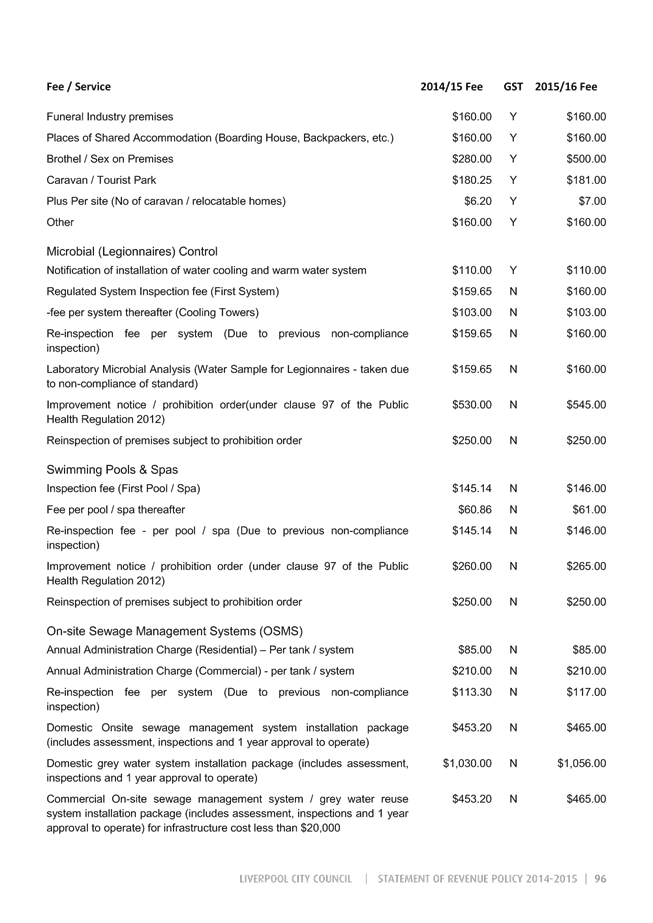

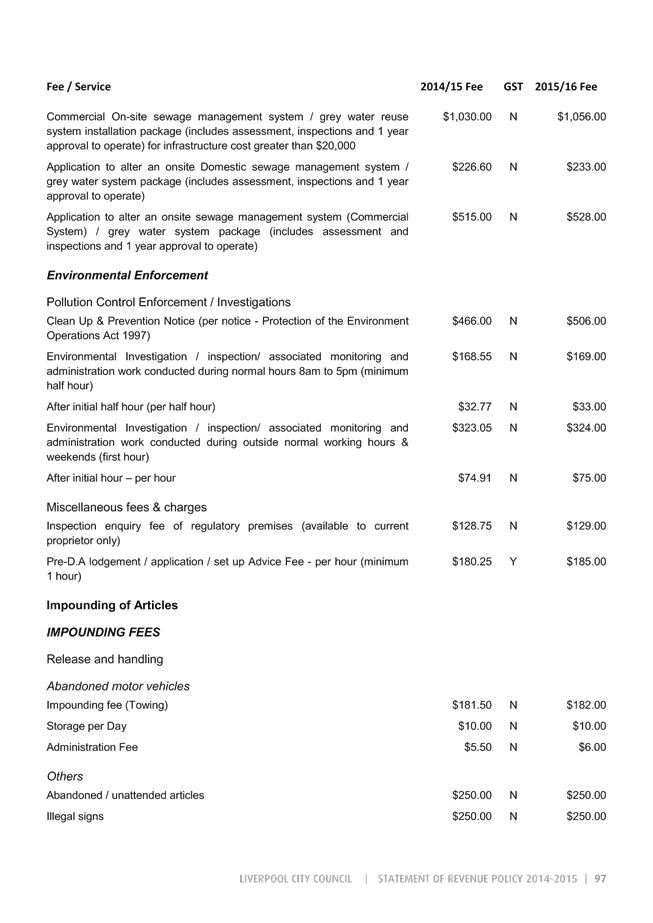

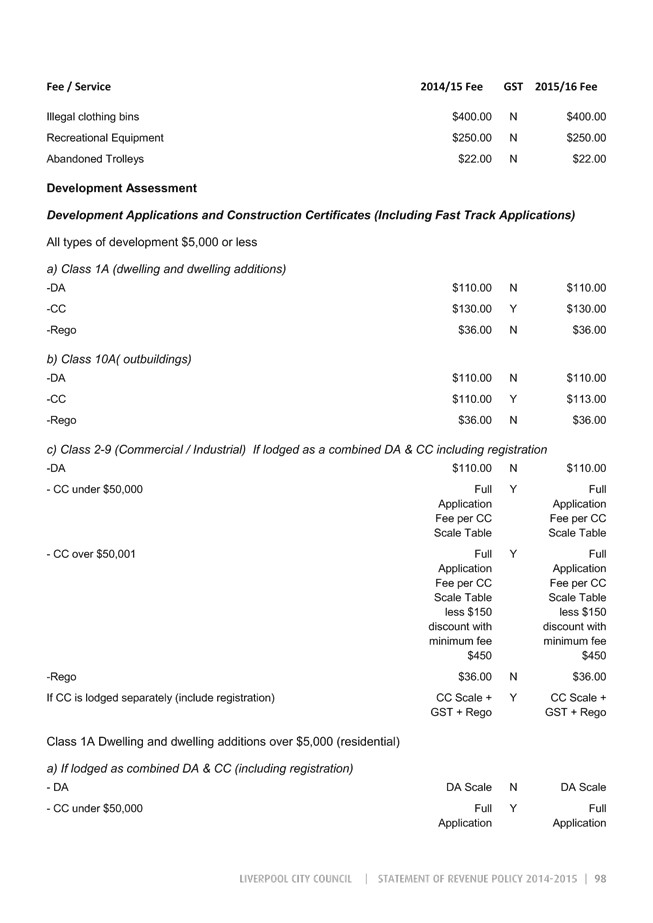

The Operational Plan outlines the specific actions which Council will deliver as well as the budget for the 2015-16 financial year and Statement of Revenue Policy (Fees and Charges).

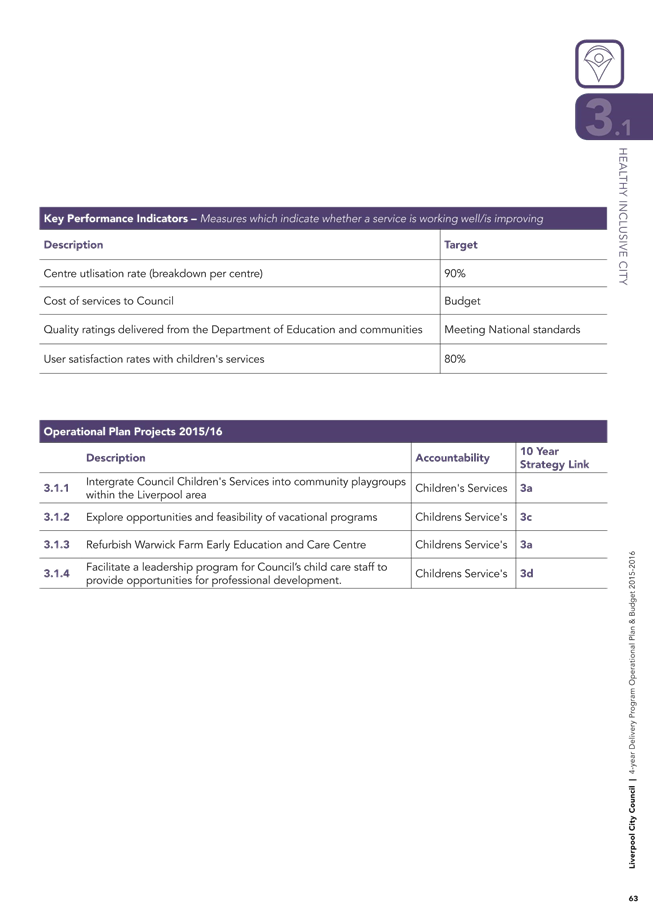

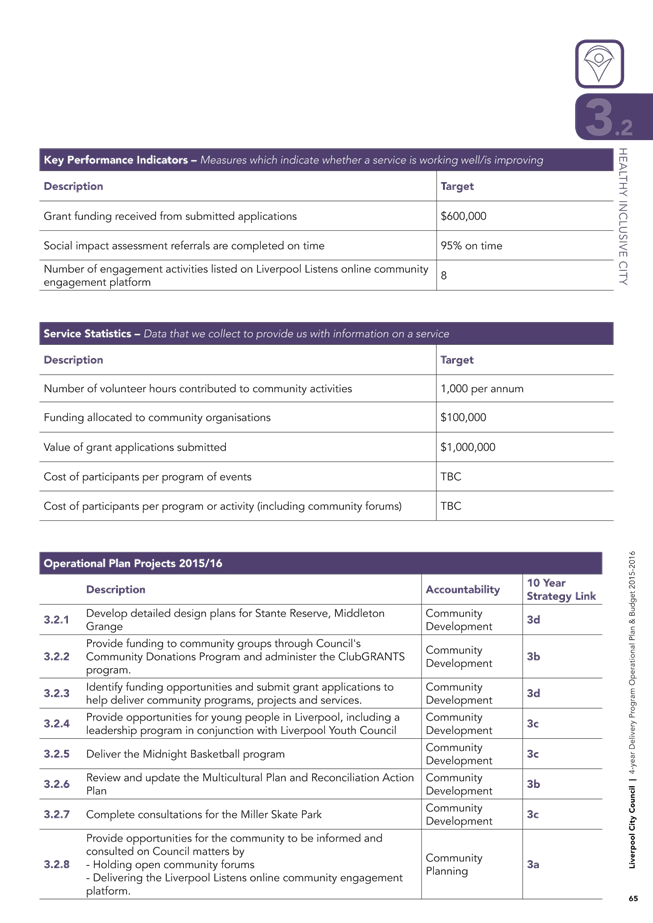

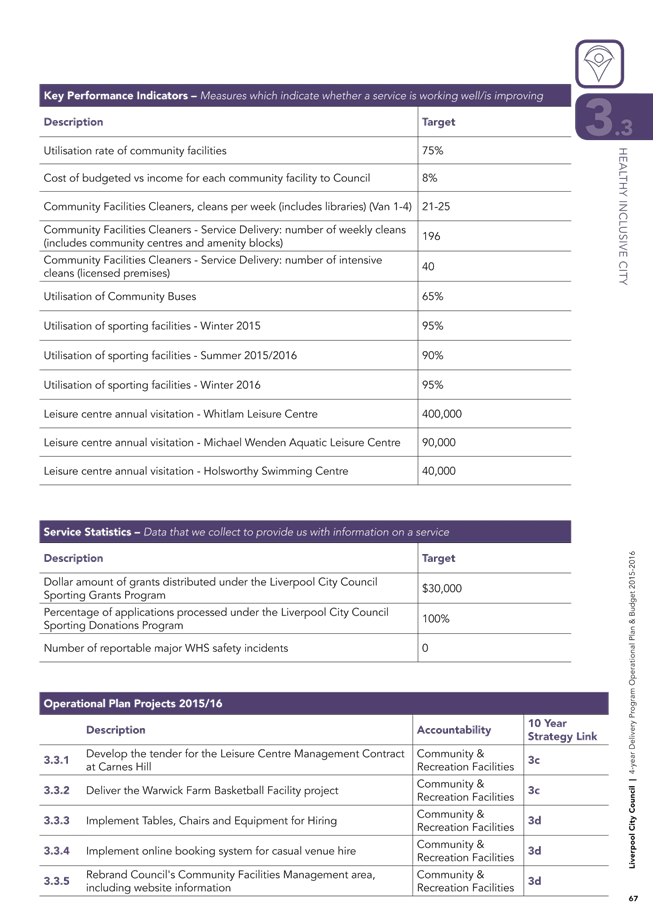

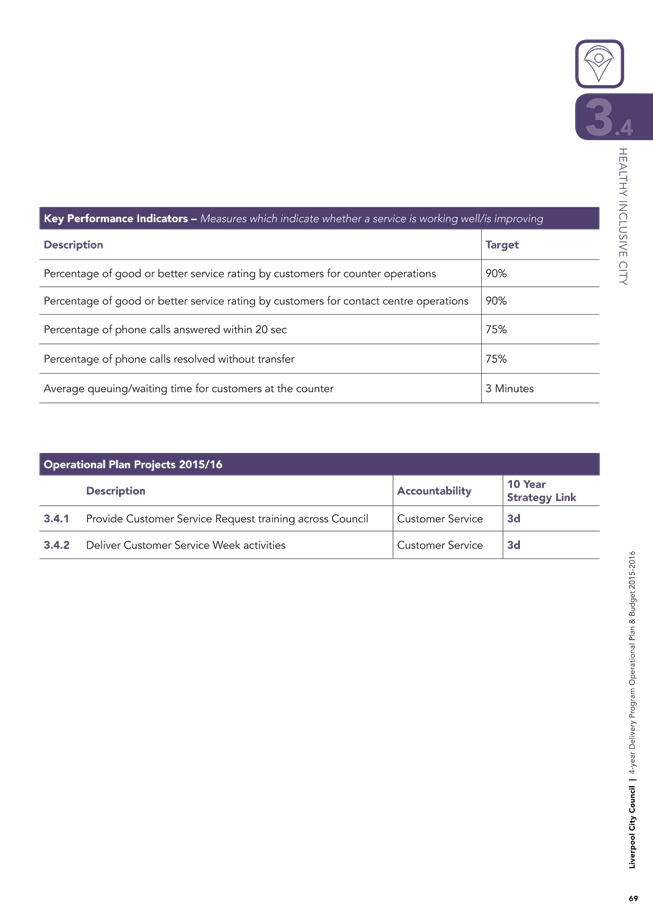

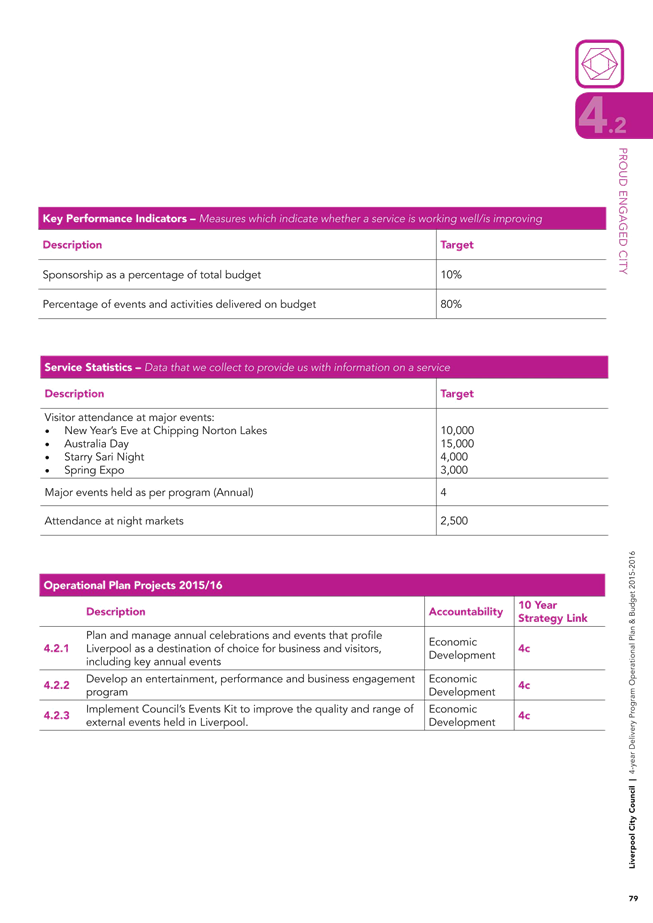

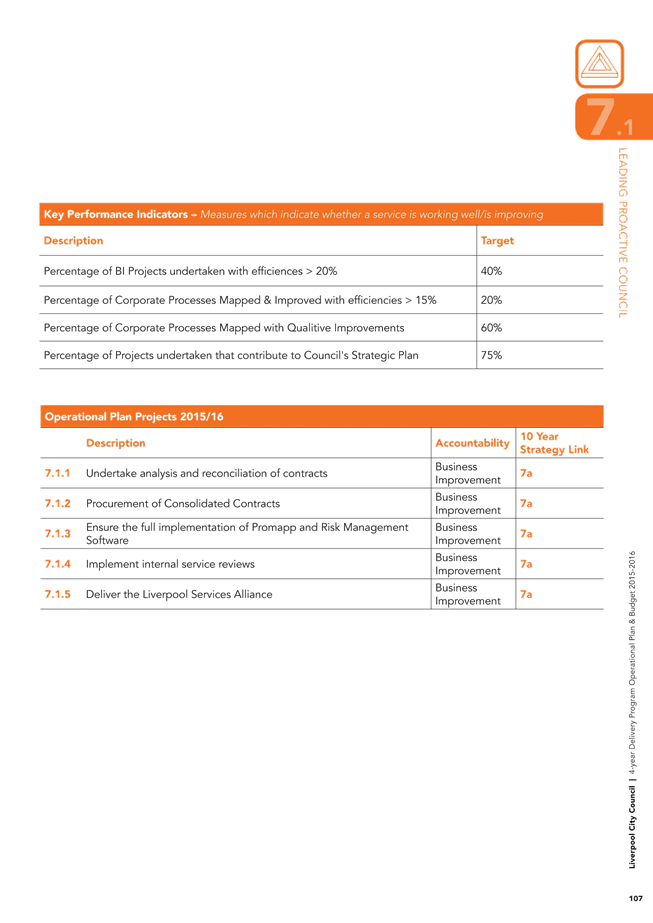

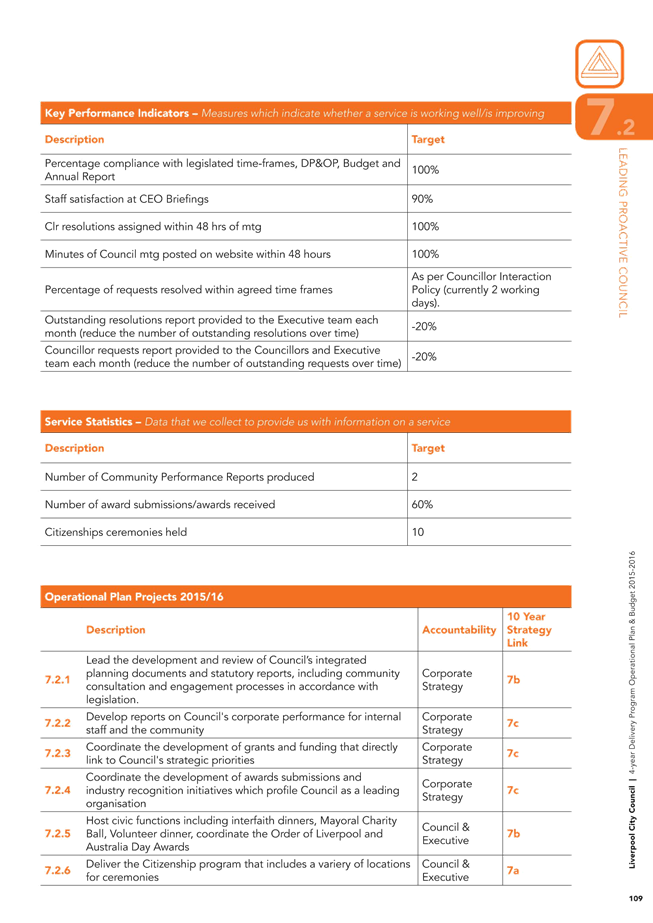

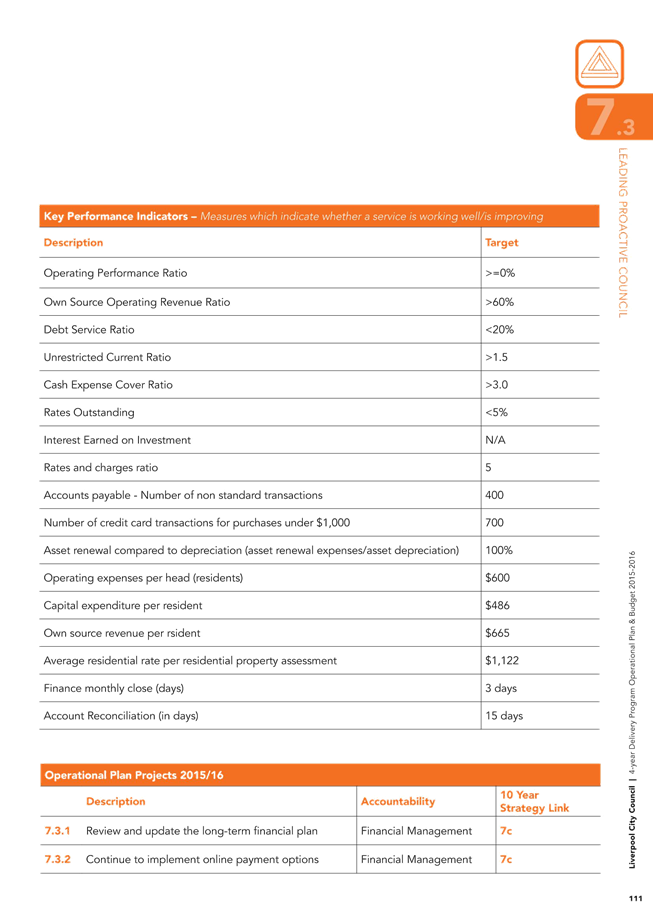

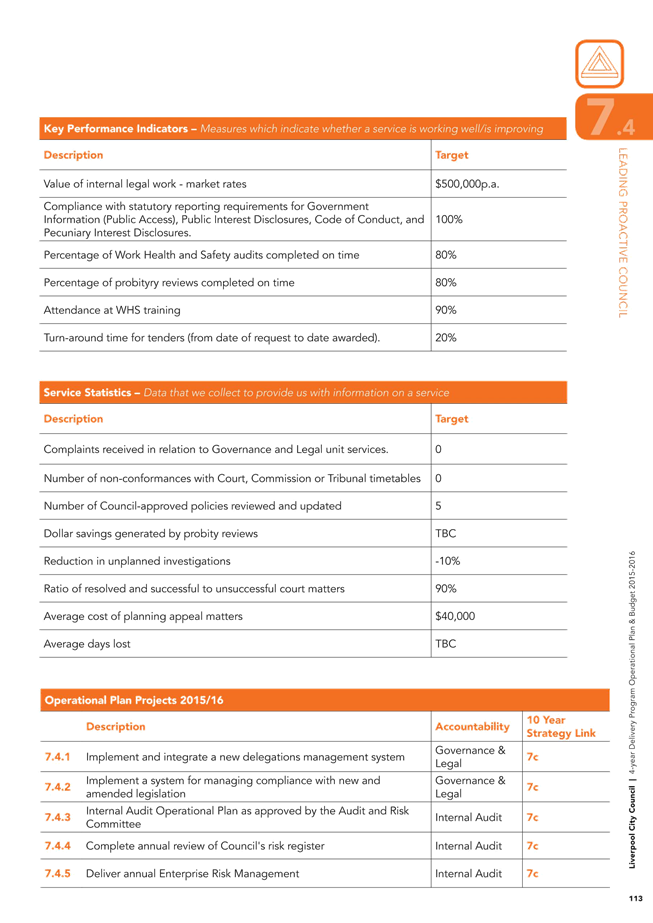

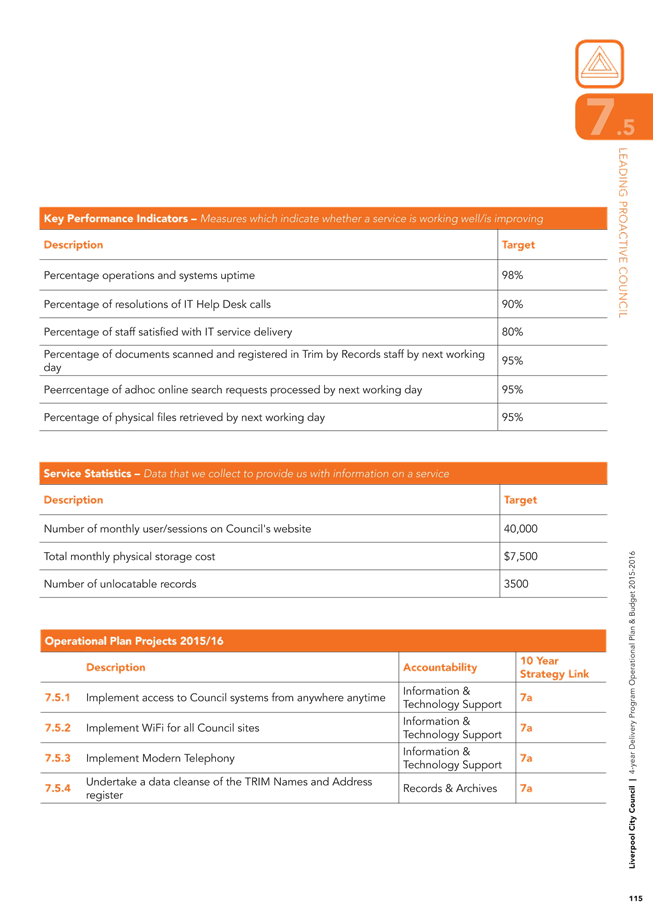

For improved integration and functionality, the Delivery Program and Operational Plan have been included in the same document. It includes the following:

· Council's principal activities/services over four years;

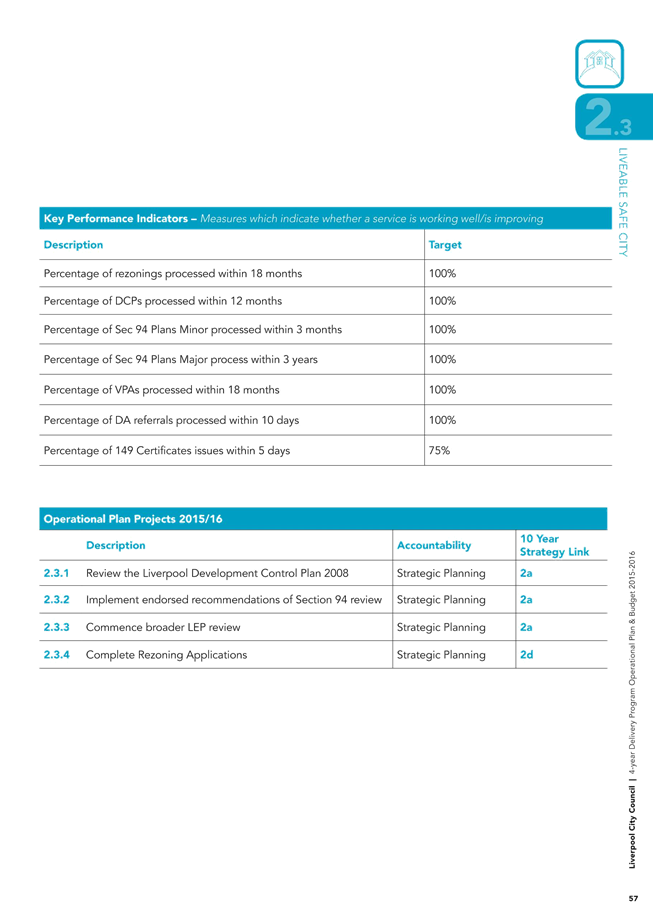

· Key Performance Indicators and Service Statistics to determine effectiveness;

· 2015-16 actions;

· 2015-16 draft budget;

· 2015-16 proposed capital works program; and

· 2015-16 draft revenue pricing policy (proposed rates, fees and charges).

The Local Government Act 1993 requires Council to undertake a detailed review of its Community Strategic Plan and Delivery Program by 30 June in the year following an election. The Operational Plan and annual budget are required to be adopted by 30 June of each year.

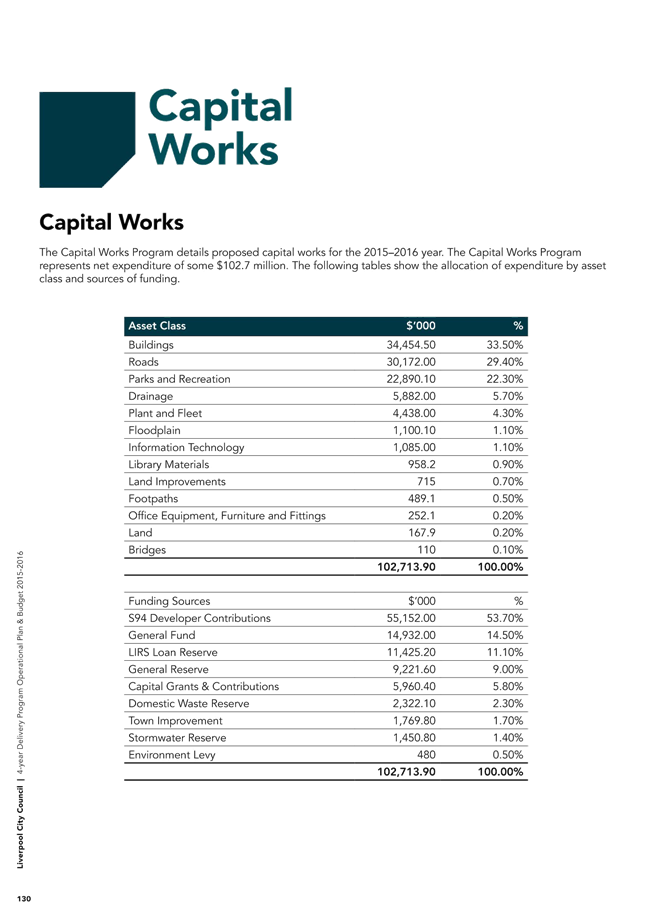

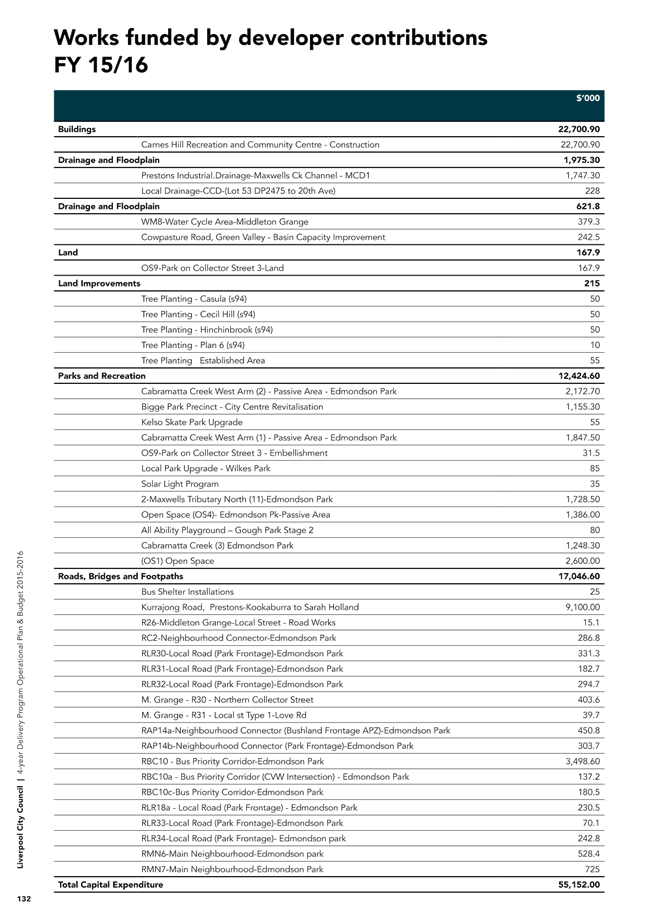

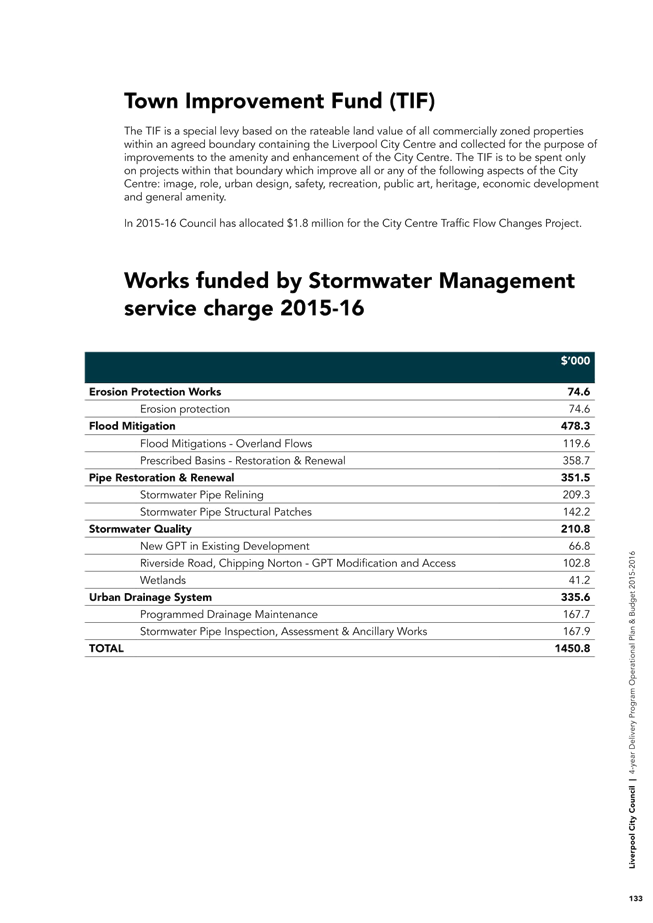

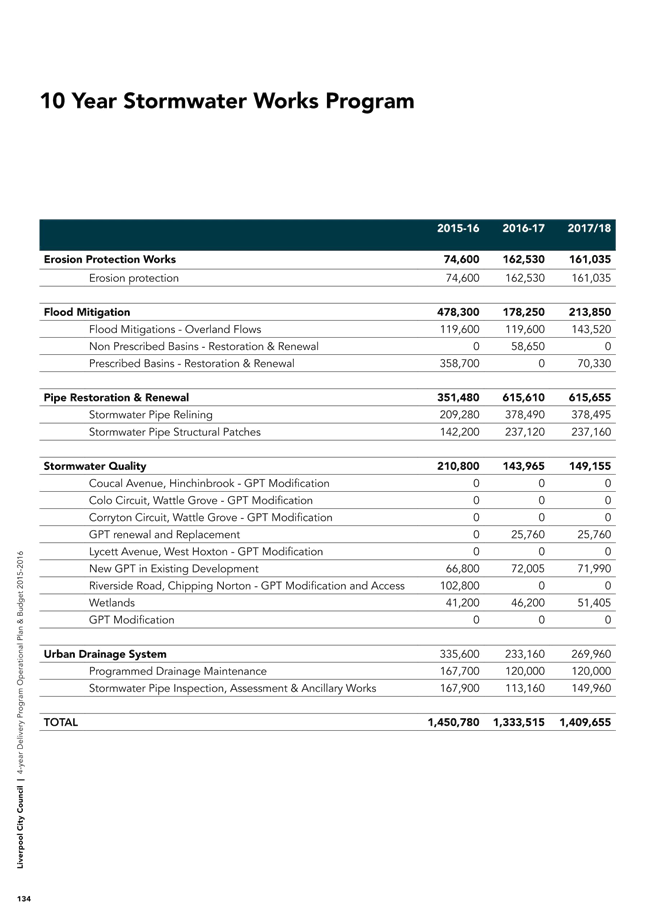

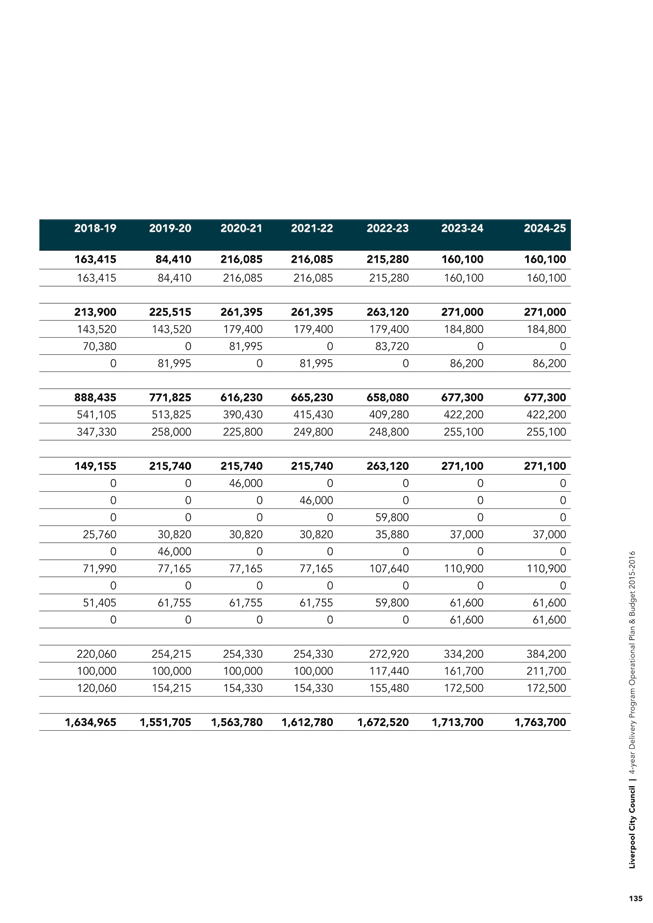

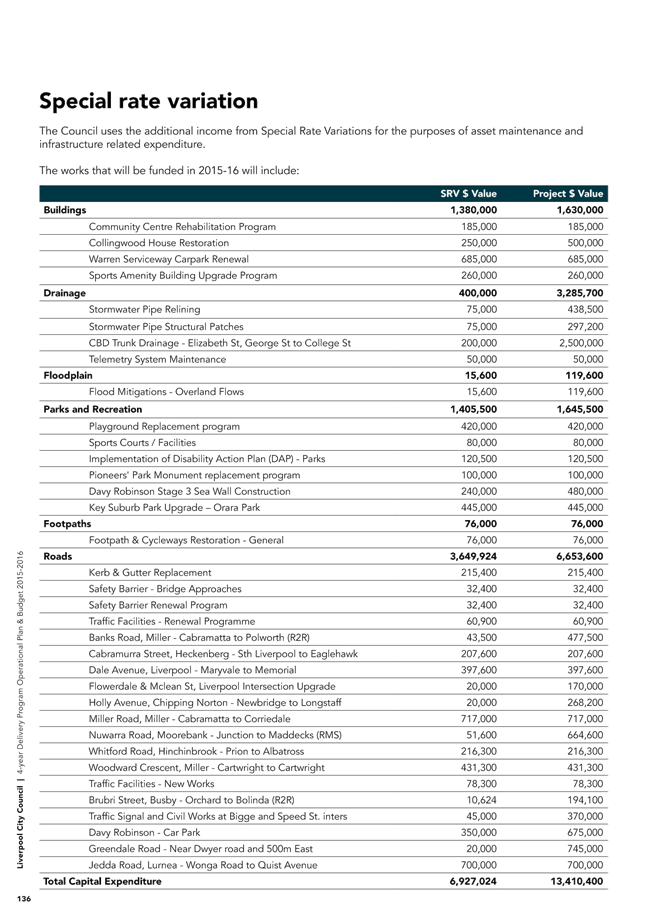

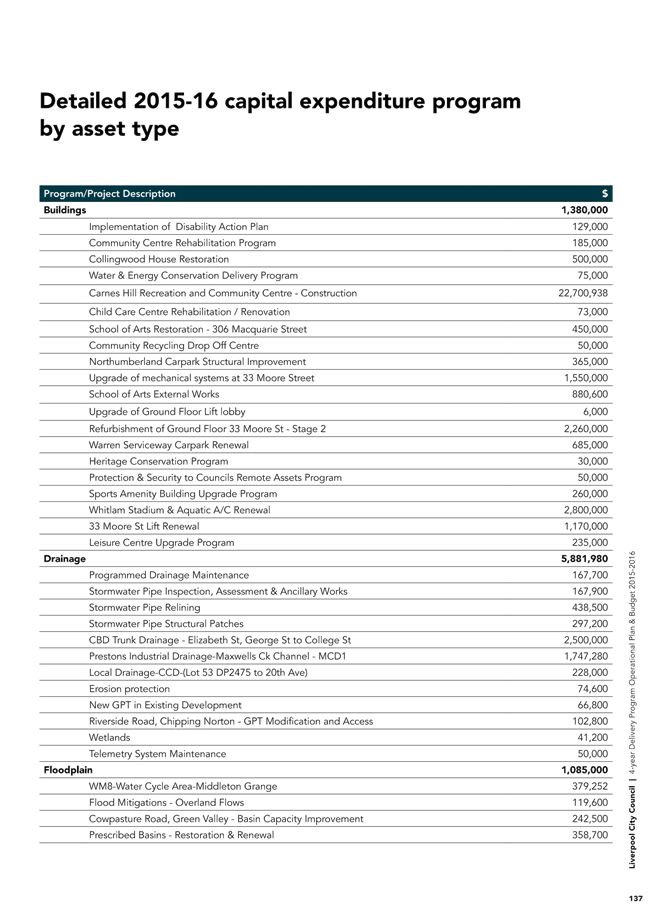

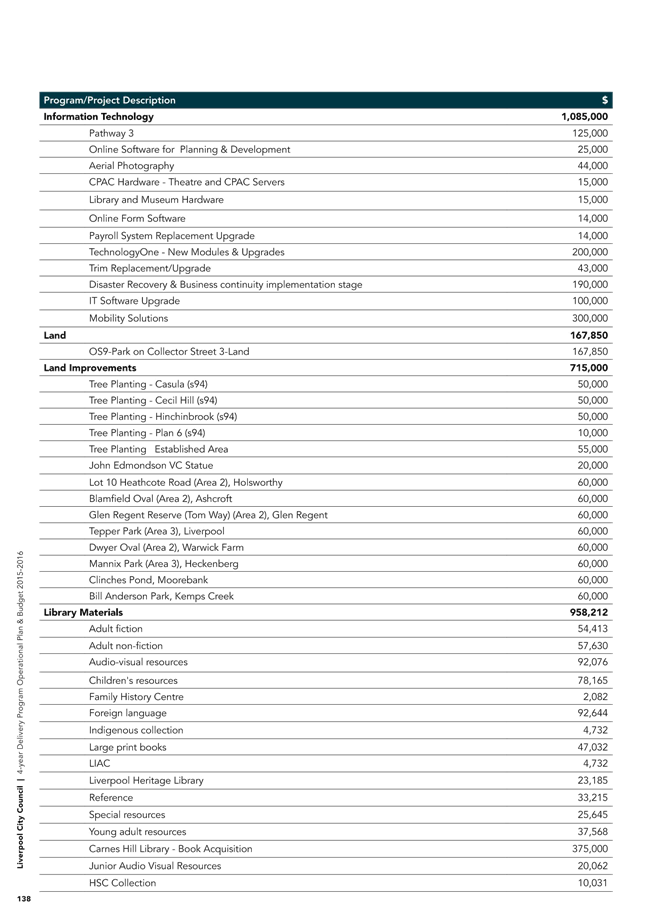

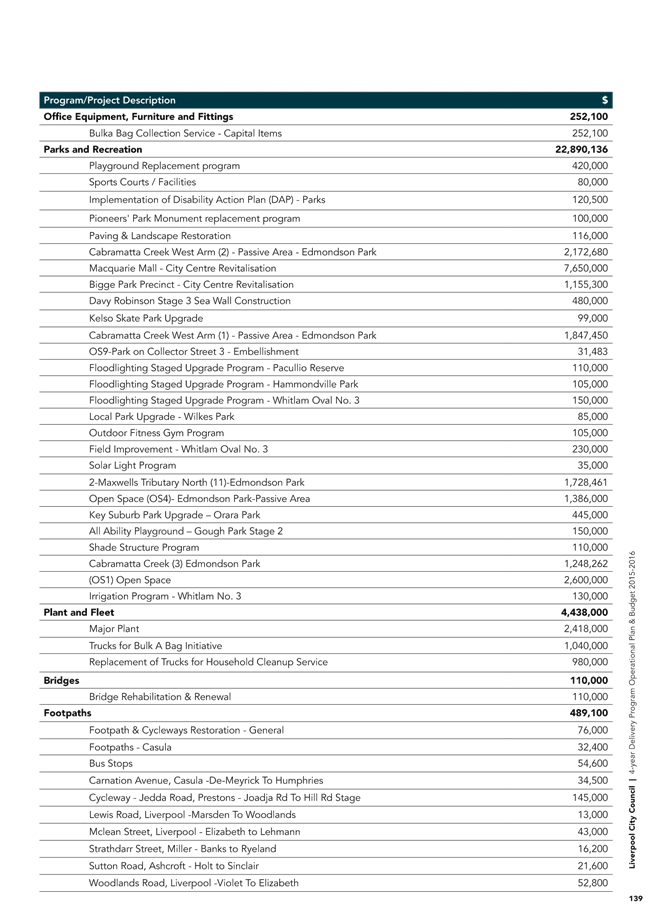

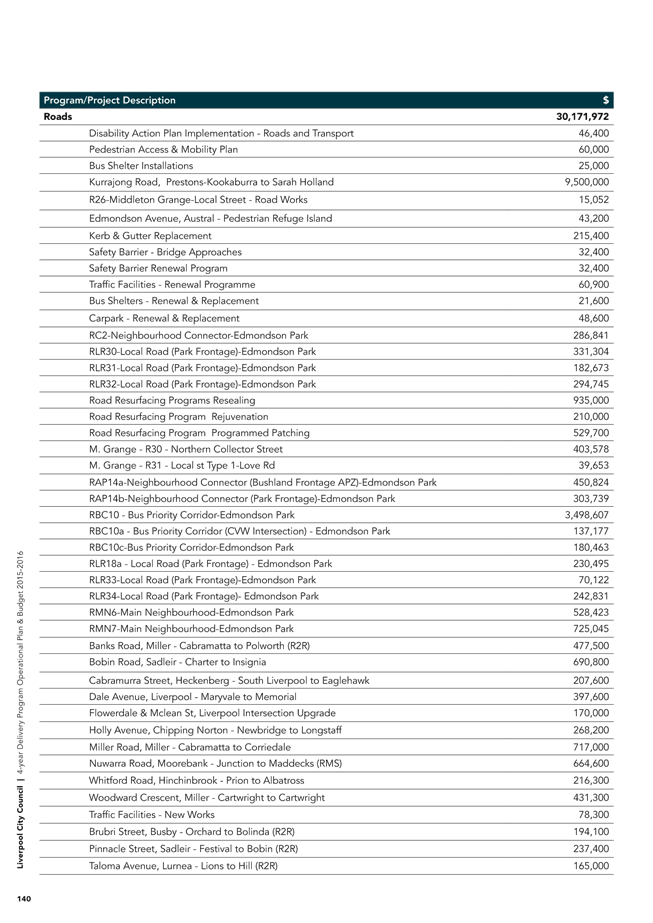

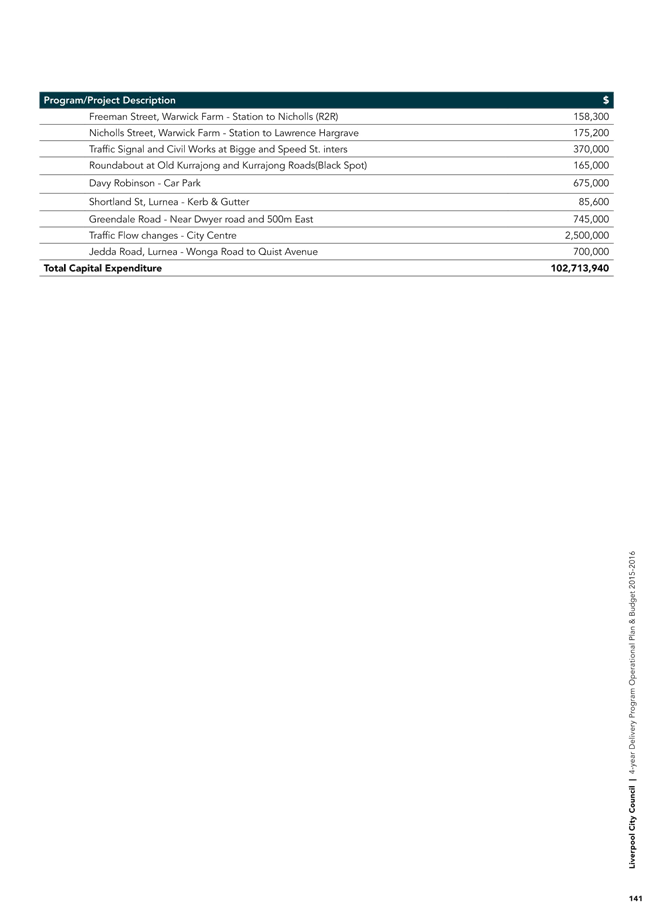

Capital Works

Council has committed $102.7m to capital works in the 2015-16 budget, details of works to be undertaken are available in the full document provided under separate cover.

Proposed major works include:

· The construction of Carnes Hill Recreation and Community Centre;

· The construction of the new look Macquarie Mall;

· The completion of extensions to Kurrajong Road;

· Investigation and design of, and land acquisitions for a Warwick Farm bypass road;

· Construction of CBD Trunk Drainage;

· City centre traffic flow changes.

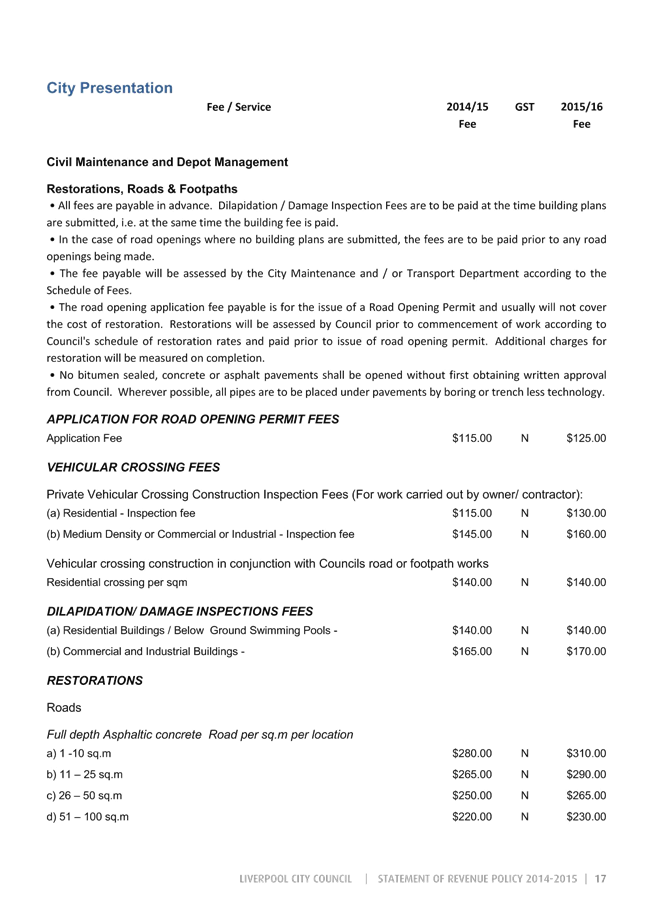

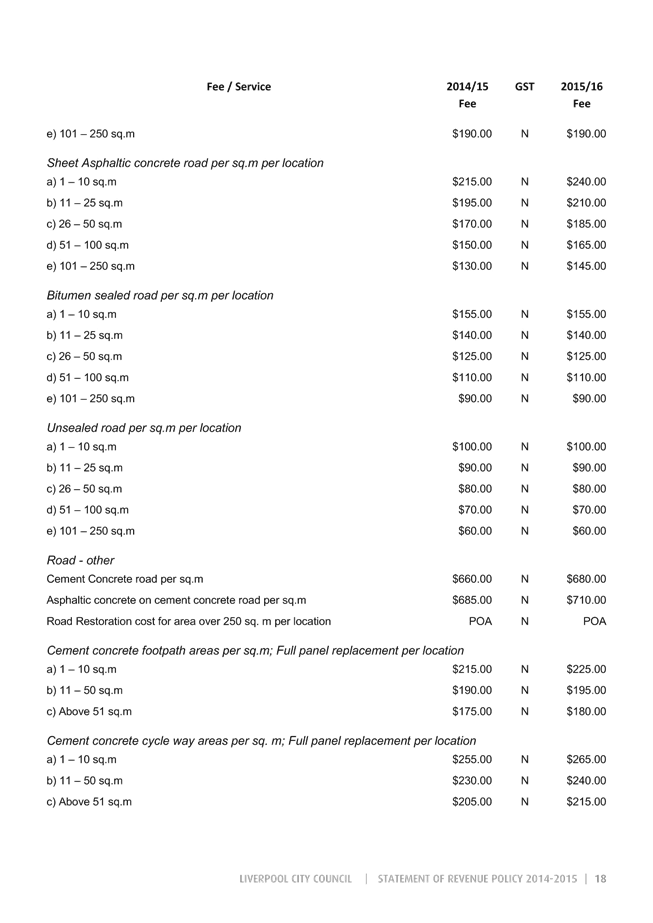

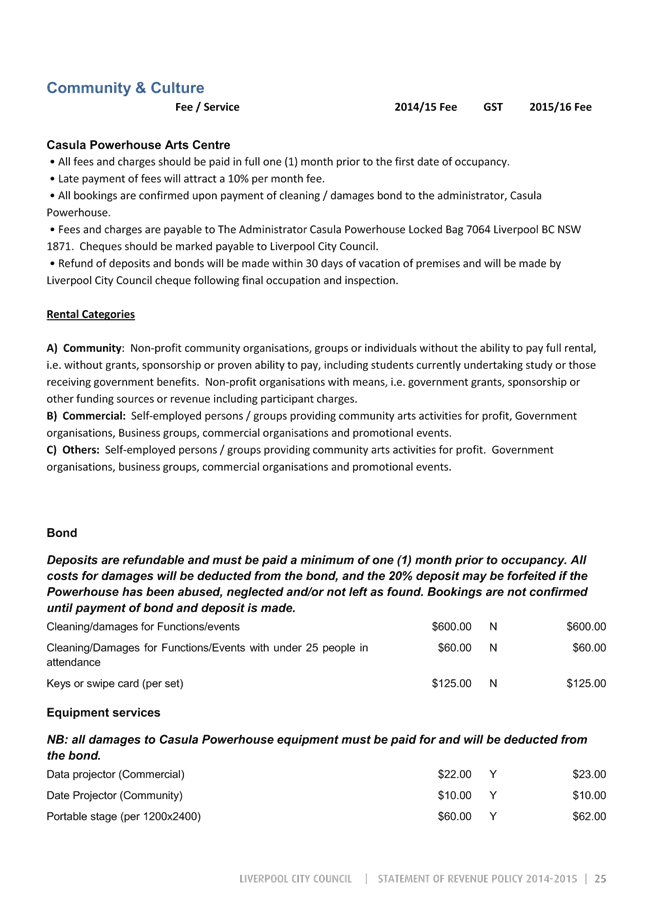

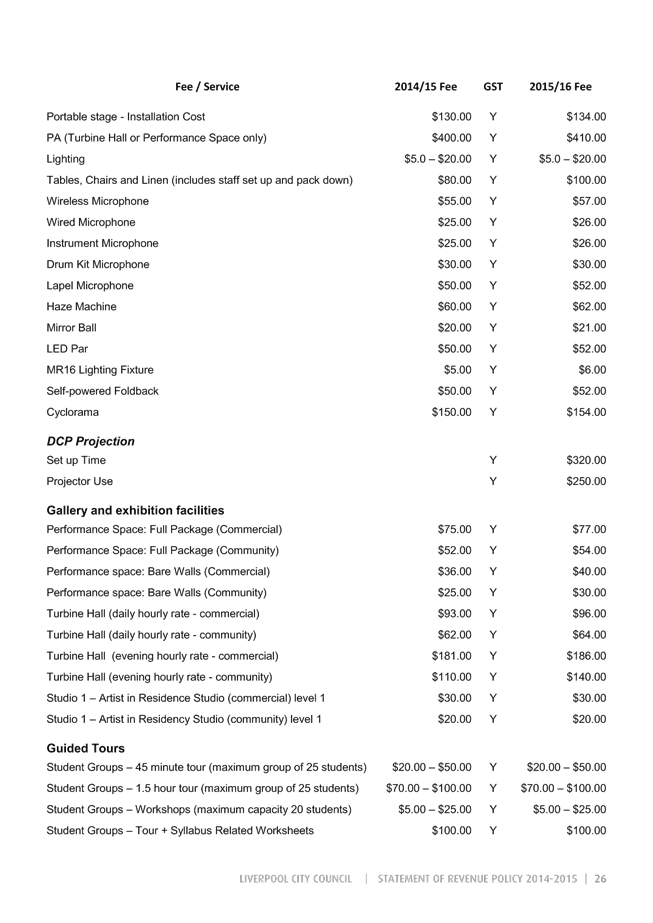

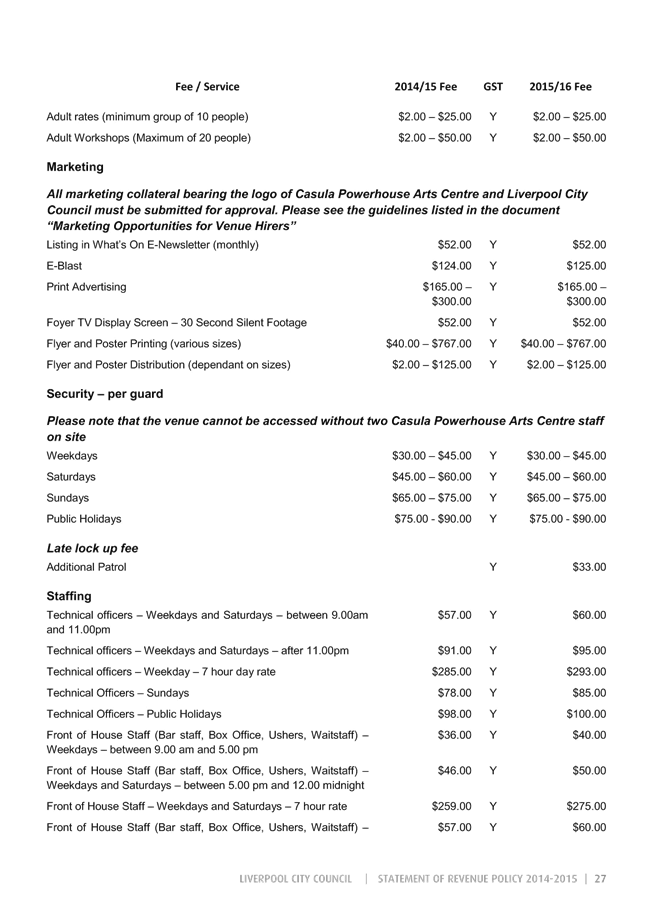

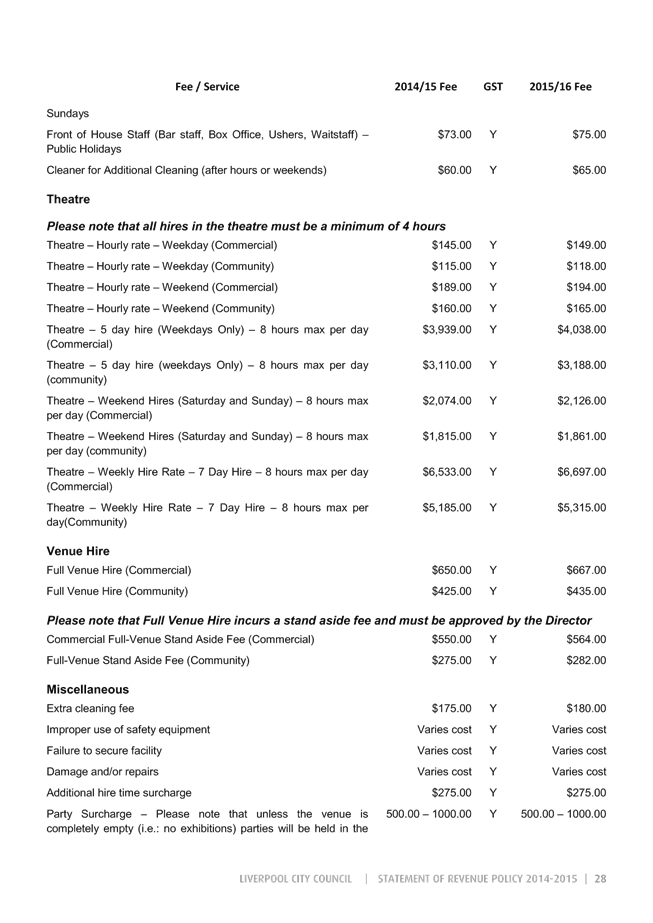

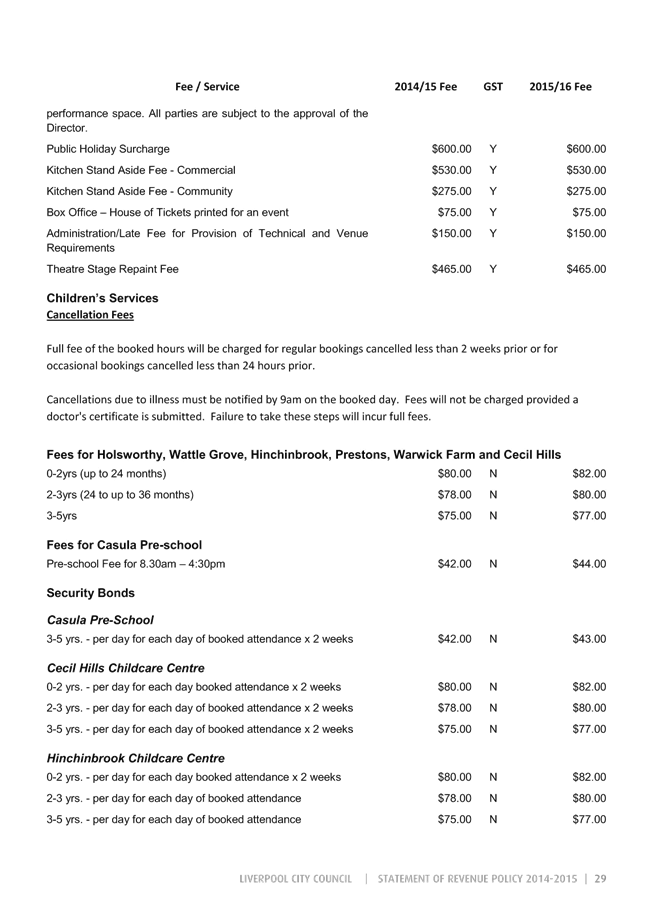

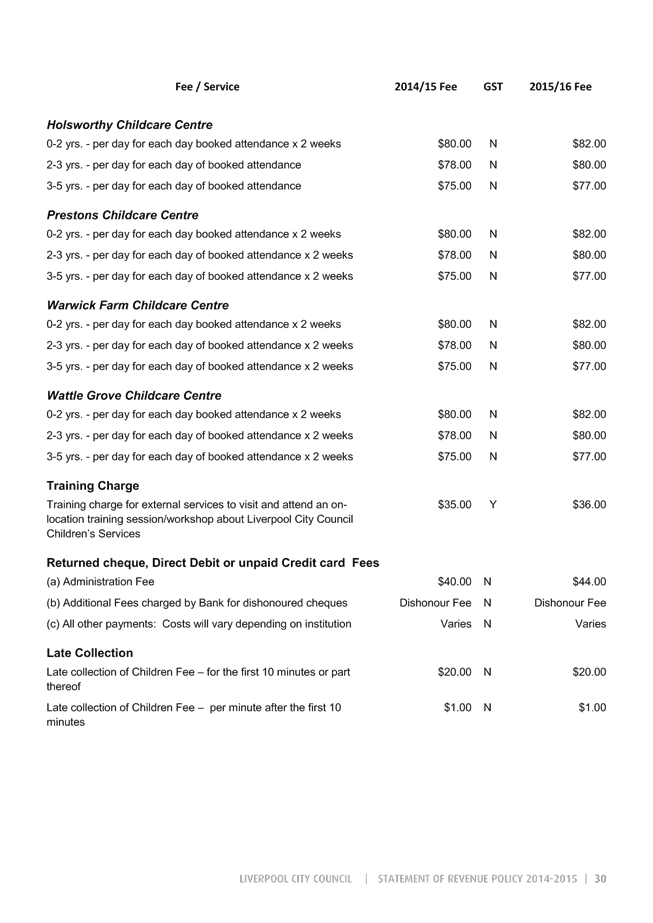

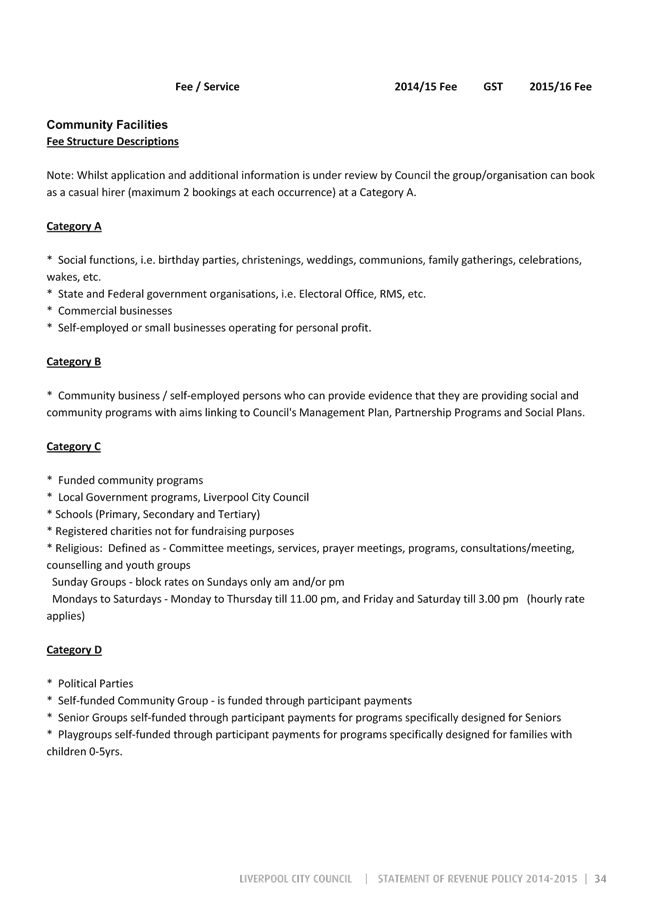

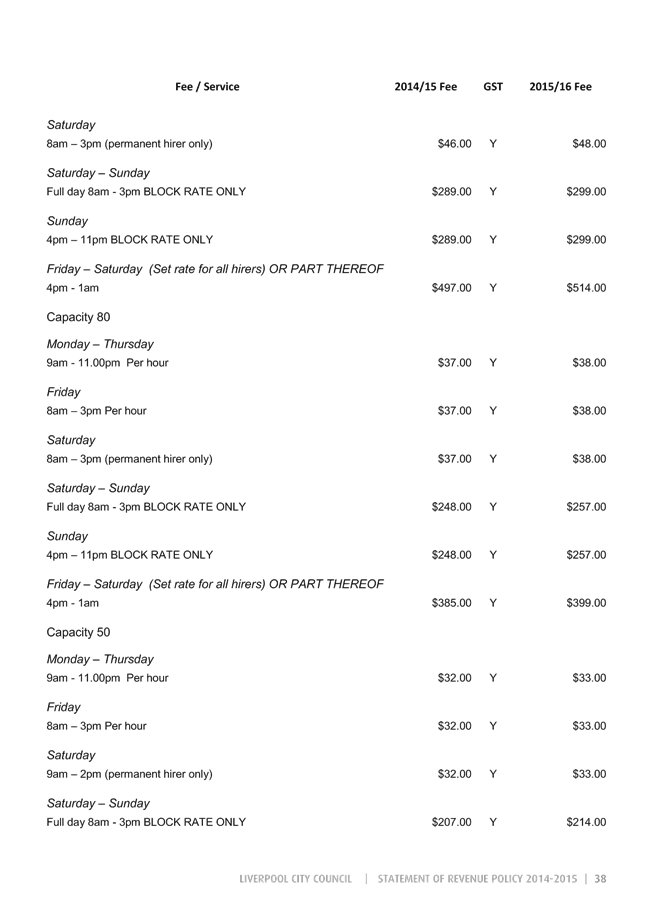

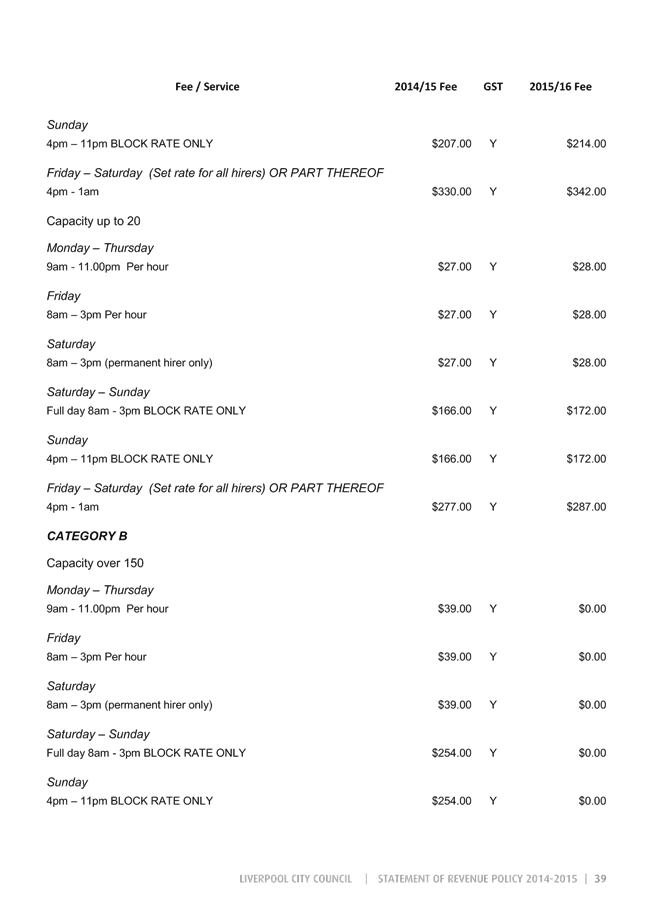

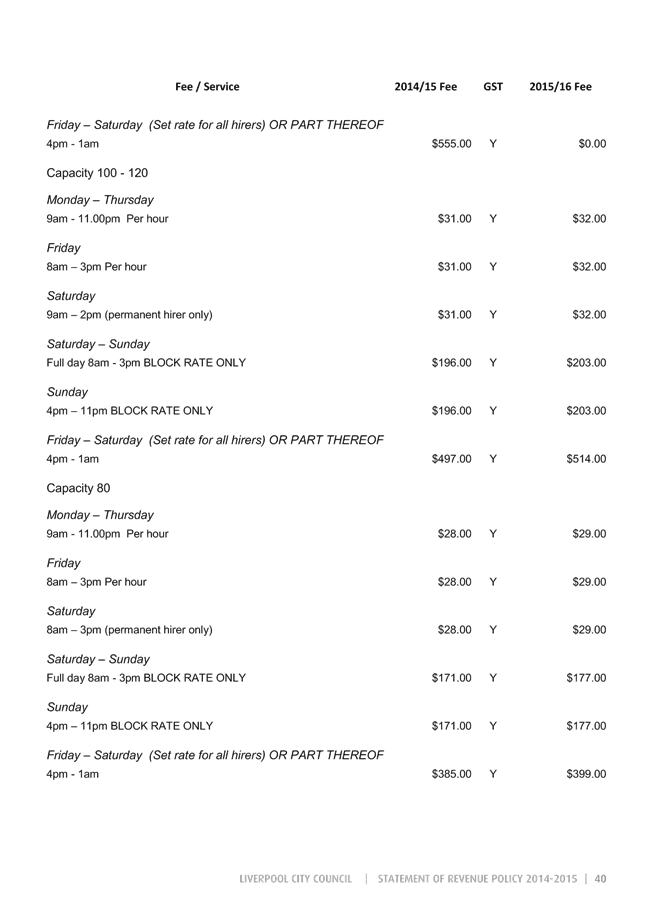

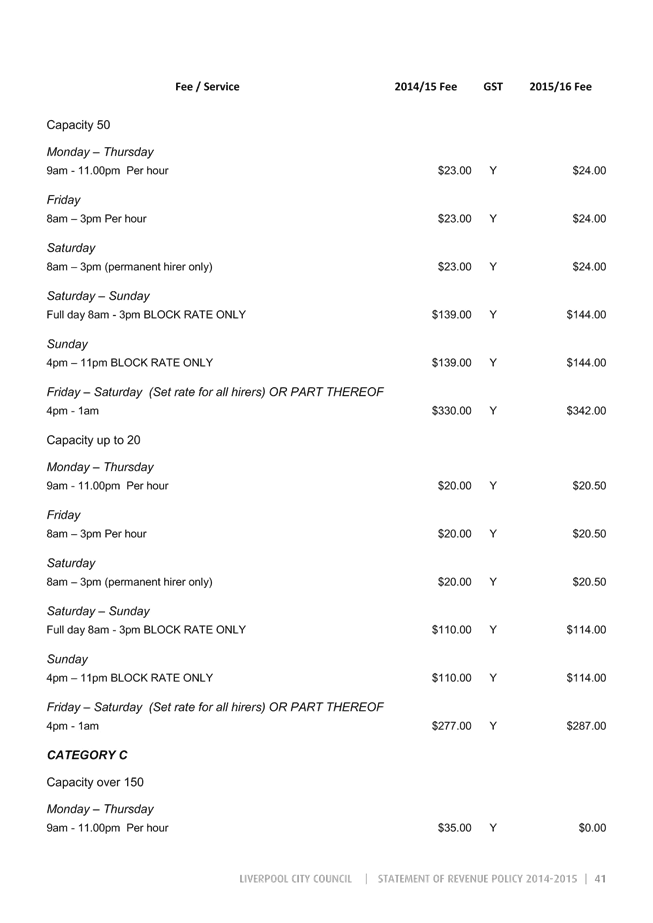

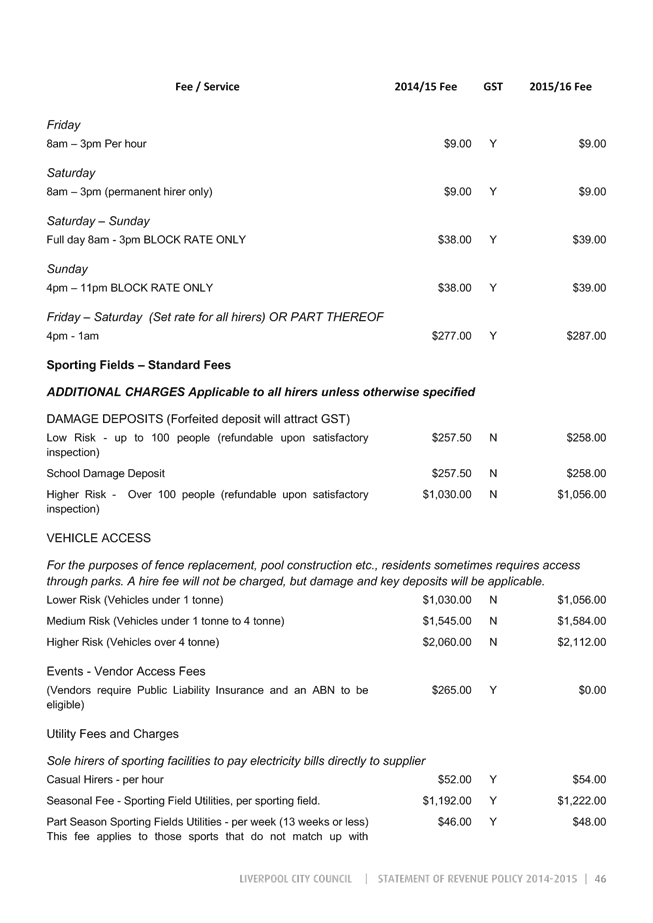

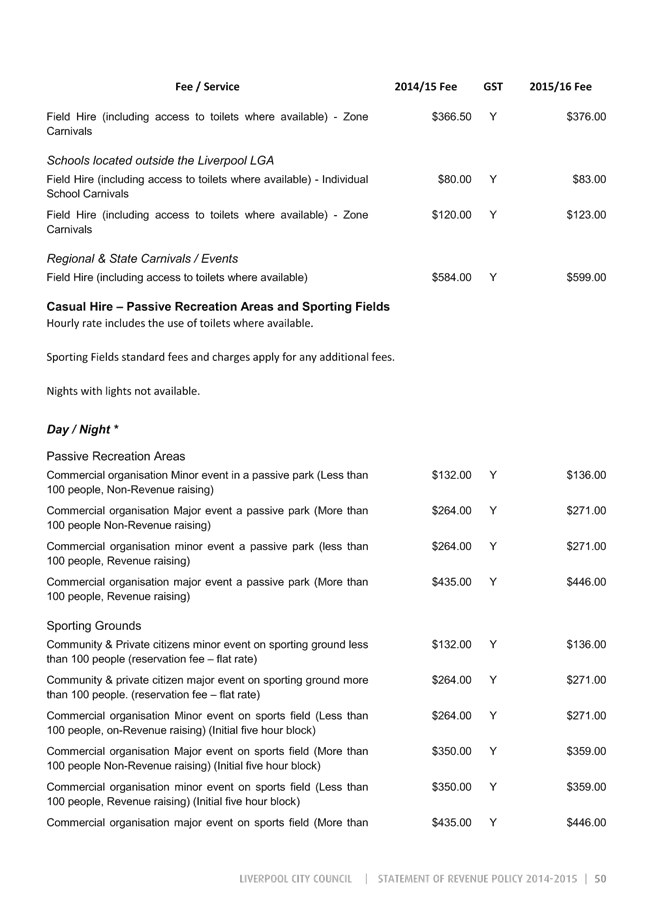

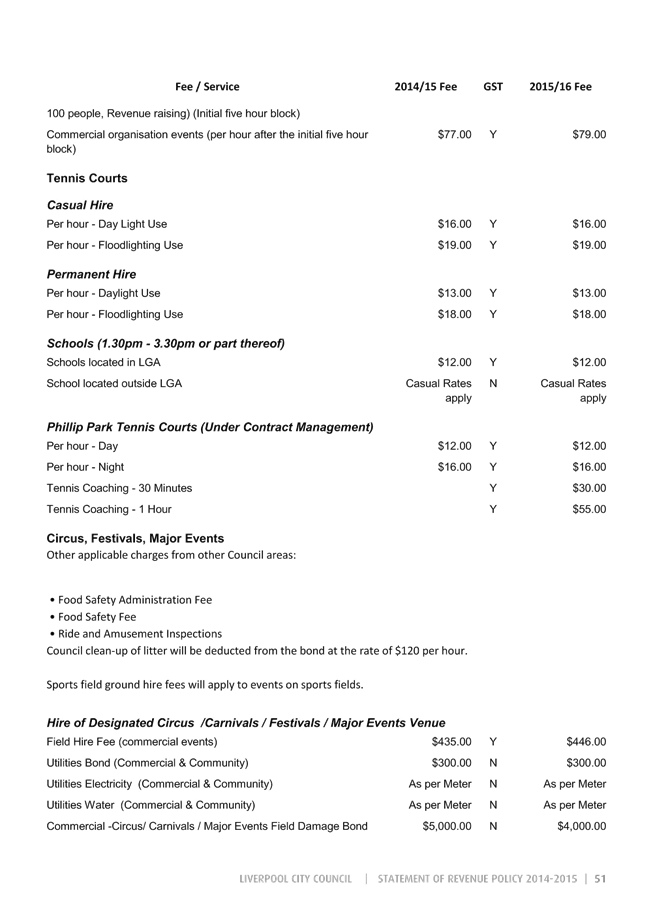

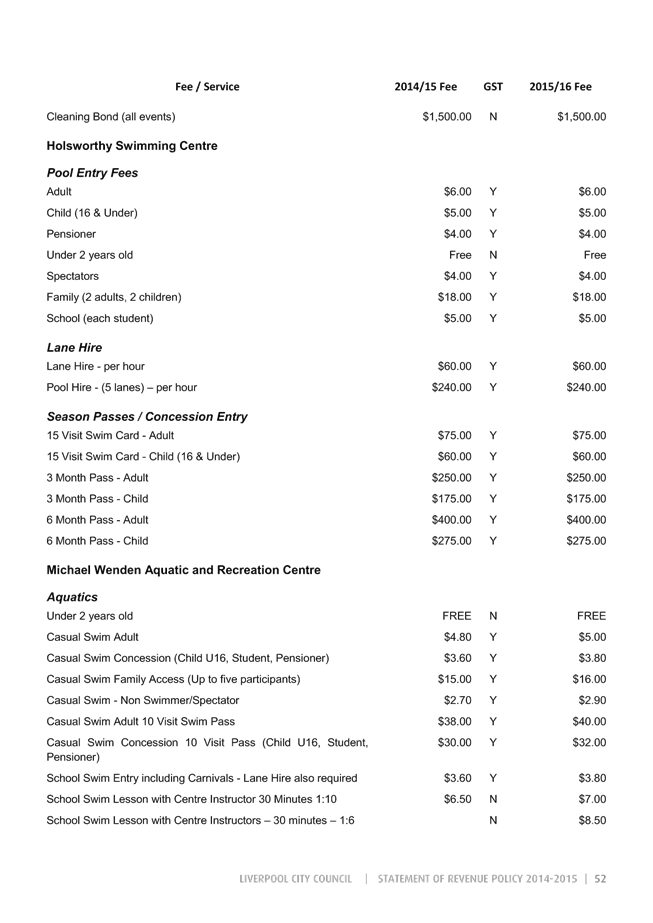

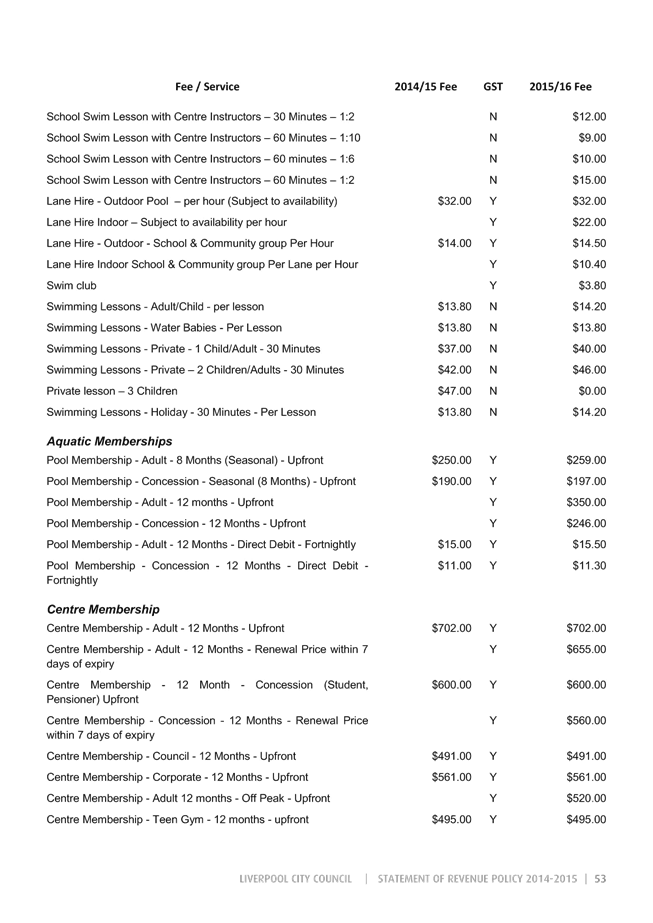

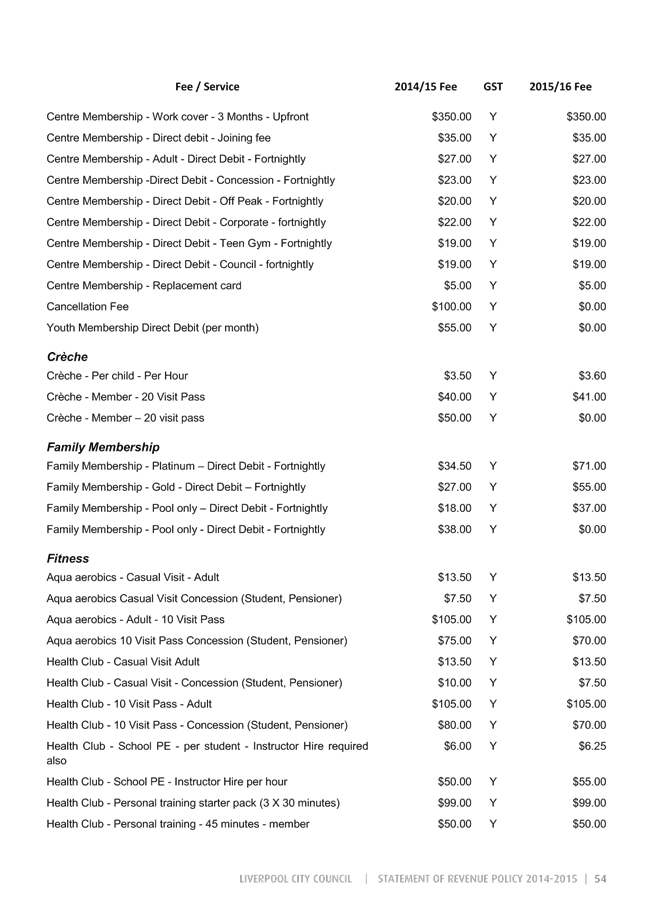

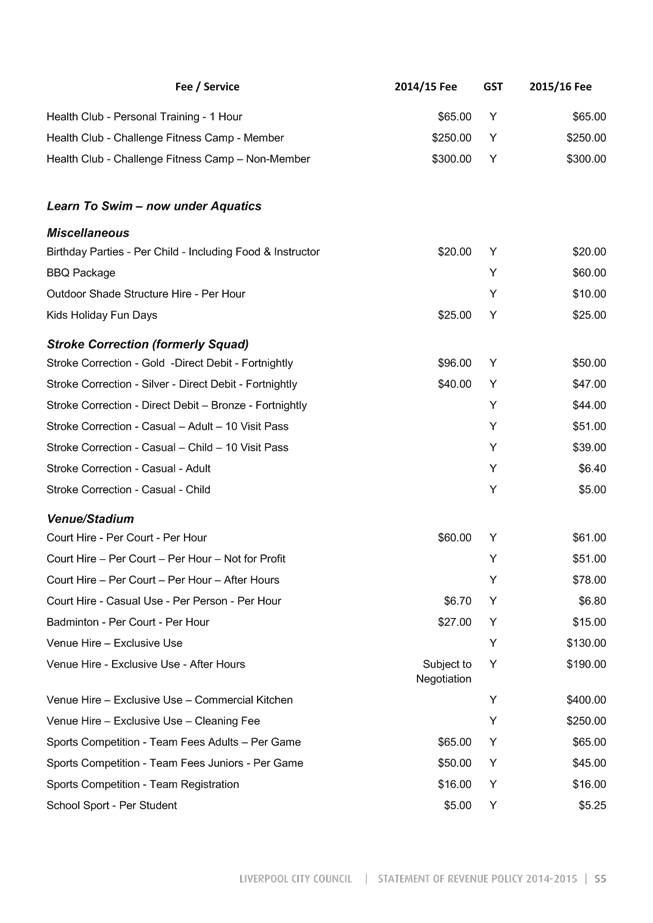

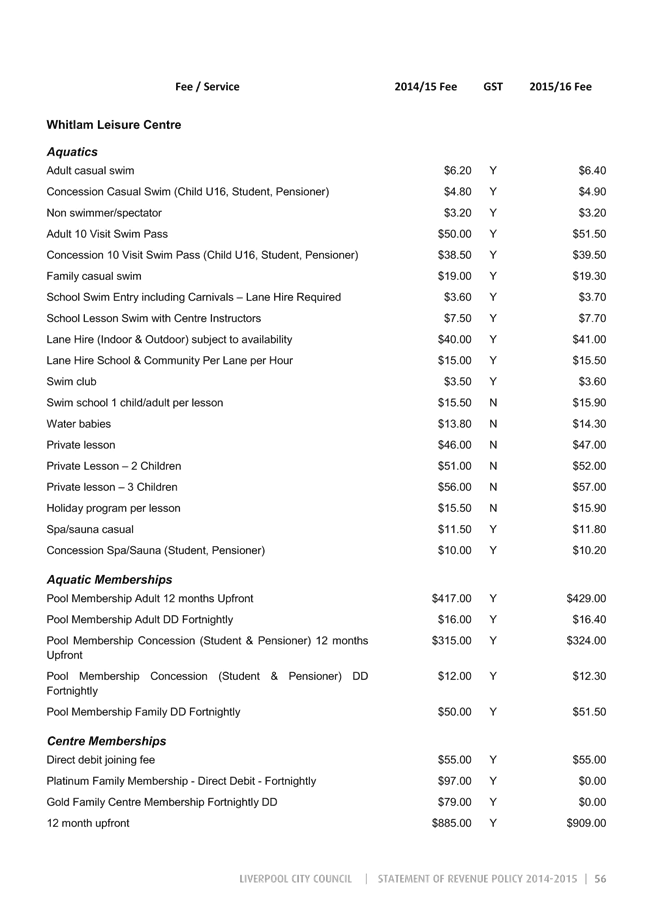

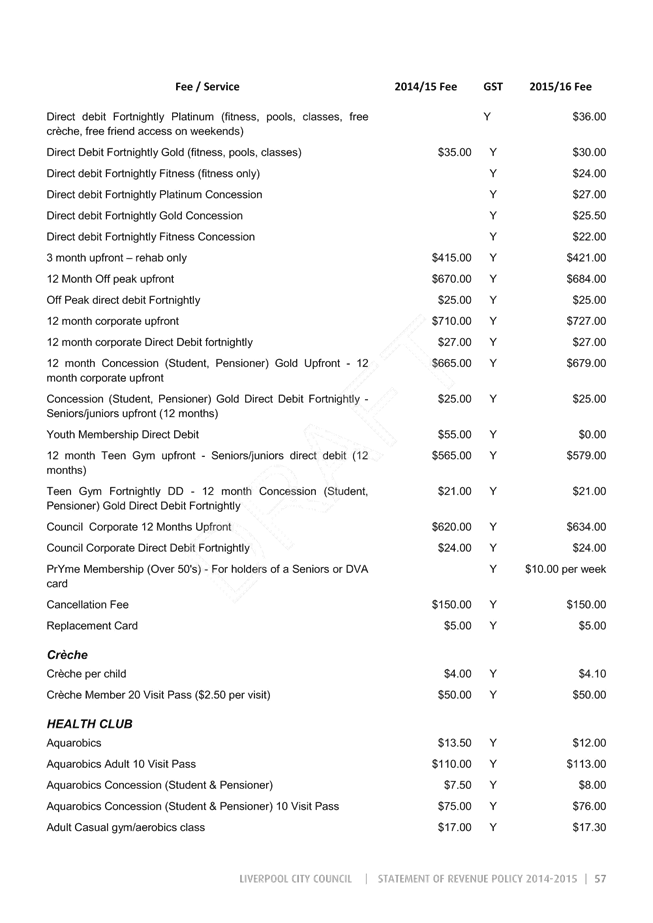

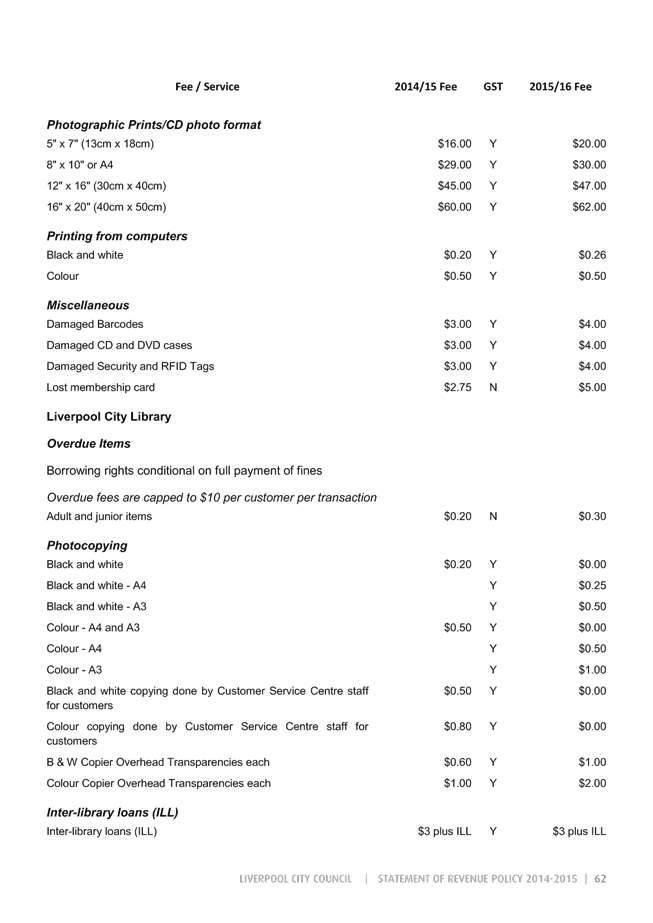

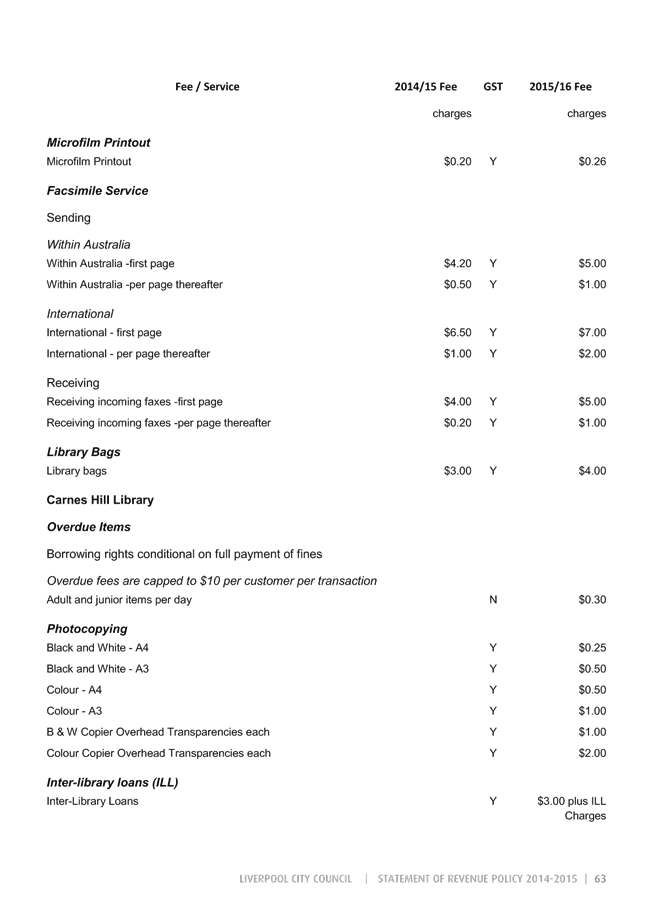

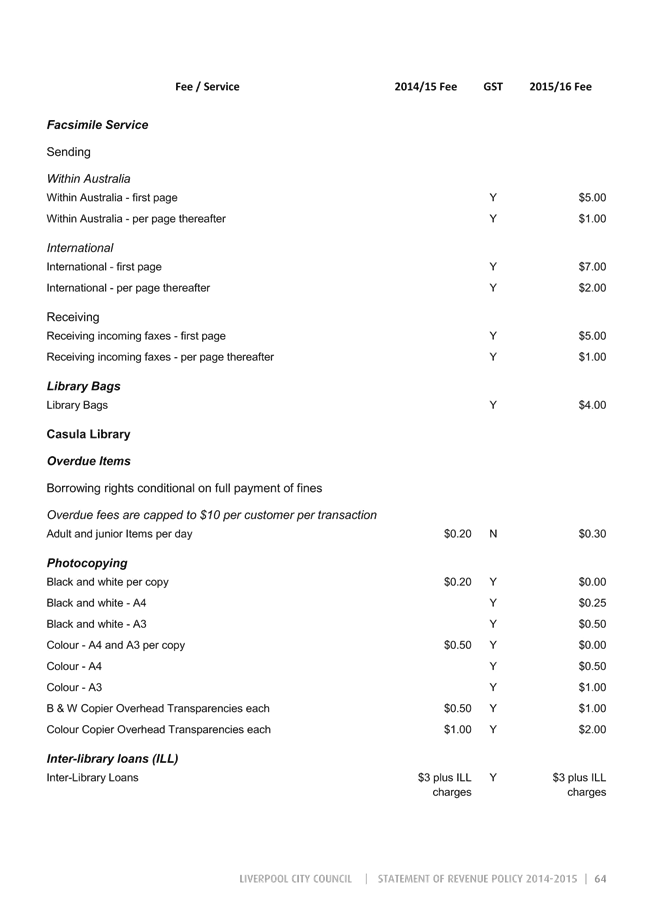

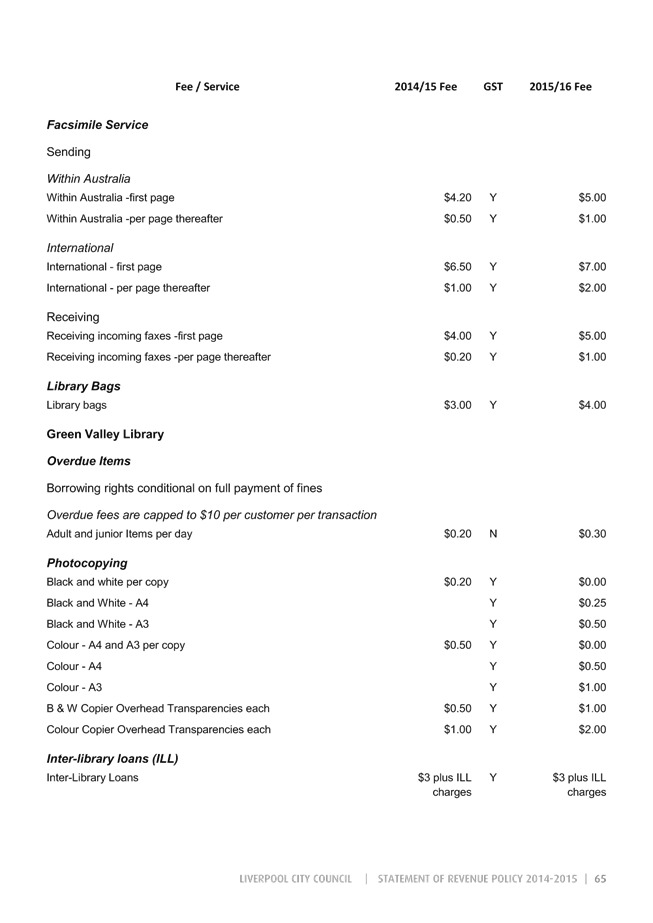

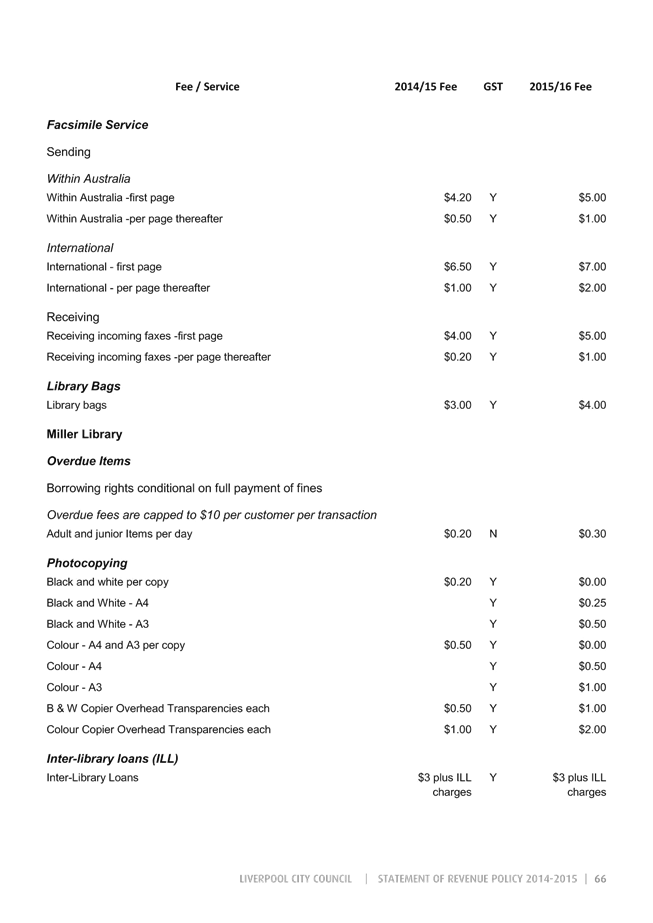

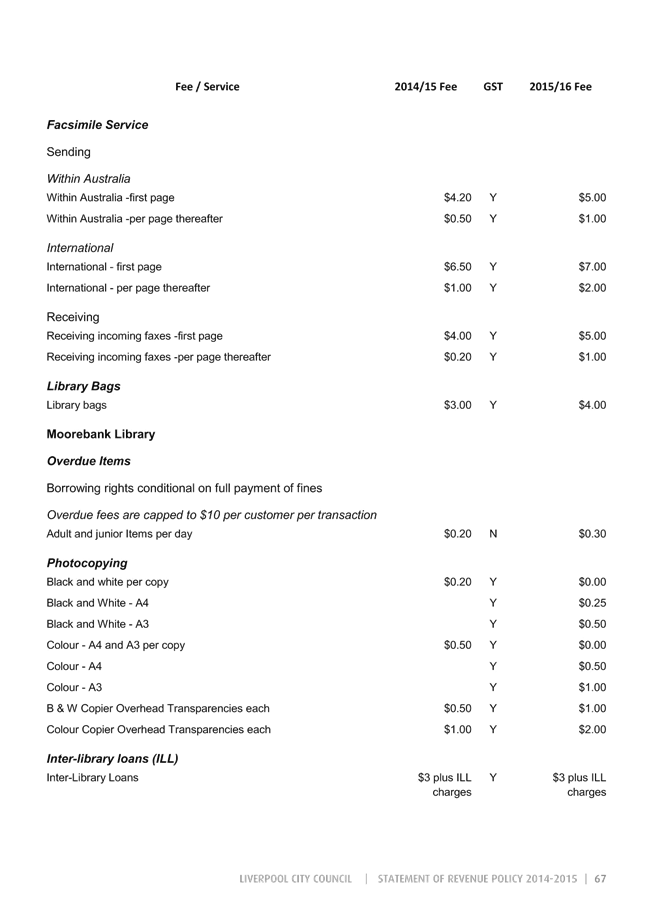

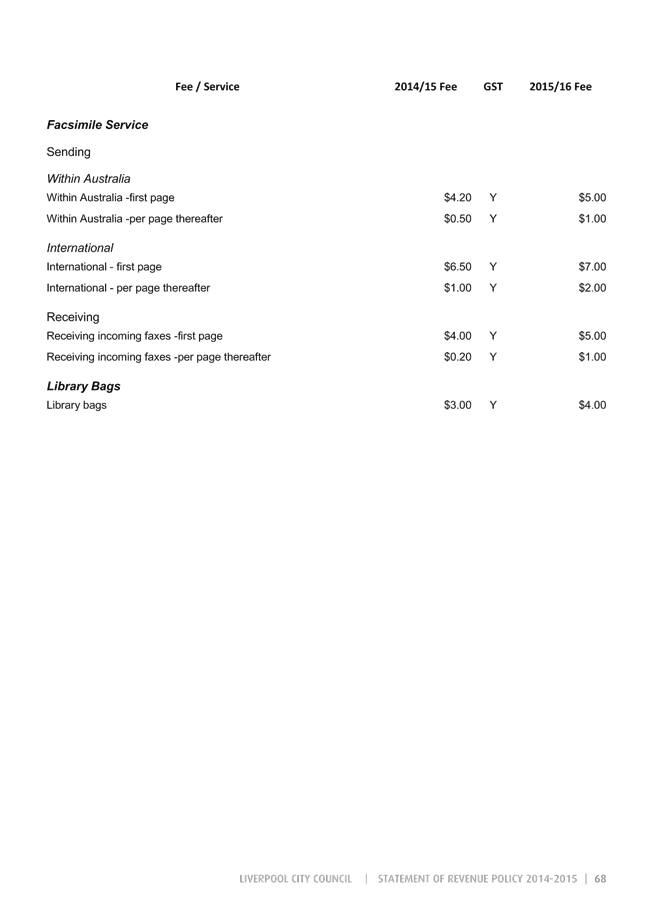

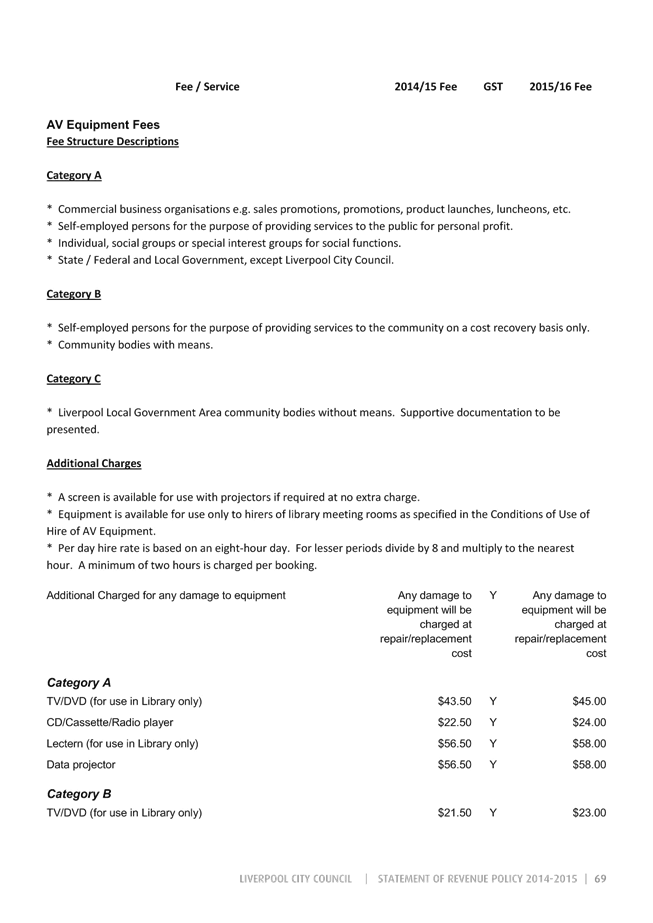

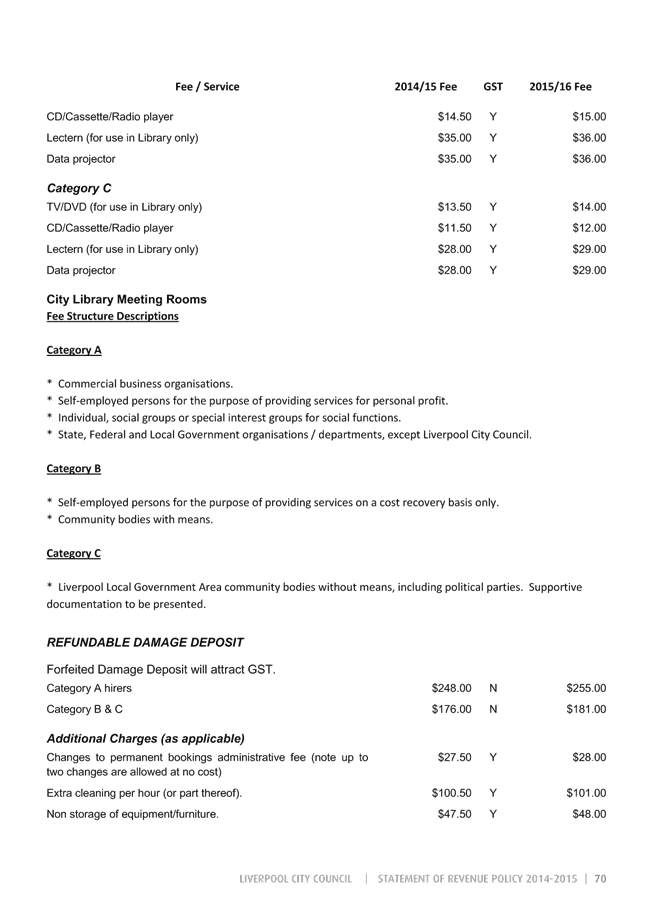

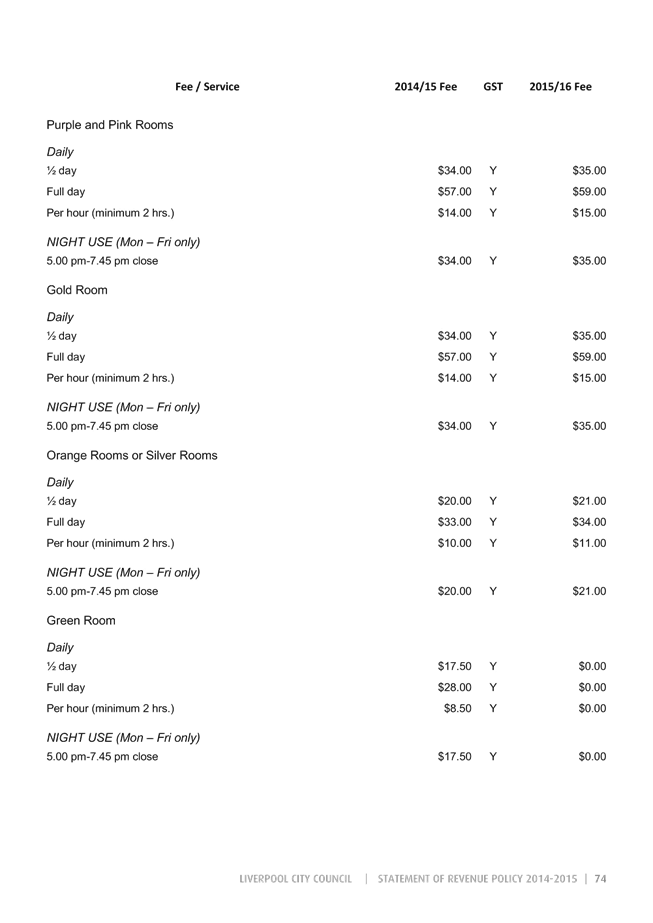

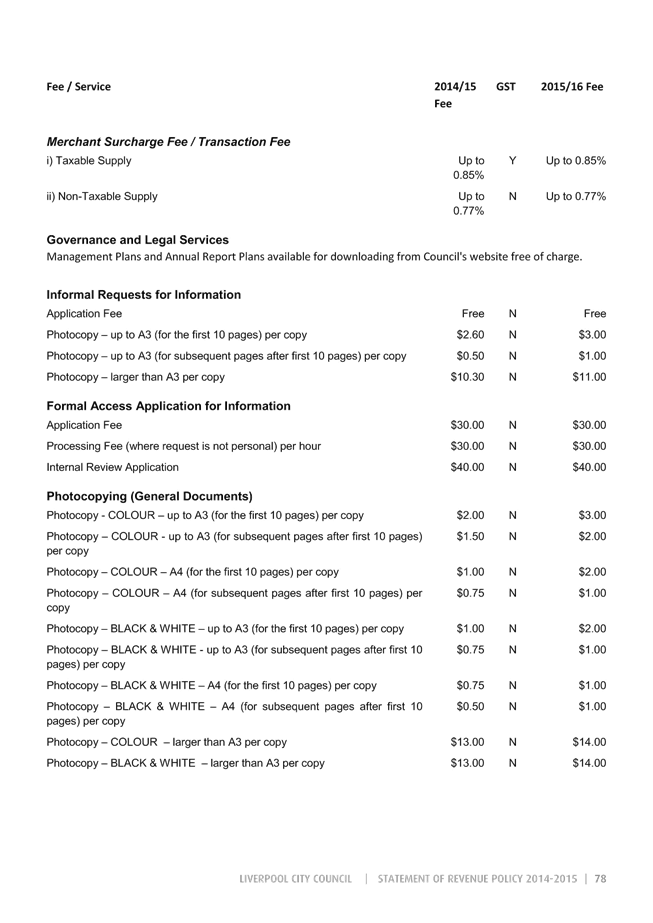

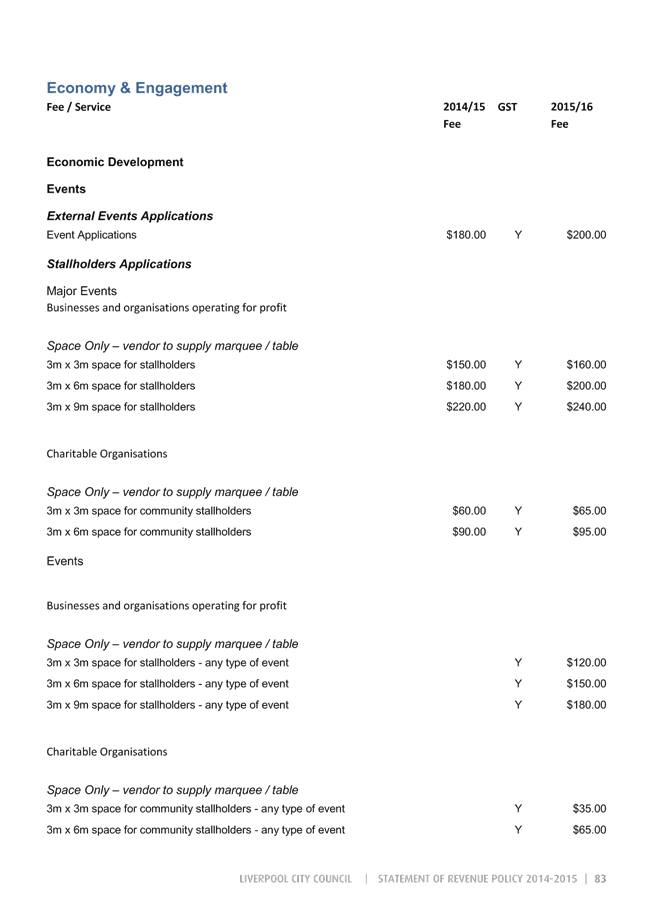

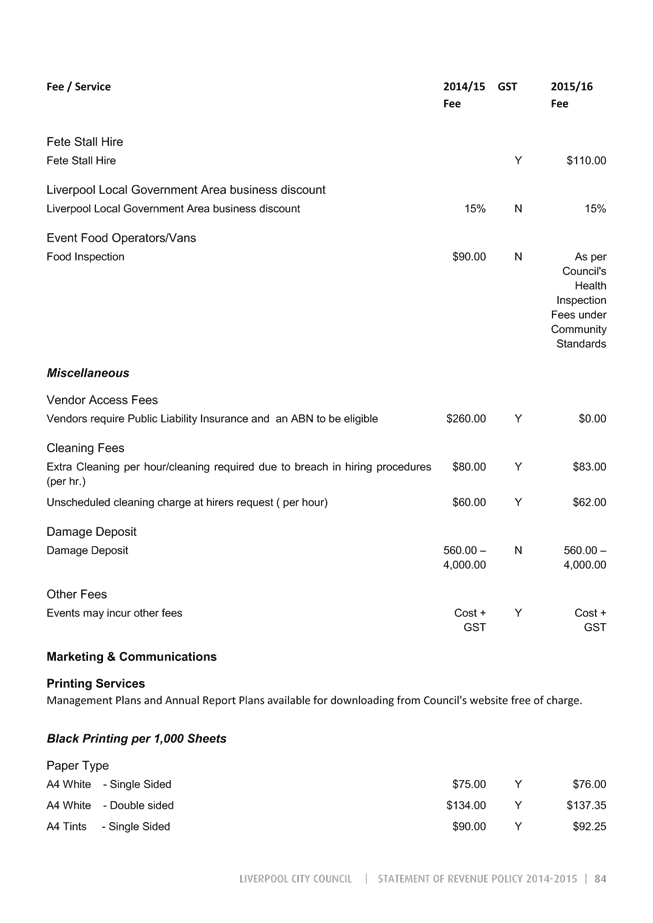

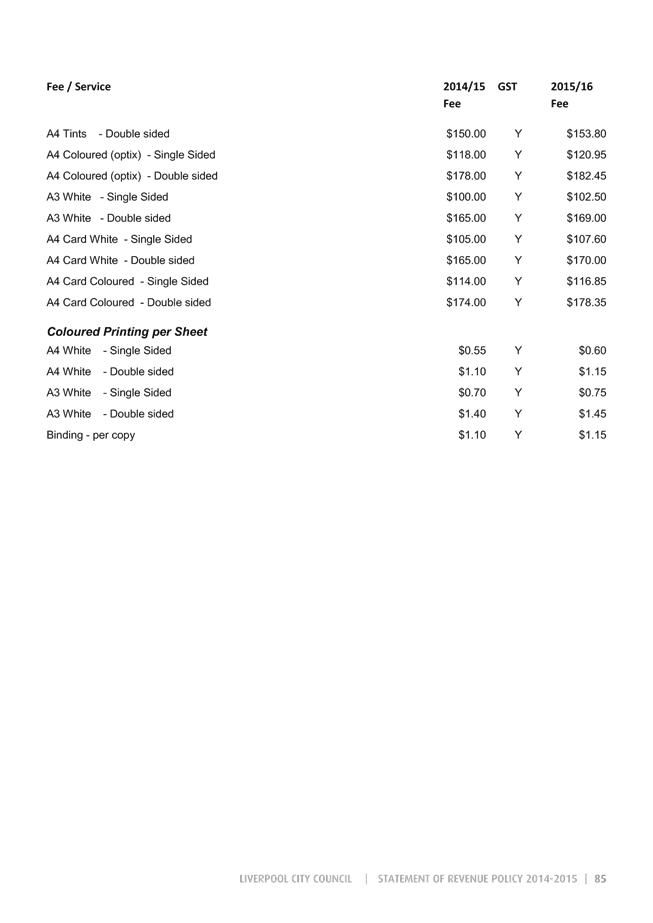

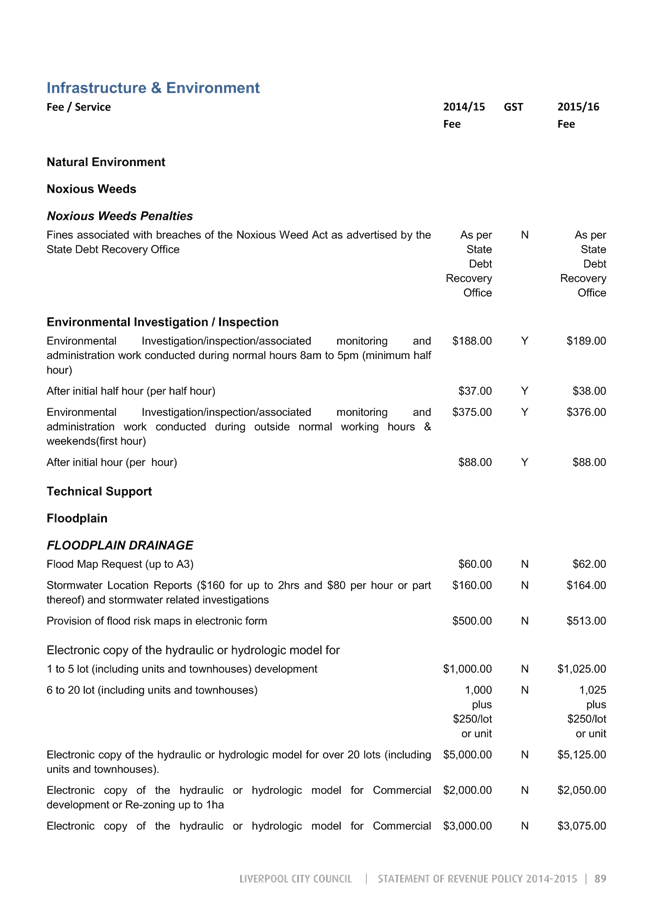

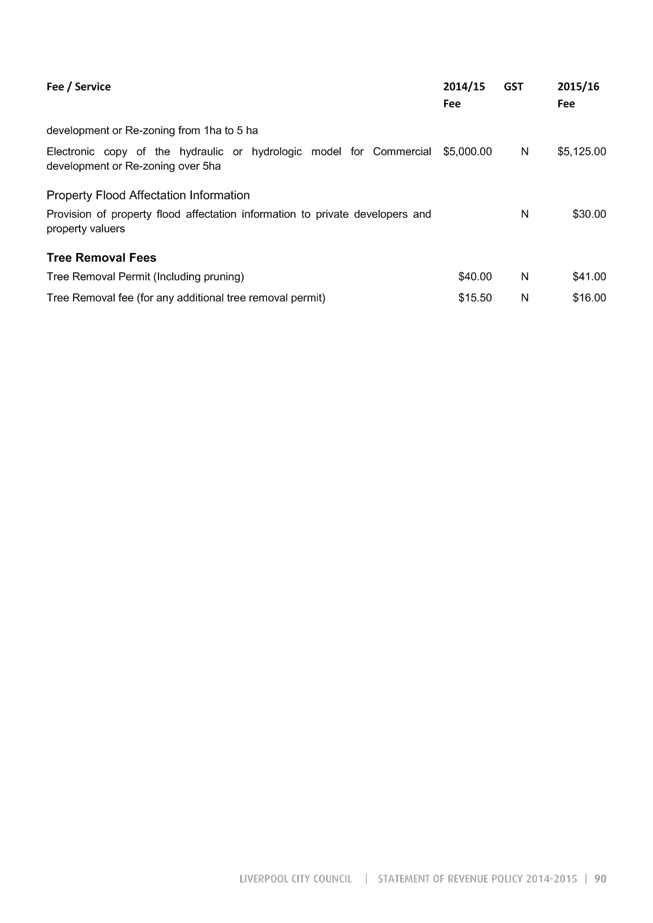

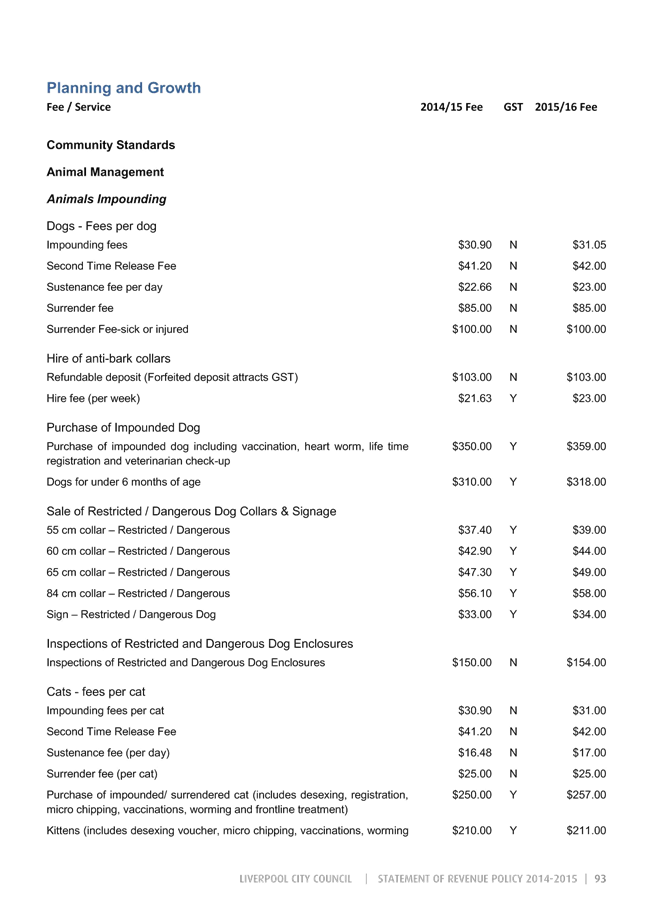

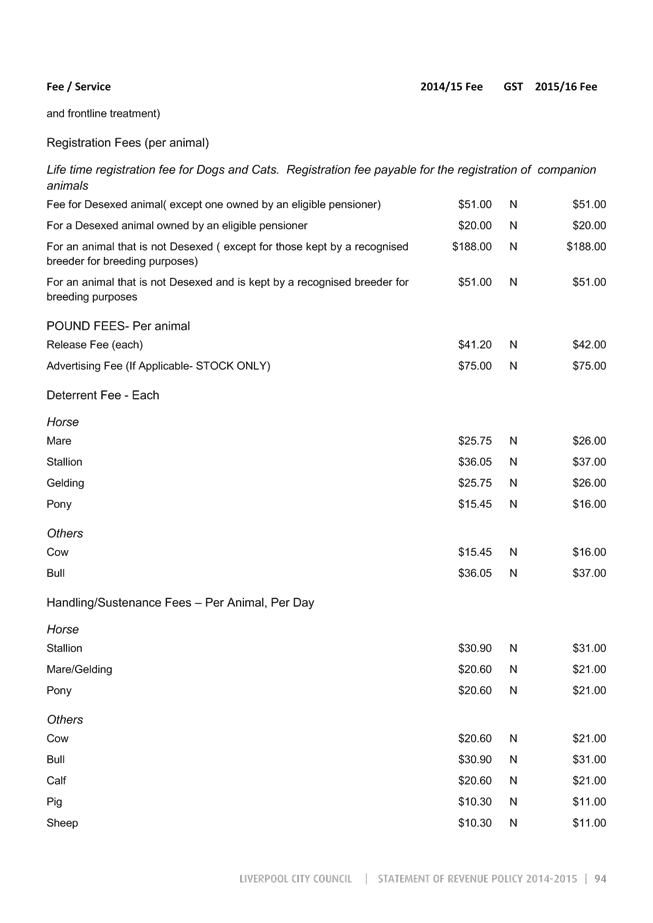

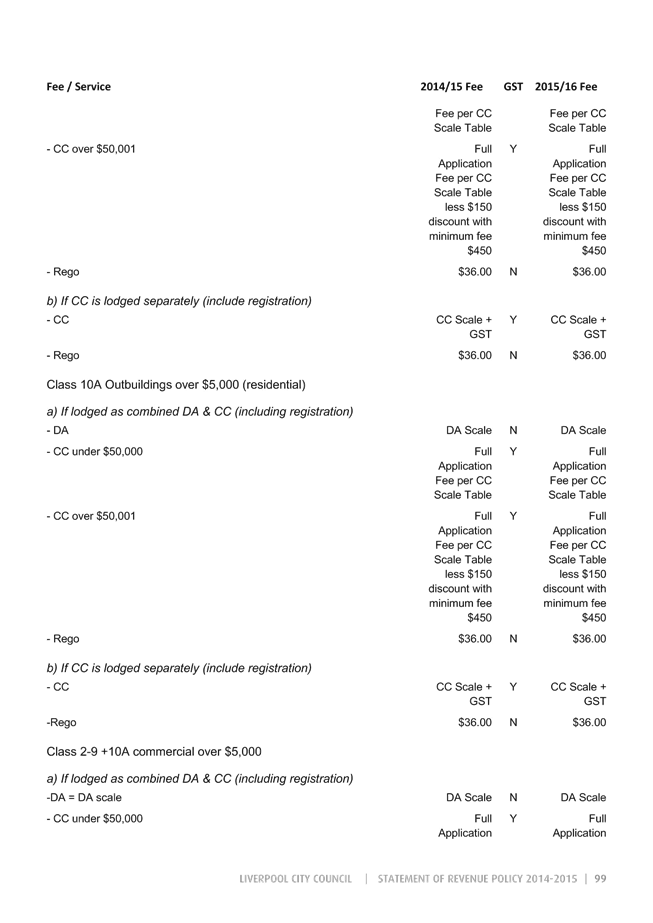

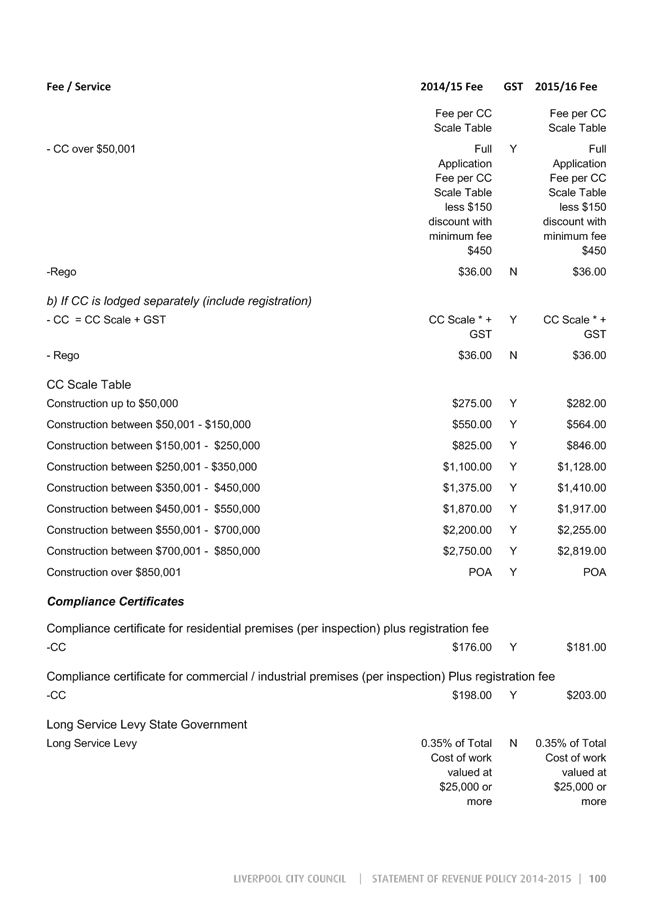

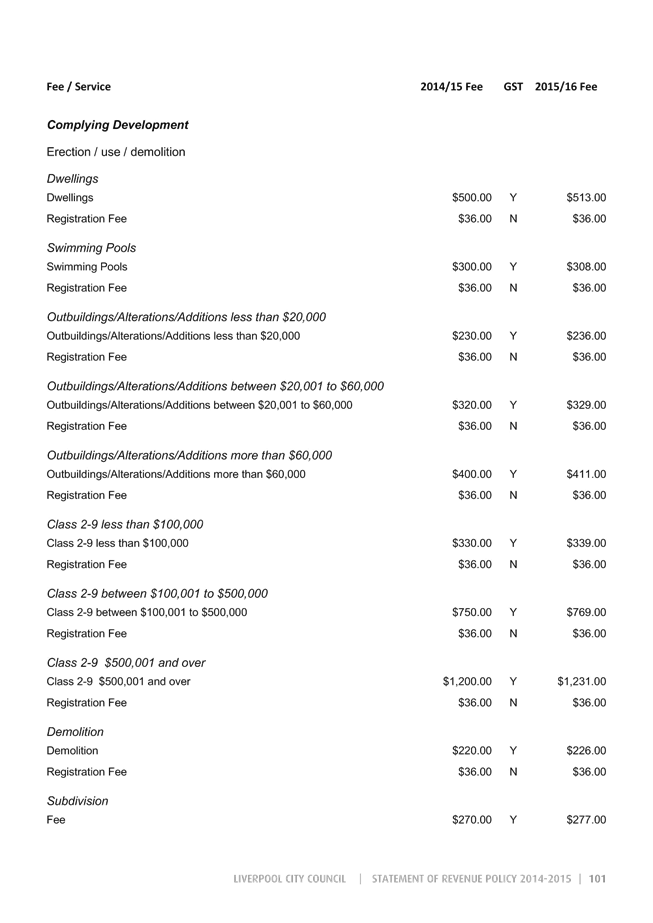

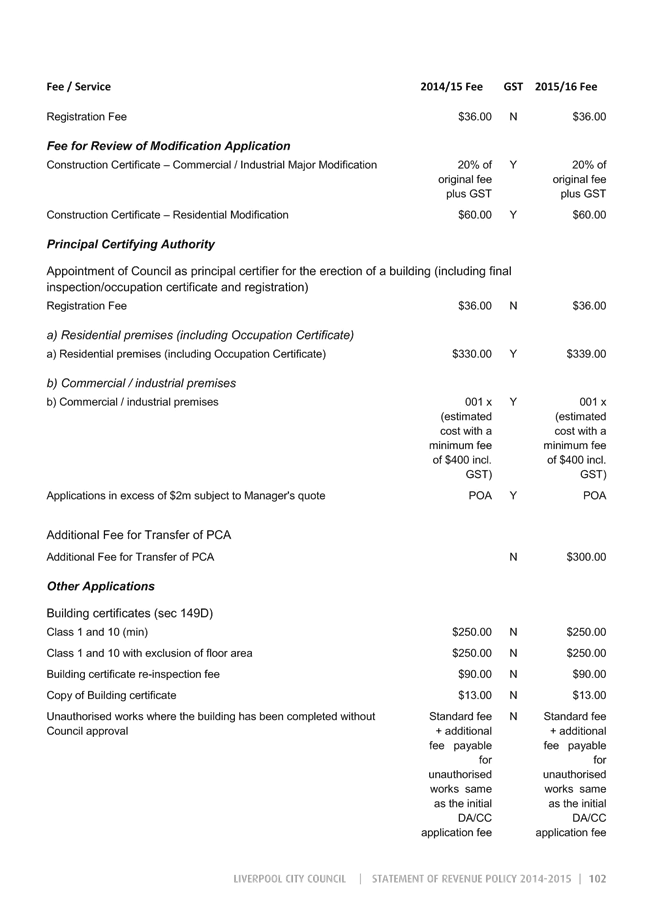

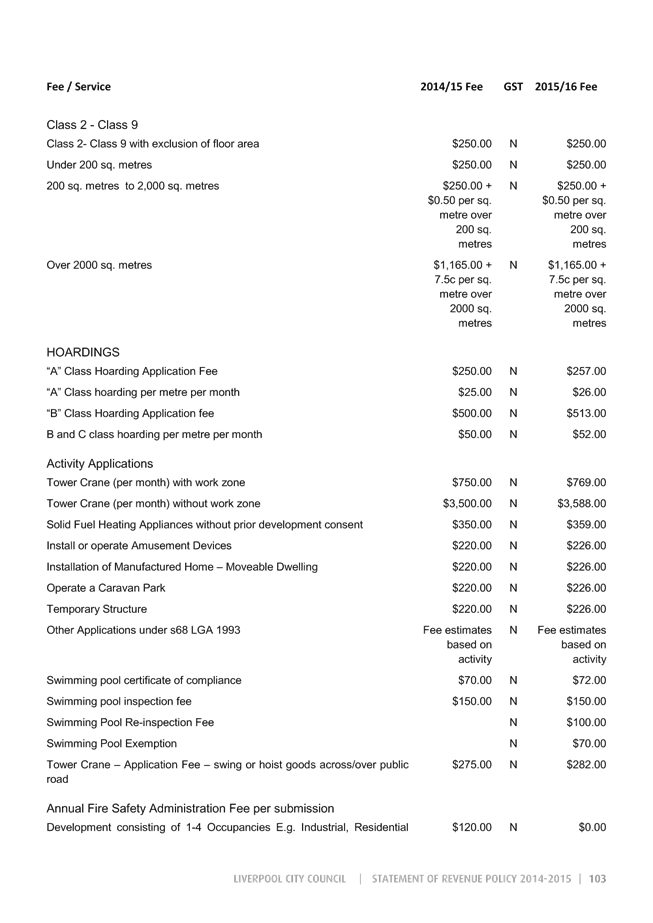

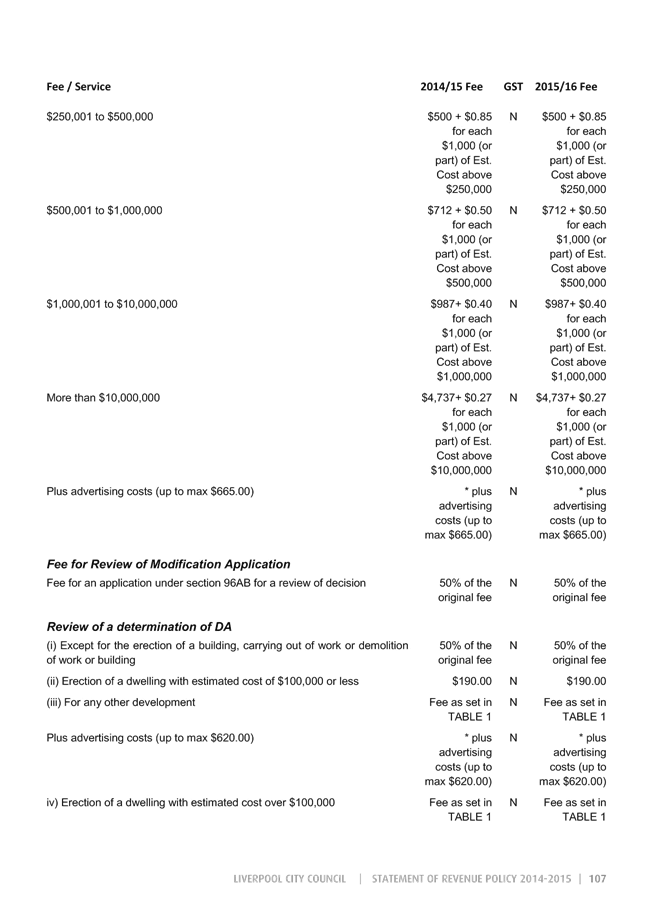

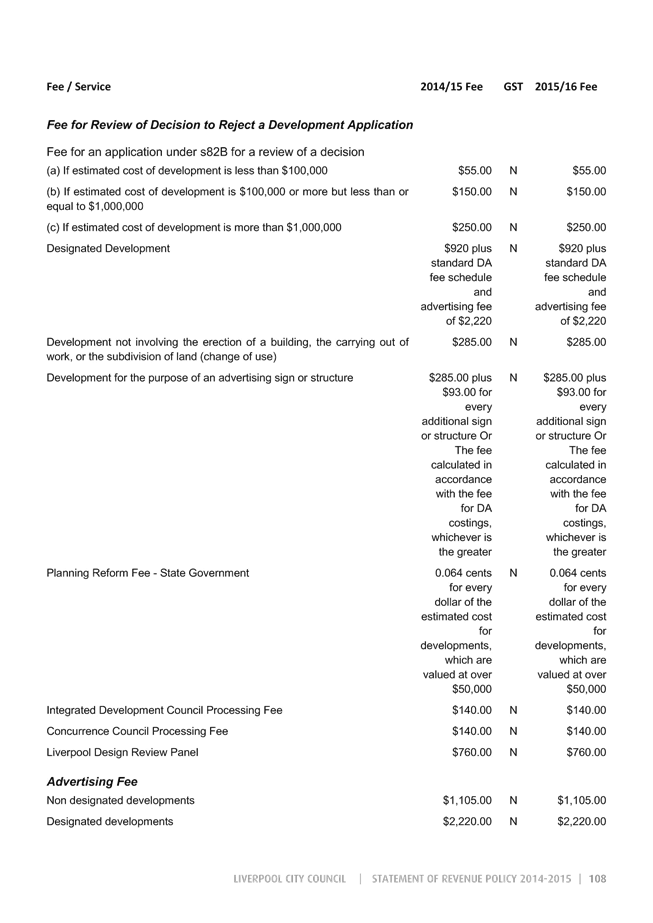

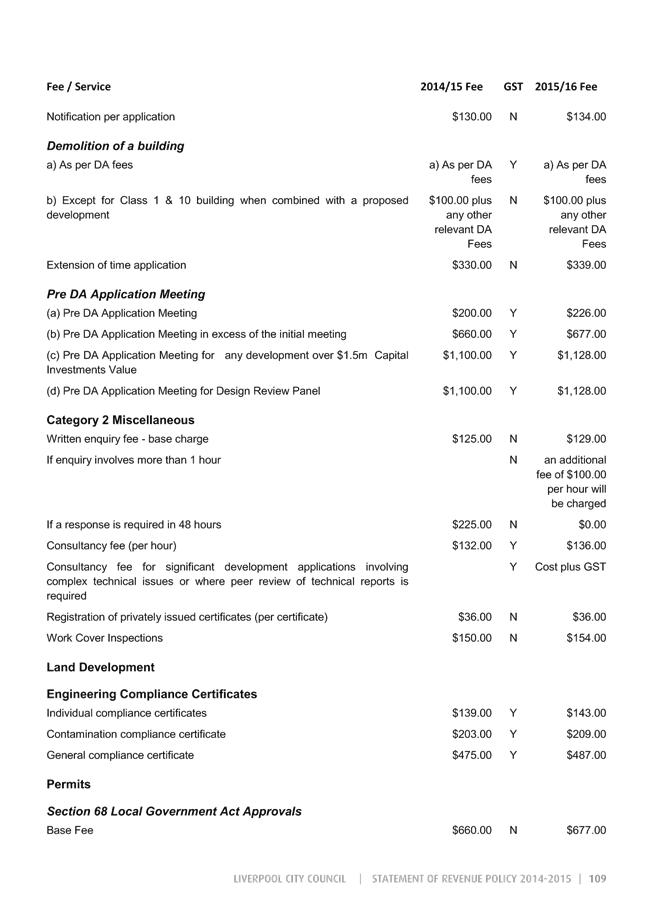

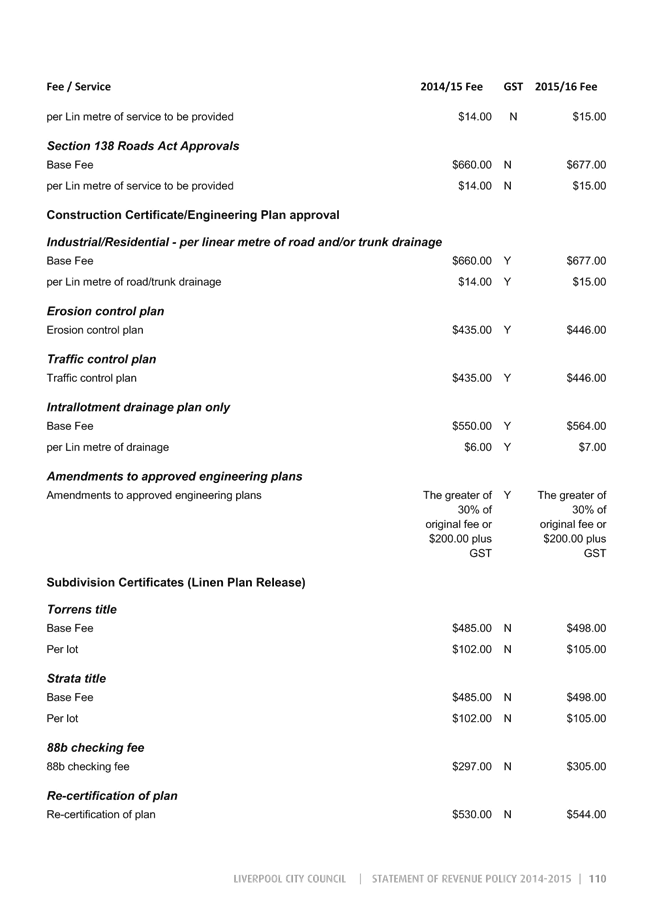

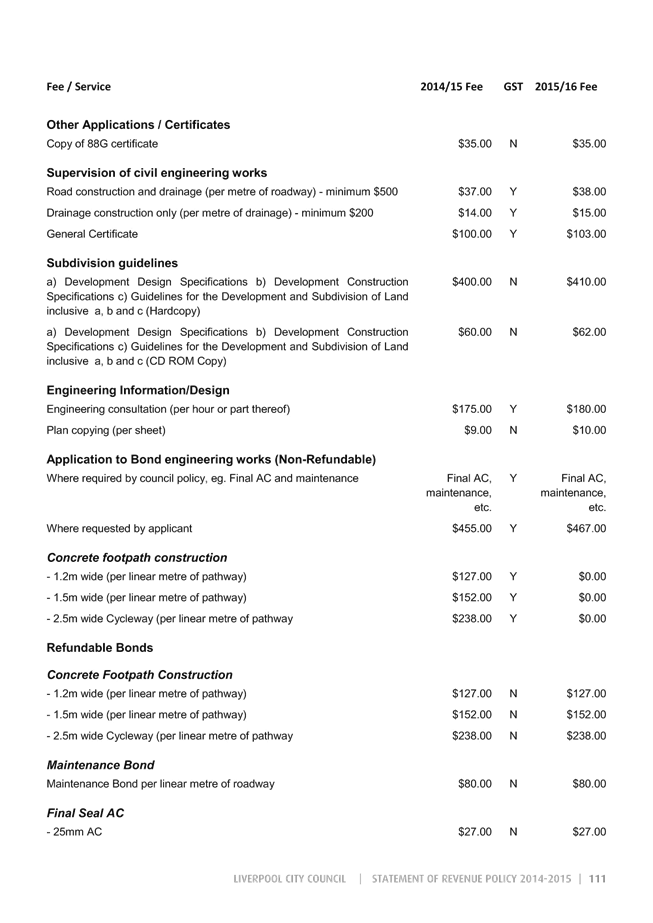

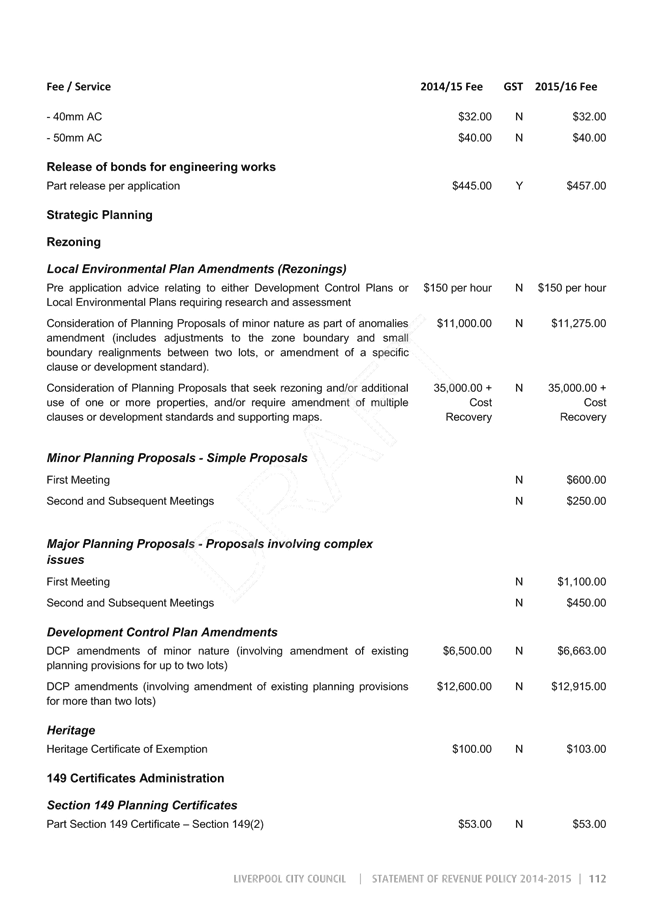

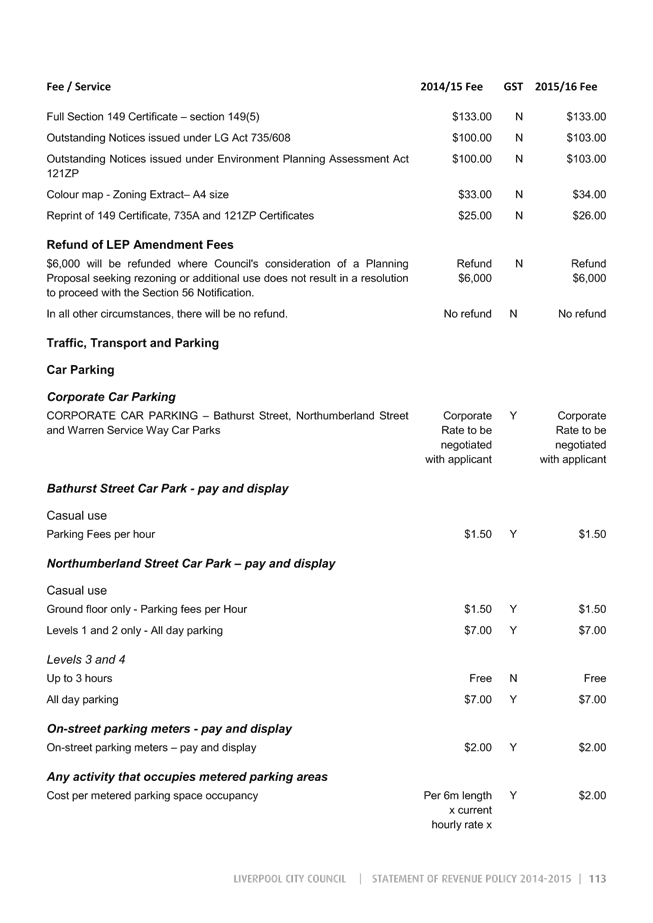

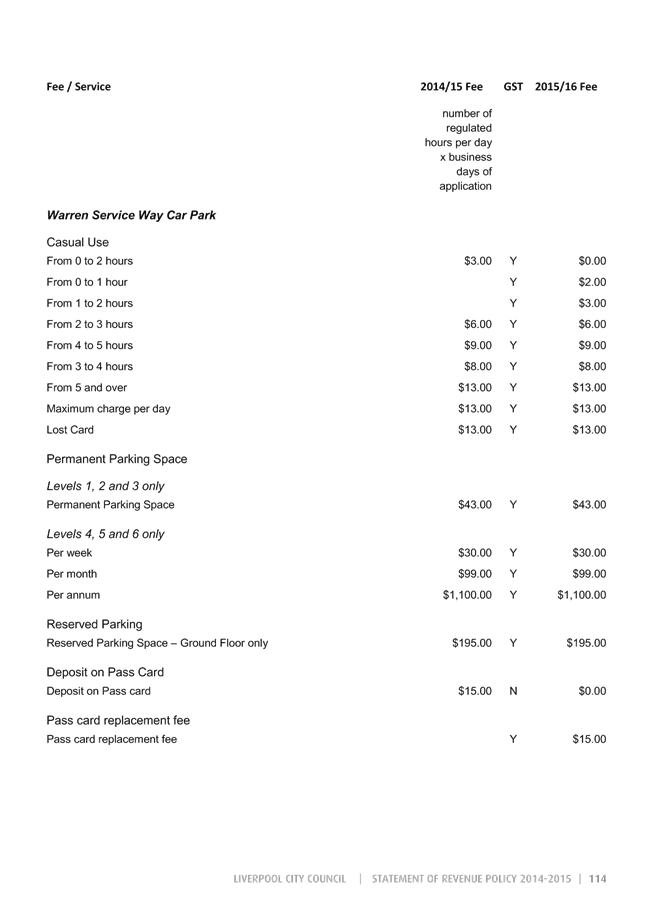

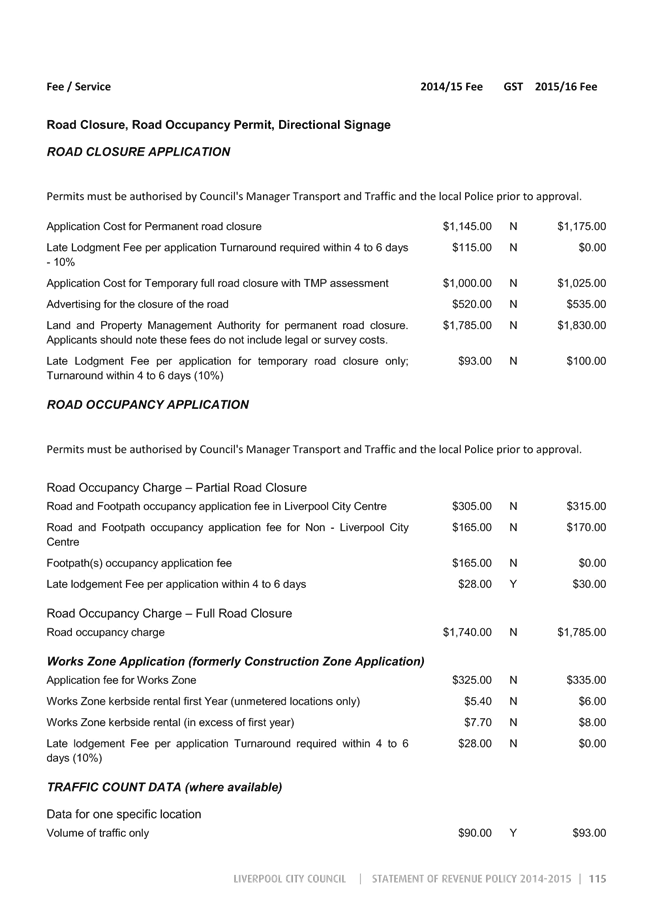

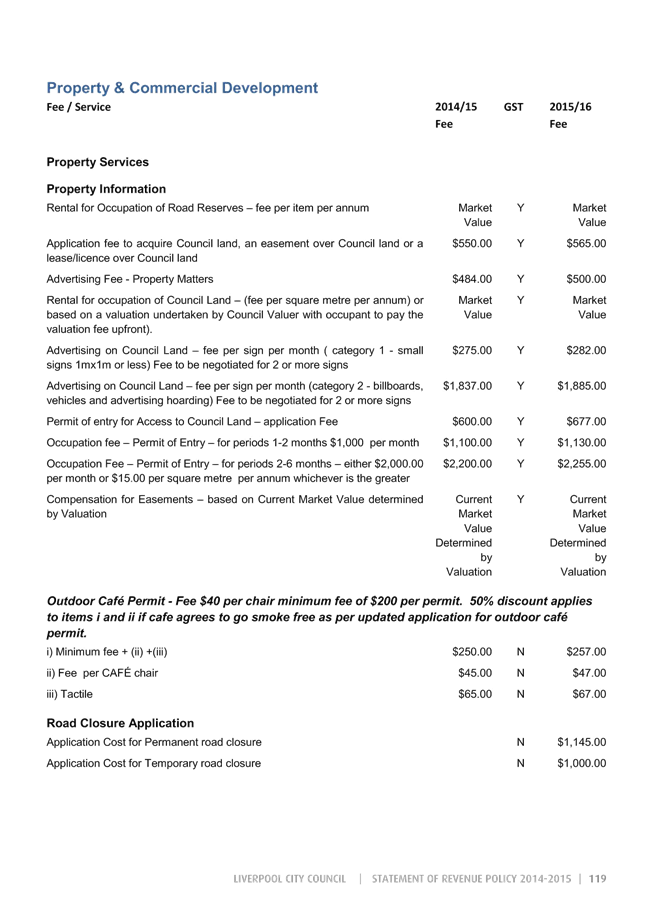

Proposed Changes to Fees and Charges

At its April meeting, Council resolved to place the following additional fees and charges on Public Exhibition. These fees will remain as draft in the Revenue Pricing Policy and will not be enforced unless they are adopted at the Council meeting on 17 June.

|

Item |

Proposed Fee |

|

Minor planning proposals (simple proposals) |

First meeting - $600 Second and subsequent meetings - $250 |

|

Major planning proposals (proposals involving complex issues) |

First meeting - $1,100 Second and subsequent meetings - $450 |

|

Heavy Vehicles Local Roads Permit |

$70.00 per vehicle |

|

Whitlam Leisure Centre - PrYme Membership (Over 50's)" |

$10.00 per week for holders of a Seniors or DVA card |

Proposed Changes to the Delivery Program and Operational Plan

In response to both internal review and comments received, the following changes were made:

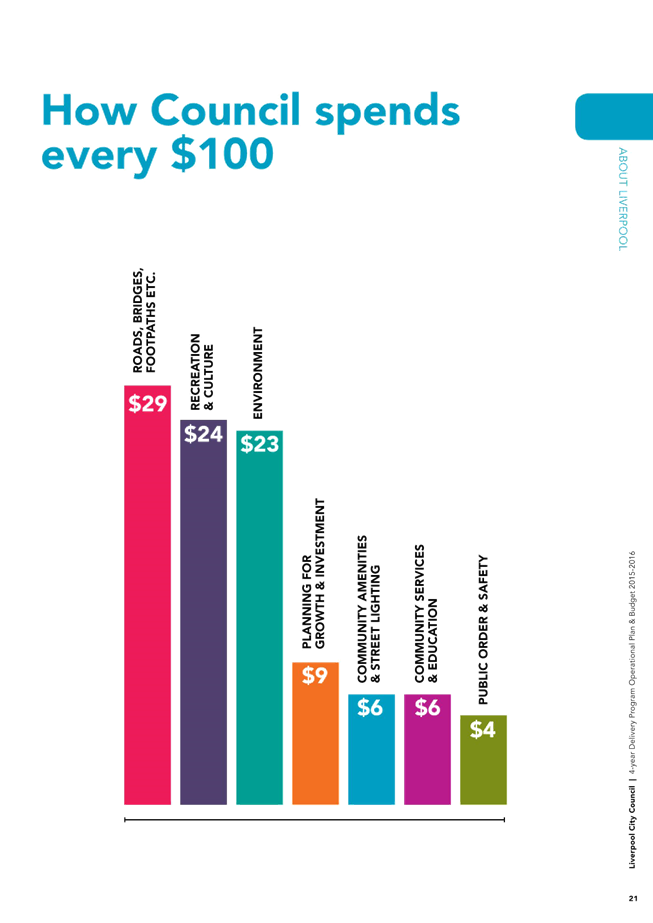

· A $100 breakdown of Council’s expenditure has been created and

included to present the budget in a simple and easily accessible format.

· Following a review of the Victorian Local Government Indicators

against Council’s draft KPI’s and Service Statistics, a number of

measures have been added, removed and changed.

· The profile of the No Intermodal project has been increased in the document, being added as a standalone, strategic project for Council.

Several editorial and incidental changes have also been made to the draft documents as a result of internal staff feedback. These changes are minor in nature with their purpose being to improve readability and clarity of the documents.

Proposed Changes to the Budget

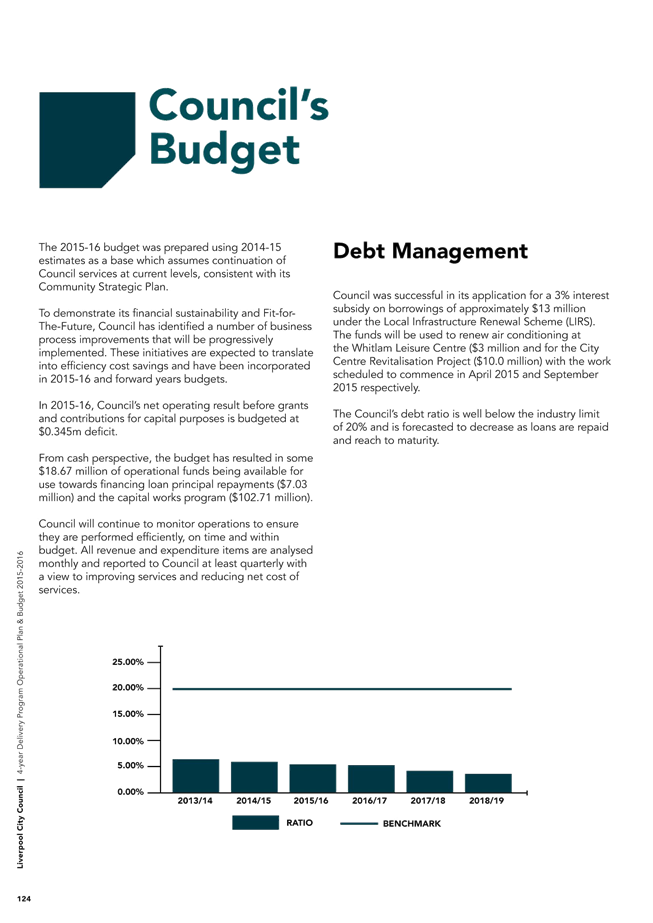

Feedback received during the exhibition period did not materially change the 2015/16 budget. The amendments below were the result of a more accurate s94 revenue forecast and the impact of reassessing useful lives of infrastructure:

• S94 Developer Grants & Contributions was revised to exclude $8.0m in-kind non-cash contributions

• The useful lives of infrastructure assets were compared against other council’s and reset. This resulted in a further $2.982m favorable adjustment to depreciation expenditure

The Council is budgeting for a $0.345m deficit net operating result before grants & contributions for capital purposes in 2015/16. This compares with a $3.341m deficit result in the exhibited budget.

Public Exhibition

The documents were placed on Public Exhibition between 25 March and 26 April. The following methods were undertaken in order to solicit public feedback and input:

· Hard copies were placed at various locations including Council’s Customer Service Centre and the Liverpool Library;

· Presentations were made at the Rural and Urban Community Forums;

· The document was placed on Council’s homepage and the Liverpool Listens page;

· Mail-out to all Liverpool Listens members;

· Public notices were placed in local and ethnic newspapers;

· Updates were made on Council’s Facebook account directing people to the plans.

As a result of the exhibition period, three formal submissions and two Liverpool Listens queries were received. A summary of the feedback received included:

· A request for more financial detail to be presented in the document;

· A request for the financial detail to be simpler to understand;

· A request for Council to increase the promotion of public exhibition and submission invitation as well as lengthening the exhibition period;

· Requests to commit funds and works to footpaths in Busby and Orchard Road through to St Johns Road,

· Requests to alter the budget including; increasing the maintenance budget by $1 million; and transferring the environmental levy to City Presentation.

A summary of the feedback received during the public exhibition period and officer responses to these submissions has been attached for your information.

CONSIDERATIONS

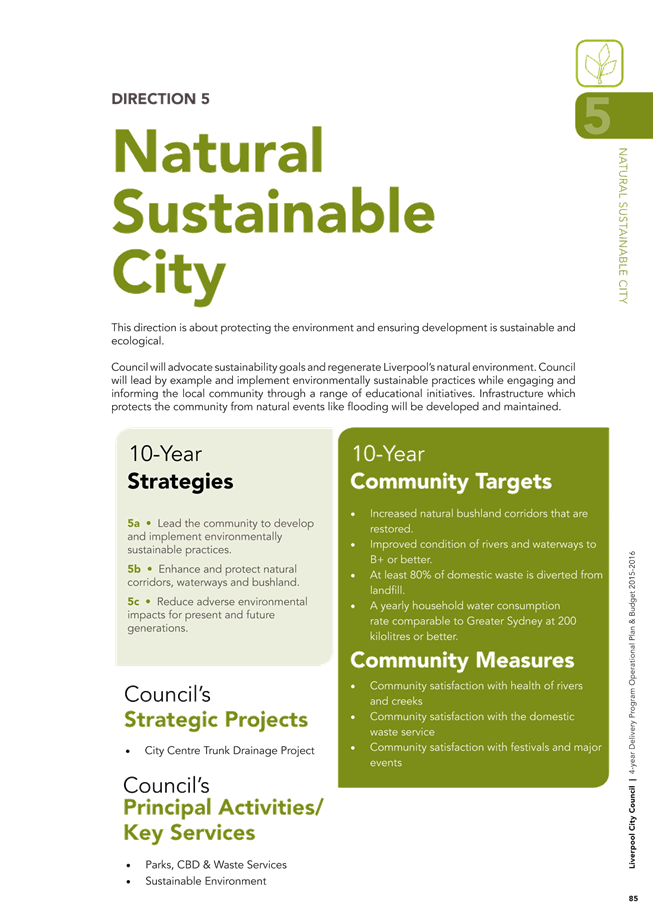

This report recommends adoption of Council’s Delivery Program and Operational Plan. The document comprehensively states Council’s position and intention as an entire organisation into the coming 2015-16 year. The document encompasses all economic and financial, environmental and sustainability, social and cultural and civic leadership and governance considerations of Council.

ATTACHMENTS

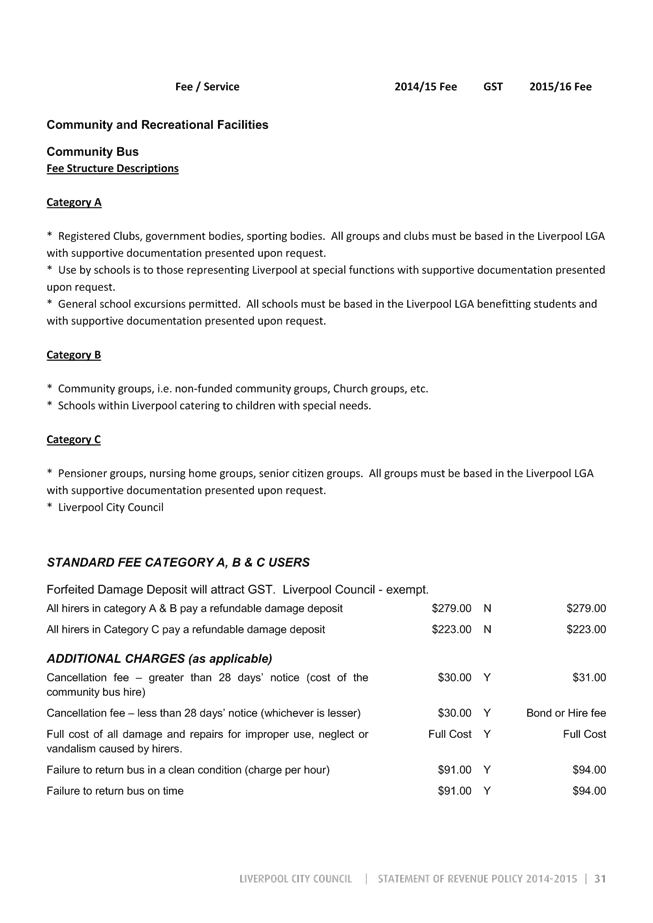

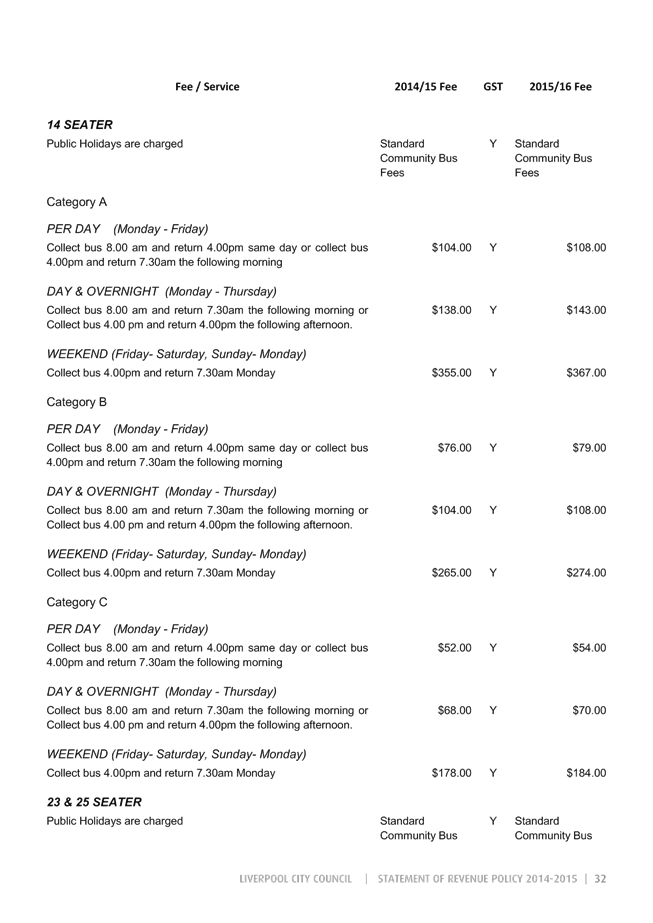

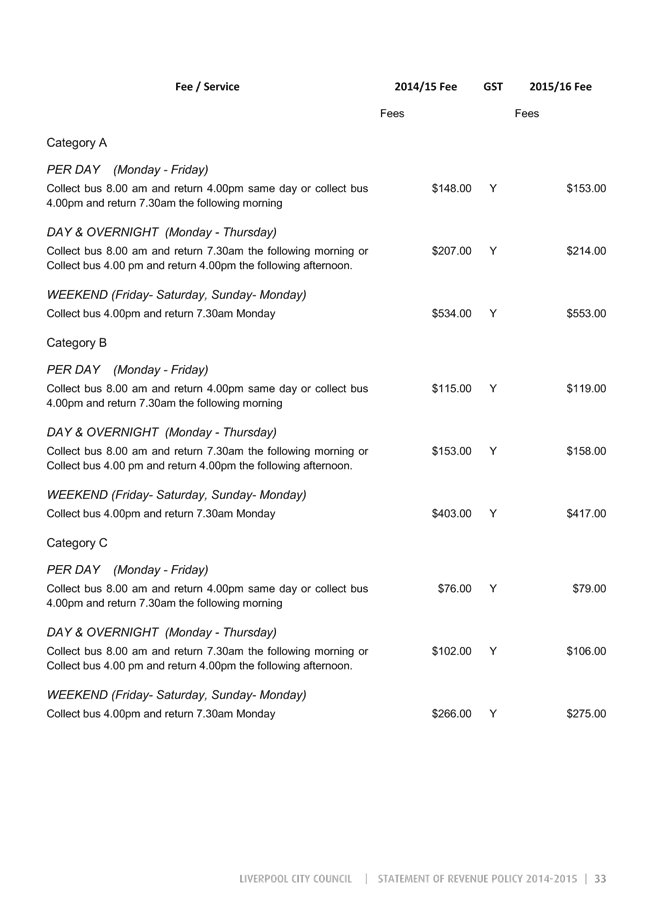

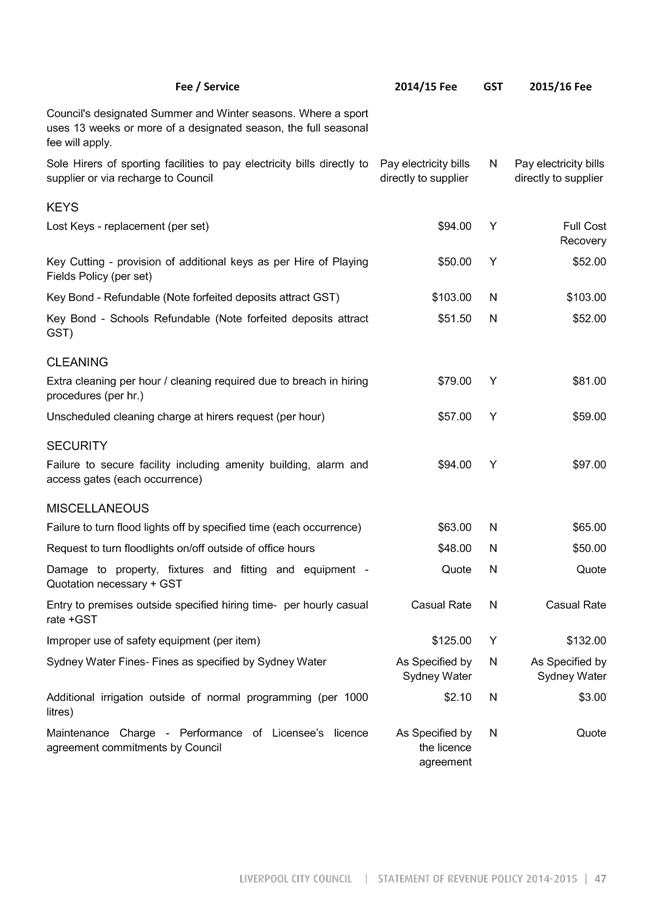

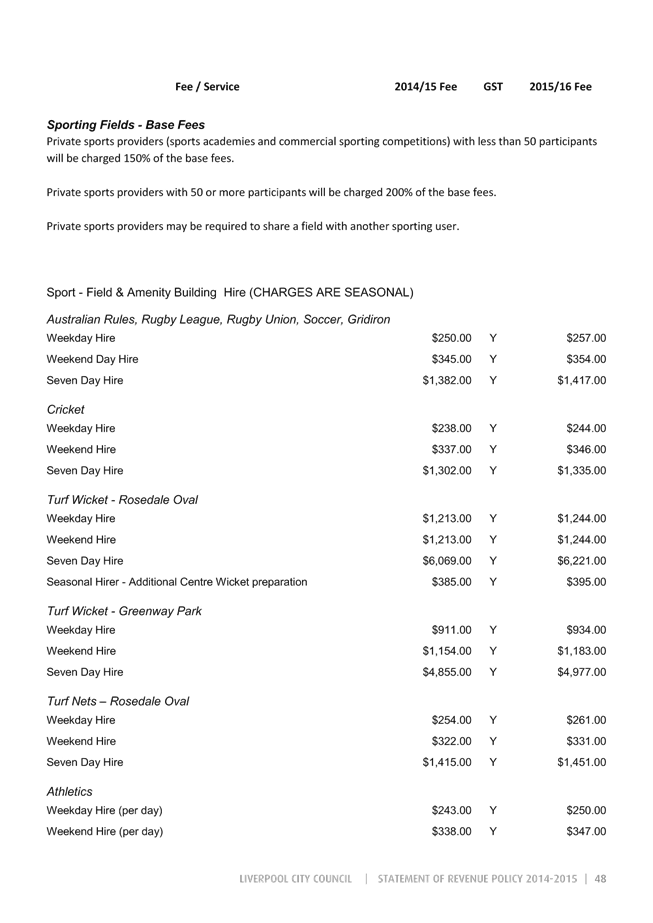

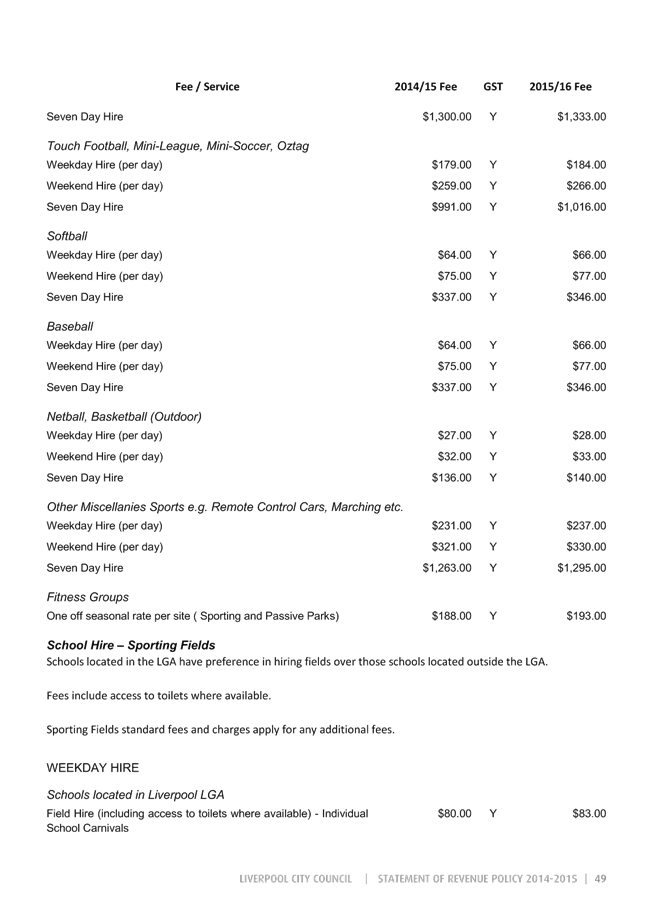

1. Draft Delivery Program 2013/17 & Operational Plan 2015/16View

2. Draft Revenue Pricing Policy (Fees & Charges) 2015/16View

3. Summary of submissions received on the Draft 2013-17 Delivery Program / 2015-16 Operational Plan and Budget

|

29 |

|

|

CFO 07 |

Endorsement of the Delivery Program 2013-17 and Operational Plan 2015-16 including Revenue Policy |

|

Attachment 1 |

Draft Delivery Program 2013/17 & Operational Plan 2015/16 |

|

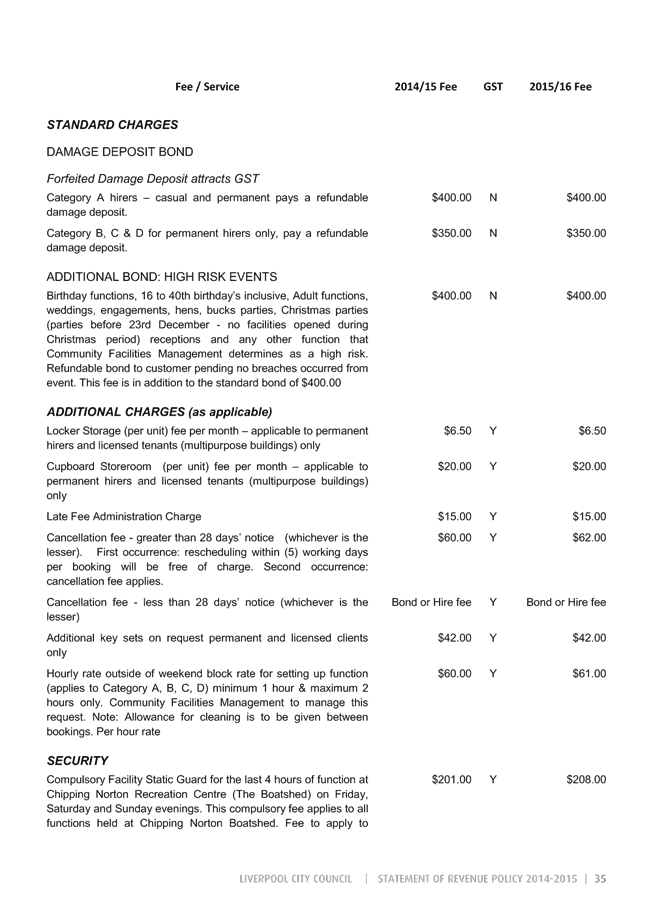

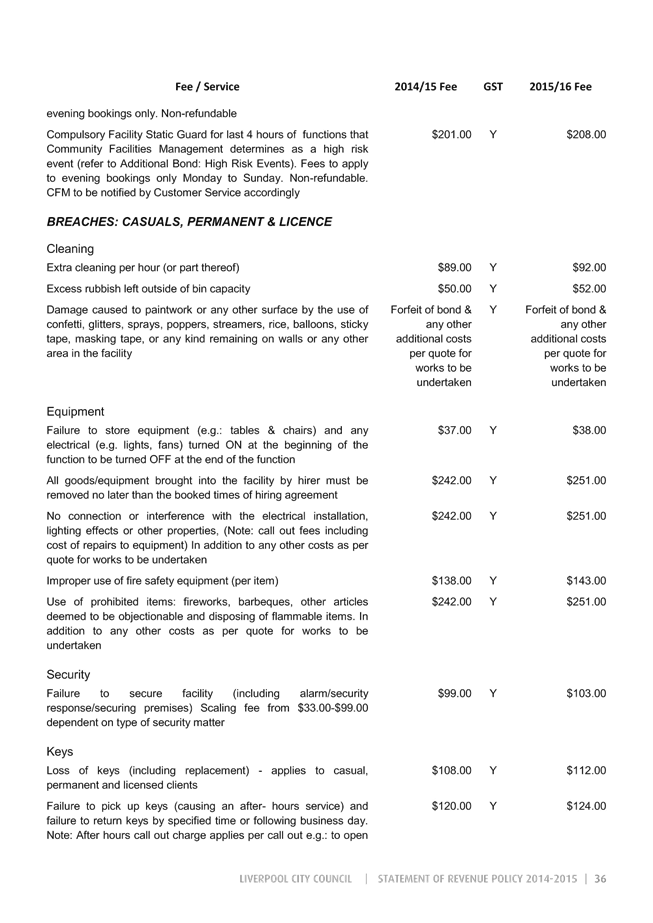

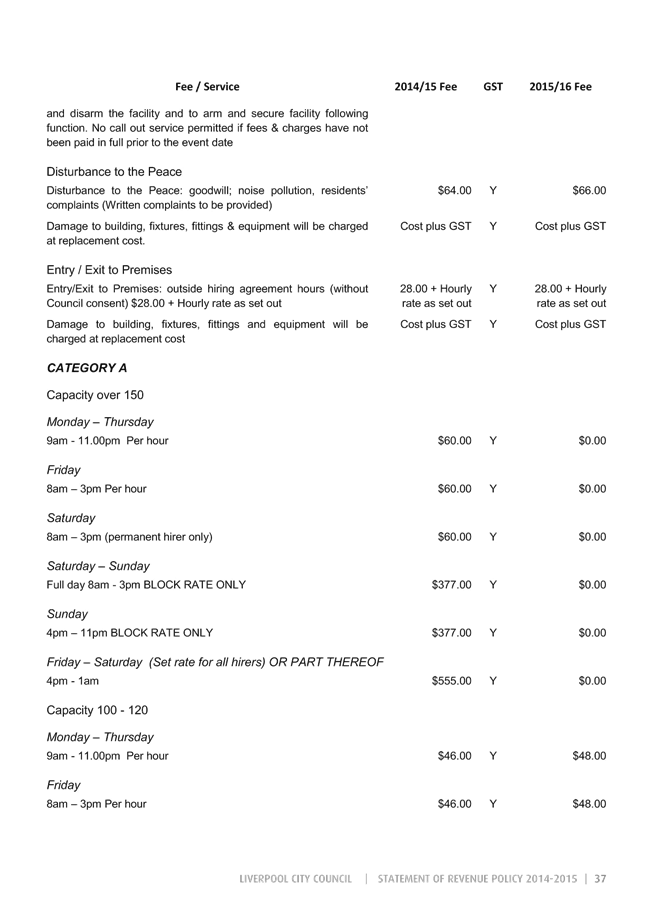

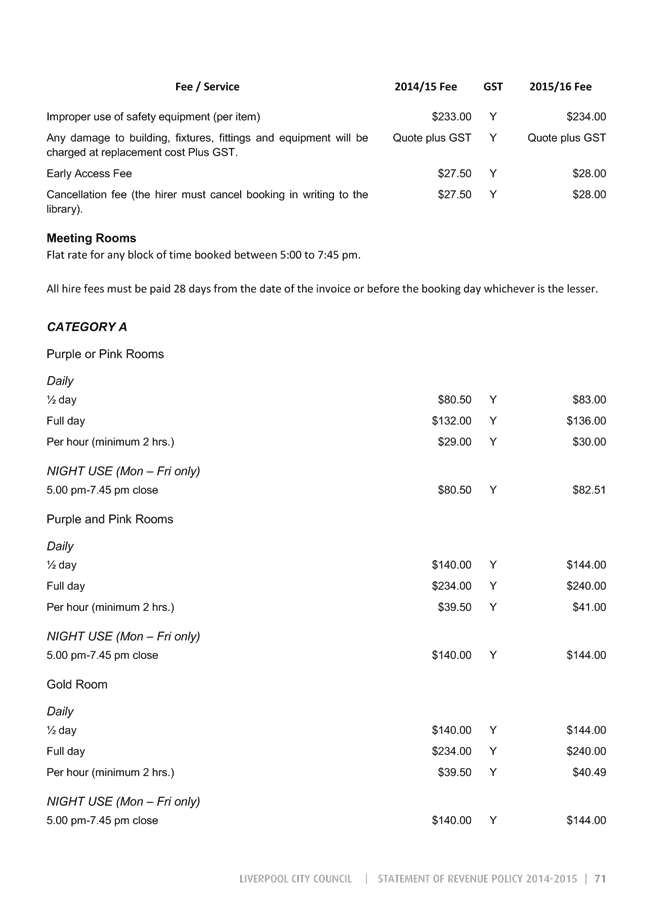

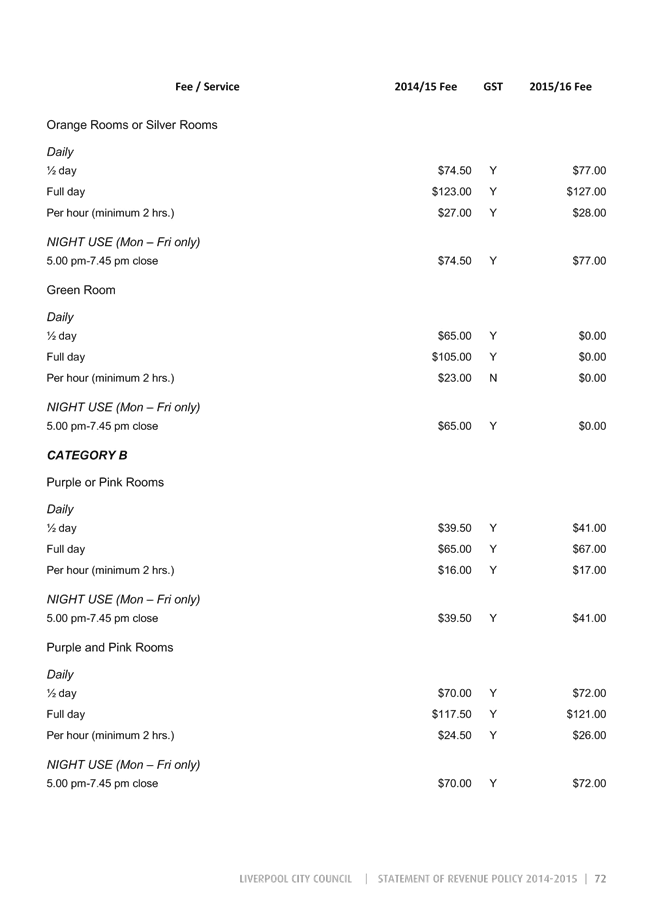

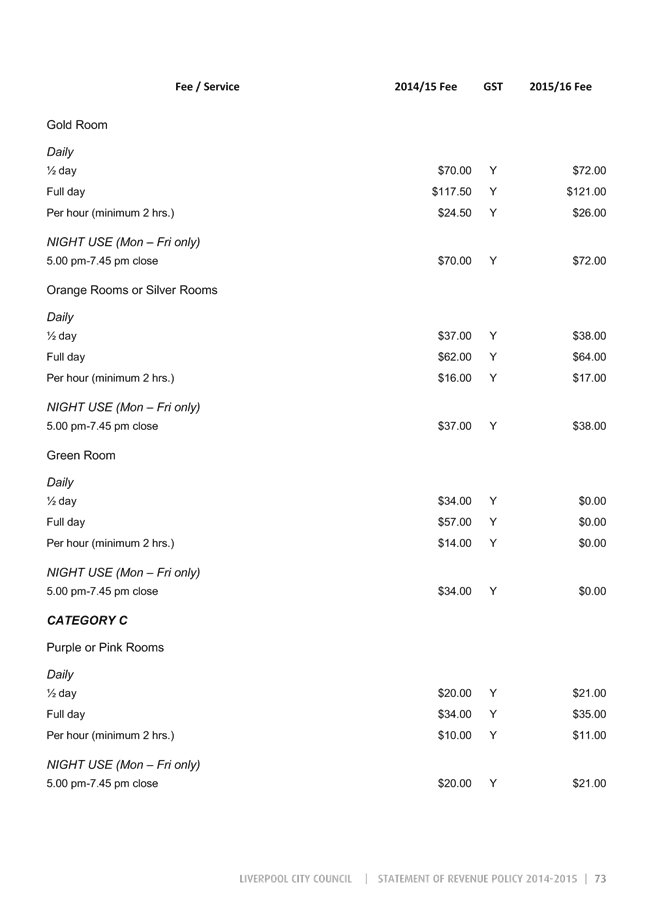

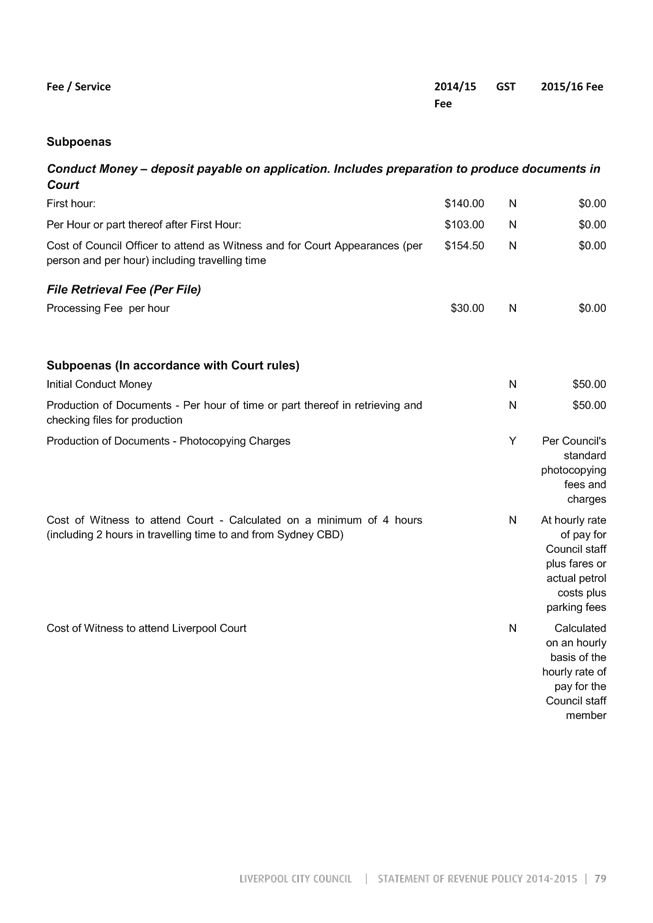

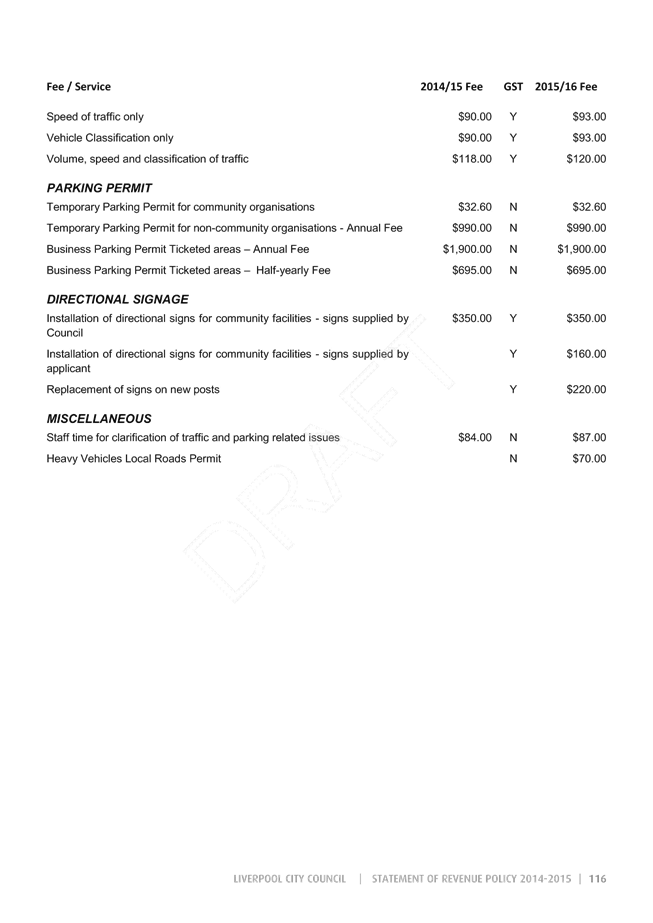

CFO 07 |

Endorsement of the Delivery Program 2013-17 and Operational Plan 2015-16 including Revenue Policy |

|

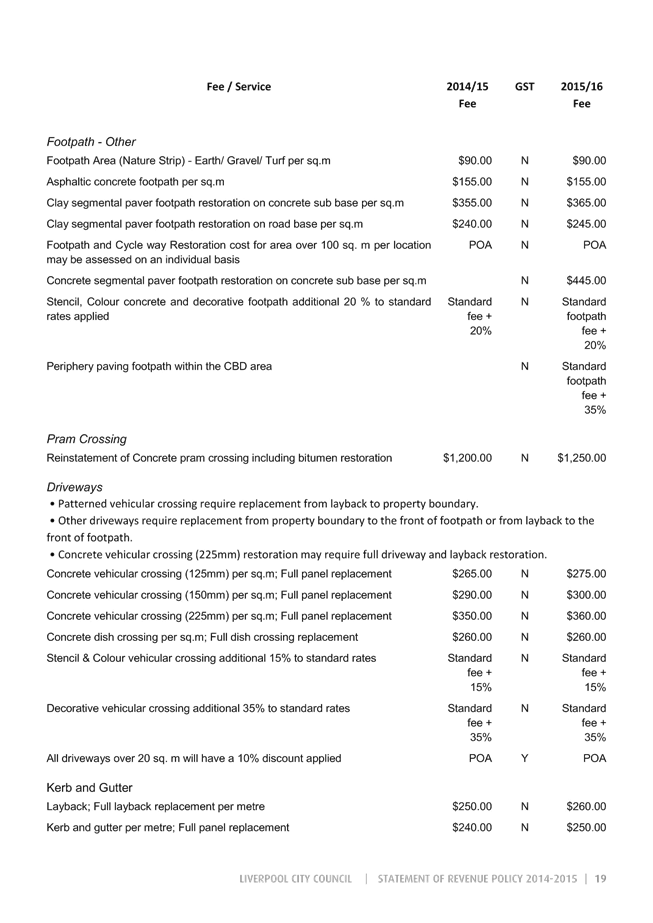

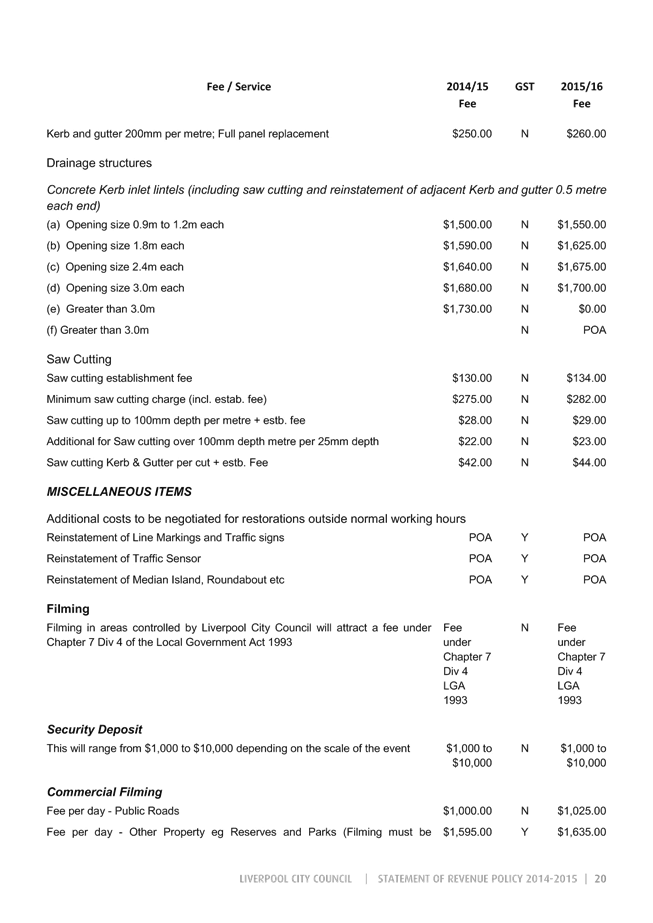

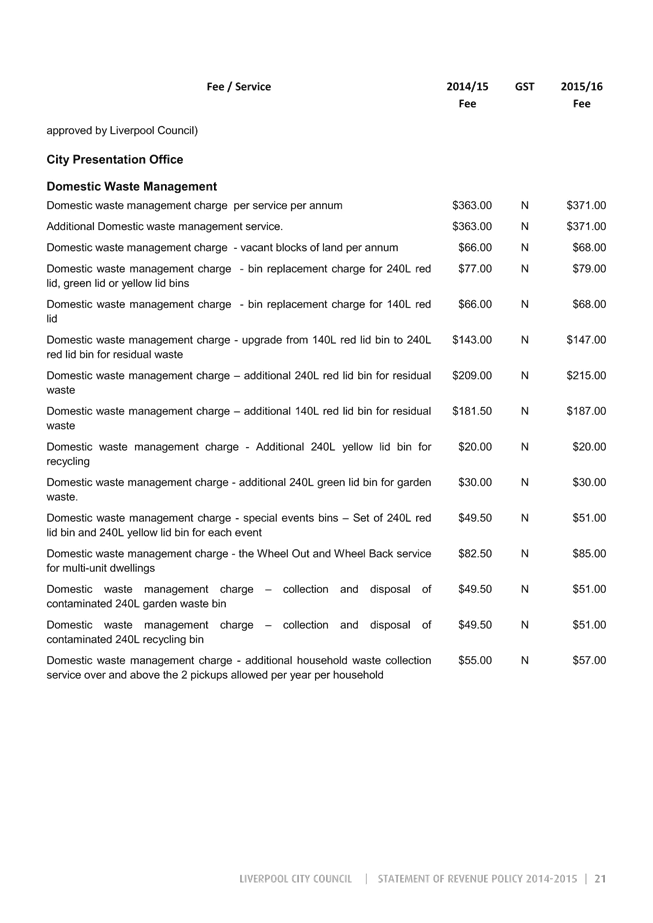

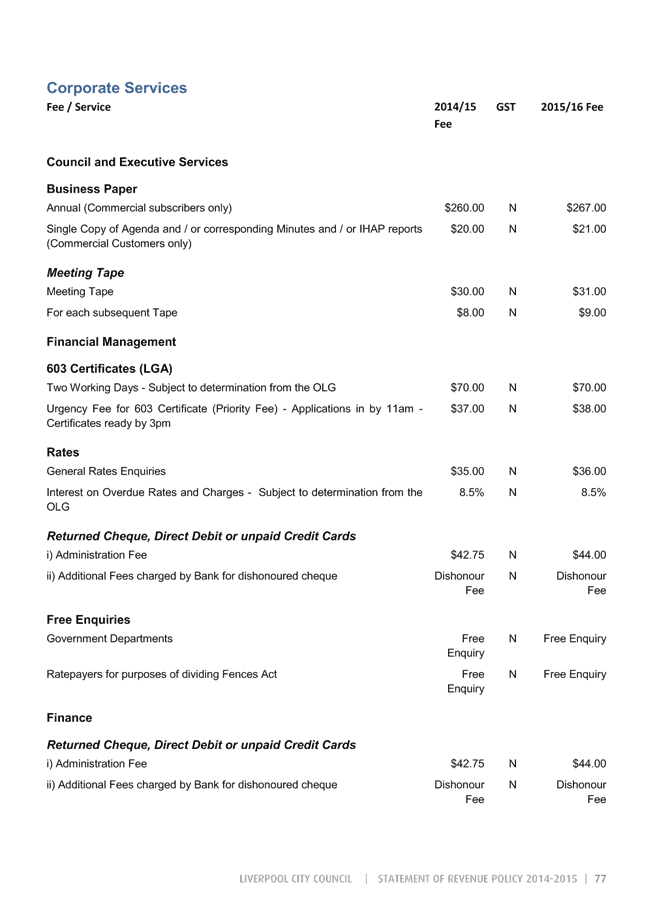

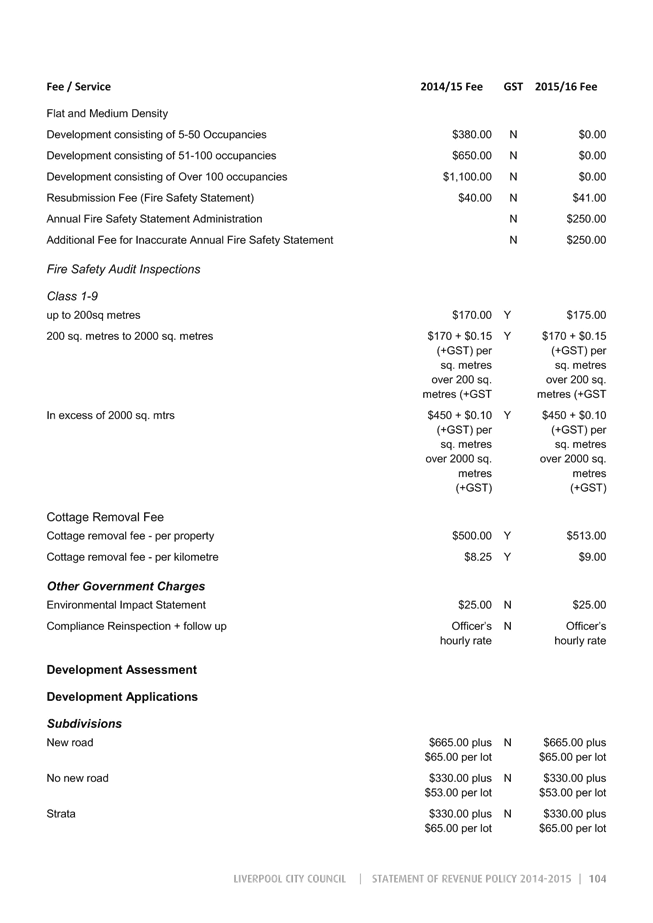

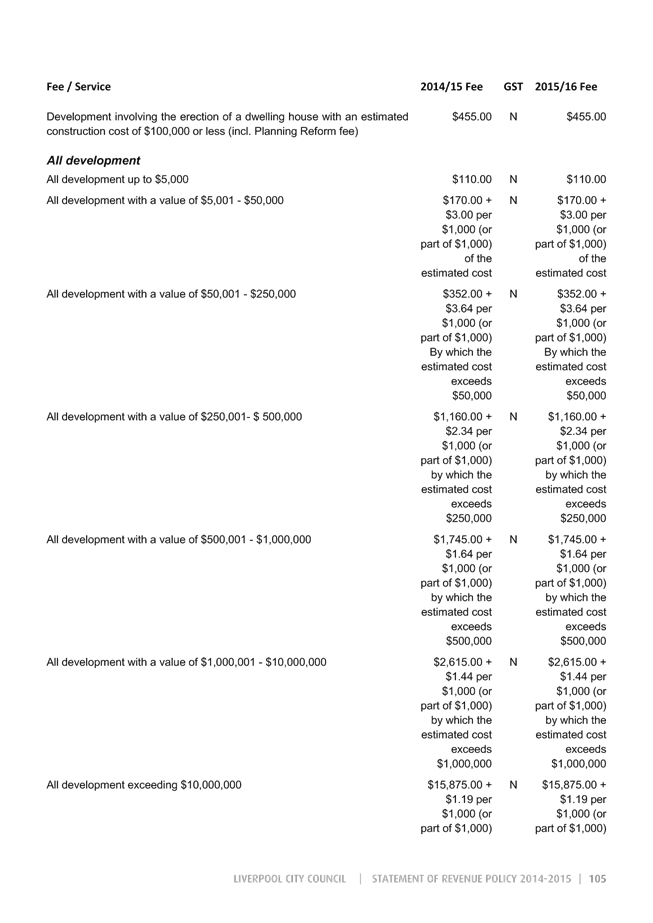

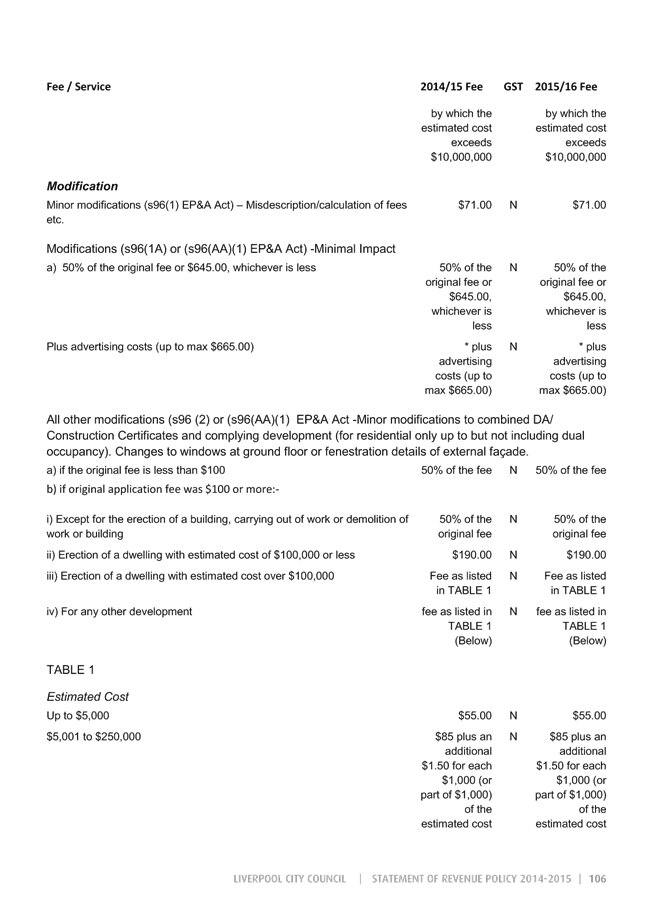

Attachment 2 |

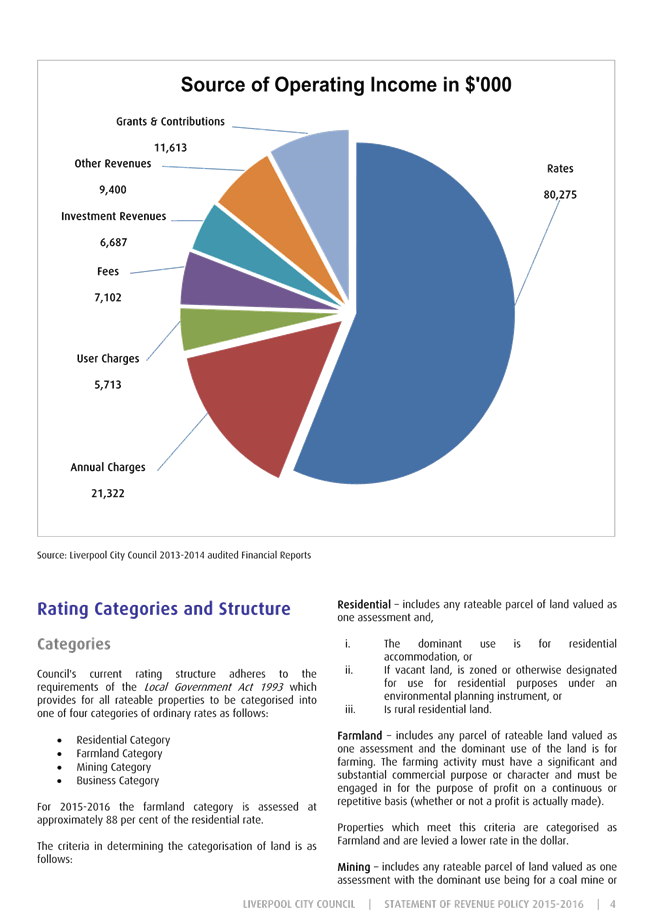

Draft Revenue Pricing Policy (Fees & Charges) 2015/16 |