City Corporate Report

CORP 02 Investment

Report November 2018................................................................ 3...........

CORP 03 Annual

Financial Reports 2017/18.................................................................. 13...........

Council in closed session

CONF 08 Liverpool

Civic Place - Proposed Car Parking Provision

Item CONF 08

is confidential pursuant to the provisions of s10A(2)(d i) of the Local Government

Act because it contains commercial information of a confidential nature that

would, if disclosed prejudice the commercial position of the person who

supplied it.

CONF 09 Acquisition

of Lot 35 DP 1228502 being Part of 10 Croatia Avenue, Edmondson Park for

road purposes

Item CONF 09

is confidential pursuant to the provisions of s10A(2)(c) of the Local

Government Act because it contains information that would, if disclosed, confer

a commercial advantage on a person with whom the Council is conducting (or

proposes to conduct) business.

Ordinary Meeting 12 December 2018

|

CORP 02

|

Investment Report November 2018

|

|

Strategic

Direction

|

Leading

through Collaboration

Seek

efficient and innovative methods to manage our resources

|

|

File Ref

|

328255.2018

|

|

Report By

|

John Singh -

Revenue Accountant

|

|

Approved

By

|

Vishwa Nadan

- Chief Financial Officer

|

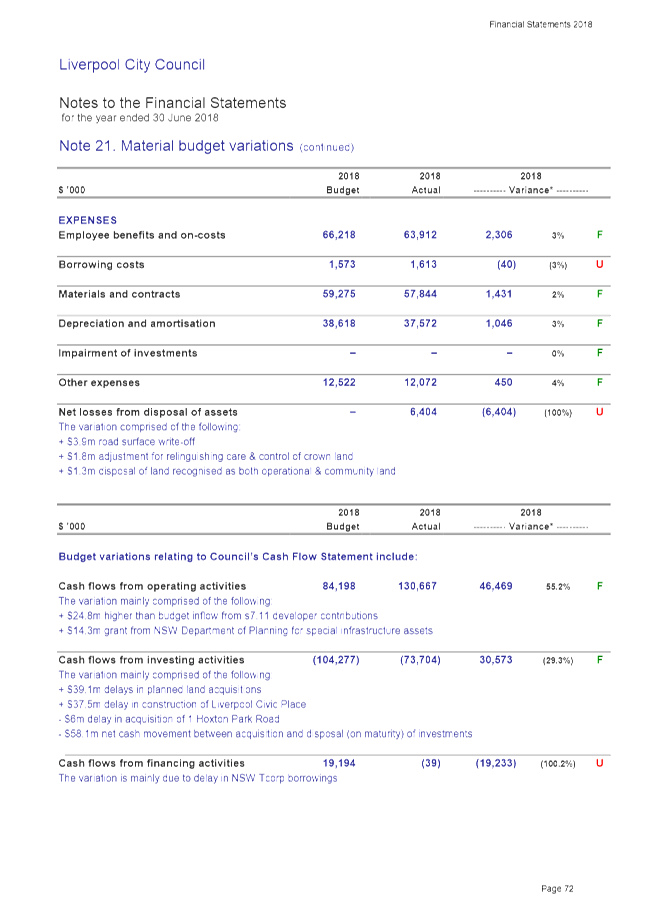

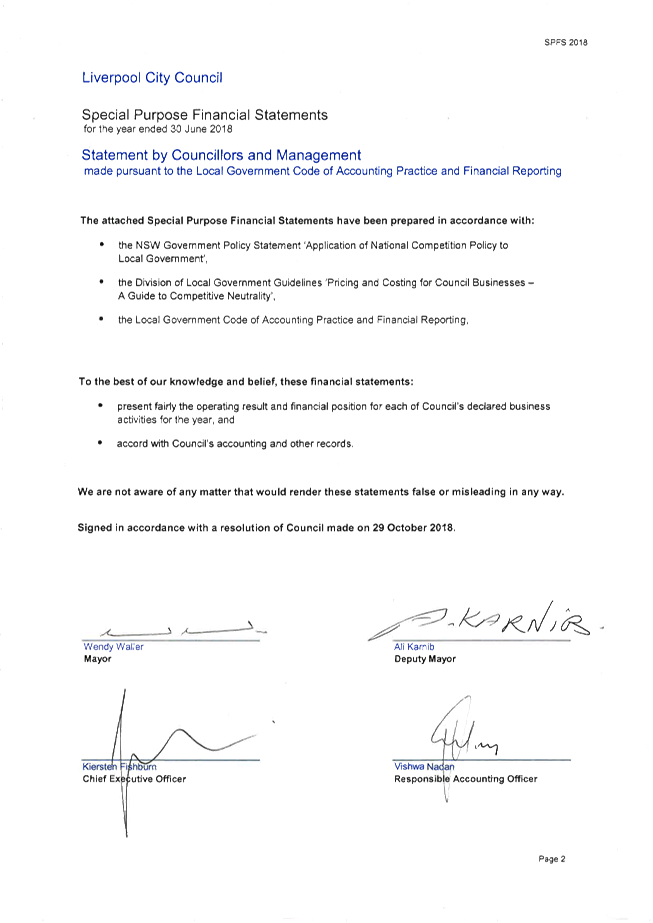

Executive Summary

This report details Council’s Investment

portfolio.

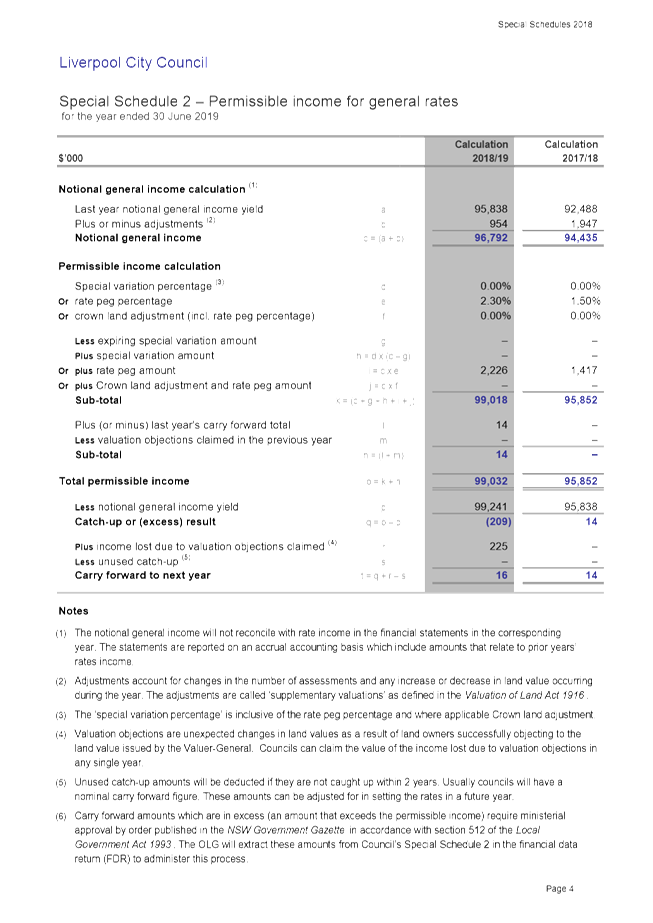

At 30 November 2018, Council held investments with a

market value of $288 million.

The portfolio yield to the end of November 2018 is 70

basis points above the AusBond Bank Bill index.

|

|

AusBond Bank Bill Index (BBI)

|

|

Benchmark

|

1.91%

|

|

Portfolio yield

|

2.61%

|

|

Performance above benchmarks

|

0.70%

|

Return on investment to November 2018 was $738k higher than budget.

This favorable year-to-date variance however is expected to reduce by year-end

as cash outlay on capital works in the remaining months will be significantly

higher.

Council’s investments and reporting obligations

fully complies with the requirements of Section 625 of the Local Government Act

1993, Clause 212 of the Local Government (General) Regulation.

Council’s portfolio also fully complies with

limits set out in its investment policy. NSW TCorp however has recommended that

Council progressively reduce its exposure to lower rated financial institutions

to below 25% of its investment portfolio by 2021.

|

That Council

receives and notes this report.

|

Clause 212 of the Local Government (General)

Regulation 2005 requires that the Responsible Accounting Officer must provide

Council with a written report setting out details of all money that Council has

invested under section 625 of the Local Government Act 1993.

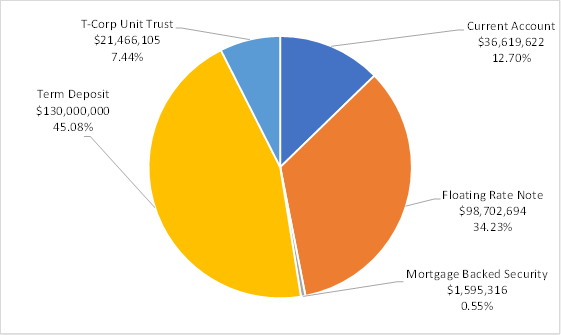

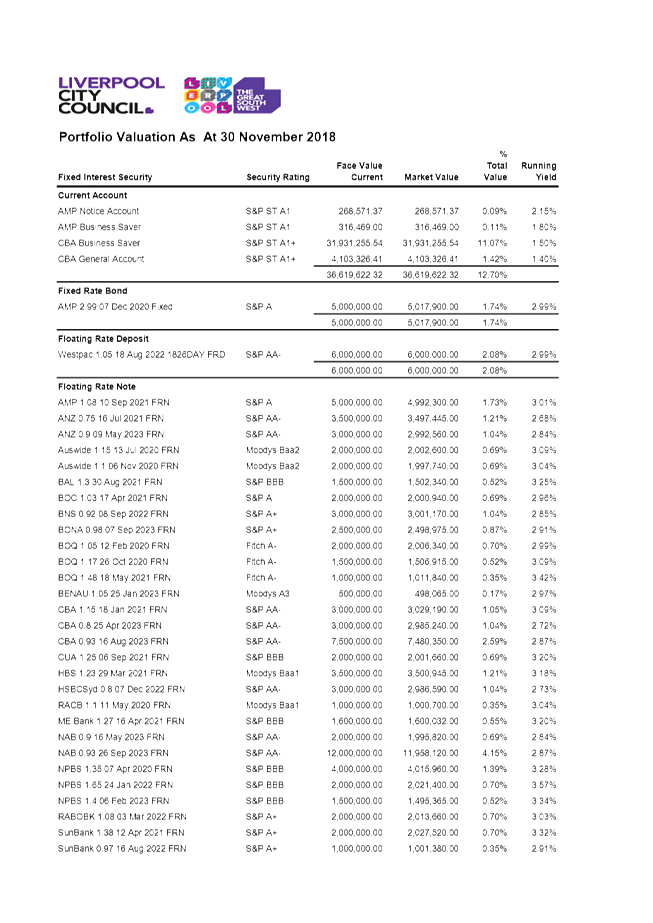

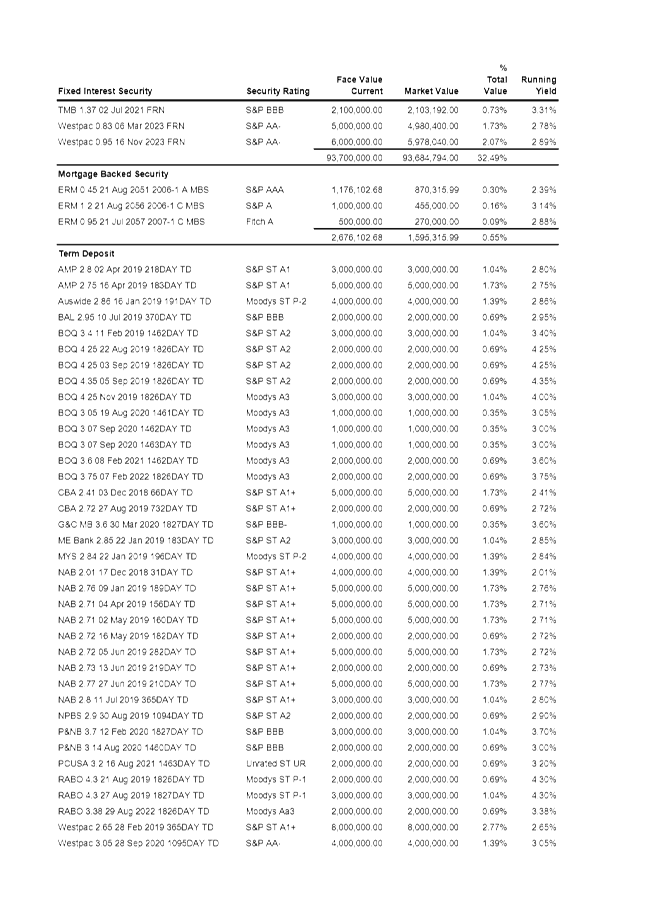

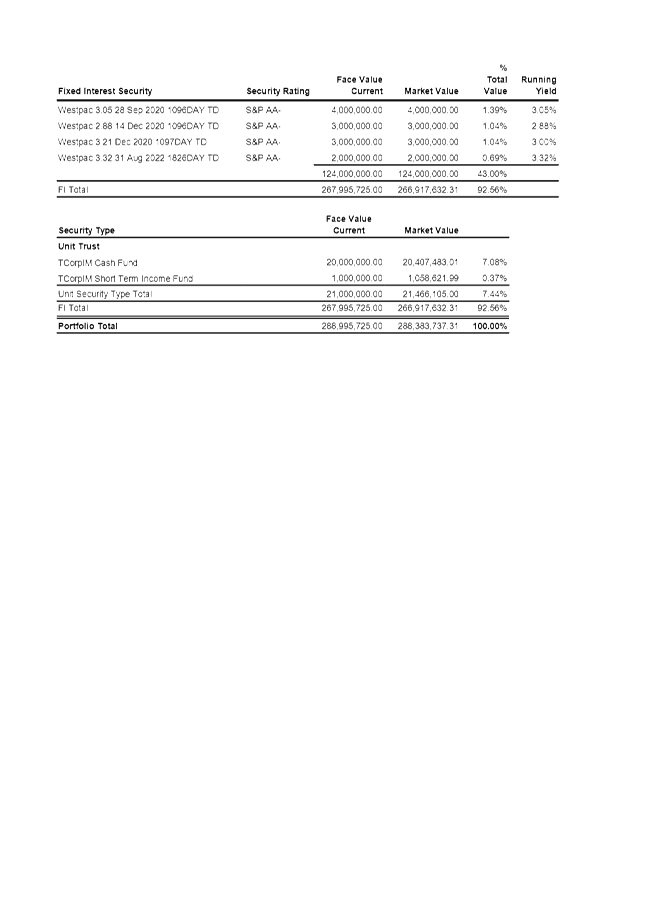

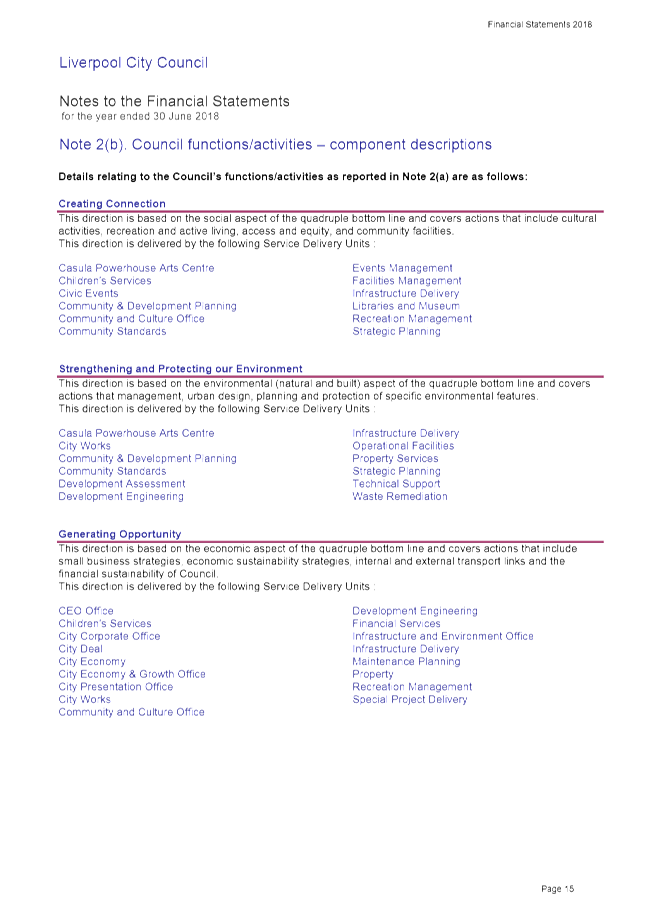

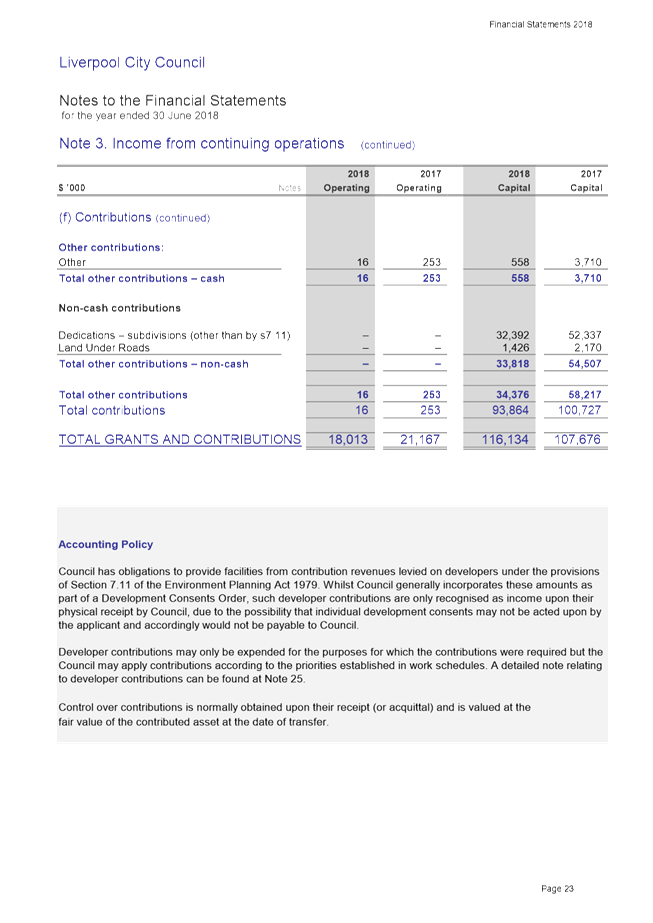

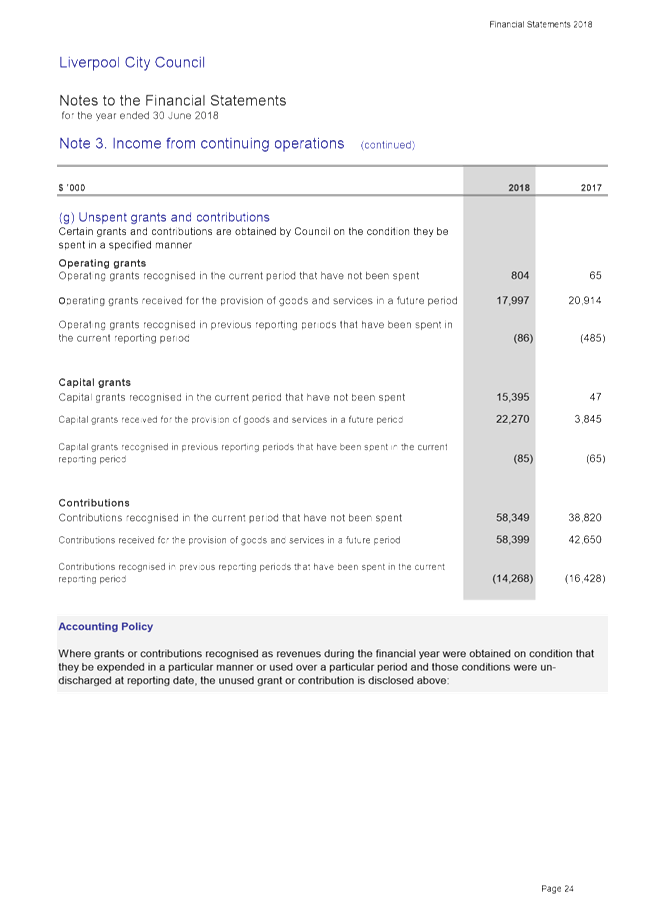

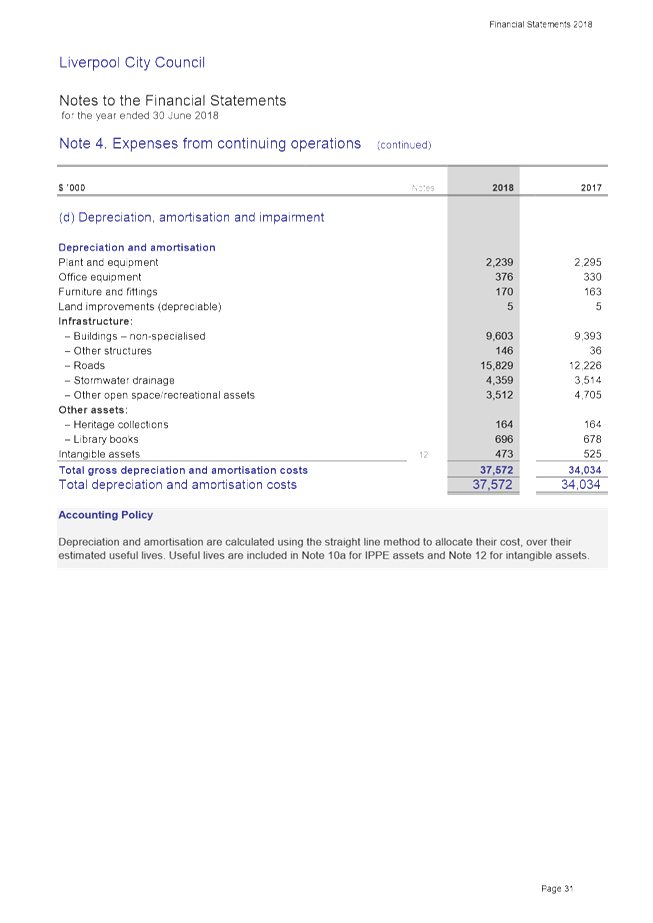

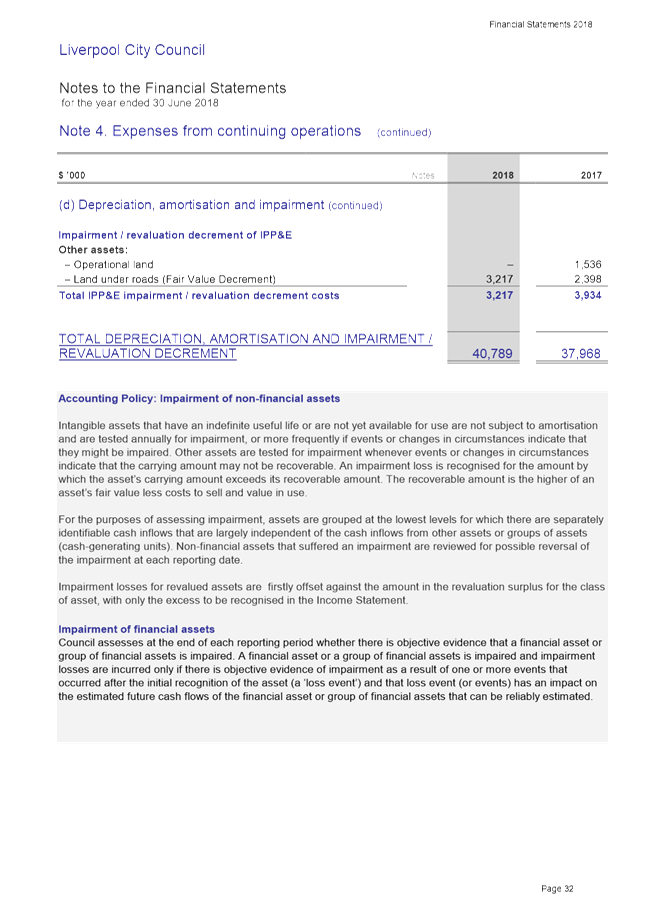

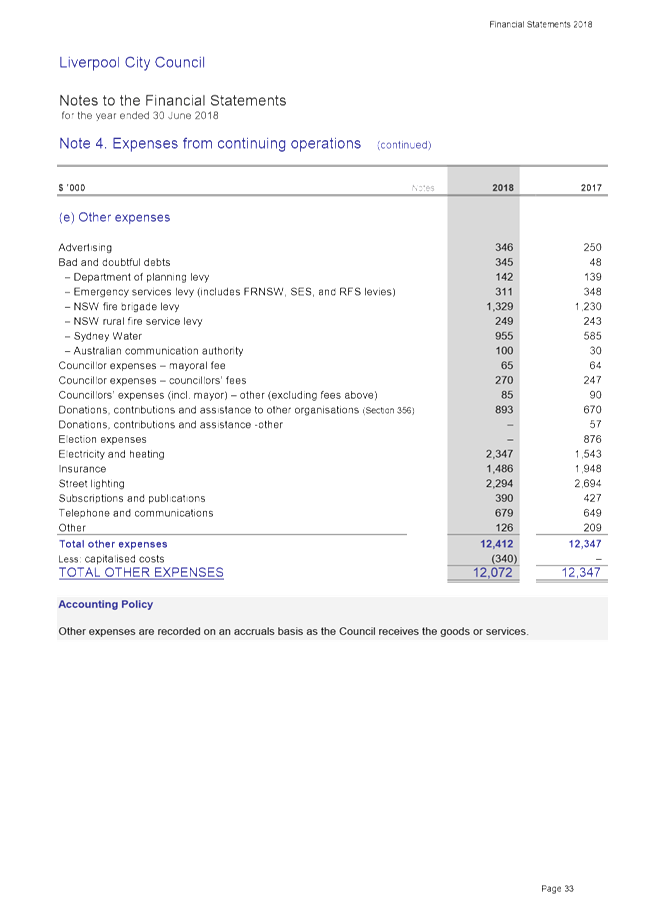

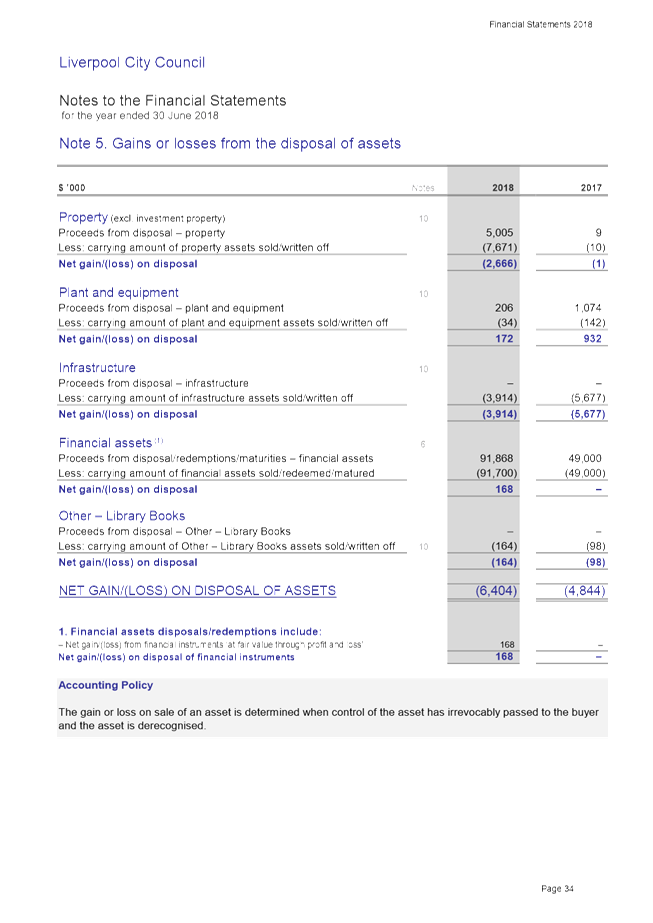

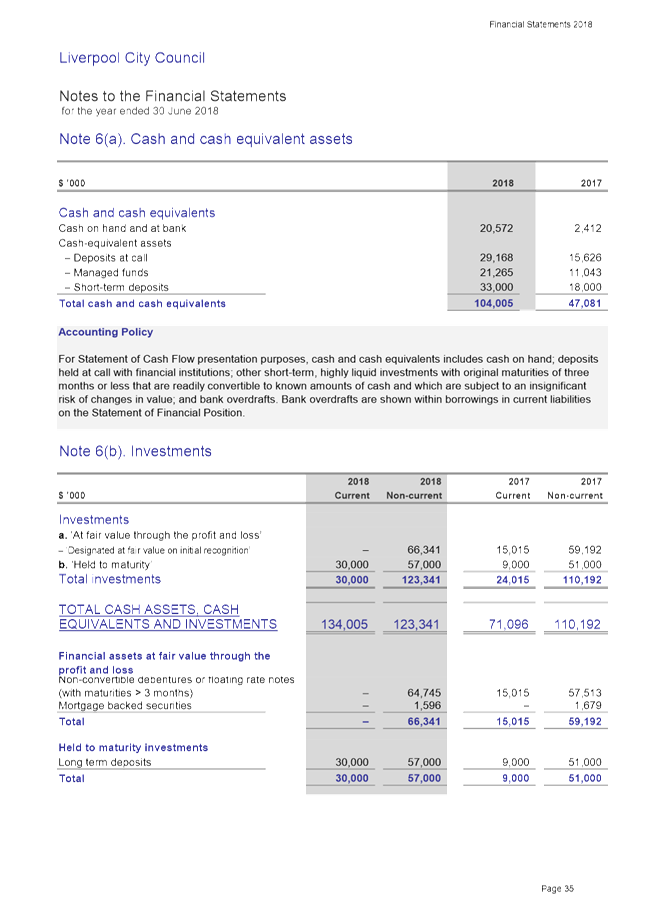

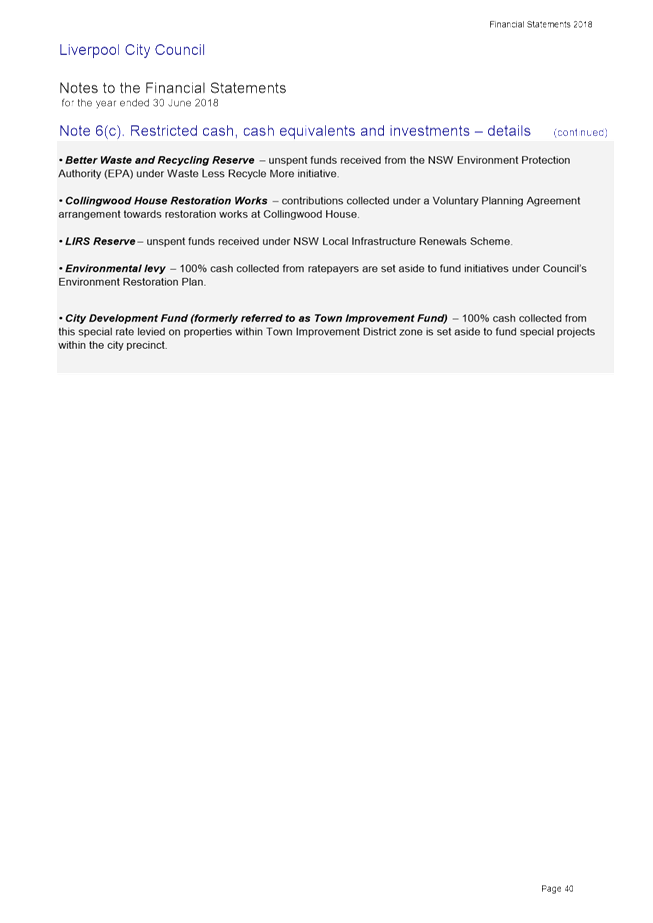

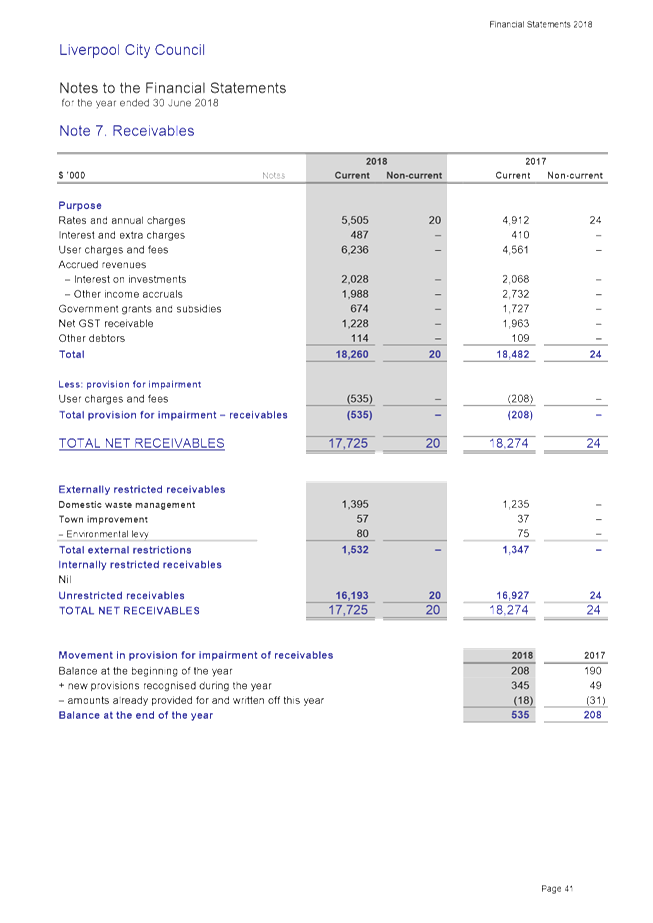

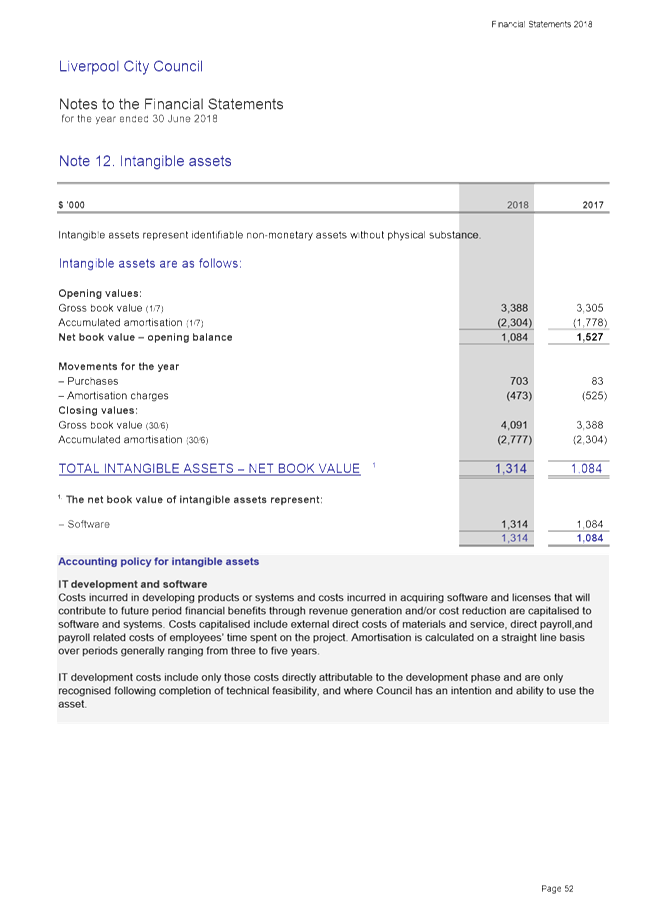

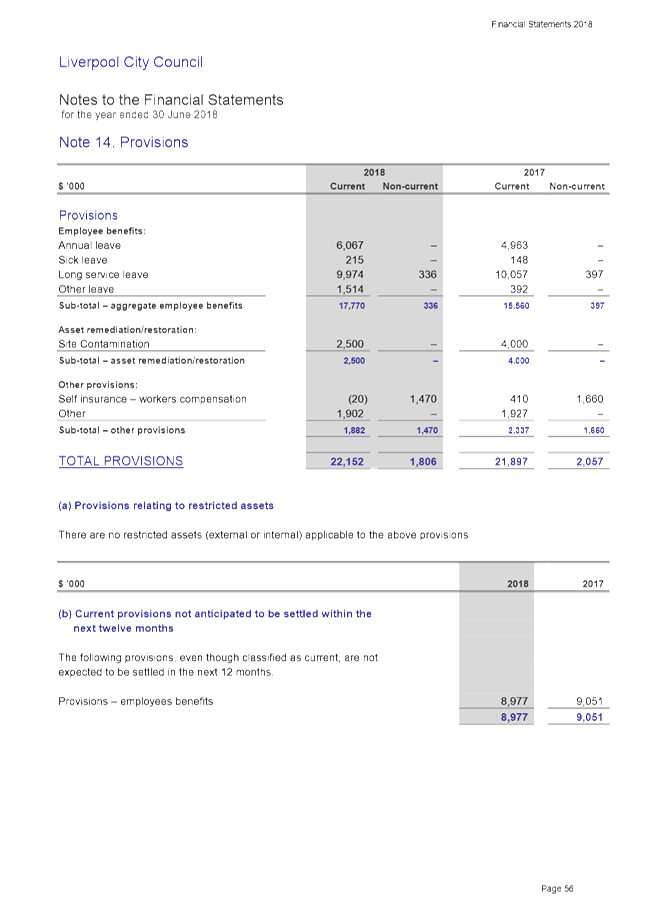

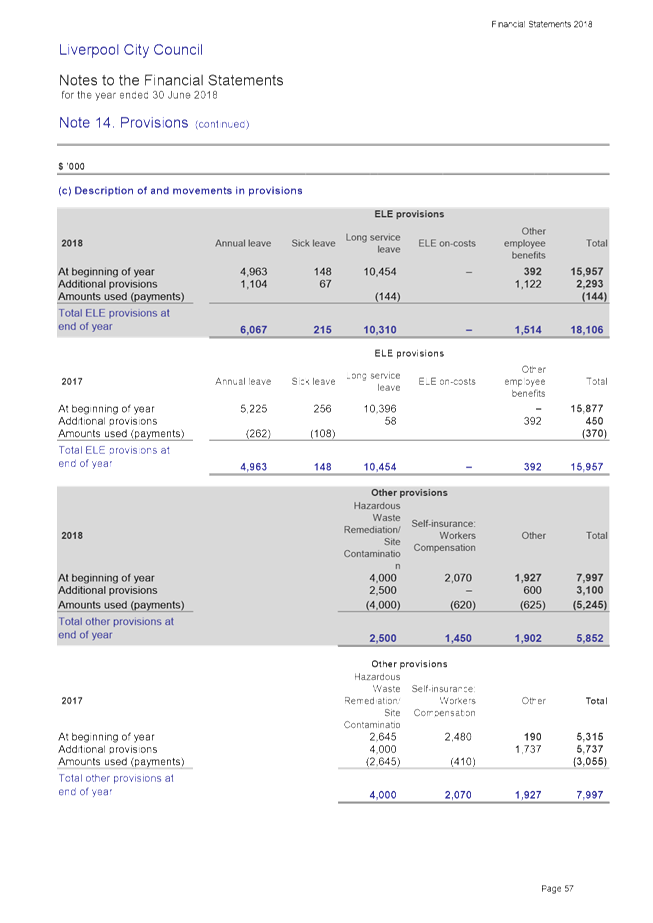

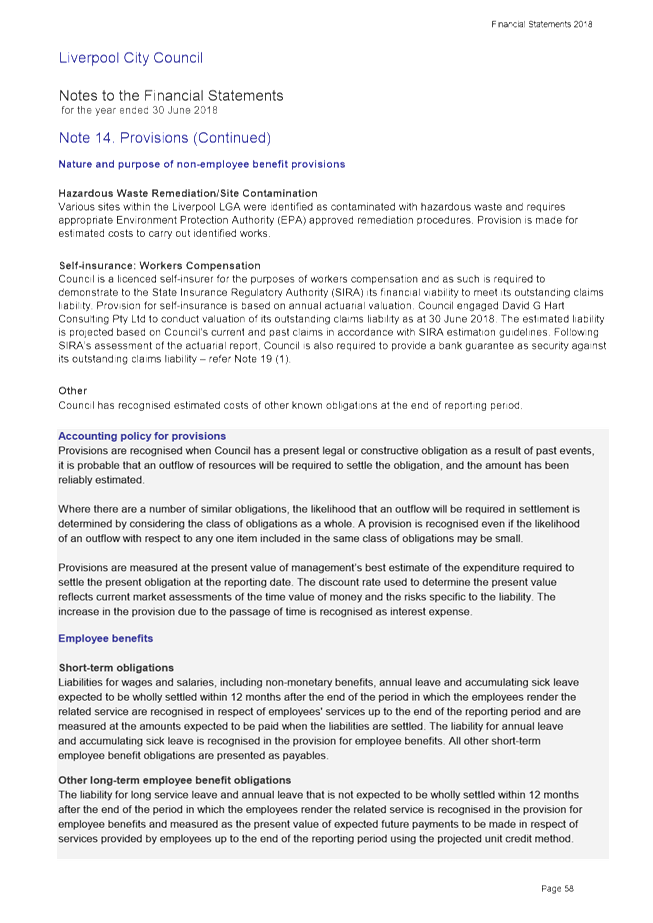

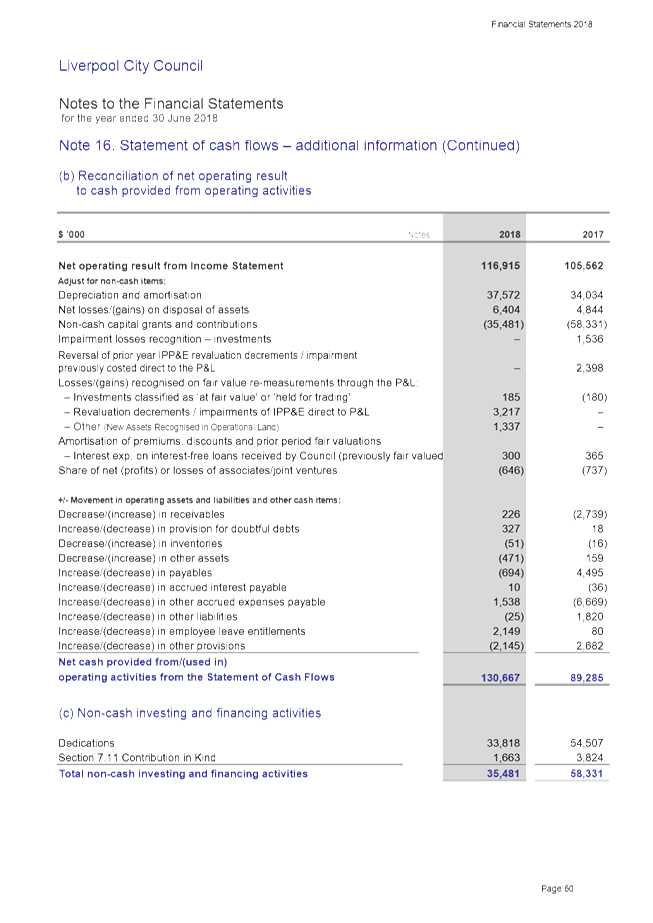

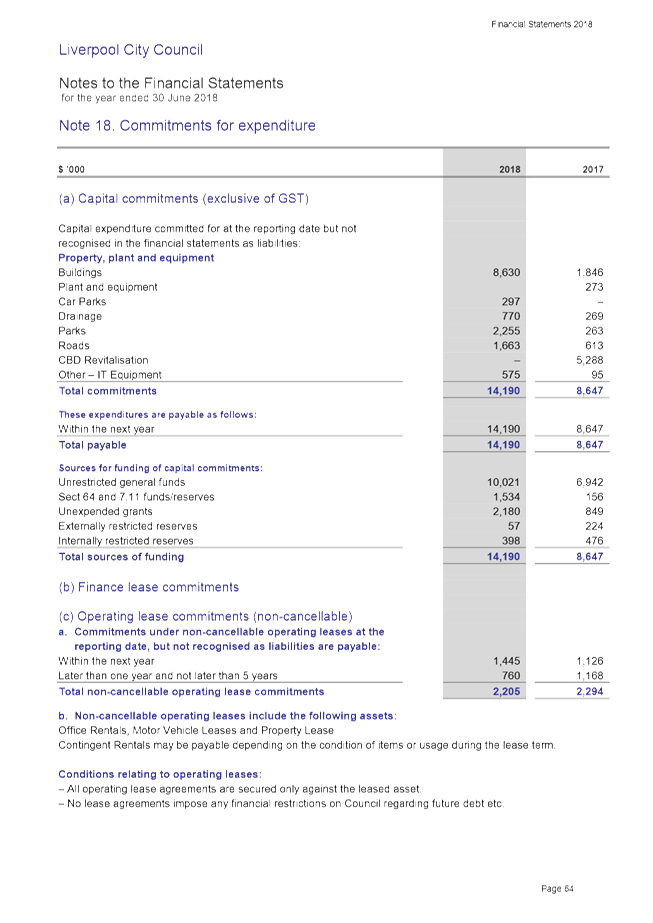

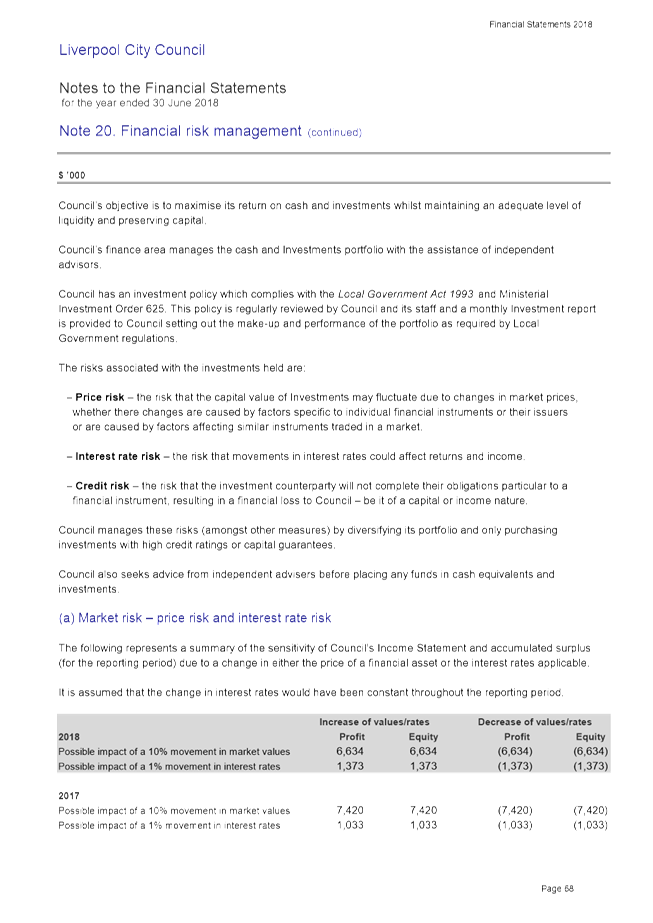

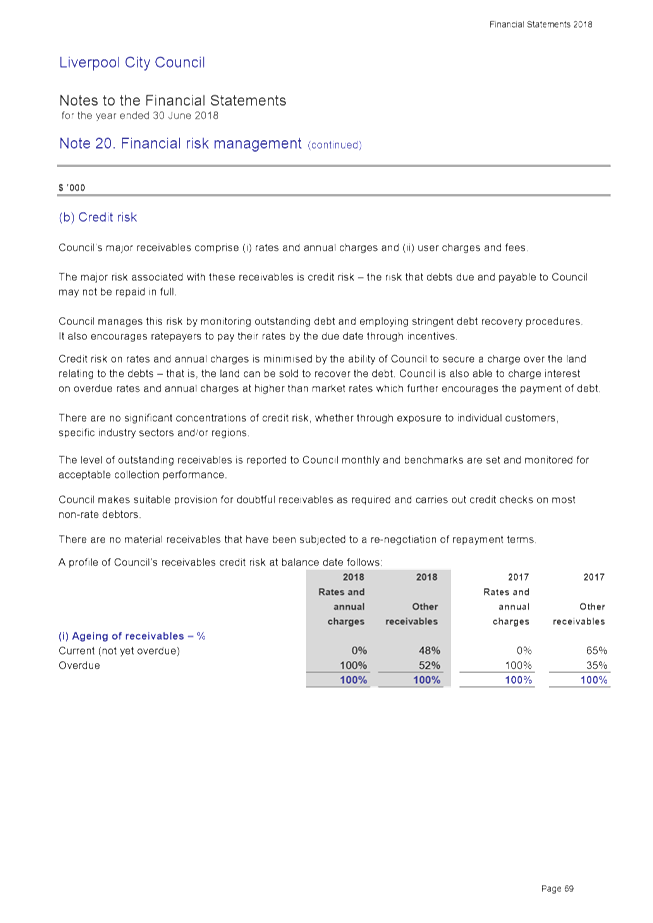

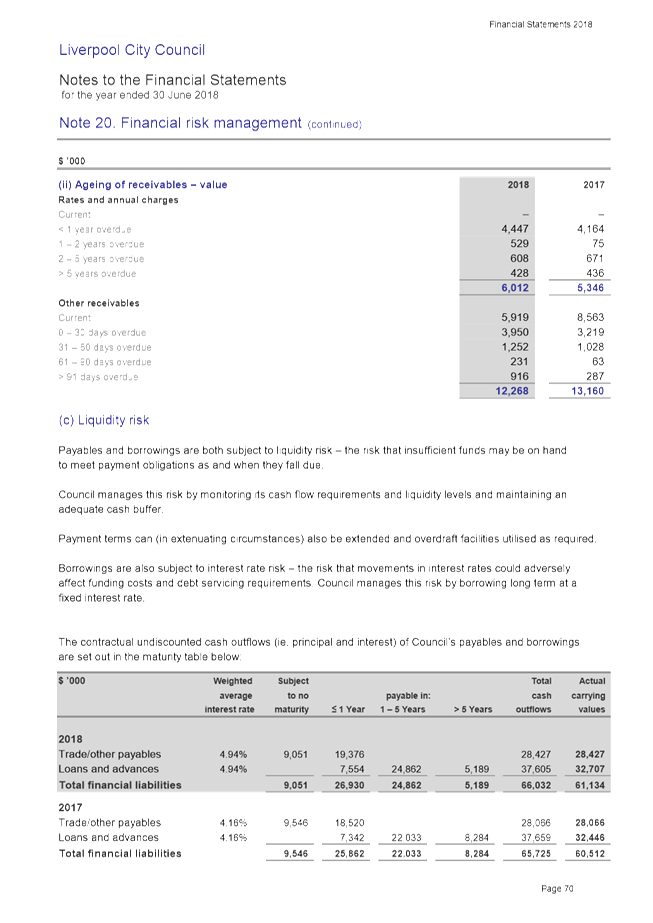

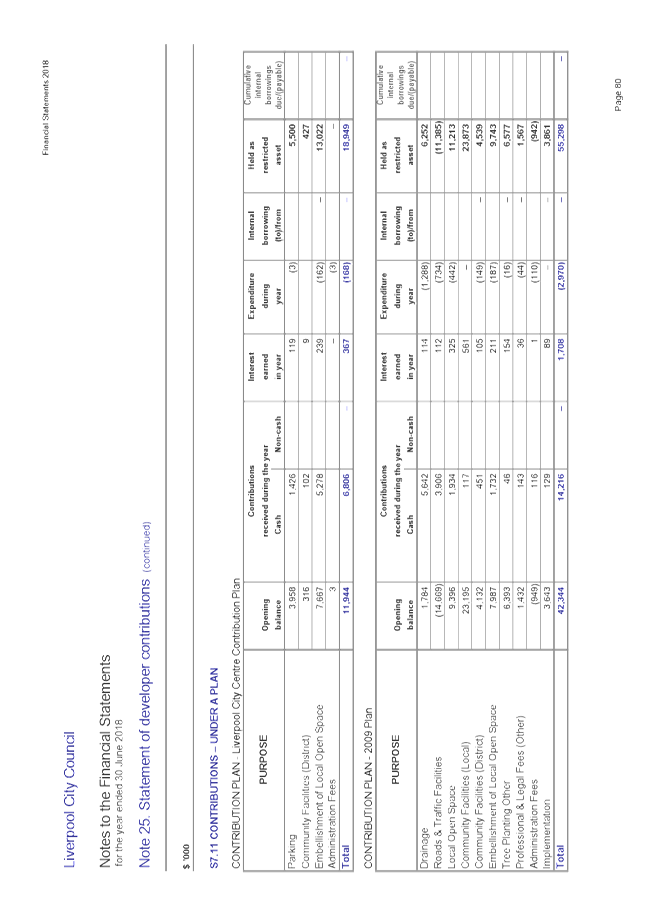

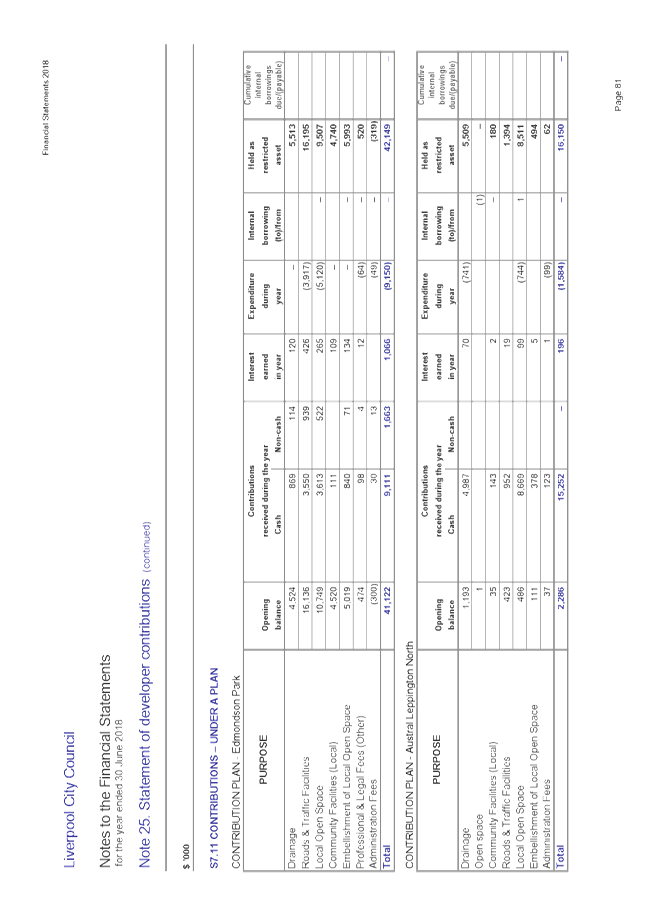

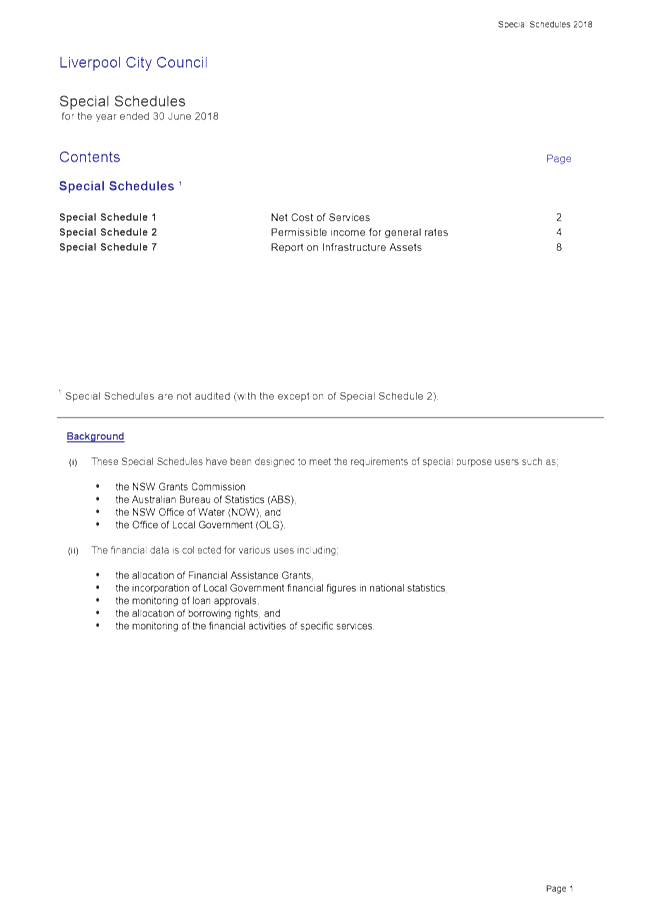

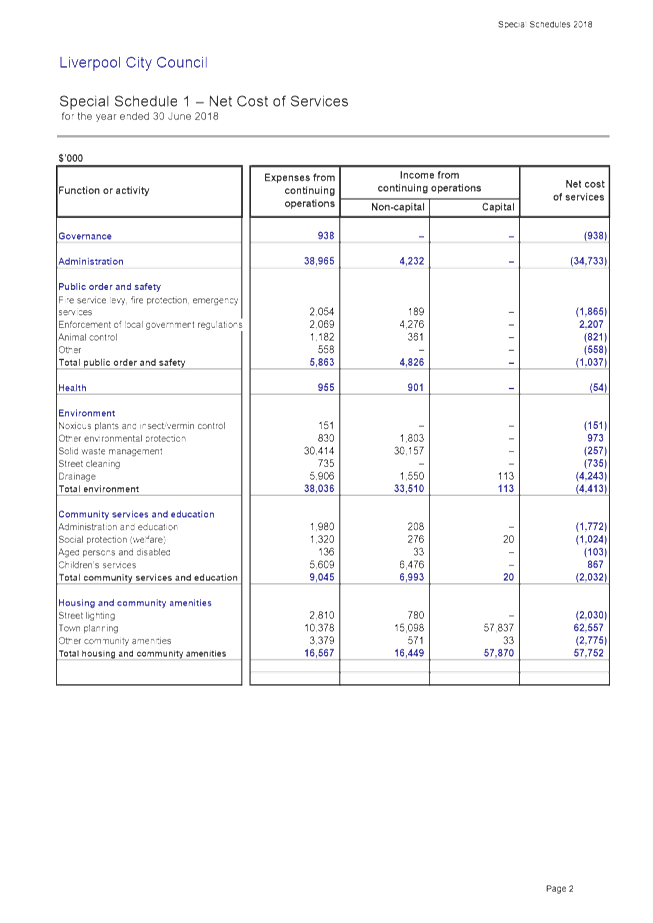

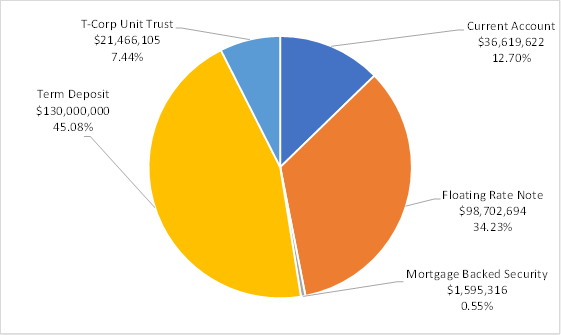

Council’s Portfolio

At 30 November 2018, Council held investments with a

market value of $288 million. Council’s investment register detailing all

its investments is provided as an attachment to this report. In summary,

Council’s portfolio consisted of investments in:

The ratio of market value compared to face value of

various debt securities is shown in the table below.

|

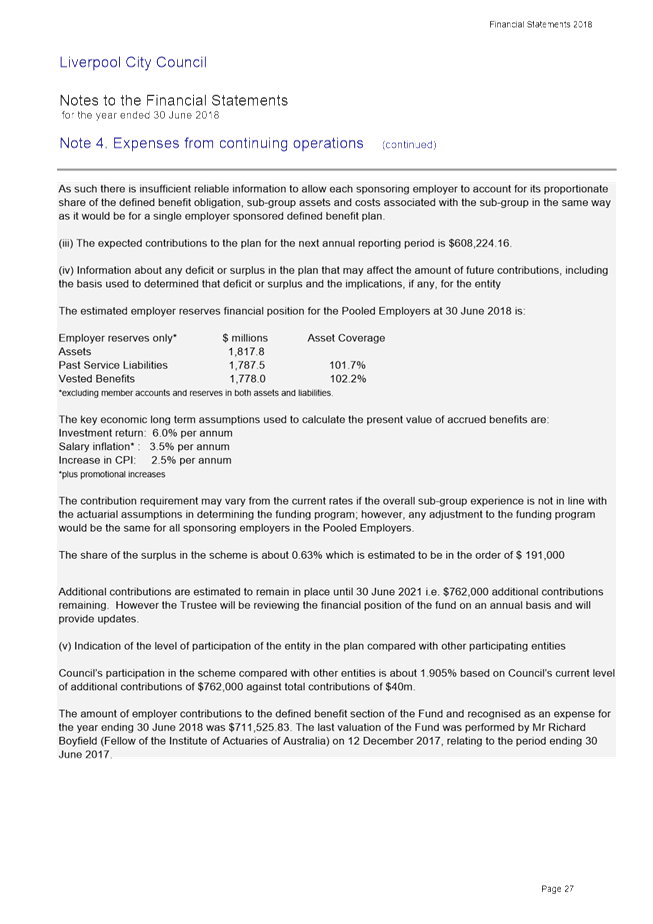

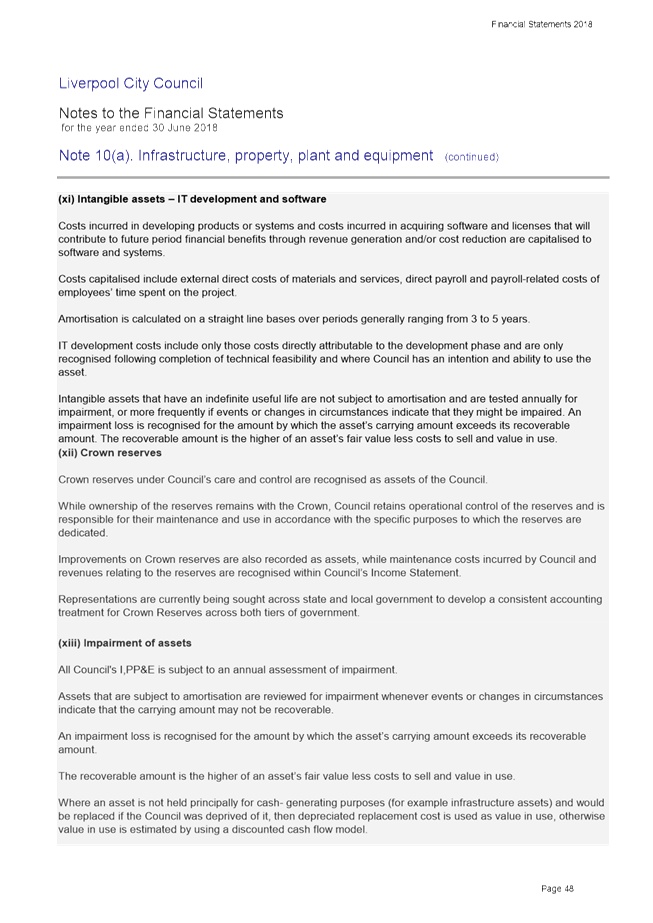

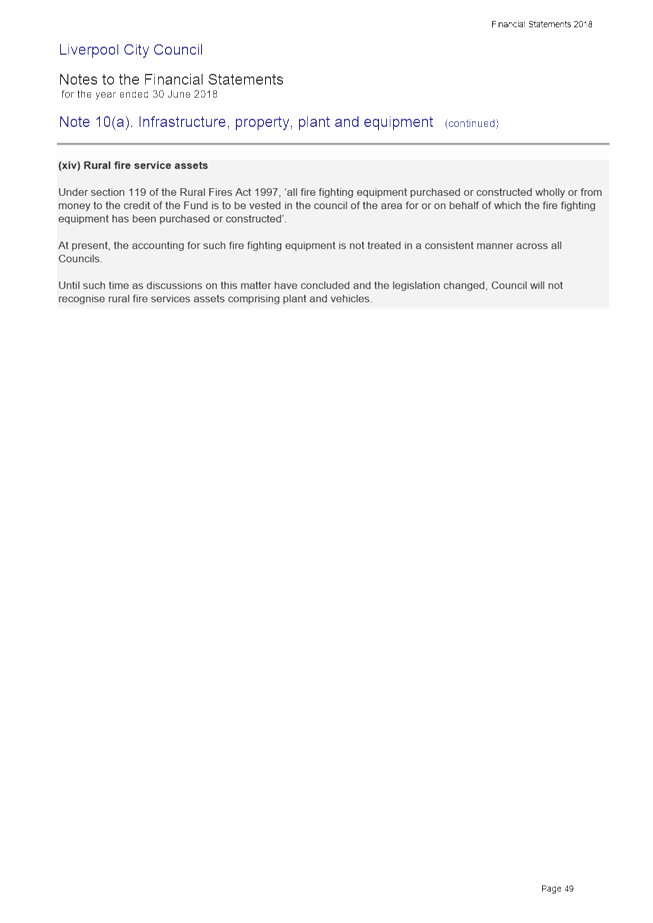

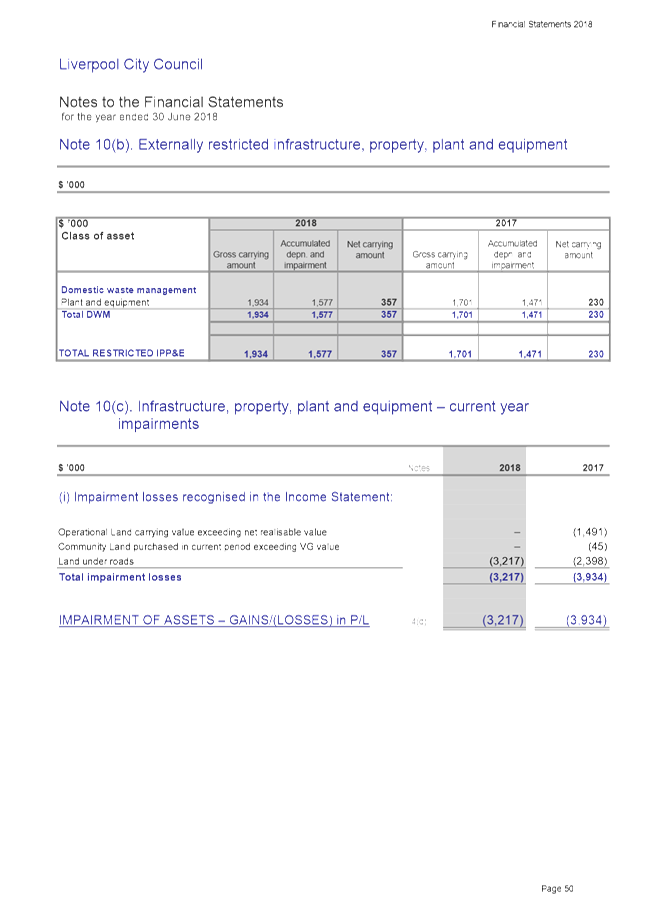

Asset

Class

|

Nov-18

|

Jun-18

|

|

Senior

Debts (FRN's ,TCD's & FRB)*

|

100.00%

|

100.22%

|

|

MBS

(Reverse Mortgage Backed Securities)

|

59.61%

|

59.26%

|

|

T-Corp

Unit Trusts

|

102.22%

|

101.26%

|

*Definition of terms

· Transferrable Certificate of Deposit (TCD)

t - security issued with the same characteristics as a Term Deposit however it

can be sold back (transferred) in to the market prior to maturity. A floating

TCD pays a coupon linked to a variable benchmark (90 days BBSW).

· Fixed Rate Bond (FRB) – returns Fixed

Coupon (interest) Rate and is tradeable before maturity.

Council is fully compliant with the requirements of

the Ministerial Investment Order including the grandfathering provisions. The

grandfathering provision states that Council continues to hold to maturity,

redeem or sell investments that comply with previous Ministerial Investment

Orders. Any new investments must comply with the most recent Order. Council

continues to closely monitor the investments in its portfolio to ensure

continued compliance and minimal exposure to risk.

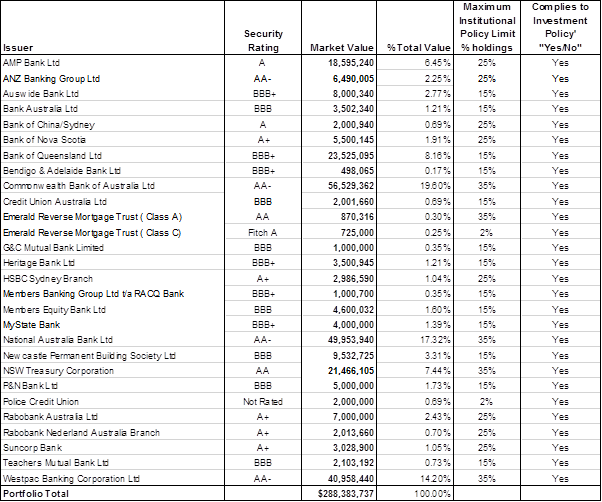

NSW TCorp has recommended that Council progressively

reduce its exposure to lower rated financial institutions to below 25% by 2021.

Council’s current portfolio investments in BBB and below rated

ADI’s is 24.26% and the position will be maintained going forward.

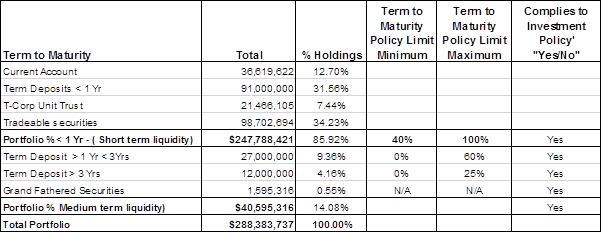

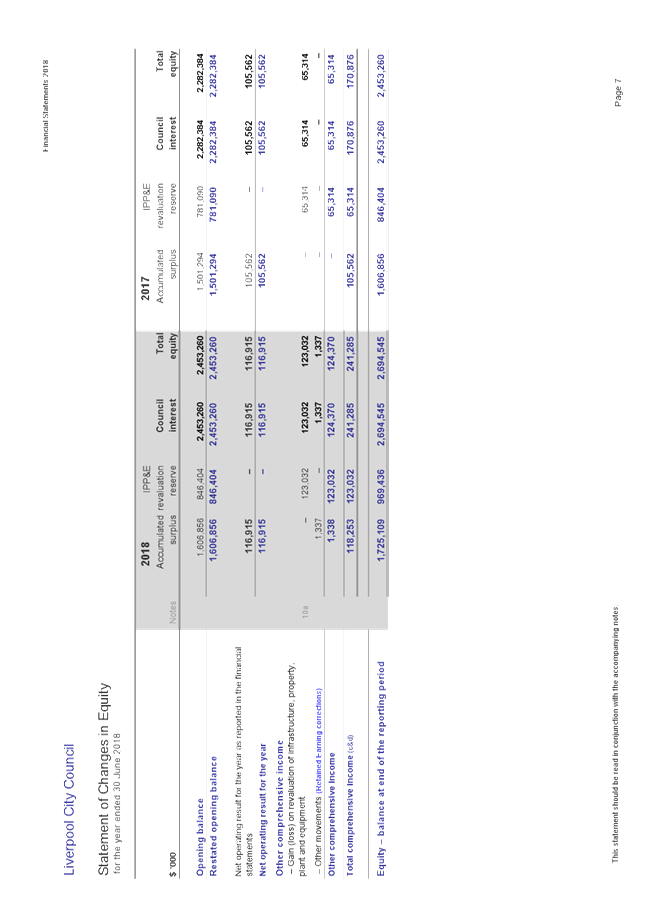

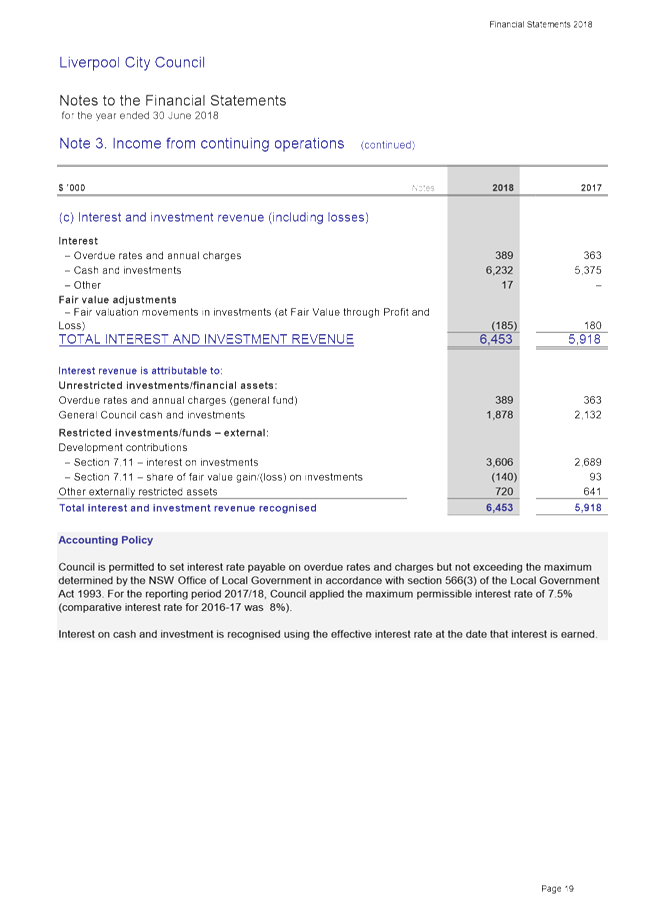

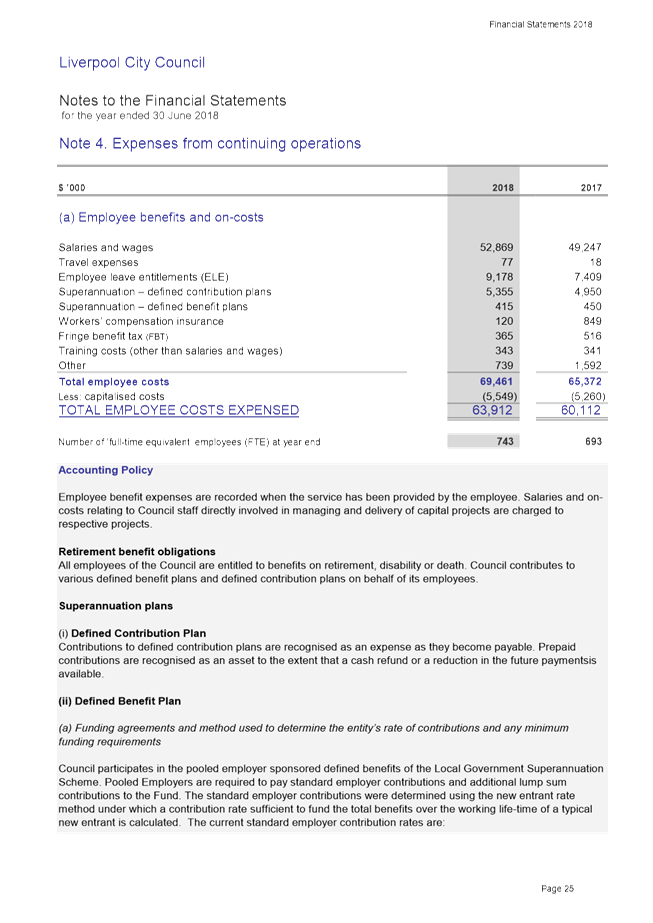

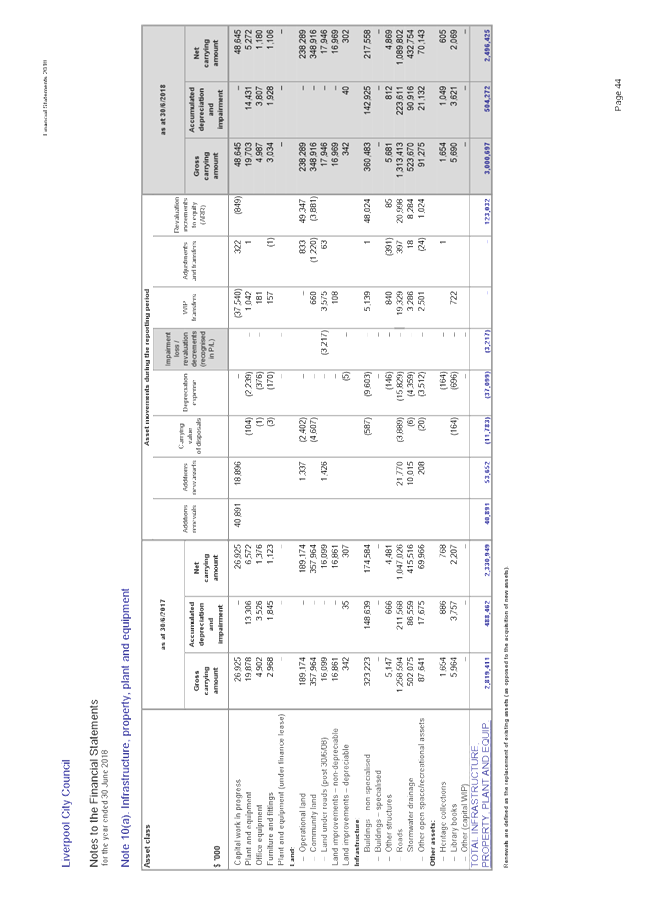

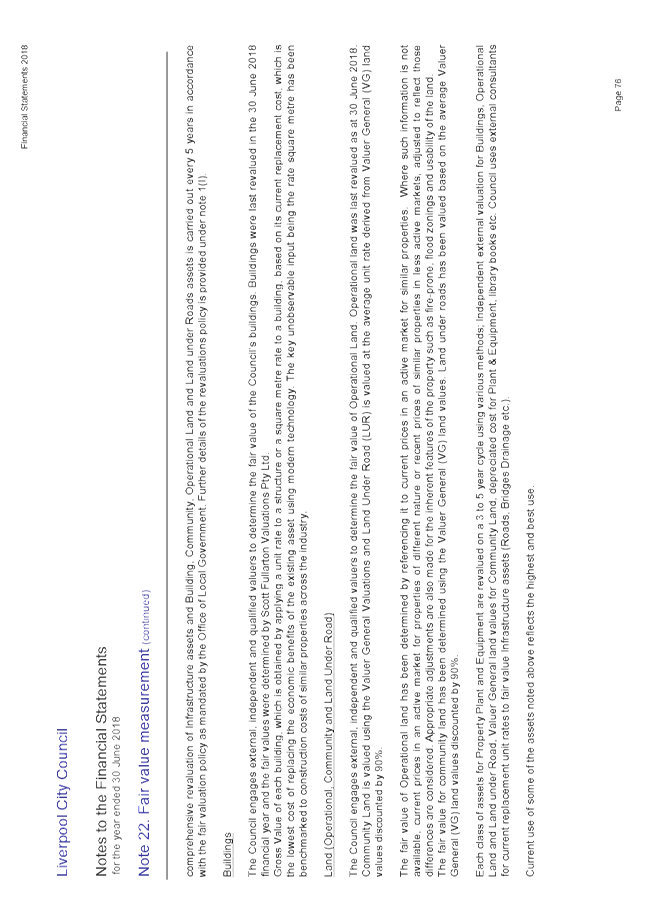

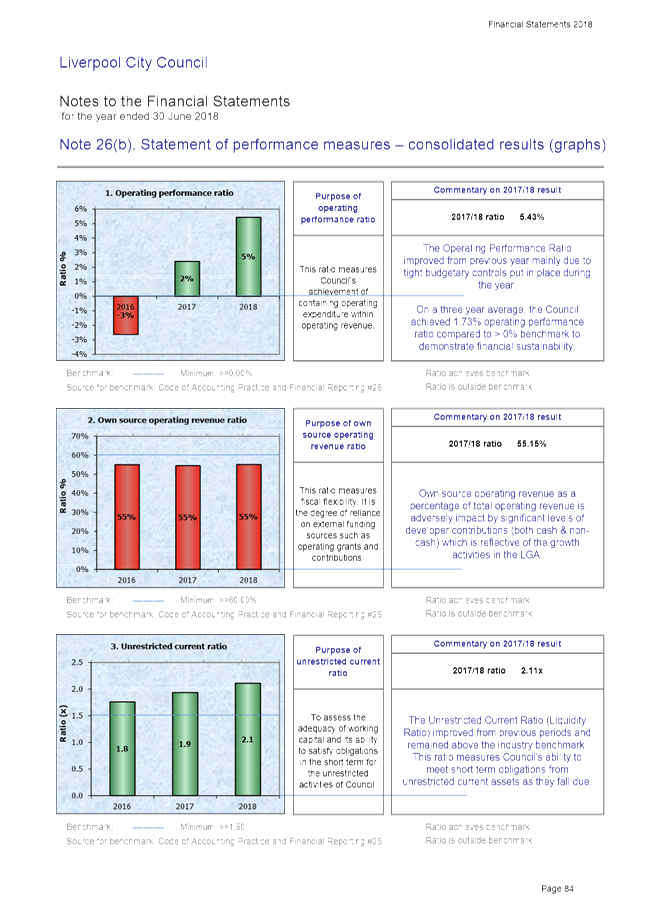

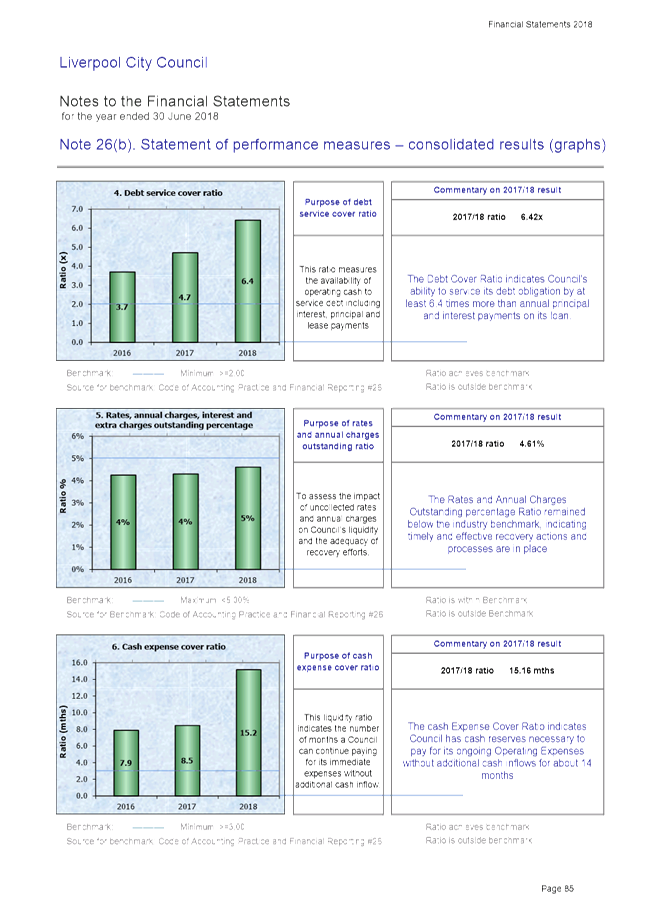

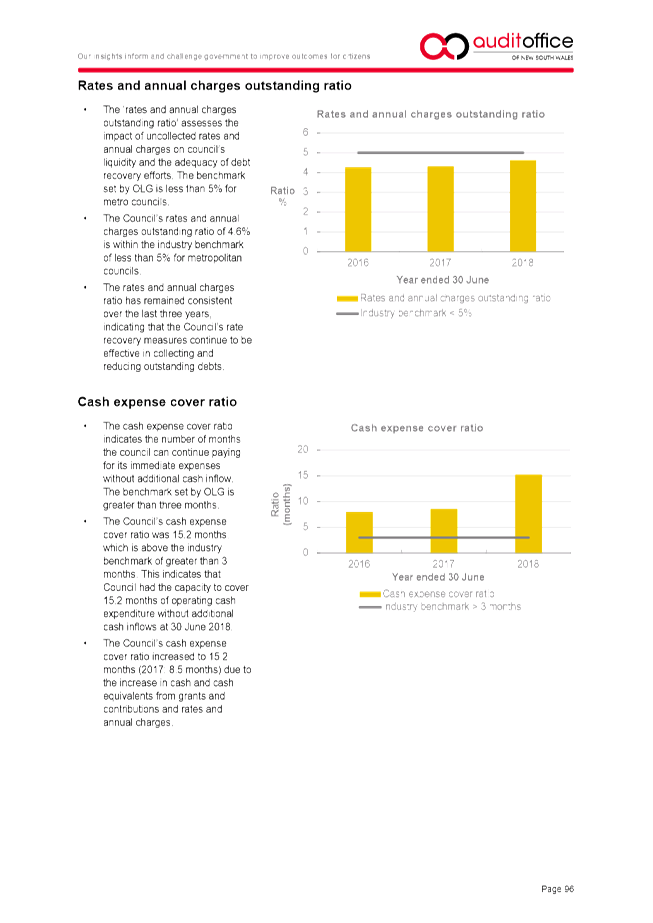

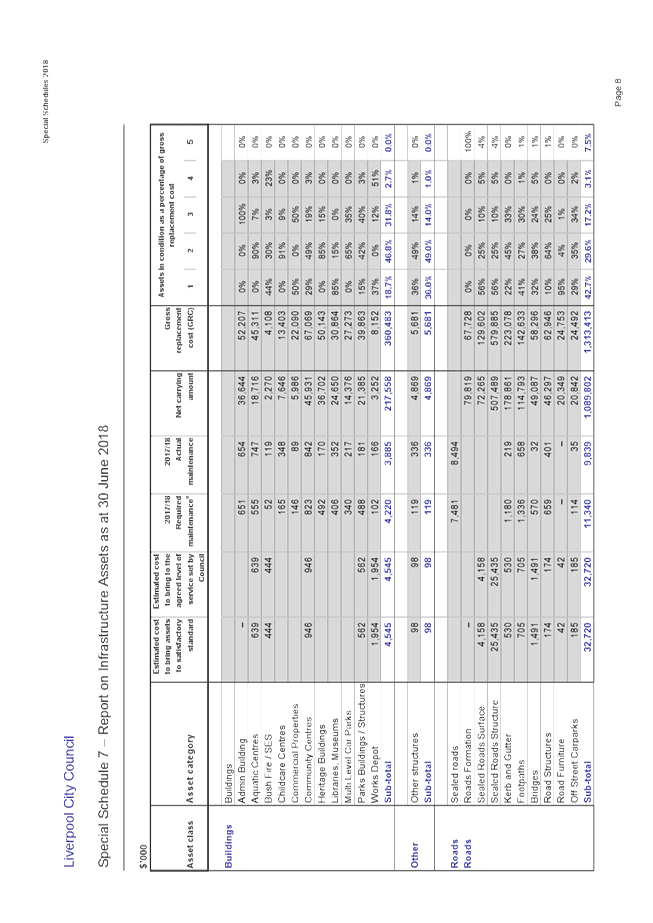

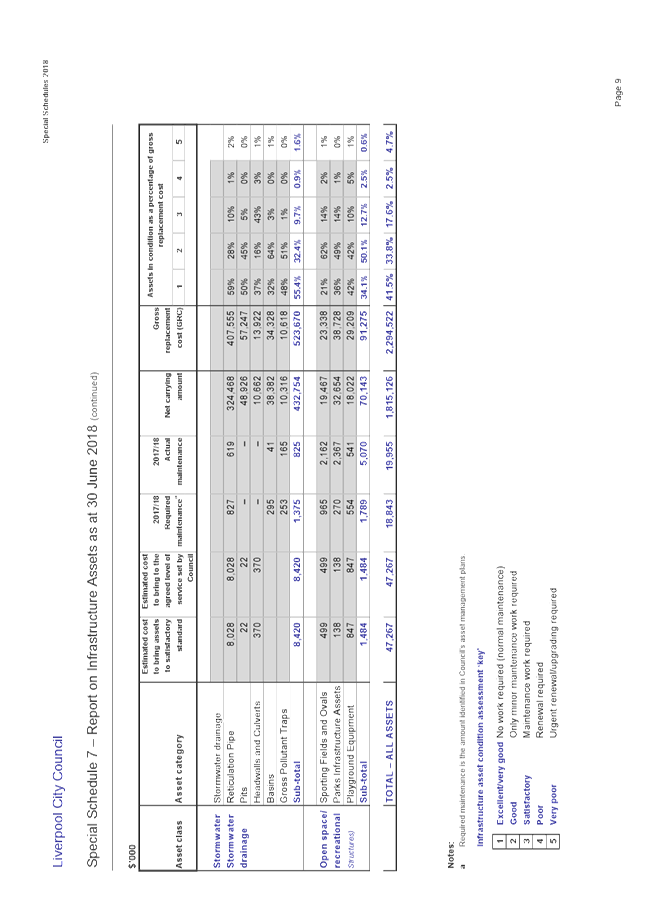

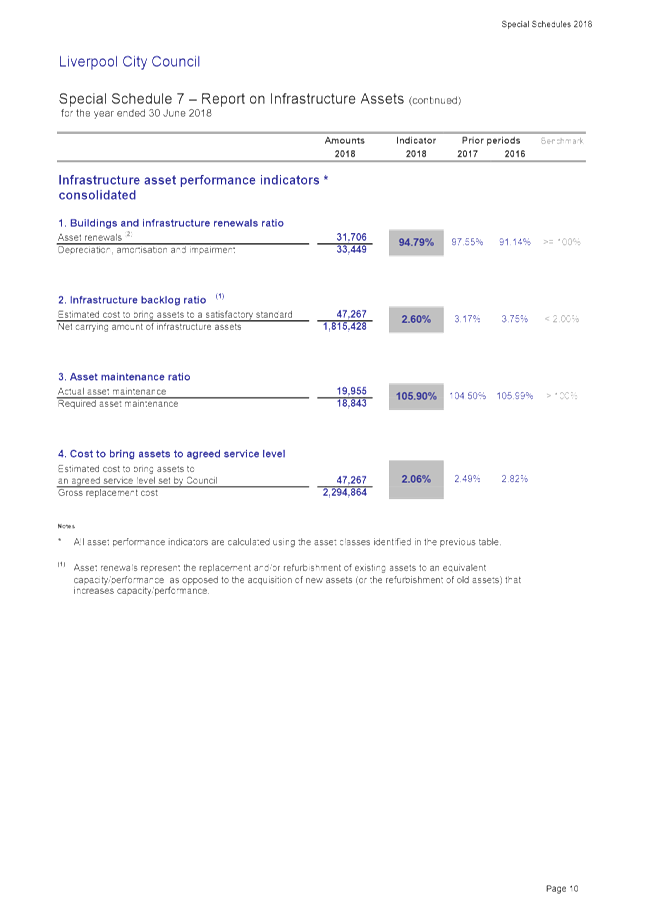

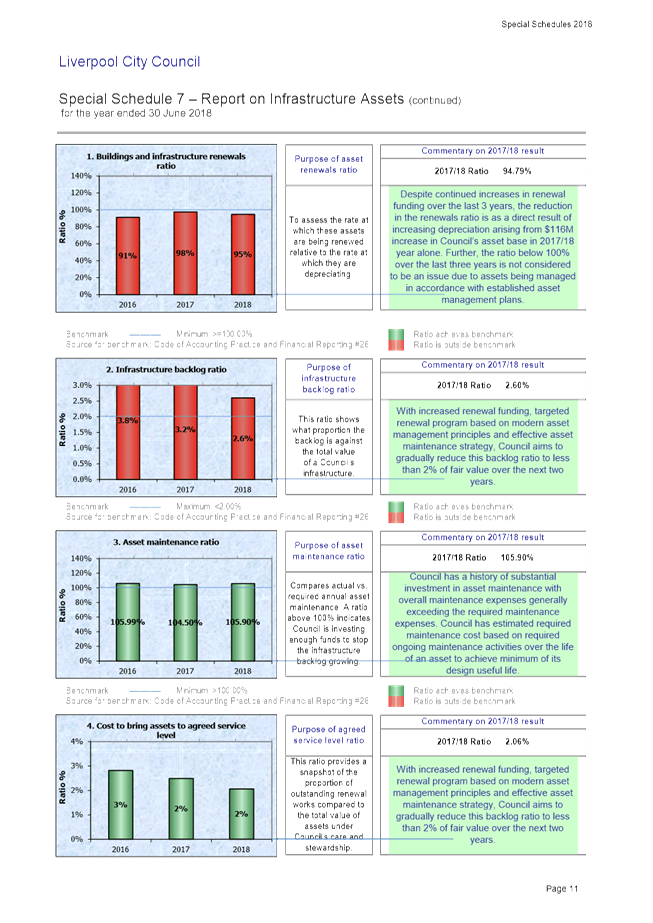

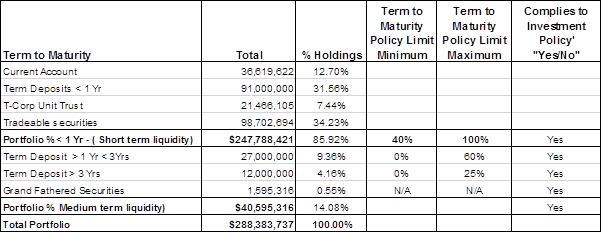

Portfolio Maturity Profile

The table below shows the percentage of funds invested

at different durations to maturity.

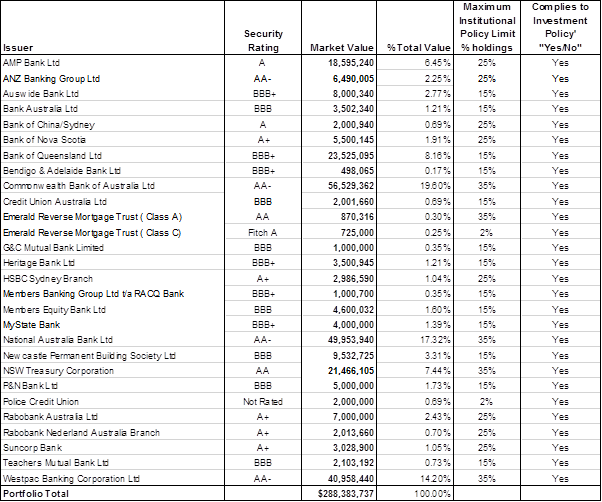

Market Value

by Issuer and Institution Policy limit as per Investment Policy

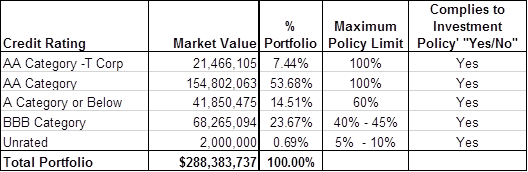

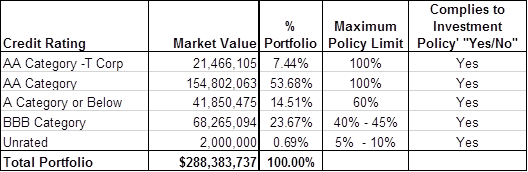

Overall Portfolio Credit Framework compliance to Investment Policy

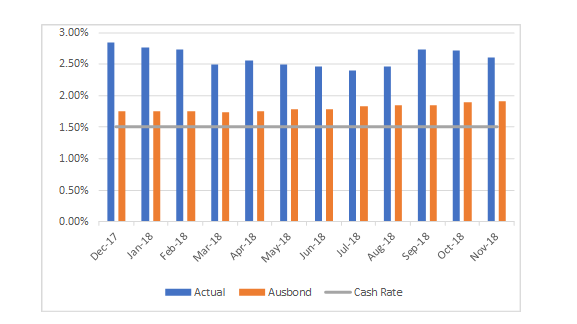

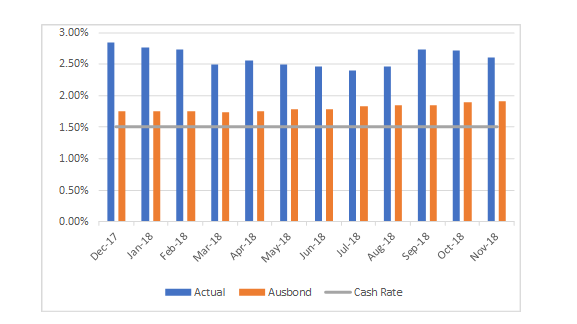

Portfolio Performance against relevant market

benchmark.

Council’s Investment Policy prescribes AusBond

Bank Bill Index (ABBI) as a benchmark to measure return on cash and fixed

interest securities. The ABBI represents average daily yield of a parcel of

bank bills. Historically there has been a positive correlation between changes

in the cash rate and the resulting impact on the ABBI benchmark.

The portfolio yield to 30 November 2018 exceeded the

AusBond Bank Bill index by 70 basis points (2.61% against 1.91%).

Council continues to achieve a solid outcome despite

ongoing margin contraction and significantly lower market term deposit yields.

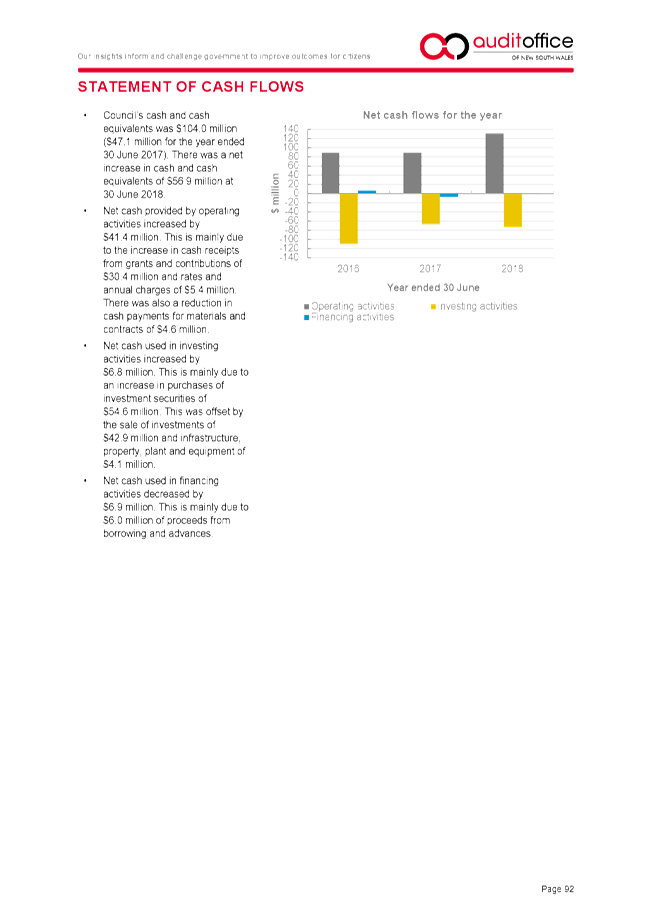

Comparative yields for the previous months are charted below:

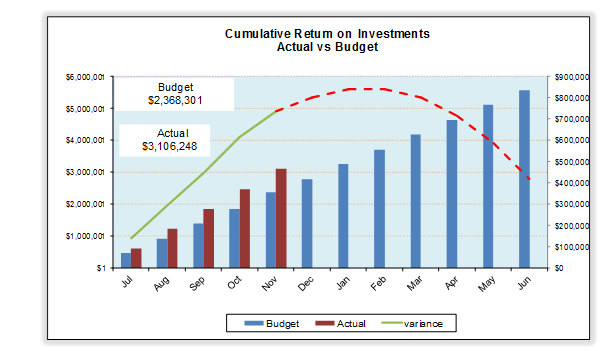

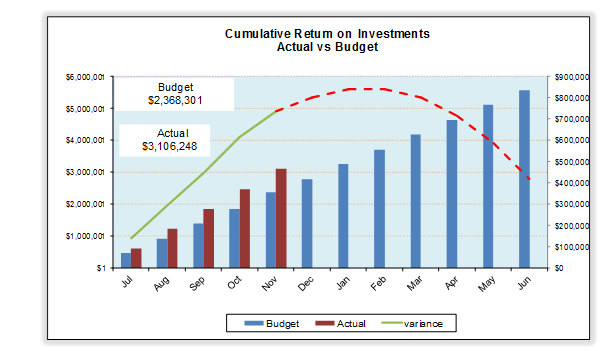

Performance

of Portfolio Returns against Budget

Council’s investment income for November 2018

exceeded budget by $738k mainly due to higher actual monthly average portfolio

holdings compared to budgeted monthly average portfolio holdings for the

period. This favorable year-to-date variance however is expected to reduce by

year-end (as illustrated in graph below) as cash outlay on capital works in the

remaining months will be significantly higher.

Investment

Portfolio at a Glance

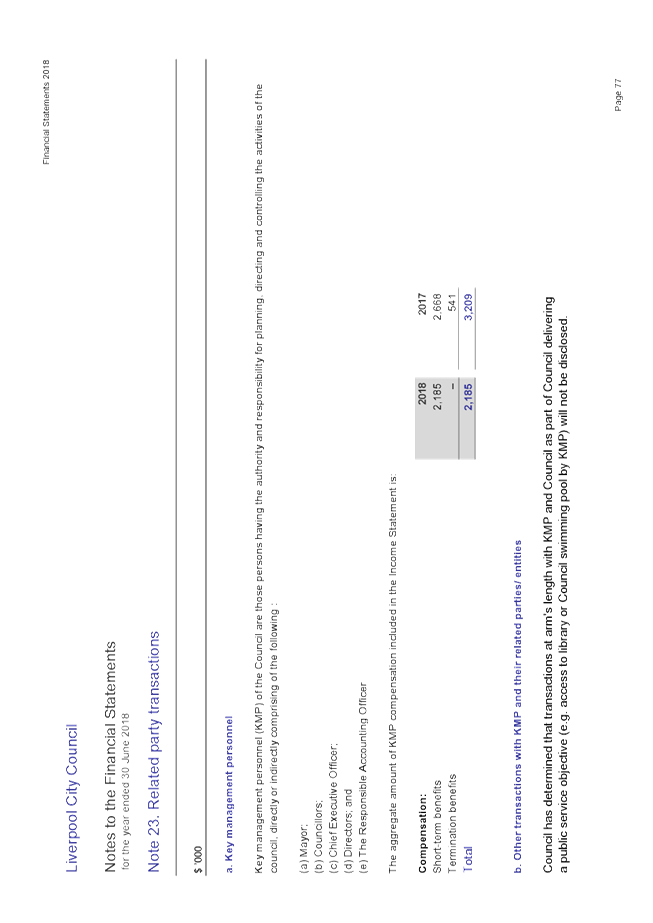

|

Portfolio

Performance

|

![MCWB01114_0000[1]](CO_20181212_AGN_344_AT_SUP_files/image008.png)

|

The portfolio

yield to 30 November 2018 exceeded the AusBond Bank Bill index by 70 basis

points (2.61% against 1.91%).

|

|

Annual Income

vs. Budget

|

![MCWB01114_0000[1]](CO_20181212_AGN_344_AT_SUP_files/image008.png)

|

Council’s

investment interest income exceeded budget by $738k as at 30 November 2018 mainly due to higher actual monthly average portfolio holdings

compared to budgeted monthly average portfolio holdings.

|

Investment

Policy Compliance

|

Legislative Requirements

|

![MCWB01114_0000[1]](CO_20181212_AGN_344_AT_SUP_files/image008.png)

|

Fully Compliant.

|

|

Portfolio Credit Rating Limit

|

![MCWB01114_0000[1]](CO_20181212_AGN_344_AT_SUP_files/image008.png)

|

Fully Compliant.

|

|

Institutional Exposure Limits

|

![MCWB01114_0000[1]](CO_20181212_AGN_344_AT_SUP_files/image008.png)

|

Fully Compliant

|

|

Overall Portfolio Credit Limits

|

![MCWB01114_0000[1]](CO_20181212_AGN_344_AT_SUP_files/image008.png)

|

Fully Compliant.

|

|

Term to Maturity Limits

|

![MCWB01114_0000[1]](CO_20181212_AGN_344_AT_SUP_files/image008.png)

|

Fully Compliant.

|

Economic Outlook – Reserve Bank of Australia

The Reserve Bank has left the official cash rate on hold at

1.5 per cent in its 4 December 2018 meeting. The current 1.5 per cent cash rate

is at a historically low level

and impacts returns on investment.

Certificate of Responsible Accounting Officer

The Chief Financial Officer, as Responsible

Accounting Officer certifies that the investments listed in the attached report

have been made in accordance with Section 625 of the Local Government Act 1993,

Clause 212 of the Local Government (General) Regulation 2005 and Councils

Investment Policies at the time of their placement. The previous investments

are covered by the “grandfather” clauses of the current investment

guidelines issued by the Minister for Local Government.

Independent verification by Head of Audit, Risk and

Improvement (HARI)

Council requested on-going independent review of its

investment portfolio by Audit Risk and Improvement Committee (ARIC) or its

representative under delegated authority. The ARIC has agreed for its

Chairperson to provide a certificate on a quarterly basis – next

certificate will be presented to Council on 28 February 2019.

|

Economic

|

Council’s investment interest

income exceeded budget by $738k as at 30 November 2018 mainly due to higher actual monthly average

portfolio holdings compared to budgeted monthly average portfolio holdings.

|

|

Environment

|

There are no environmental and

sustainability considerations.

|

Social

|

There are no social and cultural

considerations.

|

Civic

Leadership

|

There are no civic leadership and

governance considerations.

|

|

Legislative

|

Council is fully compliant with the

requirements of the Local Government Act 1993 – Investment Order

(authorized investments) and with reporting requirements under Clause 212 of

the Local Government (General) Regulation 2005.

|

1. Investment

Portfolio - November 2018⇩

Ordinary Meeting 12 December 2018

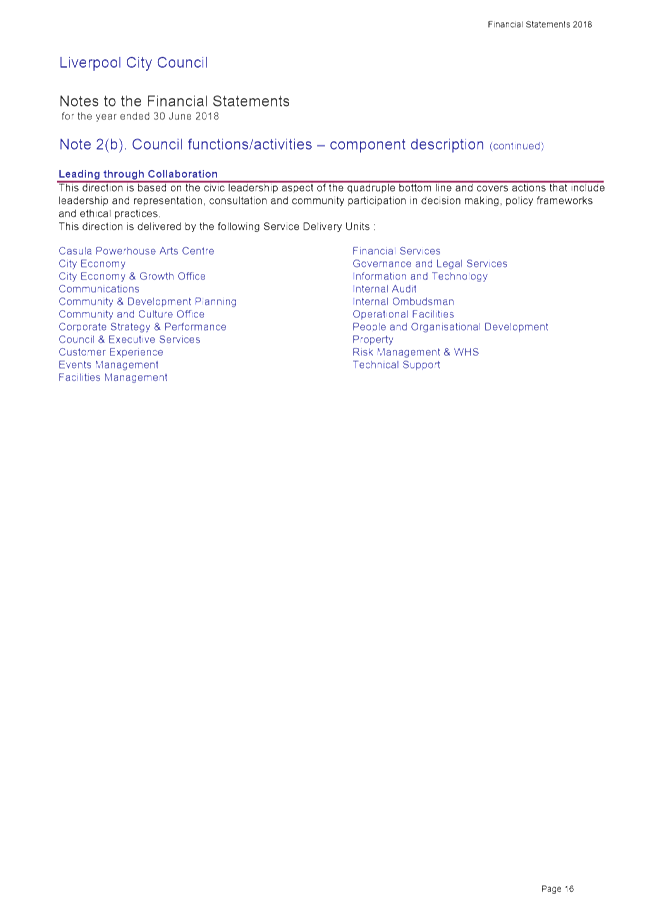

|

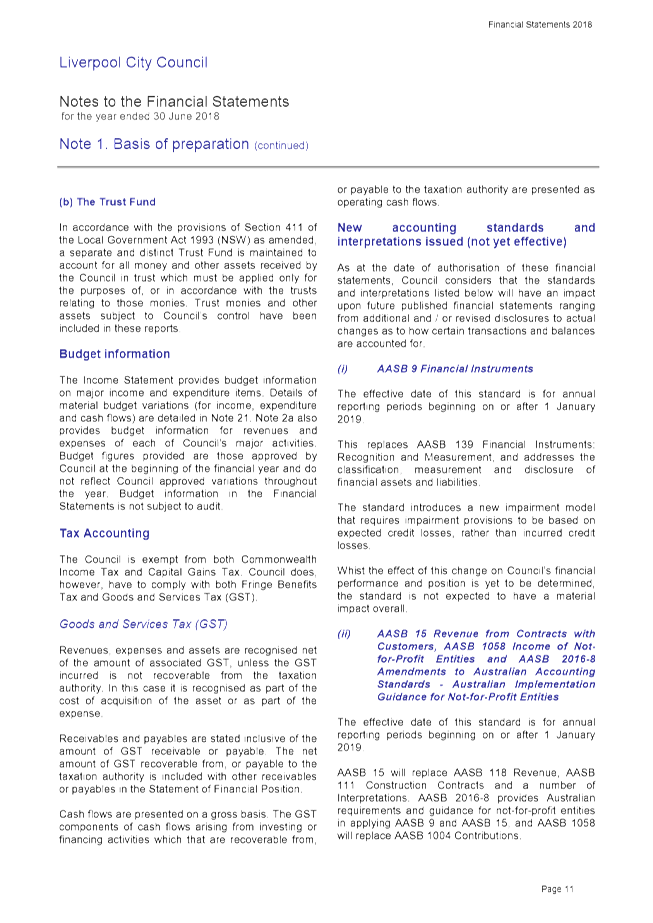

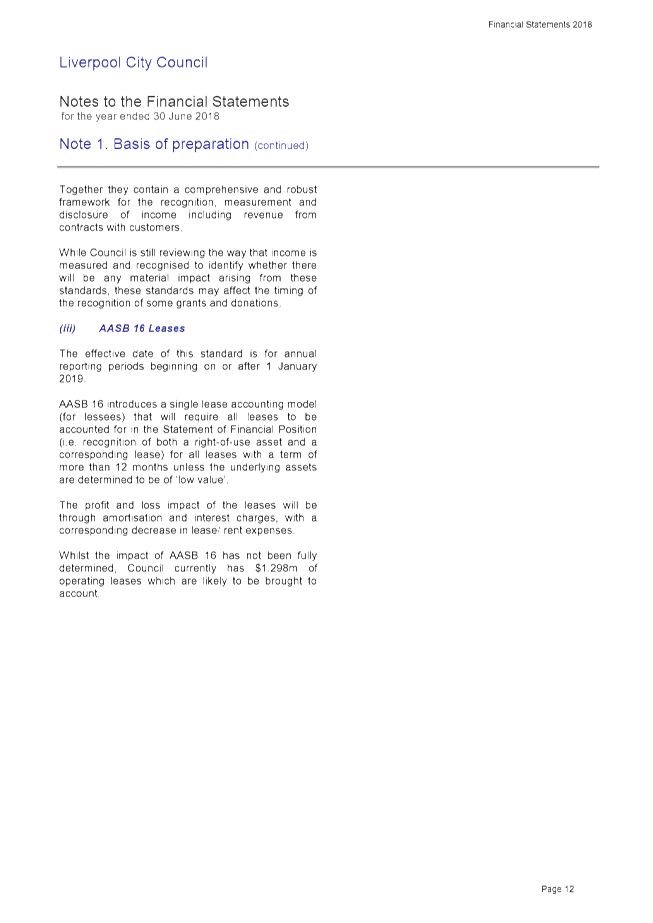

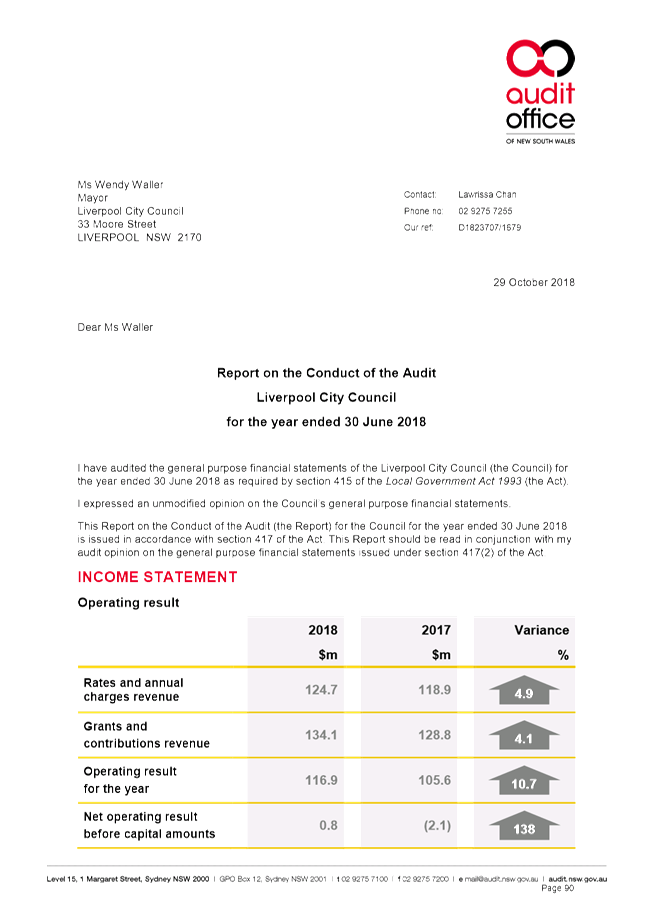

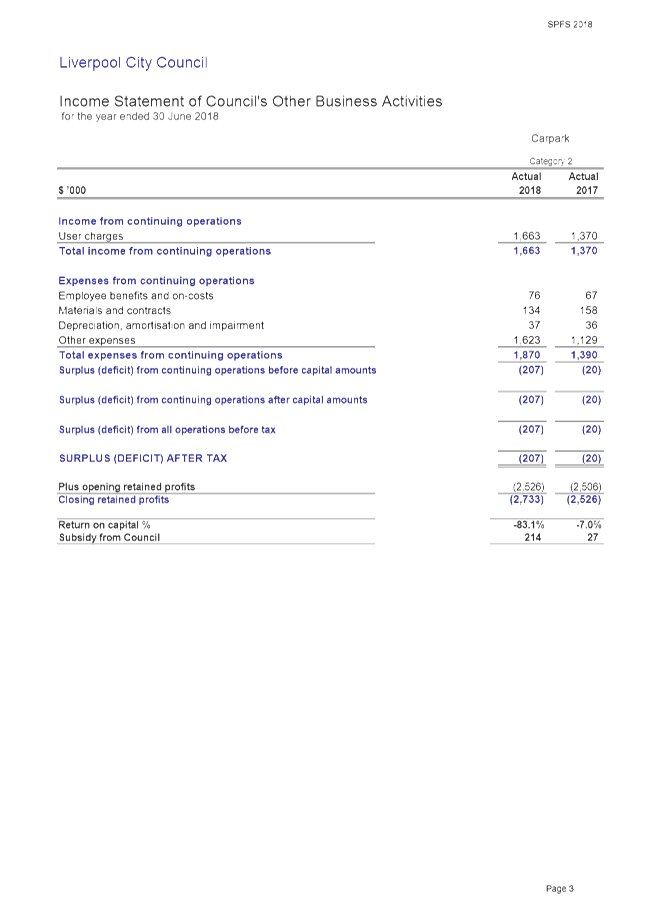

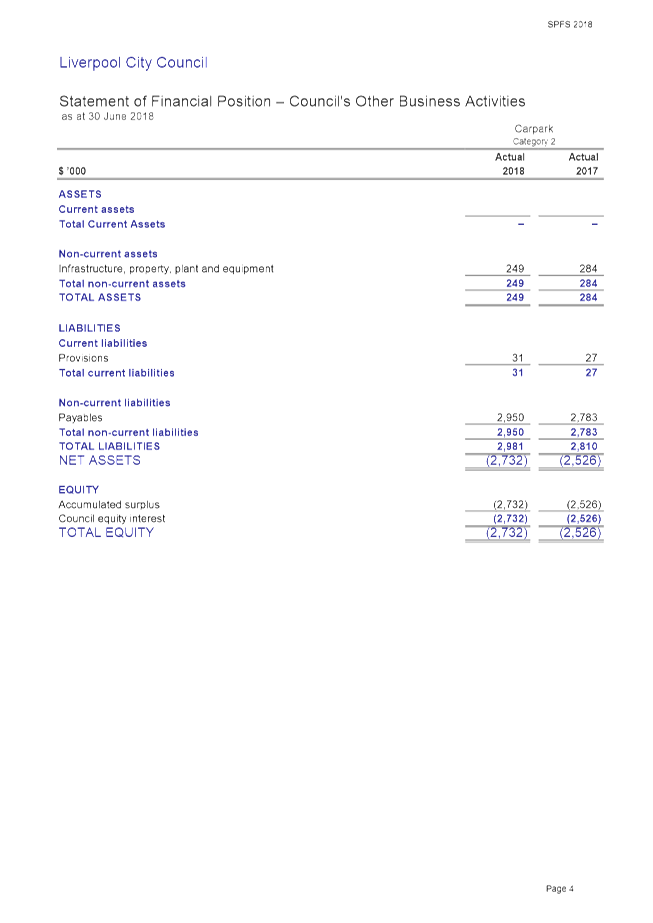

CORP 03

|

Annual Financial Reports 2017/18

|

|

Strategic

Direction

|

Leading

Proactive Council

Provide

business excellence and financial sustainability to deliver services that

meet community expectations

|

|

Key

Policy

|

Long-Term Financial

Plan

|

|

File Ref

|

328268.2018

|

|

Report By

|

Earl

Paradeza - Senior Management Accountant

|

|

Approved

By

|

Vishwa Nadan

- Chief Financial Officer

|

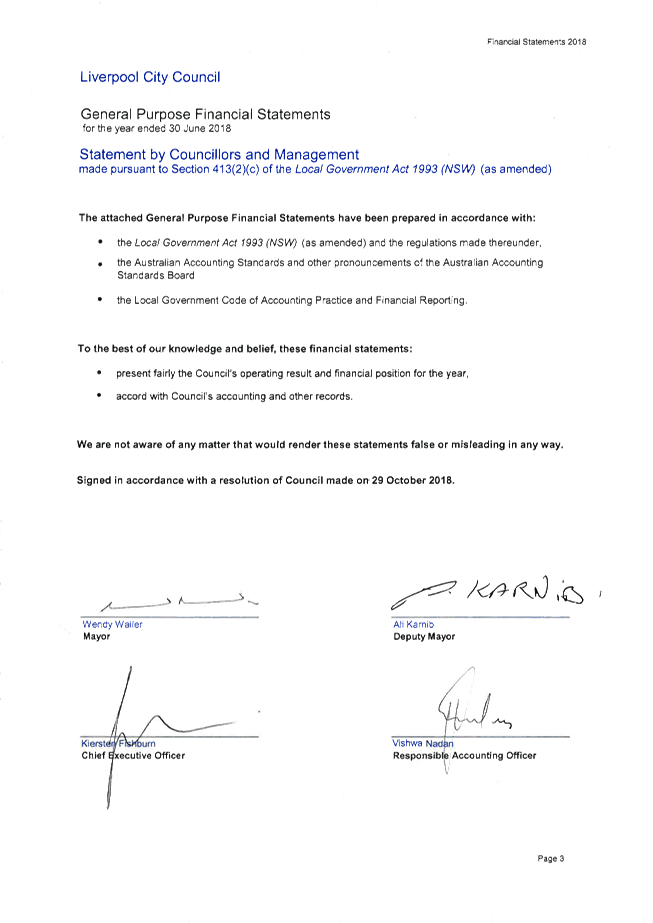

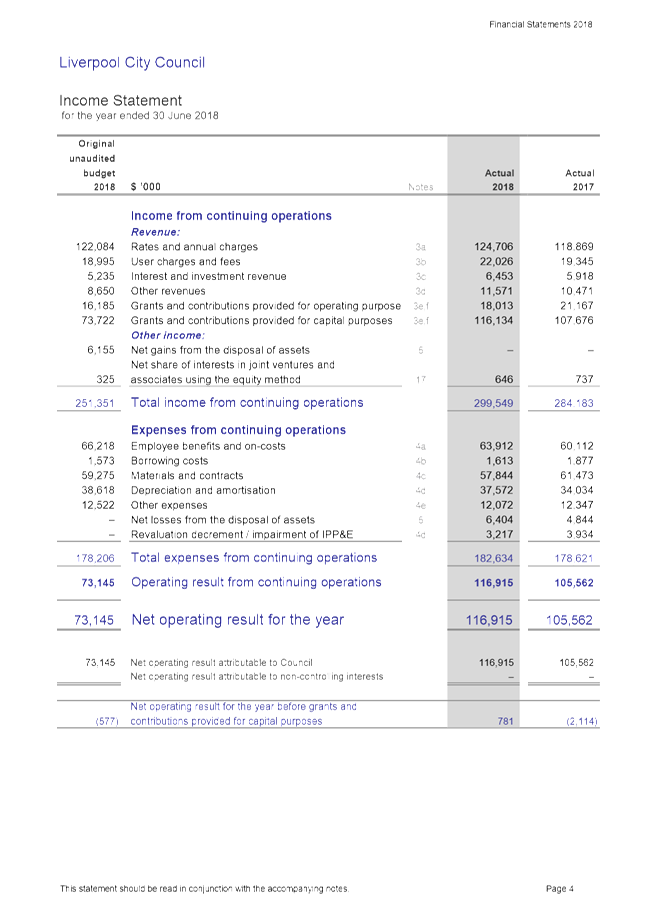

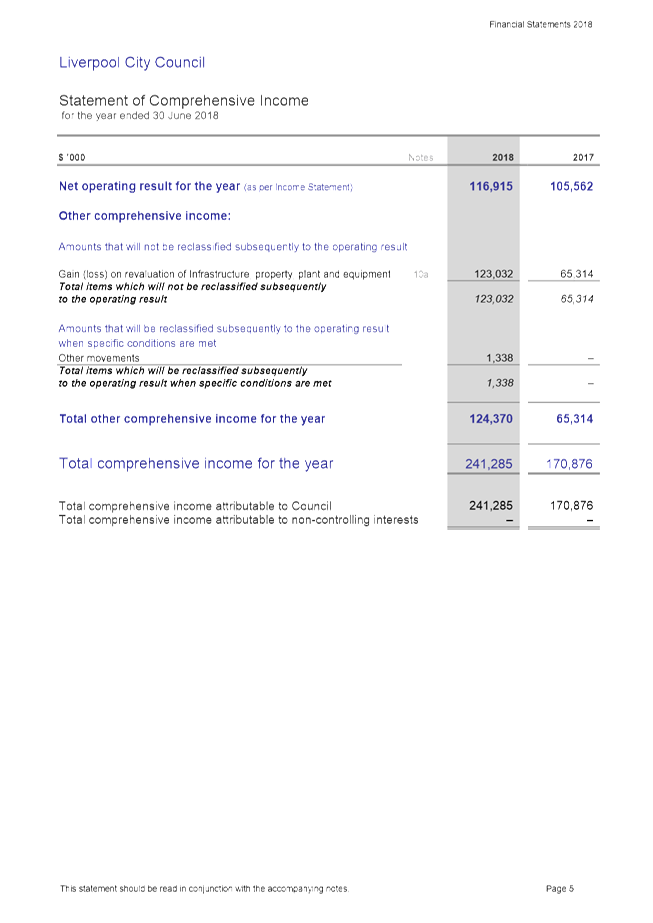

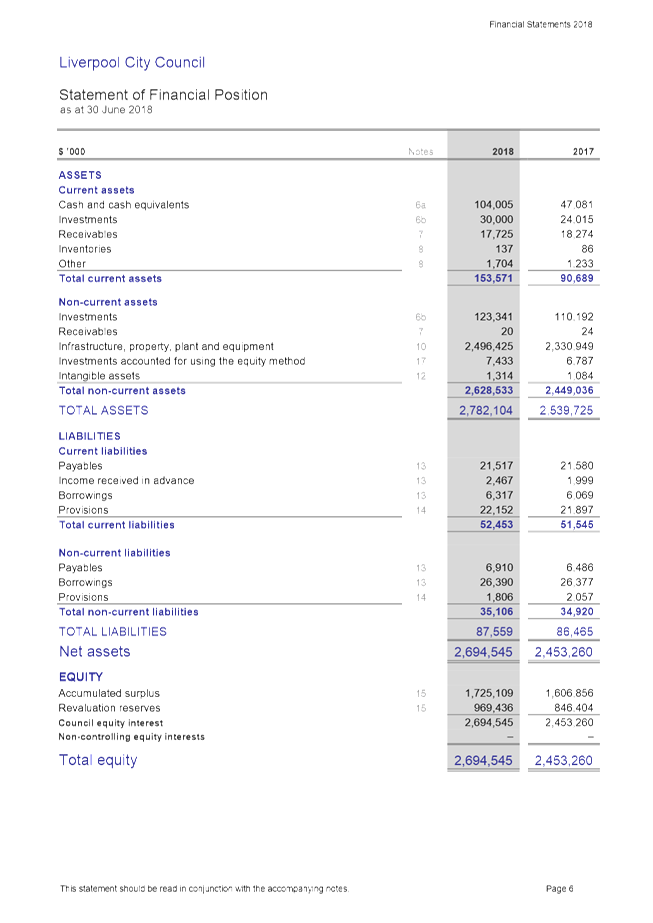

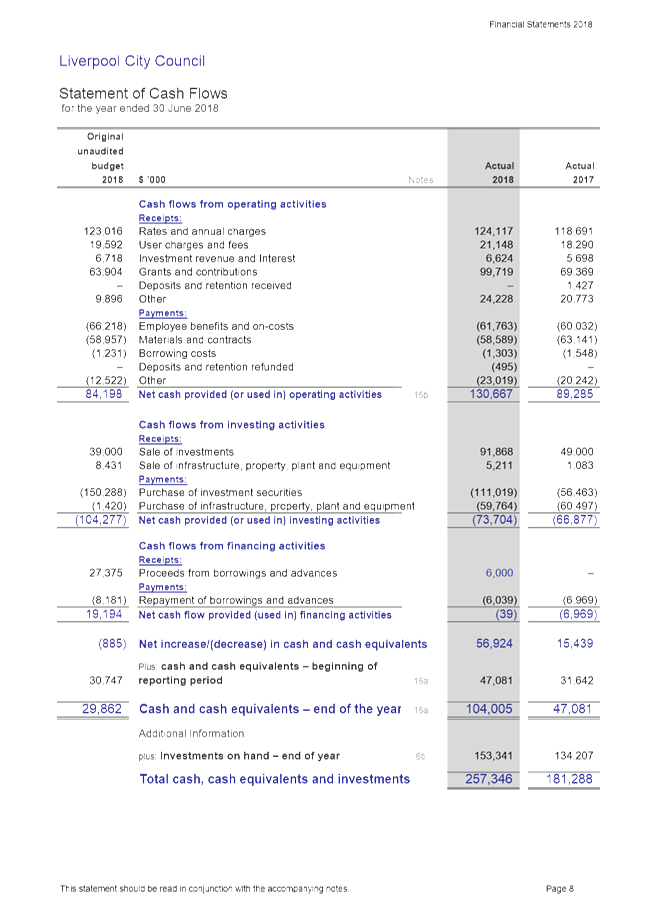

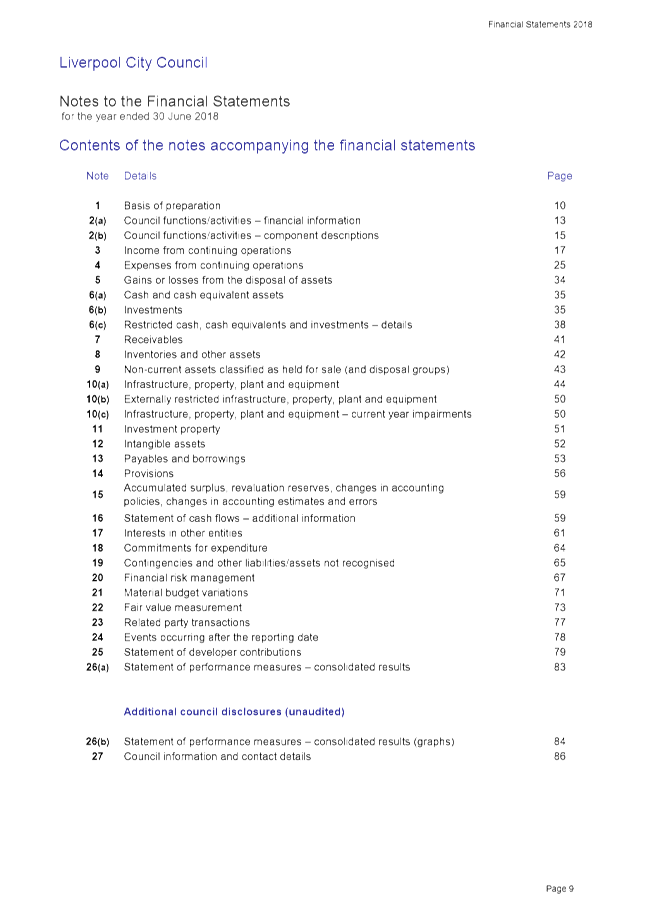

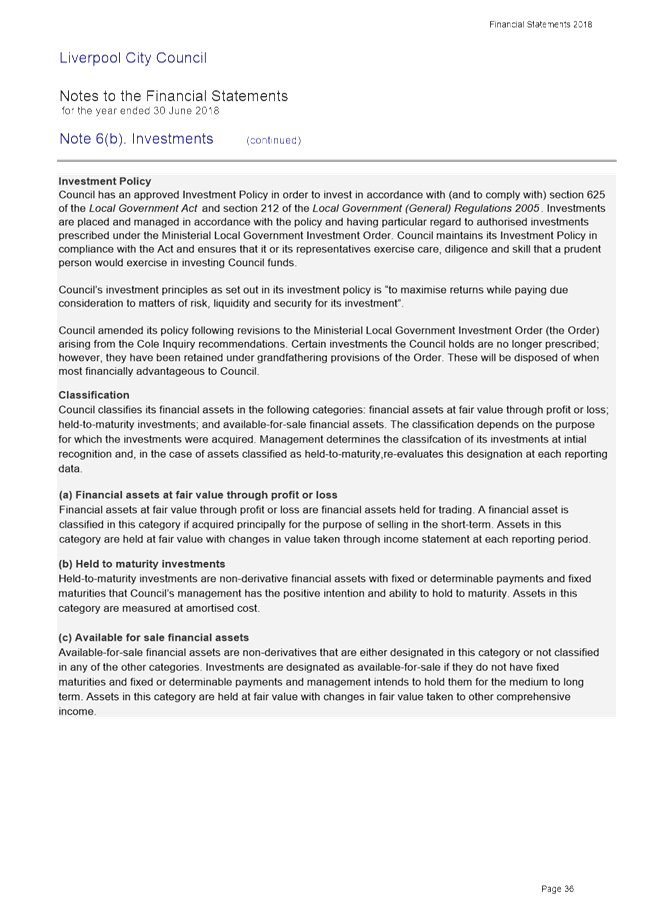

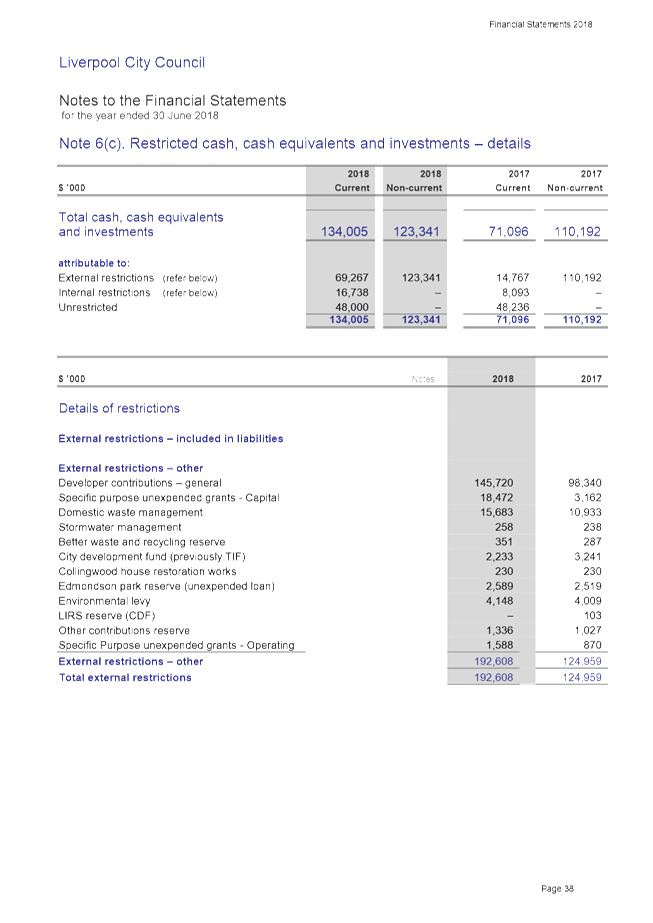

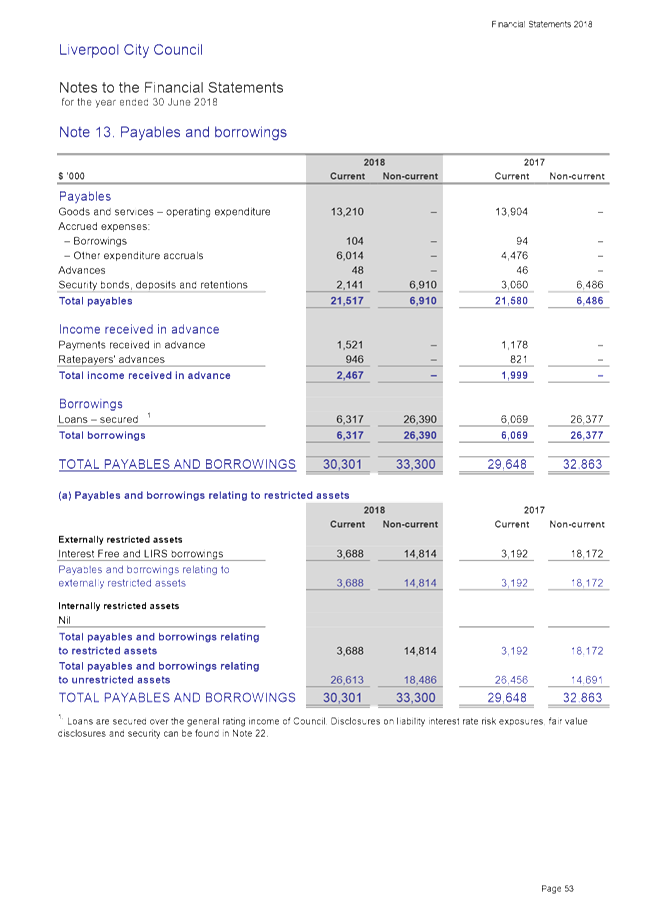

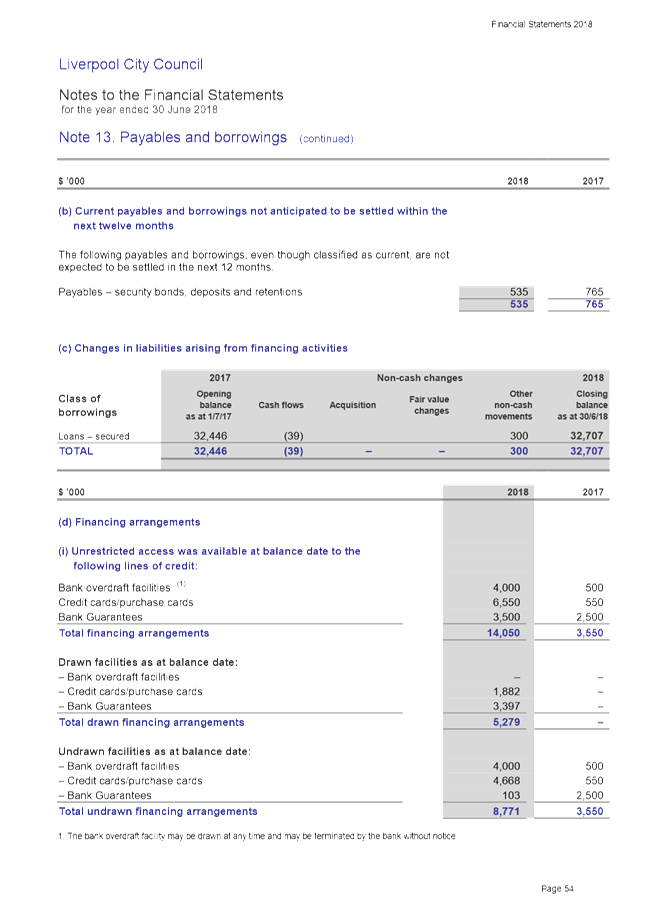

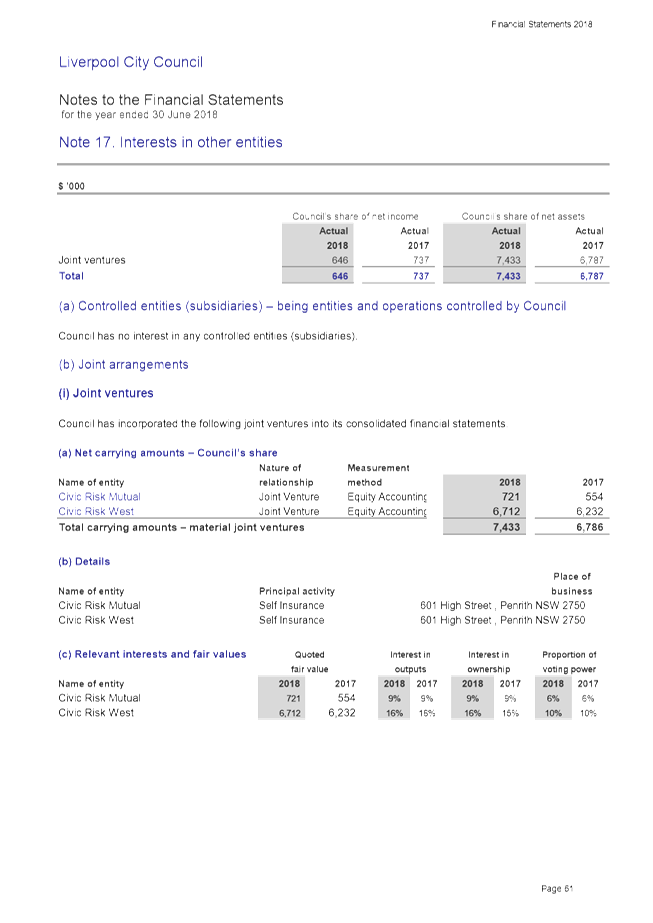

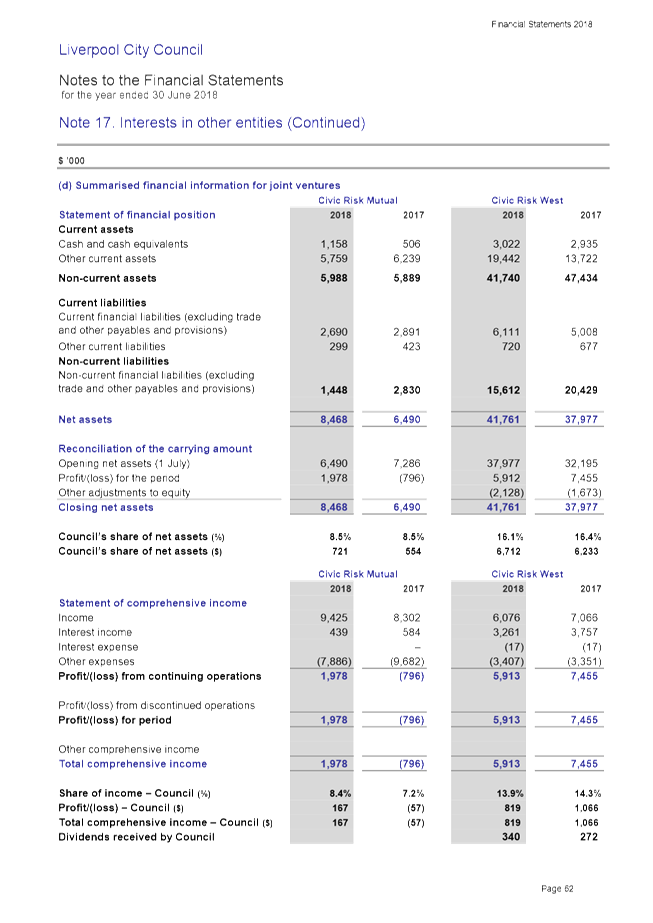

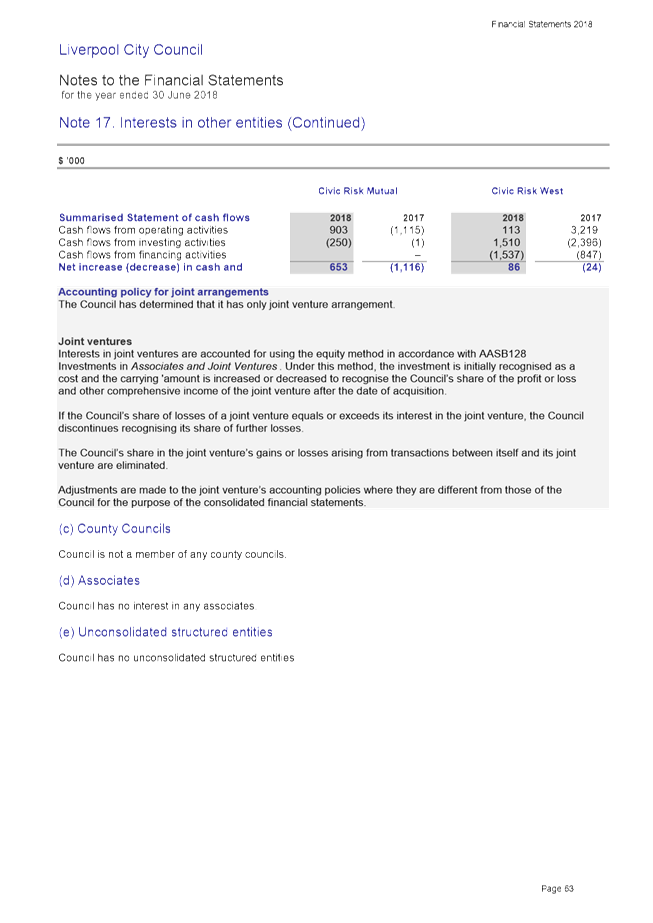

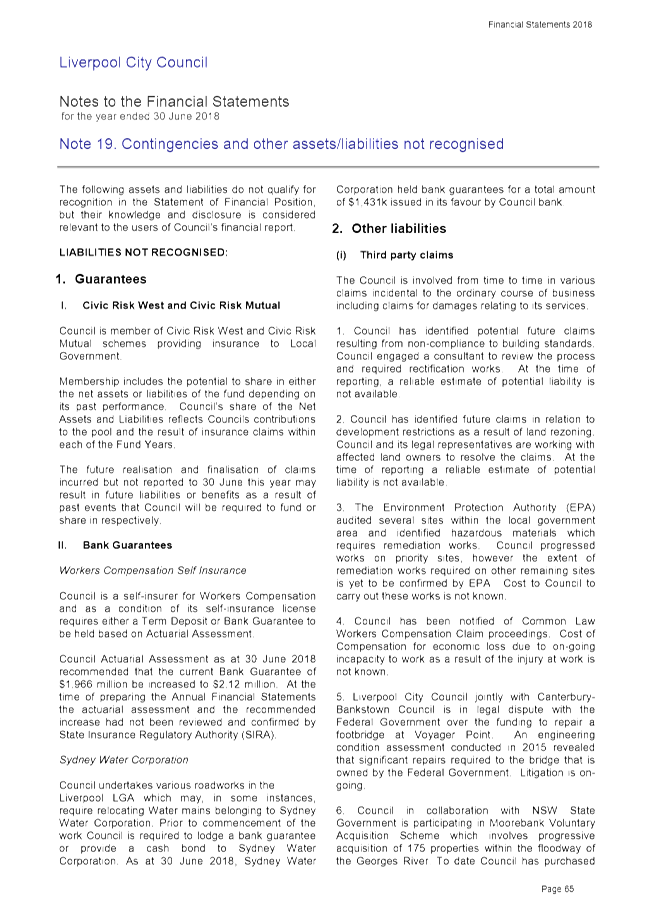

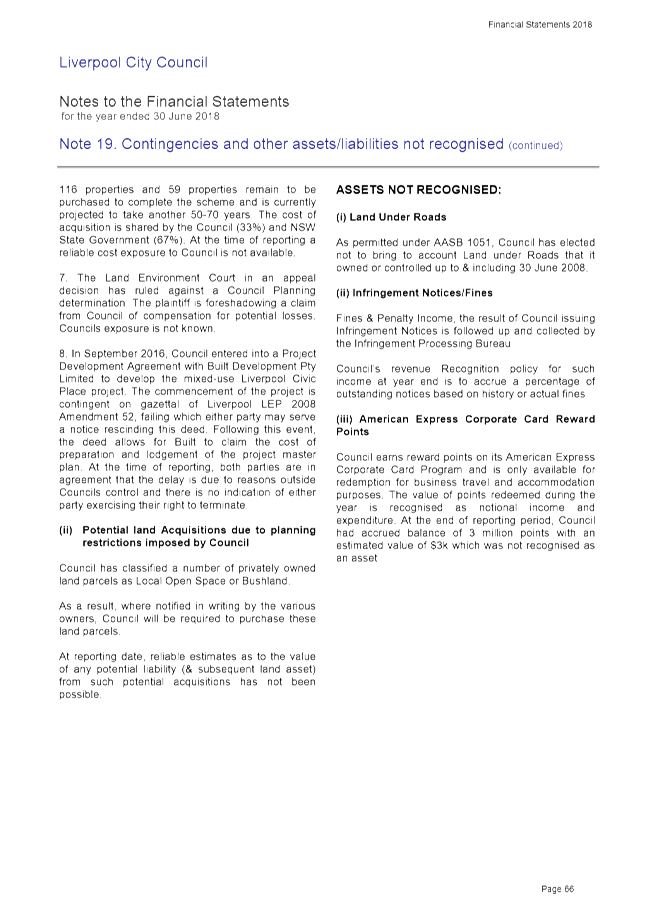

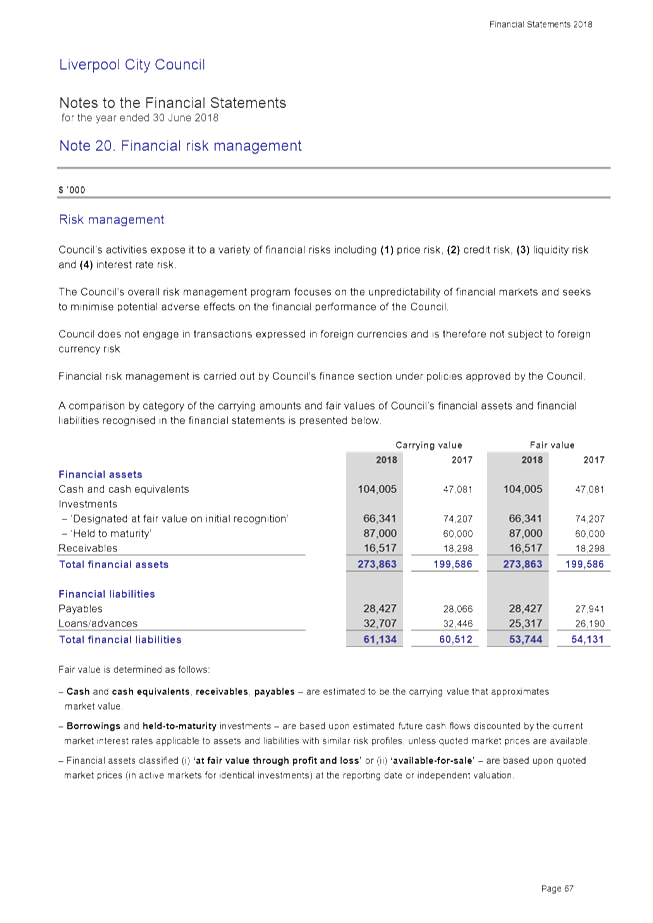

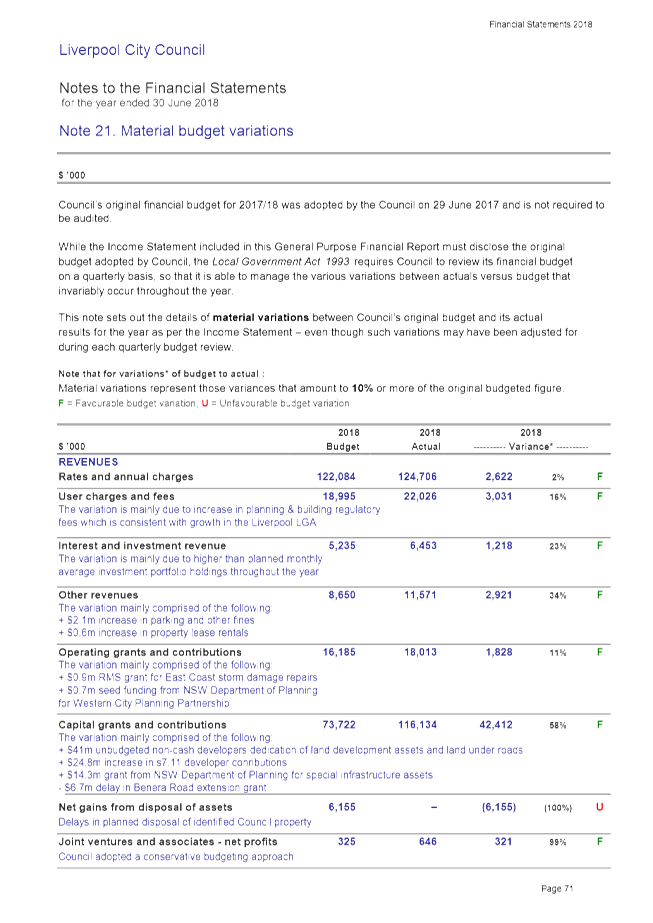

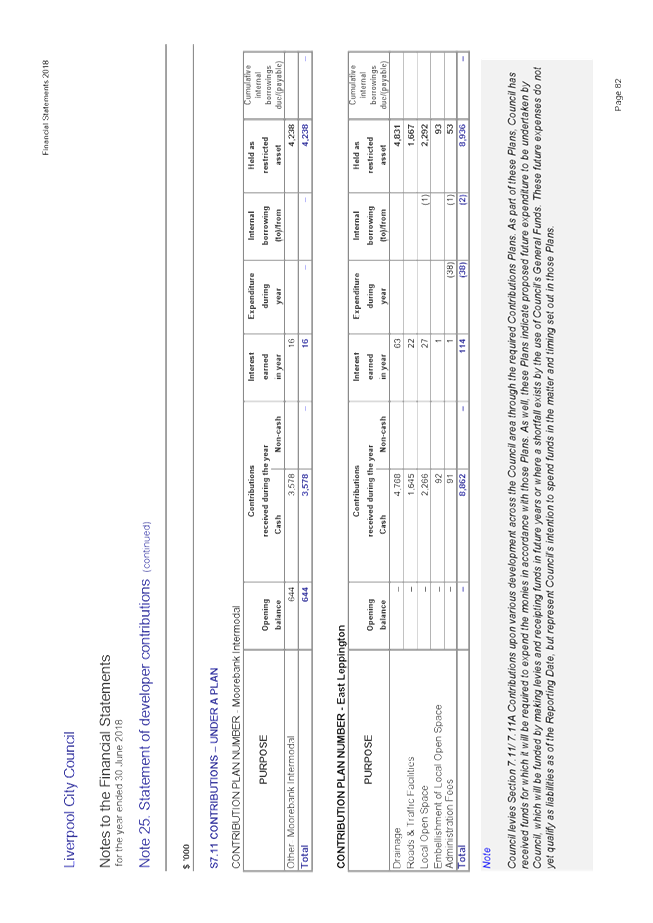

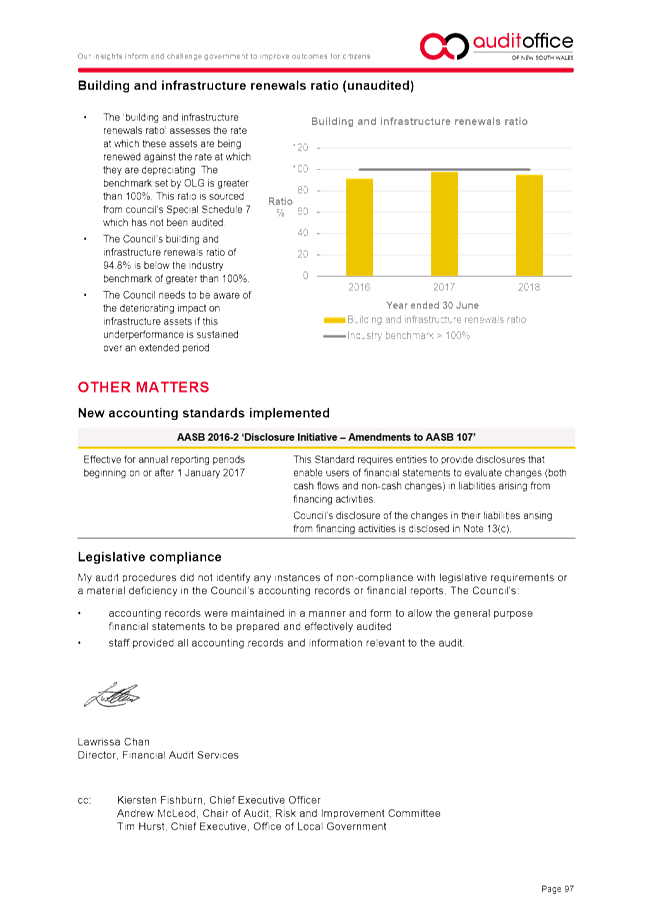

The

Council at its meeting on 29 October 2018 authorised the issue of 2017/18

audited financial statements.

The

financial statements together with the audit certificate was lodged with the

Office of Local Government (in accordance with Section 417 of the Local

Government Act 1993), and placed on public exhibition inviting public

submissions.

Submissions

closed on 29th November 2018 and Council did not receive any public

submissions on the matter.

|

That Council receives and adopts this report.

|

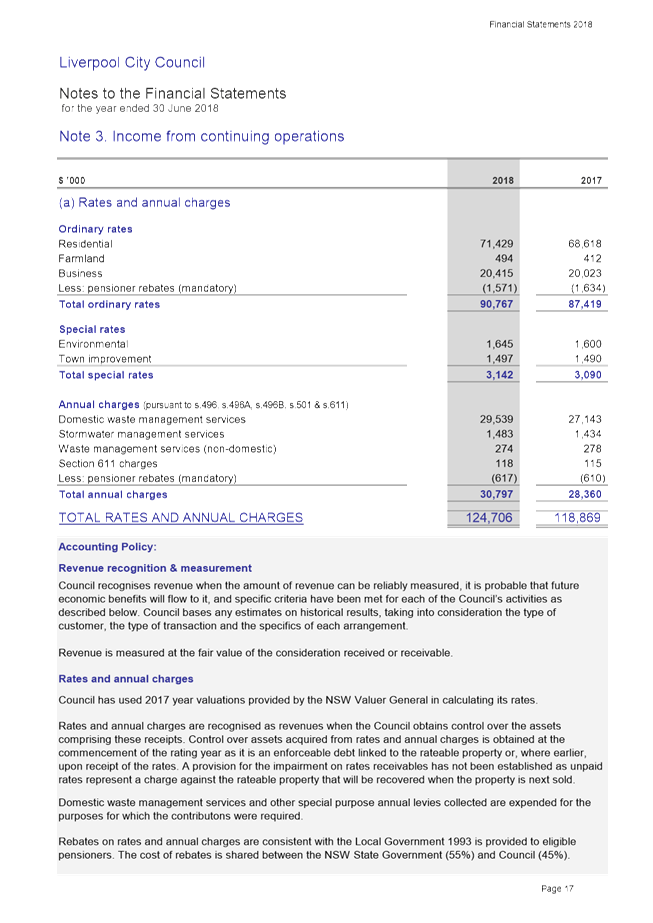

The

Council at its meeting on 29 October 2018 authorised the issue of 2017-18

audited financial statements.

The

financial statements together with the audit certificate were lodged with the

Office of Local Government in accordance with Section 417 of the Local

Government Act 1993.

The

audited financial statements were placed on public exhibition. Section 420 of

the Act permits members of the public to make submissions. The Act further

requires Council to refer all submissions to its Auditor and take action as may

be appropriate which includes notice to the Office of Local Government to amend

the financial statements.

Submissions closed on 29th

November 2018 and Council did not receive any submissions on the matter.

|

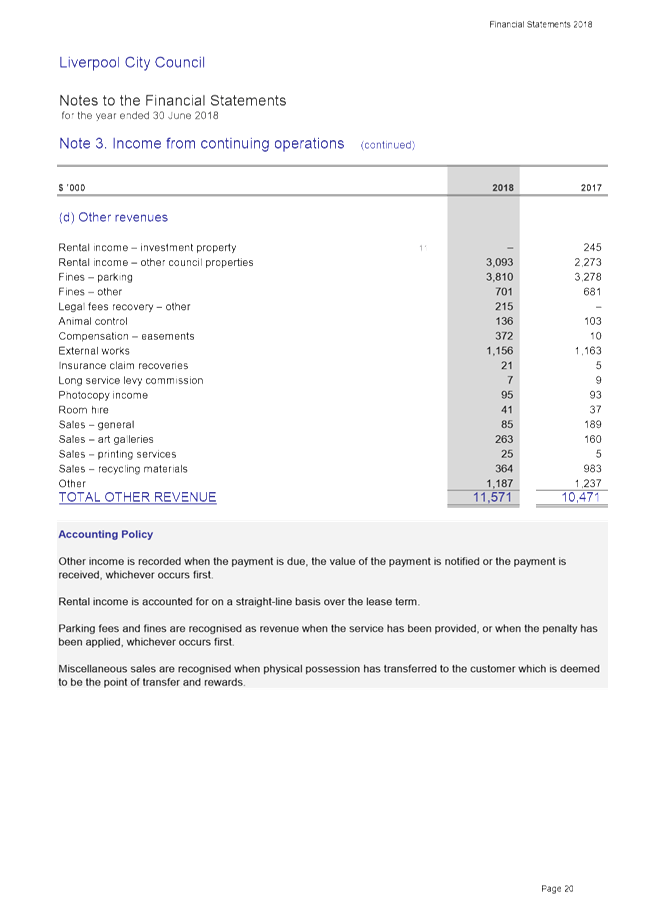

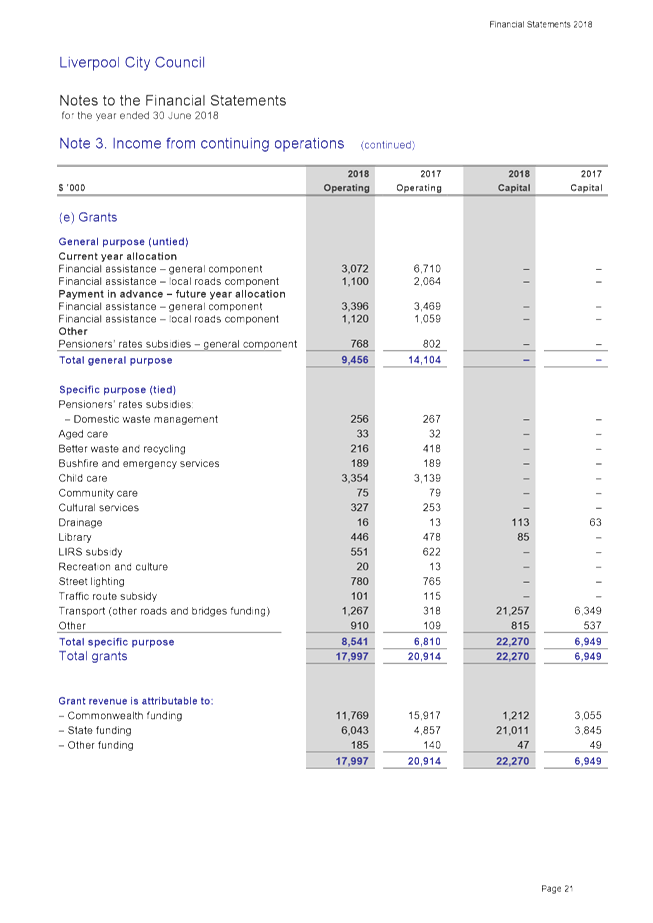

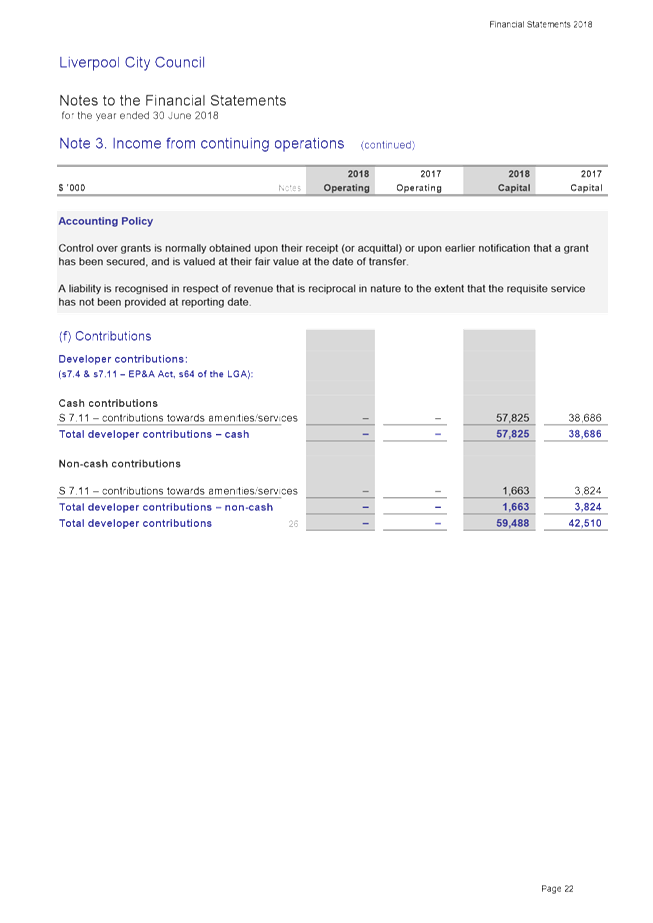

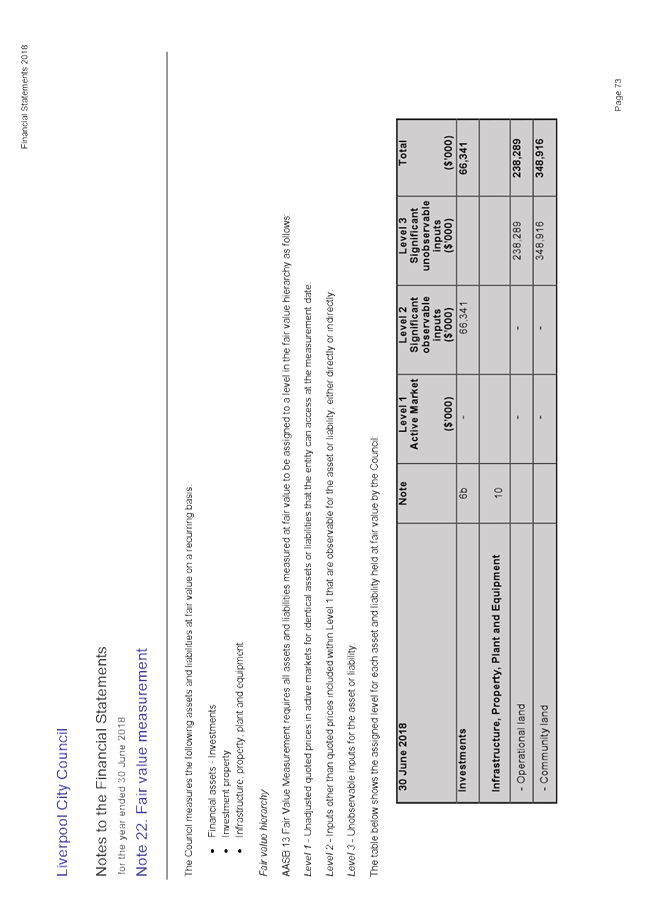

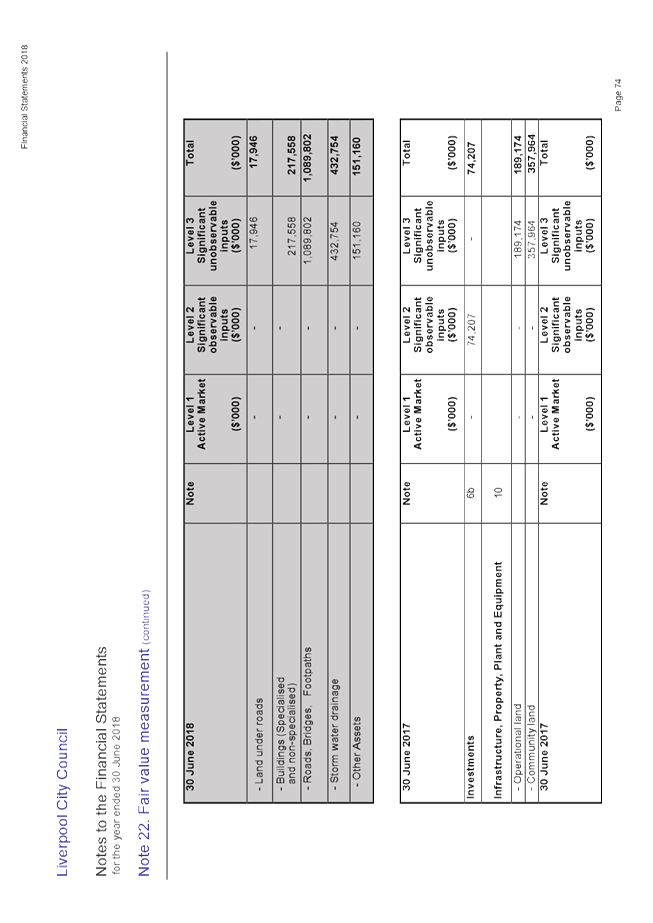

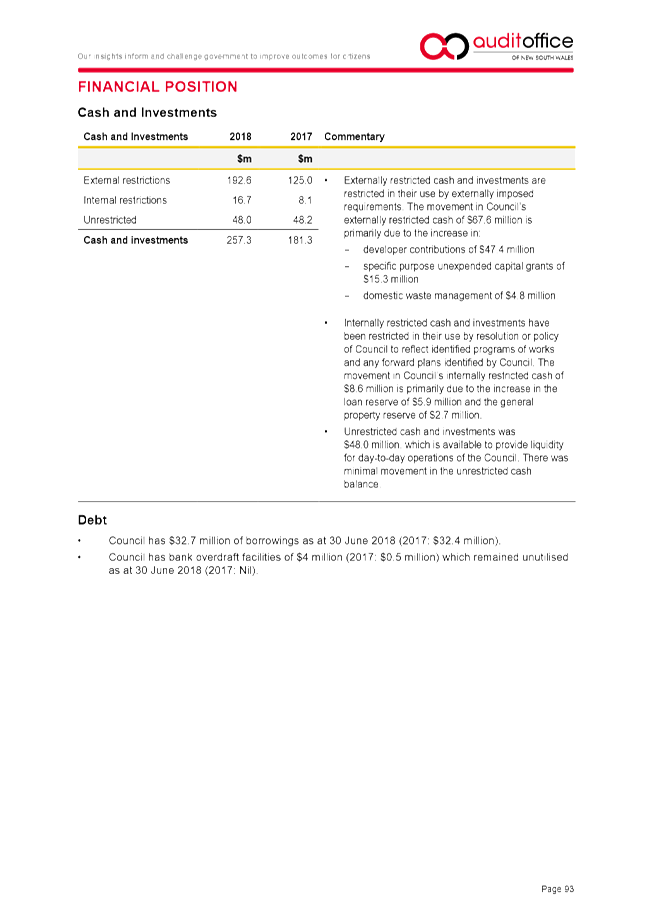

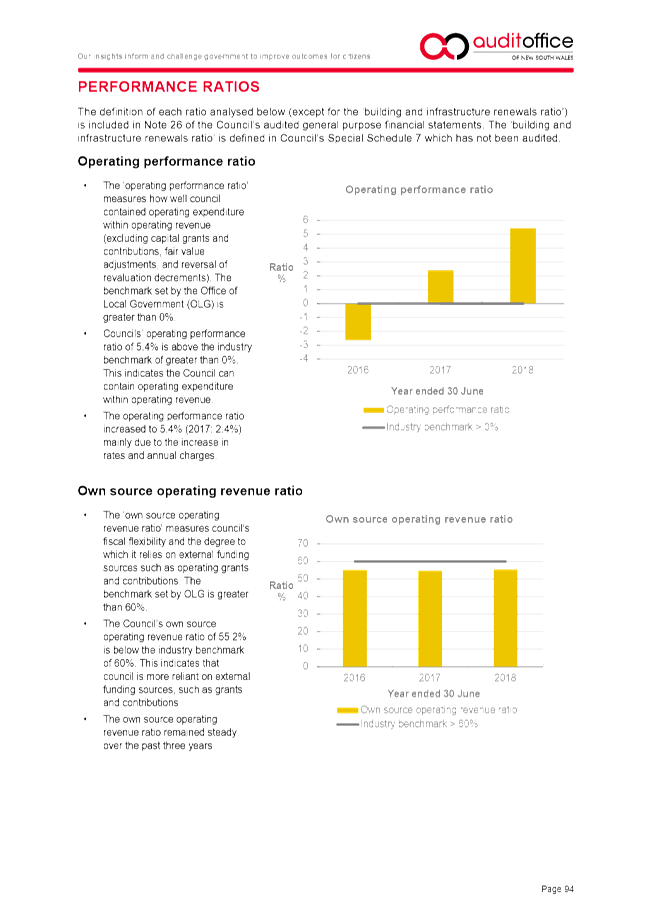

Economic

|

The audited financial results for the

year ended 30 June 2018 are contained and presented within the report.

|

|

Environment

|

There are no environmental and

sustainability considerations.

|

Social

|

There are no social and cultural

considerations.

|

Civic

Leadership

|

There are no civic leadership and

governance considerations.

|

|

Legislative

|

Section 417 and Section 420 of the Local

Government Act 1993.

|

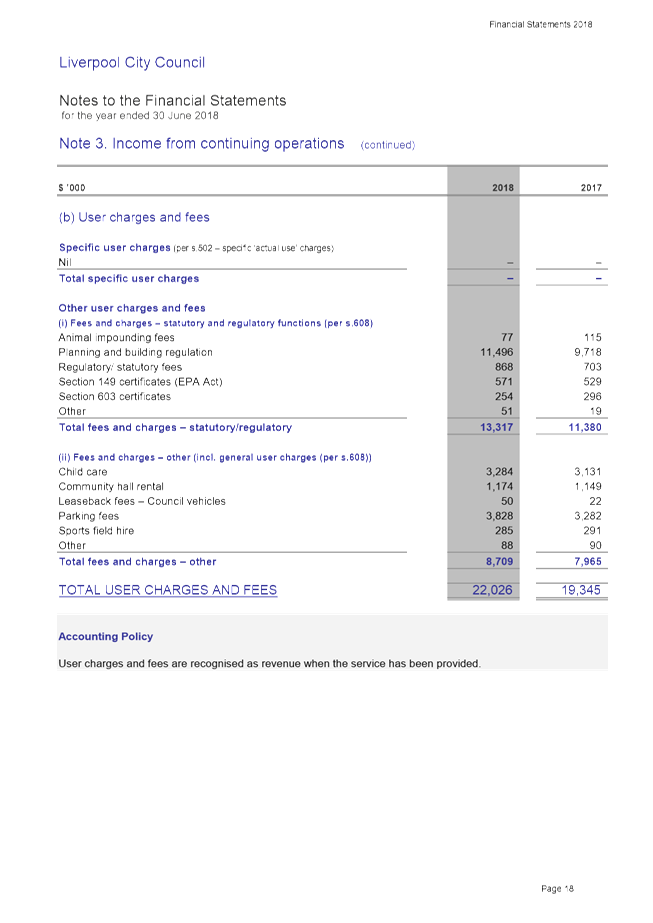

1. 2017-18

Financial Statements

![]()